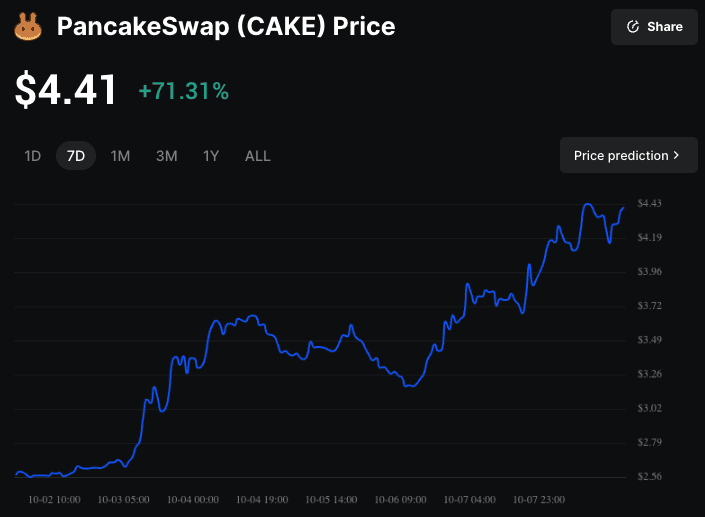

PancakeSwap’s surge last week was about DEX mechanics, not noise: tighter spreads, deeper books, and new flows helped CAKE climb about 70% in seven days as liquidity rotated into

BNB Chain. The protocol anchors roughly $2.7 billion in TVL and serves around 169,000 daily active users across swaps, farming, and staking.

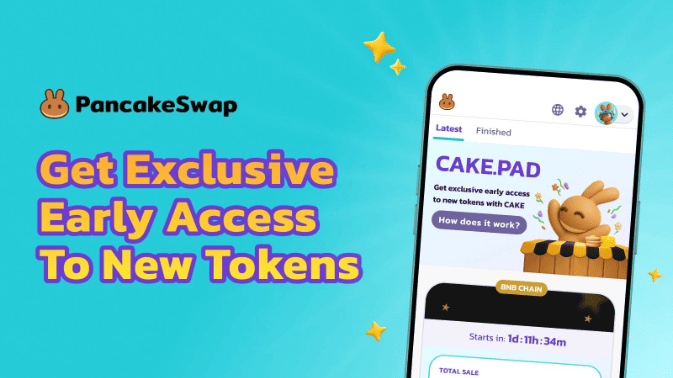

Fee-earning limit orders and the launch of CAKE.PAD pulled more maker flow on-chain while routing participation fees to burns.

PancakeSwap (CAKE) surged over 70% in a week in October 2025 | Source: BingX

If you want the how behind the headline, the breakdown below traces the features, tokenomics, and the feedback loop that lifted CAKE.

What Is PancakeSwap (CAKE) DEX and How Does It Work?

PancakeSwap is a DEX on BNB Chain that lets you swap BEP-20 assets straight from your wallet. It runs an automated market maker: you trade against liquidity pools, while liquidity providers deposit token pairs, receive LP tokens, and earn a 0.17% fee share. Impermanent loss is the key risk for LPs.

Beyond simple swaps, you can earn with

Yield Farming (stake LP tokens to earn CAKE) and Syrup Pools. Syrup Pools offer two modes: flexible (withdraw anytime; 0.1% early-unstake fee in the first 72 hours and a 2% performance fee per harvest, both burned) and fixed-term (lock up to 52 weeks for boosted APY, no performance fee, funds unlock at term end).

The toolkit doesn’t stop there: Lottery V2 uses Chainlink VRF for randomness, a five-minute BNB prediction market adds short-term plays, the

NFT Marketplace and profiles cover collectibles and identity, IFOs enable early token access, and perps arrive via a decentralized integration with ApolloX.

The anonymous “Chefs” keep much of the code open and have audits from Certik and Slowmist. Getting started is simple: set up a BNB Chain wallet like

MetaMask, fund it with BNB BEP-20 for gas, connect on PancakeSwap, choose tokens, and confirm your swap.

