The Russian cryptocurrency market in 2026 has transitioned into a fully regulated ecosystem. While the Central Bank and State Duma have legalized trading for retail investors, they have introduced a tiered access system. For most, this means a 300,000 ruble or $4,000 annual purchase limit and a mandatory risk-awareness test to ensure "financial literacy" before entering the market.

Whether you are looking for high-performance trading on BingX, the convenience of Telegram's TON ecosystem, or the absolute security of

hardware wallets, selecting the right crypto trading app is now a matter of both performance and legal compliance.

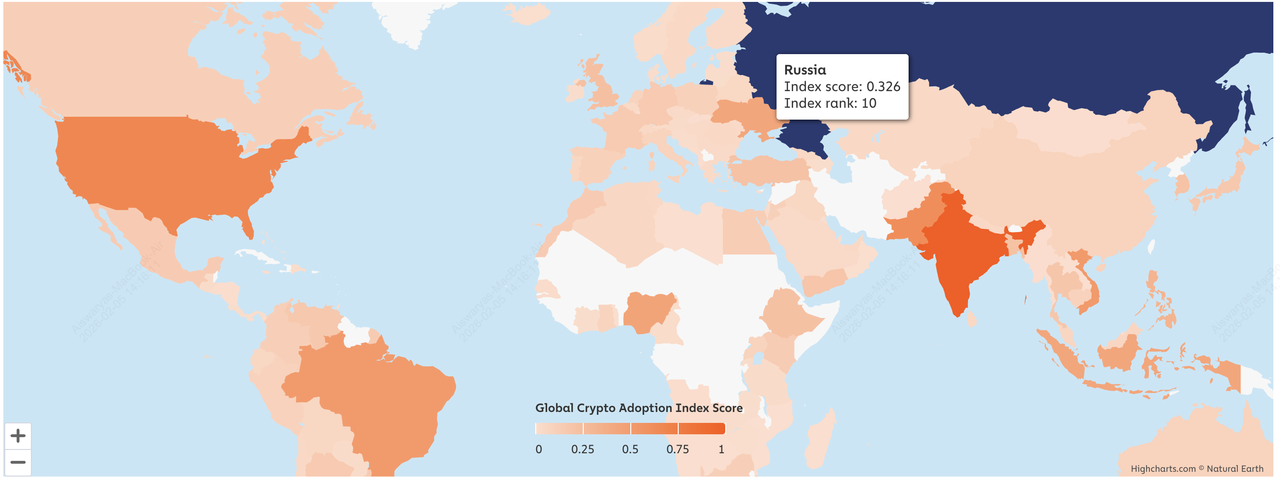

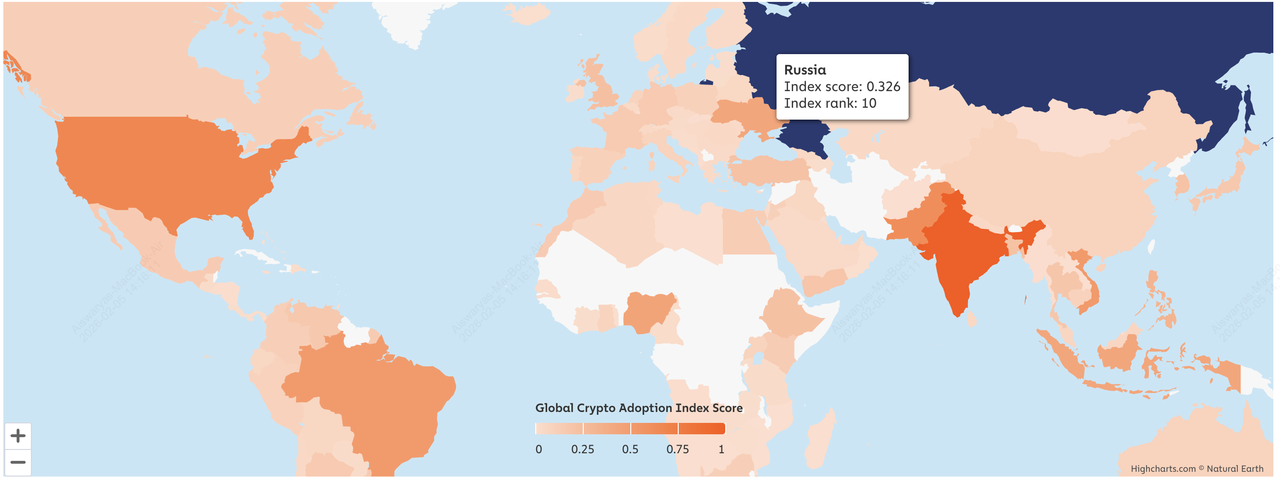

Russia Crypto Adoption Overview in 2026

Russia's crypto adoption | Source: Chainalysis

By 2026, Russia has solidified its position as a global cryptocurrency powerhouse, ranking 10th in the Global Crypto Adoption Index and emerging as the largest crypto market in Europe. In the 12 months leading into 2026, the country recorded a staggering $379.3 billion in on-chain transaction volume, a 48% year-over-year increase that propelled it past the United Kingdom. This growth is primarily driven by institutional-scale transfers, those exceeding $10 million, which surged by 86% as businesses increasingly integrated digital assets into cross-border settlement and corporate treasury strategies.

The retail landscape is equally vibrant, with approximately 20 million Russian citizens, roughly 14% of the population, now regularly using digital coins for daily financial activities. While

Bitcoin continues to lead with a 62.1% share of total holdings, decentralized finance (DeFi) has seen the most dramatic evolution, with activity surging nearly eightfold since early 2025. This shift reflects a strategic pivot toward

non-custodial infrastructure as a hedge against ruble inflation and traditional banking restrictions, transforming cryptocurrency from a niche speculative interest into a vital layer of Russia's national financial architecture.

What Are the 10 Best Crypto Apps and Wallets for Russian Users in 2026?

