Kevin Warsh is Donald Trump’s nominee to become the next US Federal Reserve Chair, with Jerome Powell’s term set to expire in May 2026. His nomination has quickly become a focal point across global financial markets, arriving at a moment when investors are closely watching inflation trends, interest rate expectations, and the sustainability of America’s growing national debt.

In the days following the announcement, US equities, Treasury markets, and the dollar all reacted as traders reassessed whether the next Fed Chair would prioritize tighter monetary discipline or take a more flexible approach to supporting economic growth. These expectations matter not only for traditional assets, but also for global liquidity conditions that shape risk appetite worldwide.

For crypto investors, the question is more direct: is Kevin Warsh pro-crypto? The answer is nuanced. Warsh is widely viewed as a monetary hawk with a strong-dollar bias, and he does not support crypto through easy liquidity, rate cuts, or central bank backstops. At the same time, he has consistently engaged with Bitcoin and blockchain as legitimate financial technology and a strategically important US industry.

How Warsh balances monetary discipline with recognition of crypto’s structural role will be critical for assessing

Bitcoin prices, crypto market liquidity, and broader risk dynamics in 2026.

Who Is Kevin Warsh, Trump’s New Fed Chair Nominee?

Source: Brendan Mcdermid / Reuters

Kevin Warsh is a former Federal Reserve governor and longtime market insider whose nomination as Donald Trump’s new Fed Chair pick has refocused attention on his policy record, crisis experience, and monetary views. His background helps explain why markets are closely watching how a potential Warsh-led Federal Reserve could approach interest rates, liquidity, and financial stability.

Kevin Warsh Career Highlights

• Wall Street Experience: Investment banker at Morgan Stanley, working in mergers and acquisitions

• Bush White House (Early 2000s): Special Assistant to the President for Economic Policy and Executive Secretary of the National Economic Council under George W. Bush

• Federal Reserve Governor (2006–2011): Appointed at age 35, becoming the youngest governor in Fed history

• 2008 Financial Crisis: Key liaison between the Federal Reserve and financial markets during the crisis

• Post-Fed Career (2011–Present): Visiting Fellow at the Hoover Institution, Lecturer at Stanford Graduate School of Business, Partner at Duquesne Family Office

• Fed Chair Shortlist in Trump's First Term (2017): Finalist for Fed Chair during Donald Trump’s first term, but ultimately passed over in favor of Jerome Powell, a decision Trump has since publicly criticized

Kevin Warsh’s Background and Policy Perspective

Kevin Warsh comes from a Wall Street and policy background rather than academia. He began his career at Morgan Stanley, where he developed a market-driven understanding of capital flows, financial risk, and institutional behavior, a perspective that later set him apart inside the Federal Reserve.

He entered government during the George W. Bush administration and was appointed to the Federal Reserve Board of Governors in 2006 at age 35, becoming the youngest governor in Fed history. During the 2008 financial crisis, Warsh served as a key link between the Fed and Wall Street, working closely with then Fed Chair Ben Bernanke on crisis response.

After leaving the Fed in 2011, Warsh remained active across finance and policy. He was a serious contender for Fed Chair during Donald Trump’s first term in 2017 before Jerome Powell was chosen. With Powell’s term ending in 2026, Warsh’s nomination reflects Trump’s renewed push for tighter monetary discipline and a more market-oriented Federal Reserve.

Is Kevin Warsh Dovish or Hawkish? Short-Term Rate Cuts, Long-Term Discipline

The consensus for 2026 is that Kevin Warsh will be tactically dovish in the near term but structurally hawkish over time. His monetary framework points to three core policy implications:

1. Stronger dollar priority

2. Tighter liquidity over time

3. Less Fed support for inflation hedges

While Warsh is likely to support rate cuts early in his tenure, he is also expected to scale back the Federal Reserve’s role as a market backstop. The result is a mix of lower short-term rates and reduced long-term policy support, increasing market volatility as the “Fed Put” is gradually withdrawn.

Historically, Warsh has been firmly hawkish. During his time as a Fed Governor from 2006 to 2011, he criticized Quantitative Easing and warned that an expanded balance sheet would weaken the dollar and inflate asset prices. His 2026 stance reflects a shift in sequencing rather than ideology: easing first, then reasserting discipline.

Short-Term: Rate Cuts to Ease Financial Conditions

Warsh has argued that interest rates are too restrictive for current economic conditions.

• AI-driven productivity: He believes productivity gains from

artificial intelligence are structurally disinflationary, giving the Fed room to cut rates without reigniting inflation.

