Restaking is moving from buzzword to core infra on

Solana. Instead of bootstrapping brand-new validator sets, projects can borrow economic security from existing staked SOL and

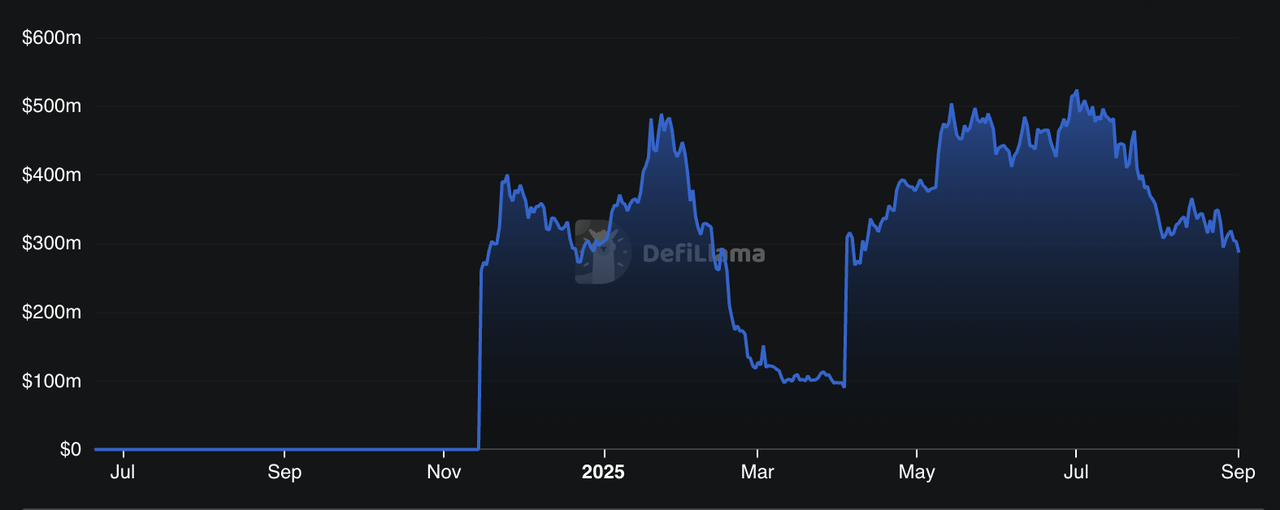

LSTs (liquid staking tokens), unlocking new services (oracles, MEV distribution, IBC bridging) and extra yield for stakers. In 2025, Solana’s restaking stack is crystallizing around a handful of serious players building real, on-chain utilities and has a total value locked (TVL) of nearly $300 million as of September.

Solana restaking TVL | Source: DefiLlama

Discover the top Solana restaking protocols of 2025, including what each does, why it matters, and where the opportunities and risks lie for users, builders, and institutions.

What Is Solana Restaking and How Does It Work?