When choosing an app in 2026, Russian users must balance RUB on-ramps, KYC compliance, and asset self-custody. Here are the top 10 choices tailored for the local market.

1. BingX

By February 2026, BingX has solidified its position as Russia’s premier Web3-AI powerhouse, serving over 40 million global users. The platform’s

TradFi Perpetual Futures have seen explosive adoption, with 24-hour trading volumes recently doubling to $2 billion, driven largely by gold and oil pairs settled in

USDT. Russian investors leverage BingX as a "super-app" where they can pivot from crypto into traditional markets with up to 500x leverage, all while maintaining

100% Proof of Reserves, a transparency standard BingX has publicly verified every month since 2022.

The core of the BingX experience is its $300 million

BingX AI integration, featuring AI Bingo and AI Master. These tools have attracted over 3 million early users by providing real-time technical analysis and automated risk management across 1,100+ trading pairs. This intelligence extends to a world-class

Copy Trading ecosystem where 400,000 elite traders manage over $80 billion in cumulative volume. For Russian users, this means they can automate complex strategies with a single click, protected by a

$150 million Shield Fund specifically designed to mitigate cyber threats and extreme market volatility.

The BingX platform combines local fiat access,

TradFi-linked markets, and institutional security, offering instant RUB-to-USDT on-ramps via T-Bank (Tinkoff), Sberbank, and the Fast Payment System (SBP) alongside trading in tokenized stocks and commodities. It also leads in

USDT-settled gold and

silver perpetuals by trading volume, giving users exposure to

real-world asset (RWA) indexing within a crypto-native interface. Security is reinforced through a $150 million Shield Fund and compliance with ISO 27001 and PCI DSS v4.0.1, delivering enterprise-grade data protection and payment security.

Best for: Active Russian traders seeking a high-performance, AI-driven environment that bridges the gap between local RUB liquidity and global traditional financial markets.