• Criticism of Powell: Warsh has said the Fed under Jerome Powell was too slow to adjust rates, leaving borrowing costs unnecessarily high for households and businesses.

Long-Term: Balance Sheet Discipline and a Smaller Fed

Despite supporting rate cuts, Warsh’s core framework prioritizes monetary discipline.

• Balance sheet reduction: He views shrinking the Fed’s $6.6 trillion balance sheet as essential and sees asset purchases as an emergency tool rather than a standing policy.

• Reduced forward guidance: Warsh favors a more flexible and less predictable Fed, allowing policy to tighten quickly if inflation remains near the 3 percent level.

| Attribute |

Kevin Warsh Hawkish Stance (2006–2011) |

Kevin Warsh Dovish-to-Hawkish Stance (2026) |

| Interest Rates |

Favored higher rates to control inflation. |

Dovish: supports short-term rate cuts.

Hawkish: prepared to tighten again if inflation persists. |

| Balance Sheet |

Opposed QE and balance sheet expansion. |

Aims to shrink the $6.6T Fed balance sheet. |

| Inflation View |

Warned about dollar debasement risks. |

Dovish: AI-driven productivity disinflation allows near-term easing.

Hawkish: maintains a firm stance if inflation pressures persist. |

| Market Support |

Skeptical of market backstops. |

Intends to scale back the “Fed Put.” |

| Communication |

Preferred limited forward guidance. |

Likely to keep policy less predictable. |

Is Kevin Warsh Pro-Crypto?

Kevin Warsh is not pro-crypto in the monetary sense, but he is institutionally crypto-aware. He does not support crypto through liquidity, interest rate policy, or balance sheet expansion. However, he recognizes crypto as legitimate financial technology and a strategically important U.S. industry. Under a Warsh-led Fed, crypto gains regulatory recognition but loses monetary accommodation.

• Why Warsh Is Seen as Crypto-Friendly: He acknowledges Bitcoin as a policy signal, has invested in

crypto-related firms, views blockchain as “the newest, coolest software,” and sees U.S.-based crypto innovation as strategically important.

• Why Warsh Is Not Pro-Crypto in the Monetary Sense: He does not treat crypto as money, opposes Fed liquidity or rate support for crypto markets, favors tighter financial conditions, and rejects the Fed acting as a backstop for digital assets.

What's Kevin Warsh's View on Gold and Bitcoin?

Kevin Warsh would treat Bitcoin as a legitimate store of value and a monetary signal, but not as an asset supported by central bank policy. Under his framework,

Bitcoin and gold are allowed to exist as inflation hedges, but must compete without liquidity support in a strong-dollar, disciplined monetary regime.

Warsh has consistently framed Bitcoin as a structural alternative to gold rather than a speculative asset. In a 2021 CNBC interview, he said, “If you're under 40, Bitcoin is your new gold,” arguing that digital scarcity has replaced physical metals as the primary hedge against currency debasement. He reinforced this view in a 2025 Hoover Institution interview, noting that Bitcoin absorbs capital that would otherwise flow into gold and functions as a monetary warning system when confidence in central bank policy weakens.

This framework became visible after Warsh’s January 2026 nomination. As markets priced in tighter liquidity and balance sheet reduction,

gold,

silver, and Bitcoin all declined, reflecting a shift toward a regime where stores of value must perform without central bank accommodation.

What's Kevin Warsh's View on Crypto?

Kevin Warsh views crypto as a financial system and technology layer rather than a speculative asset class or alternative currency. In his framework, crypto markets signal policy credibility and capital flows, but should not be supported by monetary policy or central bank liquidity.

In a 2025 Hoover Institution interview, Warsh described Bitcoin as a “policeman for policy,” arguing that its price reflects confidence in central bank discipline. When policy is credible, speculative demand should ease. When it is not, crypto highlights policy stress rather than causing it.

Beyond price signals, Warsh stresses crypto’s technological importance. In early 2026, he called blockchain “the newest, coolest software” in finance and warned that pushing innovation offshore would hurt U.S. competitiveness. He supports clearer federal regulation, private-sector development, and fully backed

stablecoins, while remaining skeptical of CBDCs and rejecting monetary support for crypto prices.

How Kevin Warsh as Fed Chair Could Potentially Impact the Crypto Market?