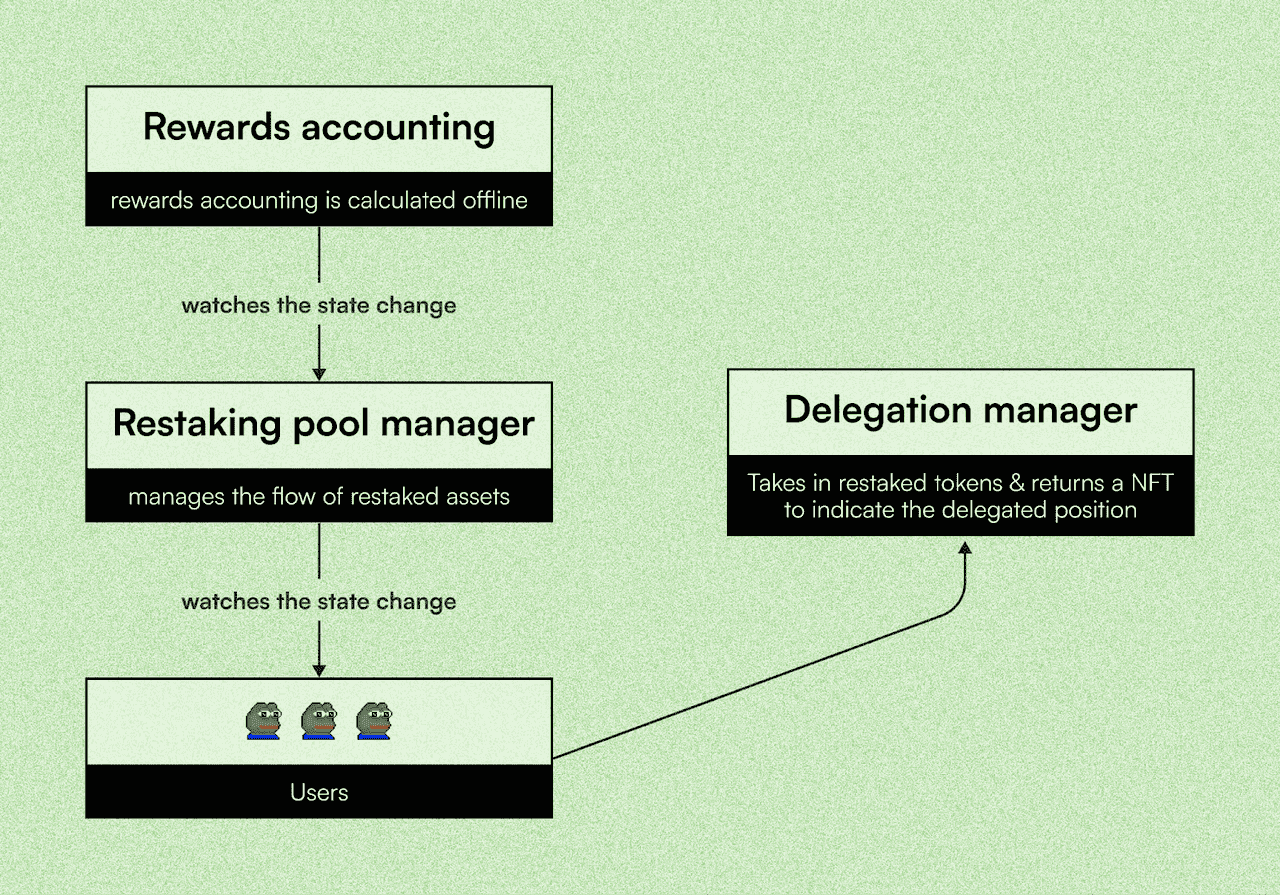

How restaking on Solana works | Source: Solayer

Restaking on Solana is a way to earn more rewards from your staked SOL by letting those tokens secure extra services in addition to the main blockchain. Normally, when you stake SOL, it helps validators secure the Solana network and earns you a base APY of around 6–8%. With restaking, you can deposit either native SOL or liquid staking tokens (LSTs) like mSOL or JitoSOL into a restaking protocol. In return, you receive a liquid restaking token (LRT) or Vault Receipt Token (VRT). This token represents your position and can still be used in DeFi, borrow, lend, or trade, while your underlying SOL continues to generate rewards.

In practice, restaking is already powering real services on Solana. Jito’s TipRouter routes MEV and priority fees from block producers directly to restakers, turning staked capital into cash-flowing assets. Picasso Network uses restaked assets to secure IBC bridging, giving Solana trust-minimized connections to Cosmos and other chains. By mid-2025, Solana restaking protocols had collectively attracted over $500M in TVL, showing strong adoption despite the sector being less than a year old. For beginners, this means you can start by

staking SOL, minting an LST like JitoSOL, and then restaking it for extra yield, all while keeping liquidity to use in other DeFi strategies.

How Solana Restaking Differs From Ethereum Restaking

Ethereum’s restaking, led by

EigenLayer, is designed for Actively Validated Services (AVSs) such as bridges, oracles, and

data availability layers. Because Ethereum has higher gas fees and slower throughput, EigenLayer had to create EigenDA, a data availability solution capable of processing 15 MB/s today with goals of 100x more. By 2025, EigenLayer surpassed $16B in TVL and supports over 100 AVSs, but participation often involves navigating complex slashing conditions and advanced yield strategies. This makes Ethereum restaking attractive for sophisticated investors and institutions, but less beginner-friendly.