2. Telegram Wallet (@wallet)

As the official financial layer of the Telegram ecosystem, @wallet is natively integrated for over 1 billion monthly active users, eliminating the need for external downloads. In 2026, it serves as an "invisible" bank for 25 million active accounts, driven by the ability to send instant, zero-fee off-chain transfers to any Telegram contact as easily as a text message. While the core interface is custodial for maximum simplicity, it uniquely features TON Space, a non-custodial "wallet within a wallet" that allows users to manage private keys and interact with over 250 TON dApps and NFTs. The platform’s robust P2P Market supports a high volume of RUB-to-USDT swaps with a competitive 0.9% maker fee, though retail buyers should note that convenience often results in a 1% to 3% price premium compared to global exchange order books.

Best for: Beginners and social traders who prioritize instant RUB-to-crypto on-ramps and fee-free

peer-to-peer transfers within their existing contact list.

3. Tonkeeper

By 2026,

Tonkeeper has emerged as the dominant self-custody force within The Open Network, boasting over 30 million active users and facilitating more than 9 million monthly on-chain transactions. As the first

Telegram wallet to fully implement the W5 Smart Wallet standard, it has solved the biggest hurdle in crypto onboarding: the need for native tokens to pay fees. Through its "Gasless" architecture, users can now send USDT or

Notcoin and have the network fee automatically deducted from the token balance itself. This is complemented by the Tonkeeper Battery, a programmable off-chain account that can be "charged" via in-app purchases in App Store or Google Play or

stablecoins to cover over 300 different types of transactions, including NFT minting and complex DeFi swaps, even when the user’s

TON balance is zero.

Best for: DeFi power users and NFT collectors who require absolute control over their private keys while demanding the "gasless" convenience of a centralized app.

4. Matbea

Operating since 2014, Matbea has evolved into one of Russia’s most resilient crypto-financial hubs, processing over 22,000 weekly orders with a historical turnover exceeding 3.8 billion rubles. It functions as a specialized "hybrid" platform, combining a non-custodial multi-currency wallet supporting 61+ digital assets with an automated instant-swap engine. Matbea’s standout feature in 2026 is its proprietary AML address scoring system, which automatically vets incoming transactions against global risk databases; this ensures that users do not inadvertently receive "tainted" coins that could trigger bank freezes under Russia's 115-FZ anti-money laundering law. With a user base of 200,000+ clients, the platform offers deep integration with local rails like Sberbank and the Fast Payment System (FPS), providing a highly localized bridge that bypasses the complexities of international offshore exchanges.

Best for: Beginner-to-intermediate Russian users who prioritize the legal "cleanliness" of their assets and require a straightforward, RUB-optimized interface for frequent domestic transactions.

5. Trust Wallet

By February 2026,

Trust Wallet has expanded its dominance as the world’s most versatile non-custodial mobile gateway, now serving over 220 million users globally with a staggering 35% market share in the self-custody space. Its infrastructure supports an industry-leading 100+ blockchains and more than 10 million digital assets, allowing Russian investors to manage everything from Bitcoin and

Solana to niche

Layer-2 tokens in a single, unified interface. A major 2026 highlight is the implementation of the SWIFT Smart Contract Wallet and FlexGas (EIP-7702), which eliminates the technical barrier of holding native gas tokens by allowing users to pay transaction fees using the stablecoins like USDT they are already sending. With a built-in Security Scanner that has proactively blocked over $160 million in fraudulent transactions, Trust Wallet provides a high-trust environment for engaging with its native staking protocols, which currently hold over $750 million in Total Value Locked (TVL) across 20+ different assets.

Best for: Diversified investors and NFT collectors who require "one-tap" access to dozens of different blockchains and high-yield, native staking without the complexity of manual network configuration.

6. MetaMask

MetaMask remains the world’s most used Web3 gateway in 2026, surpassing 100 million monthly active users and serving as the primary bridge to over 17,000 decentralized applications (dApps). Built on a robust open-source framework, the wallet has evolved beyond a simple browser extension into a cross-chain hub supporting 15+ EVM-compatible networks, including

Ethereum,

Polygon, and

Arbitrum, through its "MetaMask Portfolio" dashboard. A critical update for 2026 is the "Smart Transactions" feature, which utilizes MEV protection to prevent front-running and has saved users an estimated $120 million in slippage fees globally. For Russian power users, MetaMask’s Snaps ecosystem allows for the integration of non-EVM chains like Bitcoin and Solana into a single interface. While it lacks direct RUB bank integration, its built-in Aggregated Buy feature connects to multiple third-party providers, though users should expect a 2% to 5% total fee including gas and provider margins.