Kevin Warsh’s nomination signals a regime shift for crypto markets. While his recognition of Bitcoin lends institutional legitimacy to the sector, his commitment to monetary discipline undermines the liquidity conditions that previously fueled broad crypto rallies. The impact is structural rather than ideological: less liquidity-driven upside and sharper differentiation between assets.

| Factor |

Short-Term Impact (2026) |

Long-Term Impact (2026-2030) |

| Liquidity |

Negative: Balance sheet reduction drains "easy money." |

Neutral: Markets reset on real productivity. |

| Regulation |

Positive: Clearer rules for banks and exchanges. |

Bullish: Massive institutional inflows. |

| Volatility |

High: Less "Forward Guidance" means more shocks. |

Lower: Mature asset class behavior. |

1. Liquidity Tightening Becomes a Structural Headwind for Crypto

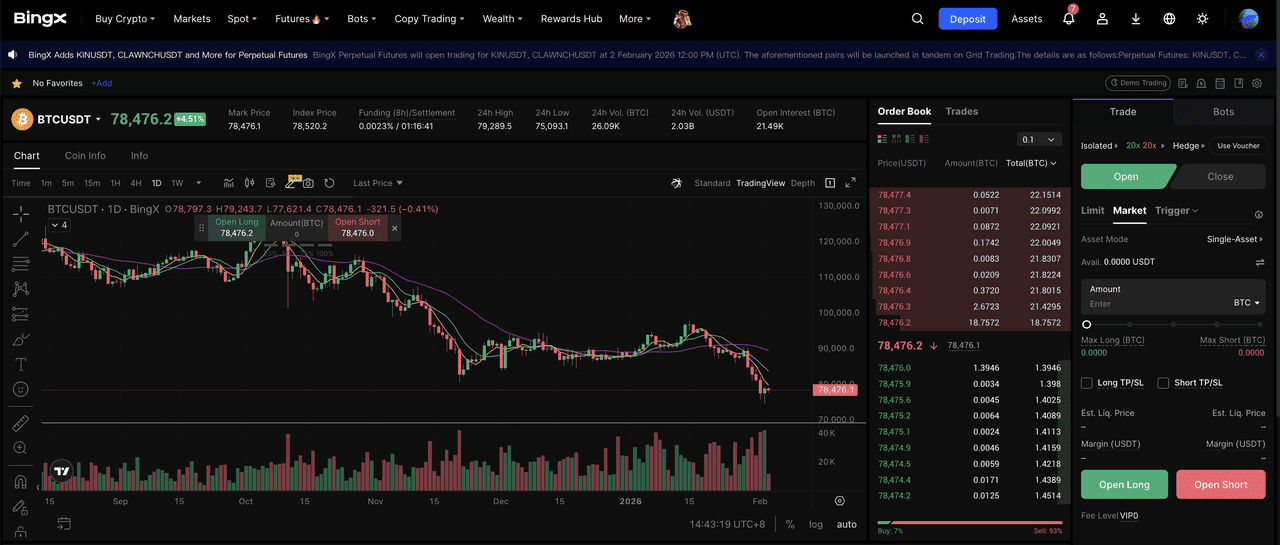

The most immediate impact of a Warsh-led Fed would be tighter liquidity across crypto markets. Warsh has long argued that the Fed’s $6.6 trillion balance sheet distorts asset prices and fuels speculative excess. Since his nomination was signaled on January 30, Bitcoin has already fallen below $80,000 as markets began pricing in reduced accommodation. If Warsh accelerates quantitative tightening, the liquidity tailwinds that supported widespread crypto gains in 2025 are likely to fade, increasing pressure on leveraged trading and high-beta tokens.

2. Regulatory Clarity Improves Access but Removes Price Support

While liquidity may tighten, regulatory conditions are likely to improve. Warsh favors clear, market-driven rules over regulation by enforcement, which could lower barriers for institutions. Banks may gain greater freedom to hold digital assets, and private-sector stablecoins could benefit from clearer federal frameworks. However, this clarity does not translate into monetary support. Crypto markets would gain legal footing, but lose indirect price support from accommodative policy.

3. Bitcoin Consolidates as a Macro Asset While Speculation Thins

Warsh’s framework draws a clearer line between Bitcoin and the rest of the crypto market. Because he views Bitcoin as a monetary signal rather than a speculative trade, its macro relevance may persist even under tighter conditions. In contrast, assets without durable demand or real utility are likely to struggle in a strong-dollar, disciplined policy regime. The outcome is a smaller, more selective crypto market where performance depends on fundamentals rather than liquidity.

Is Kevin Warsh Confirmed to Be the Next Fed Chair?