Solana’s restaking, powered by protocols like Jito, Solayer, Picasso, and Cambrian, takes a more streamlined approach. With sub-$0.01 fees and ~65,000 transactions per second, Solana restaking is accessible to everyday users. It focuses on endogenous AVSs, applications built directly inside Solana’s L1, such as MEV routers, oracles, and modular rollups. Users typically receive liquid tokens (VRTs or LRTs) that can be reused in DeFi, combining base

staking rewards with extra service fees. For beginners, Solana restaking works more like “staking-plus,” a simple, low-cost way to boost yields while staying liquid in DeFi.

Why Solana Restaking Matters in 2025

Restaking on Solana is no longer just about speculative points but is also tied to real cash flows. For example, Jito’s TipRouter distributes MEV and priority fees directly back to restakers, meaning users earn tangible rewards on top of base staking APY. This gives SOL holders a way to compound returns without locking liquidity, with restaking yields stacking on top of 6–8% staking APY. At the same time, protocols like Picasso are opening Solana to

Cosmos via IBC, letting users deploy restaked assets across chains for trading, bridging, and yield opportunities that were previously siloed.

For developers, platforms like Cambrian and Jito’s NCN templates dramatically reduce launch times for new services by reusing Solana’s security instead of bootstrapping validators from scratch. On the user side, liquid receipts such as VRTs/LRTs make it easy to stay liquid while earning; tokens can be restaked, traded in DeFi, or used as collateral. Combined with Solana’s fast finality and low fees (<$0.01 per transaction), this makes restaking practical not just for institutions but also for beginners who want to boost SOL yields while supporting the ecosystem.

What Are the 5 Best Solana Restaking Protocols of 2025?

Solana’s restaking ecosystem is expanding quickly in 2025, with several protocols leading the way in unlocking higher yields, shared security, and new on-chain services.

1. Jito (Re)staking

Jito (Re)staking is one of Solana’s flagship restaking platforms, letting users deposit SOL or supported SPL assets into vaults that issue Vault Receipt Tokens (VRTs). These tokens represent your staking position and can be reused across Node Consensus Networks (NCNs), such as TipRouter, without sacrificing liquidity. With 14.9M SOL staked (worth billions at 2025 prices), over 187,000 holders, and an APY of around 6.7%, Jito has become a cornerstone of Solana’s staking economy. Users can choose vaults, operators, and slashing conditions modularly, which provides both flexibility and control over their exposure.

The launch of TipRouter, Jito’s first NCN, showcased restaking’s power by redistributing billions in MEV and priority fees back to stakers, turning SOL into a cash-flowing asset rather than just a passive stake. JitoSOL, its liquid staking token, compounds staking and MEV rewards while remaining usable across

Solana DeFi for lending, LPing, and farming. Beyond user yield, Jito’s infrastructure underpins 97.5% of Solana’s stake weight via the Jito-Solana validator client, reinforcing its systemic role in network efficiency. Combined with its governance-driven expansion and integrations with DeFi protocols like

Kamino, Jito is not just a restaking tool but a core infrastructure layer powering Solana’s growth.

2. Solayer

Solayer is a Solana-native restaking platform designed to maximize the blockchain’s strengths in throughput, low latency, and composability. Unlike Ethereum-focused EigenLayer, which secures external AVSs, Solayer emphasizes endogenous AVSs, protocols and services that run directly inside Solana’s L1. It supports restaking with both native SOL and liquid staking tokens (LSTs), issuing liquid receipts that can be reused across DeFi. With over $112M in total deposits and 304,000 users by 2025, Solayer’s rapid adoption reflects demand for scalable restaking infrastructure tailored for high-speed networks. Its InfiniSVM engine boasts over 1M TPS, powered by hardware acceleration, RDMA networking, and optimized execution models, pushing Solayer beyond traditional blockchain limits.

