On September 1, 2025 (12:00 UTC / 08:00 ET),

World Liberty Financial (WLFI) is set to make a splashy debut with 24.67 billion WLFI tokens unlocked at launch, representing 24.67% of its 100‑billion‑token supply, per CoinMarketCap data that’s been confirmed directly with the WLFI team.

Before its official spot launch, WLFI futures Open Interest hit a high of neared $950 million before cooling to $887 million on Monday, signaling that the token’s debut will likely be highly volatile and closely watched by both whale traders and everyday investors.

In this guide, you will discover World Liberty Financial (WLFI) tokenomics, governance model, and how to trade s volatility ahead of its 1

September token launch.

What Is World Liberty Financial (WLFI)?

World Liberty Financial (WLFI) is a politically charged decentralized finance (DeFi) platform co-founded by members of the Trump family. Positioned at the crossroads of traditional finance (TradFi) and blockchain, it has drawn global attention for its unusual mix of political branding, financial engineering, and community-driven governance. As of early September 2025, blockchain data shows WLFI holdings worth approximately $363.3 million sitting across known wallets, much of it in the audited Lockbox contract awaiting the September 1 unlock.

The platform revolves around two core assets:

1. USD1 stablecoin: A regulated, dollar-backed stablecoin tied to U.S. Treasury bonds. By 2025, USD1’s market cap exceeded $2.3 billion, making it a key liquidity anchor for lending, borrowing, and cross-border payments in DeFi. Its integration into protocols like Aave and Euler has helped establish institutional trust.

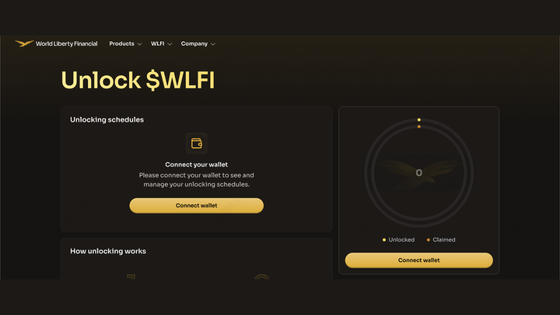

WLFI token unlocks on September 1, 2025

2. WLFI governance token: The centerpiece of the ecosystem. Initially launched as a non-transferable governance tool,

WLFI now transitions into a tradable asset after a 99.94% “Yes” vote in July 2025. Holders can not only buy and sell WLFI but also propose and vote on treasury usage, unlock schedules, and major roadmap decisions. Importantly, Donald Trump’s family members, through DT Marks DeFi LLC, hold a significant equity and token stake (estimated at 22.5–40% of supply), giving the project both visibility and controversy.

WLFI introduces a rare mechanism where token supply is not fixed by cliffs or vesting only, but by community votes. On September 1, 20% of presale tokens unlock, while the remaining 80% will only be released if voted on by holders. This structure aims to reduce sudden sell-offs, align supply with demand, and give investors direct influence over the project’s liquidity and long-term growth.

WLFI Tokenomics: 27B Tokens Unlocked, $900M OI, and $2.3B USD1 Stablecoin Backing

The WLFI tokenomics model gives the token both governance power and practical utility within the World Liberty Financial ecosystem. Holders can vote on key decisions such as how and when new tokens are unlocked, how treasury funds are deployed, which products or exchange listings to prioritize, and other protocol rules. This approach makes WLFI’s supply management and growth strategies community-driven rather than controlled only by insiders.

WLFI token utility | Source: World Liberty Financial

At launch, WLFI entered circulation with 24,669,070,265 tokens, instantly positioning it as one of the largest token debuts of 2025. Depending on price, this translates into a circulating value in the tens of billions of dollars. Trading activity confirmed the hype: open interest neared $900 million in WLFI futures, while trading volumes surged more than 500% ahead of the token generation event (TGE), showing strong demand from institutional and retail traders alike.

24.67 Billion WLFI Tokens to Hit the Market at Launch

WLFI's hybrid model of a large initial supply paired with governance-gated future unlocks, is meant to create liquidity for trading from day one while still giving long-term holders the power to control how and when additional supply enters the market.

• Launch supply: According to CoinMarketCap, 27 billion WLFI tokens or 27% of the total 100B supply, were unlocked at launch on September 1, 2025. This is a much larger initial float than earlier estimates of ~3.69B, instantly making WLFI one of the biggest token debuts of the year.