Best for: Technical power users and DeFi yield farmers who require absolute interoperability with global liquidity pools, NFT marketplaces, and on-chain governance protocols.

7. Ledger

By February 2026,

Ledger has secured its position as the world's leading hardware wallet provider, with over 8 million devices sold and a valuation targeting $4 billion ahead of its planned NYSE IPO. Its flagship models, the Ledger Nano X and the newly launched Ledger Flex, utilize EAL6+ certified Secure Element (SE) chips, the same military-grade technology found in biometric passports, to ensure private keys never touch an internet-connected device. The Ledger Wallet app (formerly Ledger Live) acts as a centralized command center, supporting over 15,000 digital assets and processing billions in monthly volume through integrated staking and swap partners. For Russian users, Ledger remains a vital pillar of self-custody; although direct shipping is restricted, the device is the only hardware signer verified by ANSSI to provide absolute protection against remote hacks and physical tampering, securing an estimated 20% of all global crypto assets.

Best for: High-net-worth investors and long-term "HODLers" who require the highest level of physical security and institutional-grade protection for their primary wealth.

8. Trezor

As the world’s first hardware wallet provider,

Trezor remains a cornerstone of the 2026 self-custody market, holding an estimated 30% global market share with over 2 million devices sold. The flagship Trezor Model T is celebrated for its "Don't Trust, Verify" philosophy, utilizing 100% open-source firmware that is continuously audited by a global community of security researchers. By early 2026, the device supports a staggering 9,000+ digital assets, including Bitcoin, Ethereum, and Solana, all managed through the Trezor Suite app which now features integrated MEV protection and slippage metrics for safer decentralized swaps. While the Model T was recently succeeded by the Trezor Safe 5, SatoshiLabs has committed to supporting existing Model T units with critical security updates until at least 2036. For Russian users, Trezor’s lack of wireless interfaces (Bluetooth/NFC) and its unique Shamir Backup (SLIP39), which allows users to split their recovery phrase into multiple parts, offer a virtually impenetrable defense against both remote hacks and physical coercion.

Best for: Security-conscious investors and privacy advocates who demand fully auditable, open-source hardware and advanced recovery options for multi-generational wealth protection.

9. Bitcoin.com Wallet

As of early 2026, the Bitcoin.com Wallet has solidified its reputation as the industry’s most accessible non-custodial gateway, now serving over 50 million users worldwide. While it remains a stronghold for Bitcoin (BTC) and

Bitcoin Cash (BCH) purists, the app has evolved into a multi-asset powerhouse supporting hundreds of ERC-20 tokens and multiple Ethereum Layer-2 chains. A major technical highlight in 2026 is its robust Multi-Signature (Multi-Sig) integration, which allows couples, families, and small business treasuries to require multiple approvals before funds are moved, effectively neutralizing the risk of a single point of failure. The wallet’s 2026 update also introduced "Spendable" and "Savings" sub-wallets, allowing Russian users to segregate their daily RUB-to-crypto liquidity from their long-term holdings while maintaining 100% control over their private keys.

Best for: Bitcoin purists and families who want a simple, "no-nonsense" mobile interface combined with advanced multi-party security for shared long-term savings.

10. BTCC

Approaching its 15th anniversary in 2026, BTCC stands as the world’s longest-serving cryptocurrency exchange, having processed a record $3.7 trillion in total trading volume in 2025 alone. The platform is favored by Russian professional traders for its specialized focus on

USDT-settled perpetual futures, offering industry-leading leverage of up to 500x on over 300 assets. A major highlight for 2026 is the expansion of its RWA suite, which allows users to trade

tokenized gold,

tokenized silver, and

US stocks with the same high-speed execution as crypto pairs. With a global user base of 11 million and a flawless security record of zero hacks since 2011, BTCC maintains institutional-grade trust through monthly Proof of Reserves (PoR) audits and a segregated 1:1 asset storage policy. For high-volume traders, its updated VIP program provides tiered fee discounts, while its "no-KYC" limit allows for daily withdrawals of up to 10,000 USDT, offering a practical balance of privacy and professional-grade liquidity.

