Verified Emeralds (VEREM) is a leading innovator in the precious stone

RWA sector, transforming the traditional emerald market into a liquid, transparent, and digital asset class. By backing every token with physical, audited gemstones held in secure custody, VEREM provides investors with a "fortress" against currency depreciation and crypto market swings. As of early 2026, VEREM commands a market capitalization of over $880 million, operating under strict regulatory frameworks to bridge the gap between natural wealth and decentralized finance.

In this article, you will learn what Verified Emeralds is, how the tokenization of physical gemstones works, the importance of the VEREM token in the ecosystem, and how the project integrates "Green Mining" practices into the blockchain.

What Is Verified Emeralds (VEREM) RWA Project?

Verified Emeralds is an RWA protocol that tokenizes fractional ownership of physical emeralds. Unlike speculative memecoins, each VEREM token is a digital representation of a RWA that has been certified by the Gemological Institute of America (GIA) and documented for full traceability. The project seeks to democratize access to high-end gemstone investments, which were historically reserved for elite collectors and institutional players.

VEREM operates through three core technological and operational pillars:

1. Asset Backing & Custody: Physical emeralds are sourced through regulated mining (overseen by Alberi Holding) and held in favor of the VEREM Foundation in Abu Dhabi, ensuring the assets are bankruptcy-remote and securely stored.

2. On-Chain Transparency: Built initially on the

BNB Smart Chain (BEP-20), the project uses smart contracts to manage supply, trading, and provenance, with plans to migrate to a dedicated VER Blockchain tailored for RWA scaling.

3. Regulatory Compliance: Headquartered in the Abu Dhabi Global Market (ADGM), the project follows international standards for DLT Foundations, providing a level of institutional-grade credibility rarely seen in the gemstone industry.

In 2025, VEREM successfully transitioned from its conceptual phase to a fully functional marketplace. By early 2026, the project expanded its reach by listing on major exchanges like BingX, while simultaneously launching its "Green Initiative" to ensure all backed assets are extracted using renewable energy and sustainable practices.

How Does Verified Emeralds Work?

Key features of Verified Emeralds (VEREM) | Source: Verified Emeralds

VEREM replaces the opaque and illiquid traditional gemstone market with a streamlined, programmable tokenization model. The process ensures that for every token in circulation, there is a corresponding value in physical emeralds held in reserve.

1. Sustainable Extraction and Sourcing: The process begins at the mines managed by Alberi Holding. VEREM emphasizes "Green Mining," utilizing solar and wind power to minimize environmental impact. This ensures the RWA backing meets modern ESG (Environmental, Social, and Governance) standards.

2. Certification and Appraisal: Before tokenization, each emerald undergoes rigorous third-party auditing and GIA certification. This step verifies the stone's cut, clarity, color, and carat weight, establishing a baseline "Real World Value" that prevents over-collateralization.

3. Tokenization via Domus Giulia: The partner entity Domus Giulia handles the technical minting process. The emerald's value is fractionalized into VEREM tokens. With a fixed total supply of 50 million tokens, the scarcity of the digital asset mirrors the physical scarcity of the mineral.

4. Storage and Governance: The physical stones are placed in high-security vaults. Meanwhile, token holders gain access to the VEREM DAO, where they can participate in decisions regarding the project’s "Green Mining" progress reports and the development of the "Verland" digital ecosystem.

What Are the Key Components of the VEREM Ecosystem?

The VEREM project is more than a simple store of value; it is building a comprehensive suite of digital experiences and infrastructure designed to enhance the utility of gemstone ownership.

1. The VEREM Token

The VEREM token is the utility and governance backbone of the ecosystem. It is a non-inflationary asset with a fixed supply, designed to serve as a hedge against inflation. Unlike many RWA projects that charge high entry fees, the VEREM token contract is designed with zero transaction taxes, ensuring high capital efficiency for traders and long-term holders.

2. VEREM DAO

The DAO empowers "VereMiners" (token holders) to vote on strategic directions. This includes approving new mining partnerships, overseeing the DAO Treasury, which holds 20% of the total token supply, and implementing community-driven social programs in the regions where mining occurs.

3. Green Mining Initiative

A standout feature of VEREM is its commitment to sustainability. The project produces Progress Reports on its transition to electric mining equipment and biodiversity conservation. This makes VEREM a preferred choice for institutional investors looking for "Green RWAs."

4. Verland World and Fox Underground (In Development)

To bridge the physical and digital, VEREM is developing:

• Fox Underground: A 3D immersive platform that provides users with a "virtual tour" of the mining and processing facilities.

• Fashion Street Game: A decentralized application (dApp) where users can use their tokens to design virtual jewelry, with the community voting on top designs for rewards.

• NFT Marketplace: A platform for trading exclusive, emerald-backed NFTs that represent specific, high-value stones.

What Is the VEREM Token Used For?

The VEREM token serves as the primary medium of exchange and governance within the ecosystem. Its utility is divided into three main areas:

• Governance: Holders with a minimum balance can submit proposals to the DAO.

• Value Retention: Serving as a digital "Gold 2.0," the token allows users to hold a portion of a precious mineral portfolio without the logistics of physical storage or insurance.

• Ecosystem Access: Future platforms like the Treasure Hunt and Verem City simulation will require VEREM tokens for participation and rewards.