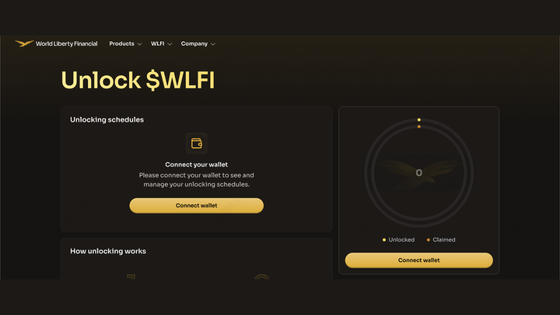

• Presale unlock: Early backers who purchased at $0.015 and $0.05 are able to claim 20% of their allocations immediately through the Lockbox system.

• Governance-controlled supply: The remaining 80% of presale tokens will not unlock automatically. Instead, future releases will only happen if WLFI holders vote for them, giving the community direct control over inflation and sell pressure.

• Security: To protect users, WLFI created a dedicated Lockbox smart contract audited by Cyfrin. Investors had to activate their Lockbox wallets before launch to prepare for claiming. The process is designed to be simple: connect an

Ethereum-compatible wallet, sign the unlock agreement, and claim tokens once the window opens.

How to Get Exposure to WLFI Ahead of Its Official Spot Launch

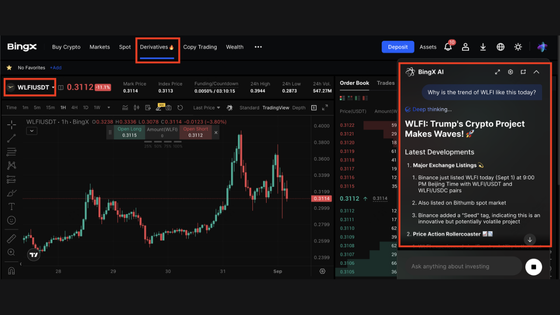

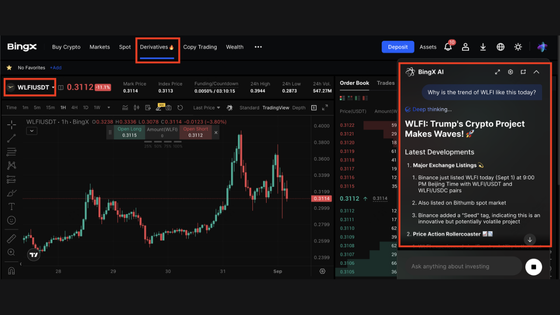

WLFI/USDT perpetual contract on the futures market powered by BingX AI insights

1. Log in to BingX and navigate to

Derivatives → Perpetual Futures → WLFI/USDT.

2. Choose between Cross Margin (balances shared across positions) or Isolated Margin (risk limited to one trade). Beginners may prefer Isolated for tighter risk control.

3. Set leverage carefully. WLFI is extremely volatile around its unlock, so start small (e.g., 2x–3x) rather than maxing out leverage.

5. Monitor funding rates and open interest (OI) closely. High positive funding means longs are paying shorts, often a sign of bullish overcrowding, while rising OI signals strong positioning that could amplify volatility.

If you’d rather not trade derivatives, you can still use

BingX Pre-Market Trading to negotiate WLFI buy/sell prices with other users ahead of spot listings. This lets you secure tokens early, but note that liquidity can be thin and prices highly volatile.

Safety Tip: Claim WLFI only through the official Lockbox page audited by Cyfrin. Never click links from DMs, airdrop scams, or unofficial sources. Always confirm contract addresses, and never share your seed phrase.

Conclusion

WLFI’s launch with 24.67 billion tokens in circulation (≈24.7% of supply) marks one of the largest token debuts of 2025, combining deep initial liquidity with a governance-first approach to future distribution. With allocations spanning ecosystem funding, Alt5 Sigma’s treasury strategy, liquidity support, and a 20% unlock for public sale buyers, the structure ensures both tradability from day one and a clear role for the community in shaping what comes next.

The remaining 75+ billion WLFI tokens, held across treasury reserves, team allocations, and partner agreements, remain locked under vesting schedules or subject to governance votes, making tokenholder participation central to how supply enters circulation. Meanwhile, the strong momentum around the USD1 stablecoin and futures activity near $900M OI highlights the scale of speculation and adoption already forming around WLFI.

Still, risks remain. Large insider stakes, political associations, and regulatory scrutiny could all weigh on long-term stability and adoption. For traders on BingX, opportunities exist through Pre-Market trades and the WLFI/USDT perpetual futures pair, but extreme volatility is expected. Use strict risk controls. Such as limit leverage, size positions carefully, and always set TP/SL orders. Above all, claim WLFI only through the official audited Lockbox.

Remember: WLFI’s debut is not just about price discovery, but also about testing whether a governance-driven unlock model can align liquidity with community decisions. As with any early-stage token, never invest more than you can afford to lose.

Related Reading