Best for: Experienced futures traders and high-volume professionals who prioritize a proven 15-year security track record and extreme leverage for complex hedging and scalping strategies.

Why BingX Is the Best Crypto App for Beginners and Pro Traders in Russia

BingX has positioned itself as a leading crypto app for the Russian market in 2026 by combining localized RUB accessibility with institutional-grade trading performance. With 40+ million users globally, the platform addresses regional needs through fast, compliant on-ramps while delivering deep liquidity and global market access, making it suitable for both first-time users and experienced traders operating at scale.

For beginners, BingX lowers the learning curve with an AI-driven ecosystem and a market-leading Copy Trading suite used by 11.5+ million users, enabling hands-free strategy replication with built-in risk signals via AI Bingo. Entry is streamlined through RUB P2P on-ramps supporting T-Bank (Tinkoff), Sberbank, and SBP, with typical settlement in 15–30 minutes. For professionals, BingX offers TradFi Perpetual Futures, including gold, oil, forex pairs, stocks, and indices, with up to 500× leverage, exceeding $2 billion in daily volume in January 2026, backed by 100% Proof of Reserves and a $150 million Shield Fund, delivering a single, secure app that scales from beginner automation to pro-grade diversification.

How to Choose Your Crypto App: 3 Key Considerations

Selecting the right crypto platform in 2026 requires balancing your trading frequency with the security of your long-term savings and your legal compliance.

1. Custodial vs. Non-Custodial (Storage vs. Speed): Think of a custodial app like BingX or Telegram Wallet as a high-speed trading desk where the platform manages your keys for you; it is incredibly convenient for daily swaps and P2P buying. However, for "generational wealth" or long-term savings, you should always move your assets to a non-custodial wallet like MetaMask or Ledger, where you hold the private keys and have absolute control over your funds.

2. Regulatory Compliance: Under Russia's finalized 2026 legal framework, trading through licensed intermediaries like BingX provides a layer of institutional protection. Using a platform that integrates with local AML (Anti-Money Laundering) standards significantly reduces the risk of your bank card being flagged or frozen under Law 115-FZ, as these platforms provide the "legitimate economic purpose" documentation required by Russian banks.

3. The 300k RUB Cap for Managing Your Limits: If you are a retail (non-qualified) investor, the law limits your total crypto purchases to 300,000 rubles per year. To stay compliant, you should track your total RUB-to-crypto volume across all apps to avoid exceeding this threshold. If you plan to trade larger amounts, you will need to undergo the official "Qualified Investor" certification, which removes these purchase caps but requires passing a more advanced risk-assessment test.

Final Thoughts: Choosing the Best Crypto App in Russia

In 2026, the Russian cryptocurrency landscape is defined by specialized choice and regulatory maturity. Whether you prioritize the high-performance AI ecosystem of BingX, the seamless social integration of Telegram, or the uncompromising cold storage security of Ledger, the available tools are now more robust and transparent than ever before. Choosing the right platform ultimately depends on balancing your need for daily liquidity with the long-term safety of self-custody.

As the July 2027 enforcement deadline approaches, staying within the evolving legal framework is essential for maintaining a secure and compliant portfolio. By leveraging platforms that support local banking rails and adhere to modern security standards, Russian users can navigate the global digital economy with greater confidence and efficiency.

Risk Reminder: Cryptocurrency trading involves significant risk and may result in the loss of your invested capital. Digital assets are subject to high market volatility and regulatory changes. In Russia, while crypto is recognized as property for investment and cross-border settlement, it remains prohibited for use as a means of domestic payment. Always perform your own due diligence, monitor your annual purchase limits, and never invest more than you can afford to lose.

Related Reading