By focusing on infrastructure acceleration, Solayer positions restaking as more than just yield farming. It enables projects like modular rollups, on-chain automation, and DeFi apps to tap into Solana’s validator security without bootstrapping new networks. Developers benefit from multi-asset support, ultra-fast execution, and composable liquid tokens (like sSOL and sUSD) that can integrate seamlessly into DeFi strategies. For users, this means earning 7.65% APY on sSOL or 3.9% on sUSD, while keeping assets liquid and deployable. For builders, it means launching services faster and more securely with Solana’s shared security layer. In 2025, Solayer is becoming a cornerstone of Solana’s restaking landscape, bridging performance-driven innovation with practical yield opportunities for both retail and institutional participants.

3. Renzo Protocol

Renzo is a multi-chain liquid restaking protocol that makes complex restaking strategies simple and accessible. Instead of requiring users to manage validator nodes, select Actively Validated Services (AVSs), or navigate slashing conditions, Renzo packages everything into user-friendly wrappers like ezSOL (for Jito on Solana) and ezETH (for EigenLayer on Ethereum). When users deposit

ETH or SOL, they receive Liquid Restaking Tokens (LRTs) that remain fully liquid across DeFi. Rewards are auto-compounded, and the protocol is backed by world-class audits and bug bounty programs, making it one of the most secure ways to restake across ecosystems. By 2025, Renzo supports over $1.47 billion in total value restaked, with $36 million+ on Solana alone.

Renzo is key to mainstream adoption of restaking because it removes the technical and operational hurdles that often keep users away. With APYs as high as 7.2% on ezSOL and 3% on ezETH, it offers competitive yields while preserving liquidity for lending, farming, or trading. Its cross-chain design also appeals to DeFi power users and institutions who want one-click exposure to restaking yield across Ethereum, Solana, and Symbiotic without micromanaging risk. Backed by top investors like Brevan Howard, Galaxy Digital, and Maven 11, Renzo continues to expand integrations with leading DeFi apps, giving both retail and professional users a practical, low-friction gateway into restaking yields.

4. Picasso Network

Picasso is a Cosmos SDK-based chain that acts as Solana’s gateway to the Inter-Blockchain Communication (IBC) ecosystem, enabling secure cross-chain messaging and asset transfers through restaking. Instead of relying on external validators, Picasso leverages restaked SOL and LSTs to provide the economic security behind these transfers. By positioning itself as a generalized restaking layer, Picasso allows Solana assets to secure AVSs like bridges, modular rollups, and dApps, ensuring transactions are permissionless and censorship-resistant. With support for 30+ networks and 70+ assets, Picasso has become a central hub for cross-ecosystem interoperability.

As Solana expands beyond its own ecosystem, Picasso plays a vital role in trust-minimized connectivity with Cosmos, Ethereum, and Polkadot. By restaking SOL to secure IBC bridges and messaging layers, Picasso unlocks new liquidity flows and broadens app integration across chains. For developers, this means building dApps with native Solana-level security that can still interact seamlessly with external ecosystems. For users, it provides safer and faster cross-chain transfers, while $PICA token stakers benefit from governance rights, bridging fees, and revenue-sharing models. In 2025, Picasso’s cross-chain design positions it as a key infrastructure player making Solana not just fast, but globally interoperable.

5. Cambrian

Cambrian is a modular security layer and developer SDK for Solana that turns restaked SOL into plug-and-play security for new services, whether you’re building dapps, middleware, or full Node Consensus Networks (NCNs). It abstracts the heavy lifting with production-ready components (consensus building blocks, node ops tools, local testing harness, and a one-command Deployment Wizard) plus deep integration with Jito restaking. Teams can reportedly ship NCNs ~90% faster, shrinking staffing from 3–4 engineers to 1–2, by assembling off-the-shelf parts instead of standing up bespoke validator, coordination, and slashing logic.

Cambrian lowers the barrier to launch restaking-backed services like oracle networks, automation layers/keepers, MEV management (sealed auctions, private RPCs), DeFi circuit breakers, AI/ZK coprocessors, and data-availability modules. Its orchestration model emphasizes telemetry-driven node selection and dynamic job routing, so operators, AVSs, and restakers can align on performance, risk, and rewards without months of infra work. The result is faster experimentation, shared security from restaking pools, and a clearer path for builders to move from prototype to production on Solana while maintaining robust, economically enforced security.