Source: PancakeSwap

Why Did CAKE Jump By 70% In 7 Days?

A cluster of product releases and tokenomics signals helped catalyze demand.

1. Maker Rebates Arrive

Fee-earning limit orders launched on September 29, 2025. Order creators now earn a 0.1% fee when their limit order is filled, a direct utility boost that tends to attract maker flow and deepen books on the DEX. Initial rollout is on BNB Chain.

2. CAKE.PAD Launch

CAKE.PAD went live on October 6. It simplifies early token access with no staking or lockups and burns 100% of participation fees, increasing CAKE’s usage and deflationary pressure. Launchpad-style features typically drive attention, liquidity, and short-term speculation.

Source: PancakeSwap

3. Tokenomics 3.0

Tokenomics 3.0 set a deflation target of about 4% annually and a 20% supply reduction by 2030, while retiring veCAKE and cutting emissions. Product-driven burns tie usage to supply reduction, a narrative that strengthens when activity rises.

4. ASTER Momentum

ASTER’s surge funneled new traders and liquidity into PancakeSwap, lifting fees and product usage that power CAKE buybacks and burns, and increasing demand for CAKE in staking and liquidity pools, which supports upward price pressure.

What Is the CAKE Token Utility?

• Farming rewards: CAKE is paid to liquidity providers who stake LP tokens in PancakeSwap Farms.

• Staking in Syrup Pools: Stake CAKE in flexible mode (harvest anytime; early unstake and performance fees are burned) or fixed-term mode (lock up to 52 weeks for boosted APY and added benefits).

• Governance: Use CAKE to vote on proposals, with boosted/weighted voting for users who lock CAKE.

• Access currency: Pay for Lottery tickets in CAKE and commit CAKE to join early token events via IFOs and CAKE.PAD.

• Boosts and privileges: Locked CAKE can unlock boosted farm yields and boosted IFO allocations.

• Reward token in products: CAKE is distributed as a reward in Farms, Lottery, and select staking flows, tying platform usage back to the token.

CAKE Tokenomics

PancakeSwap’s hard cap is 450,000,000 CAKE. Under Tokenomics 3.0, burns are funded by product fees and profits across the stack, with a working goal of around 4% annual deflation and a 20% supply reduction by 2030 via buyback and burn.

Fee routing includes 15 to 23% of spot LP fees, 20% of profits from perpetual trading, 100% of IFO fees, and 3% from each Prediction and Lottery round.

Together, these flows convert platform usage into ongoing supply reduction for CAKE.