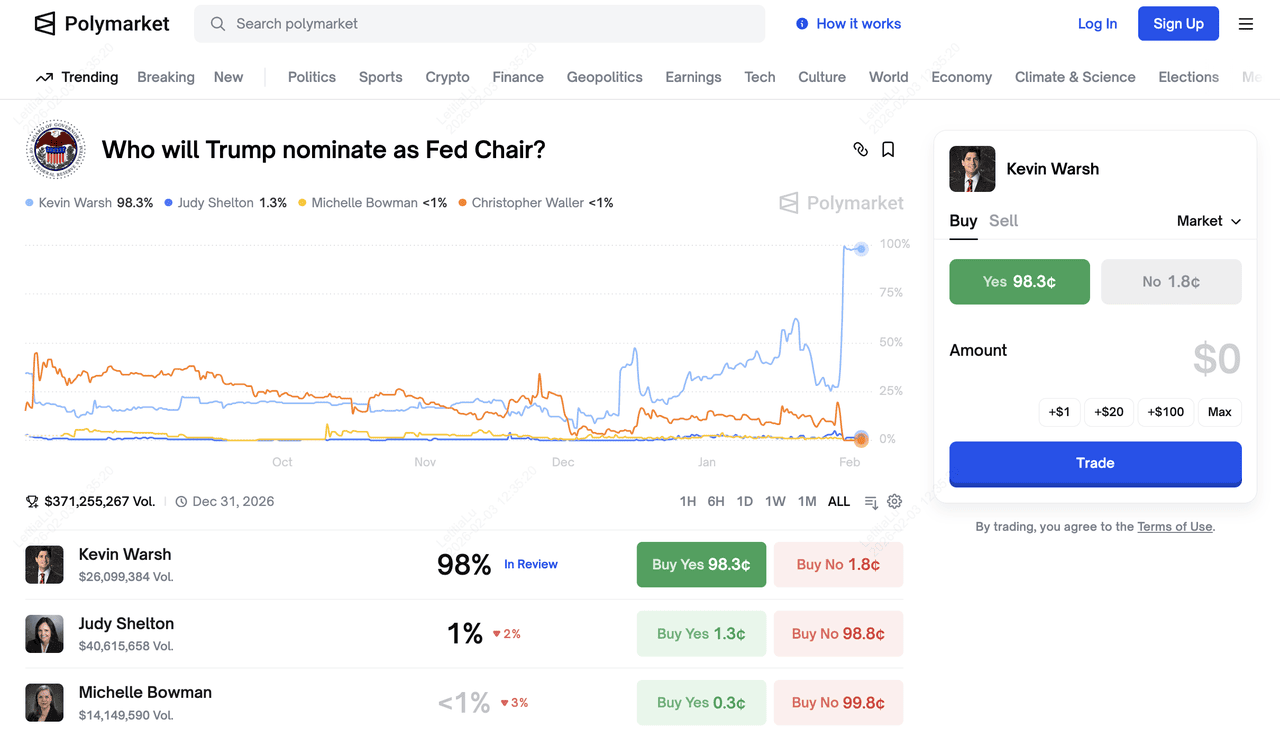

Kevin Warsh leads in the poll on Polymarket | Source: Polymarket

As of early February 2026, Kevin Warsh has not yet been formally confirmed as the next Federal Reserve Chair. The appointment process still requires a presidential nomination followed by Senate confirmation.

Market expectations, however, have become highly concentrated. On

Polymarket, traders are assigning over a 98% probability to Warsh becoming the next Fed Chair, with trading volume reaching hundreds of millions of dollars. A similar signal is visible on

Kalshi, a CFTC-regulated prediction market, where contracts tied to the Fed Chair nomination also imply near-certain odds in Warsh’s favor.

Prediction markets such as Polymarket and Kalshi aggregate real-money positions based on public information, political signaling, and media reporting. While these markets do not constitute official confirmation, they provide a useful window into how traders and investors assess the likelihood of major political appointments ahead of formal announcements.

When Will Kevin Warsh Become Fed Chair? The 2026 Timeline

As of February 3, 2026, Kevin Warsh’s transition to Federal Reserve Chair is in progress. President Donald Trump formally announced Warsh’s nomination on January 30, signaling his intent to install a more market-oriented Fed leader by late spring.

While the nomination is set, the transition follows a defined confirmation process that will unfold over the coming months.