6. Fragmetric

Fragmetric is Solana’s first native liquid restaking protocol, now upgraded into the FRAG-22 asset management standard. This framework supports multi-asset deposits, modular yield sourcing, and precise, real-time reward distribution using Solana’s Token Extensions. When users stake through Fragmetric, they can “stake twice,” earning traditional staking rewards plus additional restaking yields, while receiving Liquid Restaking Tokens (LRTs) that stay liquid for trading or DeFi participation. By clearly defining operational roles and embedding transparency at the protocol level, Fragmetric streamlines complex DeFi strategies into an accessible, composable layer for users and developers alike.

With its transparent accounting, modular design, and efficient liquidity management, Fragmetric makes advanced yield strategies more accessible to everyday users. It bridges staking, liquid staking, and restaking into a unified flow, allowing SOL holders to maximize returns while helping secure Solana-based services like oracles, bridges, and Node Consensus Networks (NCNs). By evolving into the FRAG-22 standard, Fragmetric also sets benchmarks for interoperability and scalability, positioning itself as a building block for DeFi teams seeking to plug in ready-made restaking infrastructure. In 2025, Fragmetric strengthens both user capital efficiency and the overall stability of Solana’s financial ecosystem, making it a pivotal protocol for restaking adoption.

How to Get Started With SOL Liquid Restaking

Getting started with SOL liquid restaking is easier than it looks. Here’s a simple step-by-step guide using Jito as an example.

Step 1 — Set up a Solana wallet: Install a Solana wallet like Phantom or Solflare. Back up your seed phrase offline. In the wallet, select Solana Mainnet and copy your SOL address.

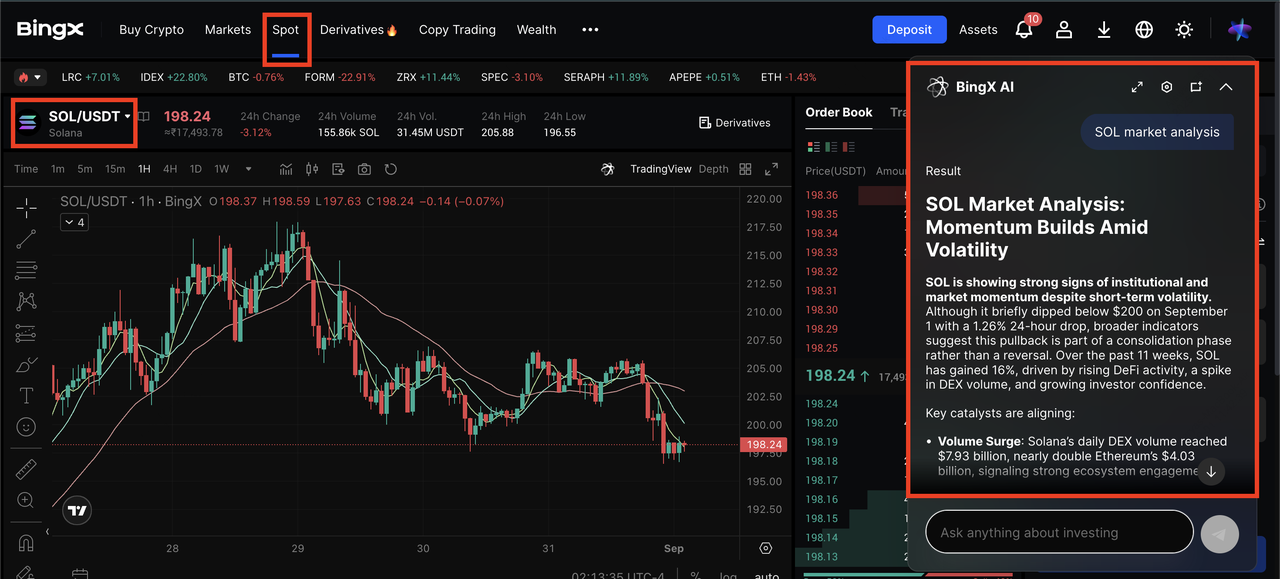

Step 2 — Buy SOL on BingX and fund your wallet: On BingX,

buy Solana tokens on the

Spot or

Convert tab (you can fund via card,

P2P, or transfers). Use

BingX AI to check real-time momentum and order-book stress before placing your order, then withdraw SOL to your wallet address on the Solana network. Send a small test first, then the rest. Network fees on Solana are typically a fraction of a cent.