Note: The total supply is strictly capped at 50,000,000 VEREM, and the team has implemented a 24-month cliff for founder allocations to ensure long-term alignment with the community.

How to Trade Verified Emeralds (VEREM) on BingX Spot Market

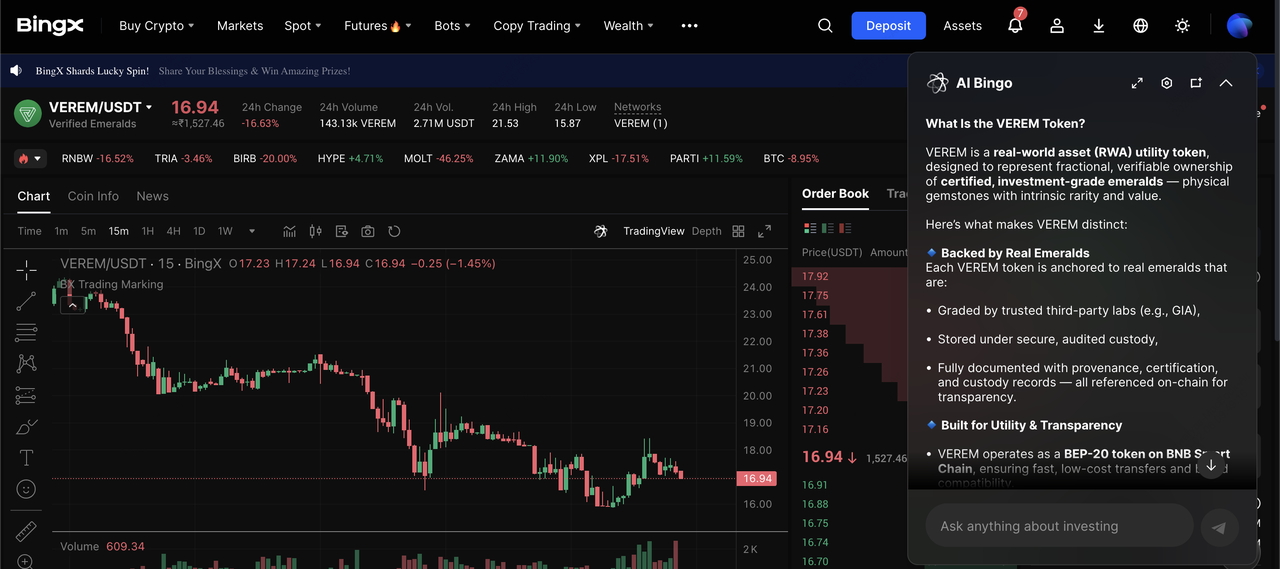

VEREM/USDT trading pair on the spot market powered by BingX AI insights

Verified Emeralds (VEREM) is traded on the BingX Spot market under the VEREM/USDT trading pair. Trading is enhanced by

BingX AI, which provides real-time "Token Analysis" and sentiment summaries to help you capture emerging opportunities in the RWA sector.

1. Fund Your Account: Ensure you have

USDT in your Spot Account. You can deposit it from an external wallet or purchase it directly via the "Quick Buy" section using a credit card or P2P trading.

2. Locate the Pair: Navigate to the Spot trading interface and use the search bar to find

VEREM/USDT.

3. Analyze with BingX AI: Before placing an order, click the BingX AI icon to get an instant breakdown of the token’s current price levels, support/resistance zones, and a summary of the latest VEREM project news.

4. Choose Your Order Type:

• Market Order: Select this for instant execution at the best current market price.

• Limit Order: Use this to set a specific price at which you want to buy or sell VEREM.

5. Execute & Monitor: Enter the amount you wish to trade and click Buy VEREM. You can track your open orders and transaction history at the bottom of the trading screen.

3 Key Considerations Before Investing in Verified Emeralds (VEREM)

Understanding the unique synergy between physical gemstone markets and decentralized finance is essential for managing the risks associated with this high-value RWA project.

1. RWA Liquidity: While the token is liquid on exchanges, the underlying physical emeralds are long-term assets. Price movements may be less volatile than typical "DeFi-only" tokens but are influenced by global gemstone market trends.

2. Regulatory Jurisdiction: VEREM is compliant with ADGM regulations. Investors should ensure their specific jurisdiction allows for the trading of tokenized commodities and DLT-based assets.

3. Phased Development: Many features, such as the Verland World and the Proprietary VER Blockchain, are currently in the roadmap phases. Investors should track the "Phase V and VI" milestones to gauge ecosystem growth.

Final Thoughts: Should You Buy Verified Emeralds (VEREM) in 2026?

Verified Emeralds (VEREM) represents a sophisticated evolution of the RWA narrative. By focusing on a high-value, scarce commodity like emeralds, and wrapping it in a compliant, "Green" framework, it offers a unique value proposition that differs from Treasury-backed or Real Estate-backed tokens.

As the RWA market moves toward $10 trillion by 2030, projects that offer certified physical backing are likely to lead the pack. If you are looking for an asset that combines the "solidity of emeralds" with the efficiency of the BNB Chain, VEREM is a project to watch closely in 2026. However, as with all gemstone investments, it should be viewed through the lens of long-term capital protection rather than short-term speculation.

Related Reading