Kevin Warsh Fed Chair Confirmation Timeline

• January 30, 2026: White House formally nominates Kevin Warsh as Fed Chair

• February–March 2026: Senate Banking Committee hearings, led by Senator Tim Scott. Warsh is expected to face questions on monetary discipline, crypto, and Fed independence

• April 2026: Full Senate confirmation vote. A simple majority of 51 votes is required

• May 15, 2026: Jerome Powell’s term as Fed Chair officially expires

• Late May 2026: Expected swearing-in of Kevin Warsh as the 17th Fed Chair

Risks That Could Delay Warsh’s Appointment

Despite a 53–47 Republican majority, confirmation is not automatic. Some senators have suggested delaying the vote pending the Department of Justice review of the Federal Reserve’s headquarters renovation. In addition, Warsh must first be confirmed to a seat on the Board of Governors before he can formally assume the Chair role.

Until confirmation is complete, Powell remains in office. For markets, Warsh’s Senate testimony in March is likely to provide the earliest signals of how his leadership could reshape monetary policy later in 2026.

Is It a Good Time to Invest in Bitcoin Under Warsh?

Kevin Warsh’s nomination has triggered a clear valuation reset across the crypto market. As of February 3, 2026, Bitcoin is trading in the $75,000–$79,000 range, roughly 30% below its 2025 highs. For investors, the key question is no longer about hype or narratives, but how Bitcoin should be positioned in a regime defined by tighter liquidity, a stronger dollar, and reduced central bank support.

Disclaimer: This content is for informational purposes only and does not constitute investment or trading advice. Cryptocurrency markets are highly volatile, and buying or shorting Bitcoin involves significant risk, including potential loss of capital. Always assess your risk tolerance and conduct your own research before trading.

The Bear Case: Liquidity Tightening as a Short-Term Headwind

The most immediate risk under a Warsh-led Federal Reserve is reduced liquidity. Warsh has consistently criticized the size of the Fed’s $6.6 trillion balance sheet and has signaled a willingness to accelerate balance sheet reduction. Historically, periods of quantitative tightening and higher real rates have been unfavorable for risk assets, including Bitcoin.

If investors expect continued downside pressure or want to hedge existing spot exposure, one way to express a short-term bearish view is through Bitcoin derivatives rather than selling long-term holdings.

How to Short Bitcoin (BTC) on BingX

If investors want to express a short-term bearish view or hedge existing Bitcoin exposure amid tighter liquidity expectations, one option is to short Bitcoin using derivatives rather than selling spot holdings. This allows traders to gain downside exposure during periods of macro or policy-driven volatility.

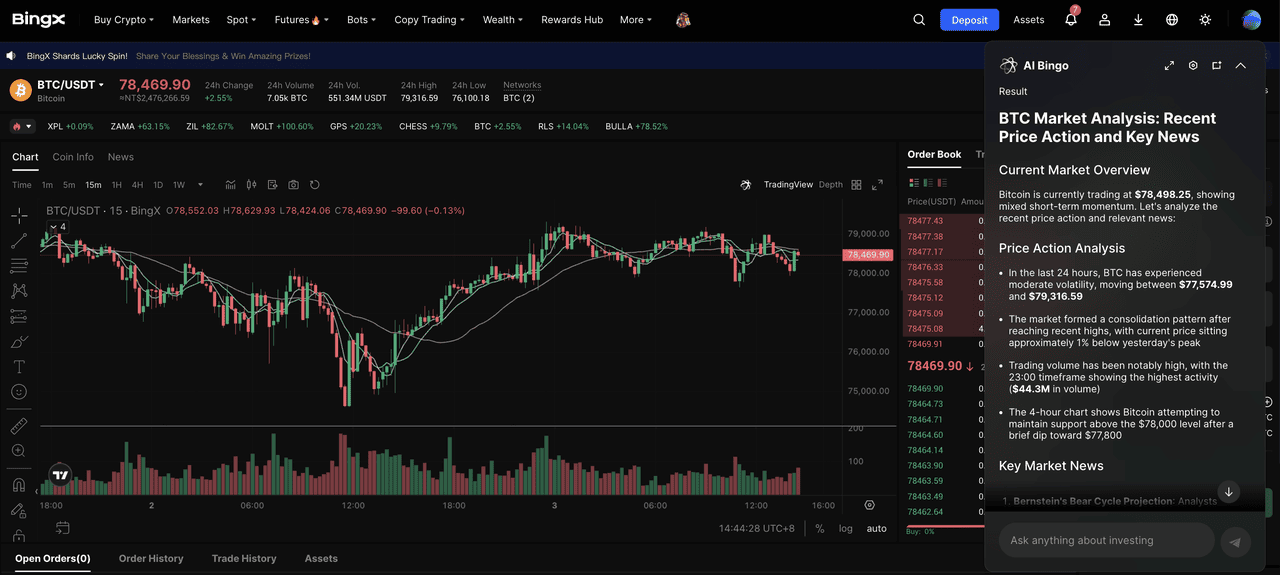

Step 2: Open the BTC/USDT perpetual futures market: Go to the

BingX Futures section and select the

BTC/USDT perpetual trading pair to access continuous Bitcoin price exposure.