SOL/USDT trading pair on the spot market, powered by BingX AI insights

Step 3 — Go to Jito (Re)staking and connect your wallet: Open the Jito (Re)staking app, click Connect, and approve in your

Solana wallet. The app will prompt you to choose where to stake (asset + vault).

Step 4 — Pick an asset and a vault: Jito supports SOL and popular Solana tokens (including LSTs like JitoSOL). Select a Vault that supports your chosen NCN (Node Consensus Network). For example, vaults that secure TipRouter. Each vault lists the assets accepted, operators, and any slashing terms.

Step 5 — Deposit and receive your liquid receipt (VRT): Enter the amount and confirm. You’ll receive a Vault Receipt Token (VRT) in your wallet. The VRT tracks your restaking position and accrues rewards as they flow to the vault; pricing updates automatically as rewards accrue.

Step 6 — (Optional) Put your VRT to work in DeFi: Some VRTs/LRTs have integrations with Solana DeFi (lending, LPs, etc.). If supported, you can supply them for extra yield or use as collateral; always check integration risk and liquidity before looping positions.

Step 7 — Monitor rewards and manage risk: Your vault dashboard shows positions and rewards over time. Review the vault’s slashing conditions and operator set periodically; diversify across vaults/operators if you want to spread risk.

Step 8 — Withdraw when needed: From the (Re)staking Dashboard → My Vaults, choose your position and click Initiate Withdrawal, then finalize once the vault’s flow completes. Your underlying asset is returned when the withdrawal finishes.

Tip for first-timers: If you’re new to Solana, one easy way to begin is by staking through Jito to mint JitoSOL, which earns both staking and MEV rewards, and then restaking it into a Jito vault to stay liquid from day one. Before depositing, always review each vault’s slashing rules and supported NCNs, start with a small amount to confirm your receipt tokens, and keep an eye on VRT liquidity if you plan to use them in DeFi. For extra safety, use BingX AI to time your entries and exits based on market conditions and stick to your preset risk limits.

Key Risks to Monitor When Restaking SOL Tokens

Restaking can boost yields, but it also layers new risks on top of traditional staking; understanding these before depositing is essential.

1. Slashing risk: Extra conditions beyond L1 staking can penalize misbehavior or downtime by operators. Diversify vaults/operators.

2. Smart contract risk: As with any DeFi, protocol bugs can impact claims/redemptions. Prefer audited, widely used stacks.

3. Liquidity & peg risk: Liquid receipts (VRT/LRT) may trade below notional under stress; verify redemption paths and caps.

4. Validator/operator risk: Poor performance or malicious activity by restaking operators can reduce rewards or trigger penalties; choose reputable, high-uptime operators.

5. Regulatory uncertainty: Rules for staking and restaking vary by jurisdiction; changes could affect rewards, taxation, or access to platforms.

Conclusion: Should You Restake SOL in 2025?

Restaking is emerging as one of the most important narratives in Solana’s ecosystem for 2025. Platforms like Jito, Solayer, Renzo, Picasso, Cambrian, and Fragmetric are creating new ways to earn yield, secure services, and expand utility for SOL holders. From MEV fee distribution to cross-chain connectivity, these protocols highlight how Solana’s speed and low costs make restaking practical for both everyday users and developers.

At the same time, restaking is not risk-free. Slashing conditions, smart contract bugs, and liquidity pressures can impact returns. Before committing assets, review each protocol’s documentation, diversify positions, and only allocate what you can afford to stake. By balancing opportunity with caution, you can take advantage of restaking while protecting your long-term capital.

Related Reading