CAKE Tokenomics 3.0 | Source: PancakeSwap Blog

How to Trade PancakeSwap (CAKE) on BingX

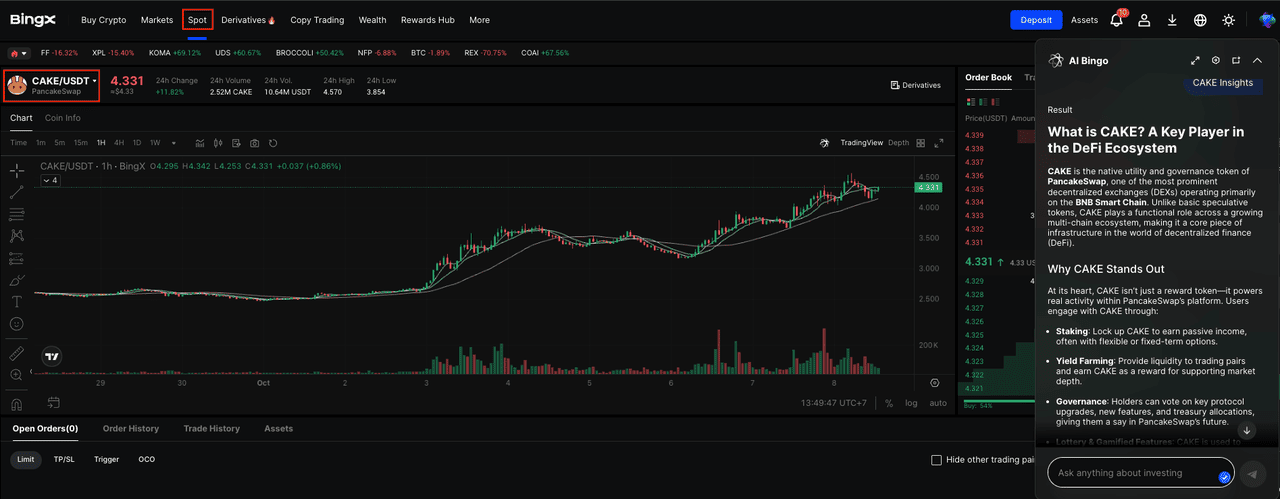

Whether you are building a long-term CAKE position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token.

With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

1. Buy or Sell PancakeSwap (CAKE) on Spot Market

CAKE/USDT trading pair on the spot market powered by Bingx AI

1. Find the market: Open BingX and search CAKE/USDT in

Spot.

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit CAKE or USDT and verify the correct network before trading.

Always conduct your own research (DYOR). Diversify your portfolio and never invest more than you can afford to lose.

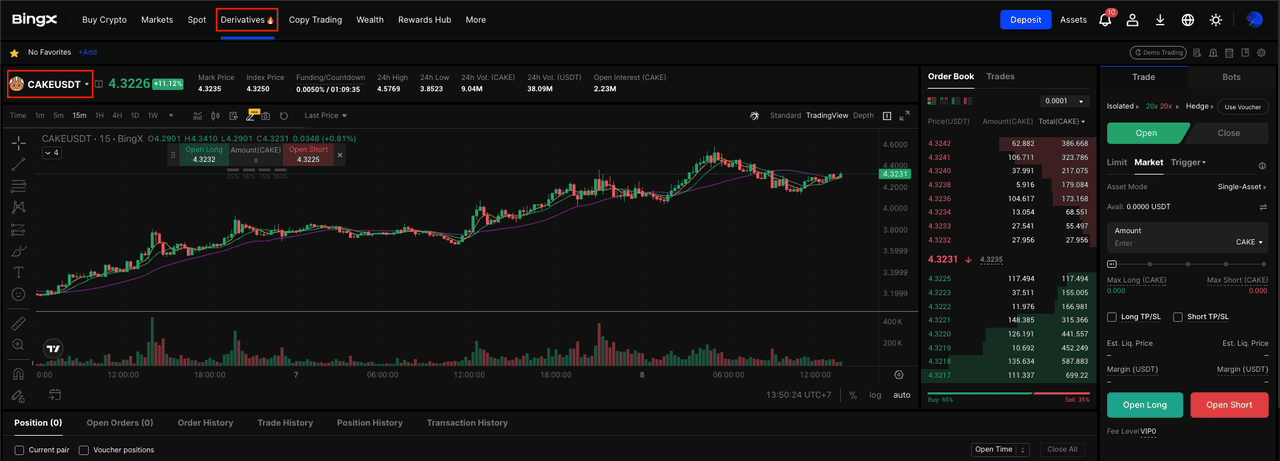

2. How to Trade CAKE Perpetual Futures

CAKEUSDT perpetual contract on BingX futures

Futures, especially perpetual futures, let you trade CAKE price movements with leverage; you don’t necessarily need to hold the underlying CAKE. You can go long (betting price will rise) or short (betting price will fall). BingX offers a

CAKE-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate CAKEUSDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk (if losses push margin below maintenance).

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Conclusion

CAKE’s rise looks driven by mechanics, not headlines. Fee-earning limit orders, CAKE.PAD’s burned fees, and Tokenomics 3.0 turn usage into steady pressure on supply, while the Infinity upgrade tightens spreads and deepens liquidity.

Decrypt links and claim pages can be spoofed; always verify announcements on official PancakeSwap channels and check contract addresses before transacting.

Related Reading