Step 3: Select a short position: Choose Short if you expect Bitcoin prices to decline or want to hedge against near-term downside risk. You can reference

BingX AI indicators for trend direction and market sentiment before entering.

The Bull Case: Institutional Legitimacy Sets a Long-Term Floor

Despite near-term pressure, Warsh’s framework also introduces a structural positive for Bitcoin. He has consistently treated Bitcoin as a legitimate store of value and a monetary signal rather than a speculative excess. While this does not translate into policy support, it strengthens Bitcoin’s institutional standing.

For long-term investors, the current range may reflect repricing rather than structural deterioration. Instead of attempting to time the bottom, some investors choose gradual accumulation to reduce entry risk.

How to Buy Bitcoin on BingX

If investors want to express a long-term bullish or accumulation view, especially after a market repricing, buying Bitcoin on the spot market provides direct exposure without leverage. Some investors prefer a

dollar-cost averaging (DCA) approach to reduce timing risk during volatile periods.

Step 1: Create and fund your BingX account: Register on BingX, complete any required verification, and deposit USDT or supported assets into your account.

Step 2: Open the BTC/USDT spot market: Go to

BingX Spot market and select the

BTC/USDT trading pair to access Bitcoin spot prices.

Step 3: Choose your buying approach: Decide between a one-time purchase or smaller, periodic buys if using a DCA strategy. You can reference BingX AI tools for market trends and sentiment indicators to help inform timing.

Step 4: Place your order: Use a market order for immediate execution or a limit order to buy at a specific price level.

Step 5: Hold or manage your position: Once filled, Bitcoin will appear in your spot wallet. You can hold it as a long-term position or adjust later based on market conditions.

This approach suits investors who view Bitcoin as a store of value that should perform on fundamentals rather than short-term liquidity cycles.

Final Thoughts: How Would Bitcoin and Crypto Perform Under a Warsh Regime?

Under Kevin Warsh, Bitcoin is unlikely to benefit from easy money or implicit central bank backstops. Instead, it would trade in a more disciplined monetary environment where price action reflects fundamentals, adoption, and investor conviction rather than liquidity support. Short-term volatility is likely to remain elevated as markets adjust to tighter financial conditions.

Over time, this shift may strengthen Bitcoin’s role as a mature macro asset. If it can hold value without policy accommodation, Bitcoin’s performance under a Warsh regime would be driven less by speculation and more by long-term confidence in its store-of-value thesis.

Related Reading

Frequently Asked Questions About Kevin Warsh and Crypto

1. Is Kevin Warsh pro-crypto?

Kevin Warsh is not pro-crypto in the sense of supporting prices or liquidity, but he is institutionally crypto-aware. He recognizes crypto as legitimate technology and market infrastructure while rejecting monetary support from the Federal Reserve.

2. How would Kevin Warsh as Fed Chair affect Bitcoin prices?

In the short term, Bitcoin could face higher volatility as markets adjust to tighter liquidity expectations. Over the long term, price performance is likely to depend more on adoption and fundamentals than central bank policy.

3. Will a Warsh-led Fed support crypto markets?

No. A Warsh-led Fed is unlikely to act as a backstop for crypto markets or support prices through monetary policy, even if regulatory clarity improves.

4. Would a Warsh-led Fed regulate crypto more strictly?

Regulation under Warsh is expected to be clearer rather than stricter. He has criticized regulation by enforcement and favors defined rules that reduce uncertainty without ongoing intervention.

5. Could tighter monetary policy ultimately benefit Bitcoin?

Possibly. If Bitcoin can maintain value without liquidity support, tighter policy may reinforce its long-term store-of-value narrative, though volatility may increase during the transition.

6. Should investors wait for Senate hearings before taking positions?

Some investors may choose to wait. Warsh’s Senate testimony could clarify his views on rates, balance sheet policy, and Fed communication, which may influence near-term market sentiment.