Bitcoin restaking went from niche idea to one of crypto’s fastest-growing sectors. In the nine months to March 2025, restaked-BTC ecosystems jumped from ~$69 million to ~$3.1 billion in value, a 4,459% surge, driven by non-custodial BTC staking and liquid BTC staking tokens (LSTs) that plug into DeFi. By early September 2025, trustless BTC staked exceeds $6.3 billion, underscoring how quickly

BTC is being mobilized to secure other networks and services.

Bitcoin restaking TVL (total value locked) | Source: DefiLlama

Below are seven of the top Bitcoin restaking protocols that matter in 2025. Learn what each BTC restaking platform does, why it’s interesting, how to get started with restaking your BTC, and where the opportunities (and risks) may lie for users, developers, and institutions.

What Is Bitcoin Restaking and How Does It Work?

Bitcoin restaking is a way to make your BTC work harder without giving up ownership. Normally, Bitcoin just sits in your wallet or on an exchange, earning nothing unless you sell or lend it. With

restaking, you can lock your BTC in a secure, self-custodial system and allow it to help secure other blockchain services, like rollups, oracle networks, or data availability layers.

In return, you earn extra rewards on top of your BTC holdings. What makes this powerful is that leading protocols such as Babylon don’t require wrapping your BTC into tokens like WBTC or bridging it to

Ethereum. Instead, they use time-locks and cryptographic proofs so your Bitcoin never leaves the Bitcoin blockchain. That means you get yield while your BTC stays in its native form, reducing the risks of bridges or custodians.

This is different from traditional staking on Proof-of-Stake (PoS) chains like Ethereum, where coins are locked directly in validator nodes. Bitcoin doesn’t run on PoS, so restaking relies on new designs that “export” Bitcoin’s security to other networks. For example, protocols can rent Bitcoin’s economic weight to secure their infrastructure, while BTC holders earn yield for contributing. In practice, this turns Bitcoin into a productive asset, letting you support new decentralized services while generating returns, without losing self-custody.

How BTC Restaking Differs From ETH Restaking

Ethereum restaking, led by

EigenLayer, uses ETH or

liquid staking tokens (LSTs) like

stETH to secure additional services called Actively Validated Services (AVSs). ETH stakers can restake their tokens through smart contracts and earn extra rewards, but they also face more complex slashing risks and need to manage validator setups or liquid restaking tokens.

Bitcoin restaking works differently because Bitcoin is a Proof-of-Work asset, not PoS. Protocols like Babylon, BounceBit, or Pell Network create mechanisms to let native BTC be locked and cryptographically committed as collateral for securing other chains. The key differences are:

• Self-custody focus: BTC stays on the Bitcoin network via time-locks, instead of moving to smart contracts on Ethereum.

• No bridging or wrapping required: Unlike WBTC, restaking doesn’t require pegged assets, reducing counterparty risk.

• Security rental model: Networks “rent” Bitcoin’s security, while Ethereum restaking extends validator duties through software modules.

For beginners, think of it this way: ETH restaking upgrades existing staking for more yield, while BTC restaking invents a way for Bitcoin to stake without changing its Proof-of-Work base. This makes BTC restaking both newer and potentially riskier, but also a huge opportunity for turning the world’s largest crypto into an income-generating asset.

Why Does Bitcoin Restaking Matter in 2025?

Bitcoin restaking is turning BTC from a passive store of value into an active yield-bearing asset. Instead of sitting idle, BTC can now secure new protocols, such as rollups, oracles, or data layers, while staying self-custodial in designs like Babylon. This boosts capital efficiency for holders, who earn rewards beyond price appreciation, and gives everyday users exposure to DeFi yields without wrapping or bridging. With nearly $6B in trustless BTC staked by August 2025, restaking is already one of the fastest-growing Bitcoin use cases, showing strong demand for ways to make BTC more productive.

For builders, restaking provides shared security on demand. Networks no longer need to inflate their own tokens or spin up costly validator sets, they can simply “rent” Bitcoin’s security. Projects like BOB Hybrid L2 already tap into BTC restaking, while data from DeFiLlama shows restaked-BTC protocols grew over 4,400% in less than a year. This combination of stronger security and real yield potential makes restaking one of the most practical and scalable narratives in crypto today, reshaping how Bitcoin integrates with the broader Web3 economy.

What Are the 7 Most Popular BTC Restaking Protocols to Know?

In 2025, several Bitcoin restaking platforms have emerged as leaders, each offering unique ways to make BTC productive while securing new blockchain networks and services.

1. Babylon (BABY): The Category’s Anchor

Babylon is the largest and most advanced Bitcoin restaking protocol, designed to make BTC productive without wrapping or bridging. Users can stake Bitcoin directly from their own wallets, locking it in time-based vaults that secure decentralized networks called Bitcoin-Secured Networks (BSNs). In return, stakers earn rewards while keeping custody of their coins. By September 2025, Babylon had more than 56,000 BTC restaked (worth over $6.2B) and had rolled out features like multi-staking, which allows one BTC position to secure multiple services simultaneously. Recent integrations, such as with BOB Hybrid L2, highlight Babylon’s role in providing “Bitcoin finality” as a service, ensuring faster, trustless settlement for partner chains.

The project also emphasizes security and decentralization, with over 250+ finality providers and multiple third-party audits (Coinspect, Zellic, Cantina) reinforcing its trust model. For networks, Babylon offers a scalable way to “rent” Bitcoin’s security instead of inflating native tokens or bootstrapping new validator sets. For users, it’s a straightforward three-step flow: stake, secure, receive rewards, all while keeping keys and coins in their control. This combination of deep liquidity, robust audits, and strong community adoption makes Babylon the reference design for Bitcoin restaking, and the backbone for many emerging BTCFi applications.

2. Solv Protocol (SolvBTC): BTC “Reserve Token” + Yield Rails

Solv Protocol is building a Bitcoin financial stack centered on SolvBTC, a 1:1 reserve-backed token that unlocks liquidity across DeFi, CeFi, and even traditional finance. As of August 2025, Solv manages more than 9,100 BTC in on-chain reserves (over $1B) and has become one of the largest institutional-grade Bitcoin vaults on-chain. Products like xSolvBTC turn idle BTC into active capital with instant redemption and continuous yields, while BTC+ allocates pooled Bitcoin into diversified strategies for maximum capital efficiency. These tokens can travel across ecosystems, with variants already integrated into Babylon and Core, enabling users to restake BTC while maintaining liquidity and proof-of-reserve transparency.

What makes Solv unique is how it bridges institutional finance and crypto-native yield. With backers like OKX Ventures and Blockchain Capital, Solv positions itself as a “universal Bitcoin” solution, ranked among the top 20 global

Bitcoin reserve holders, comparable to ETFs and even government treasuries. For everyday users, SolvBTC works like a liquid staking token (LST) for Bitcoin, meaning you can earn yield while still using your BTC in trading, lending, or DeFi. For institutions, it offers audited, compliance-ready infrastructure with integrations into

real-world assets (RWAs) and yield products from firms like BlackRock and Hamilton Lane. In short, Solv is turning Bitcoin into a productive, borderless reserve asset with both retail accessibility and institutional trust.

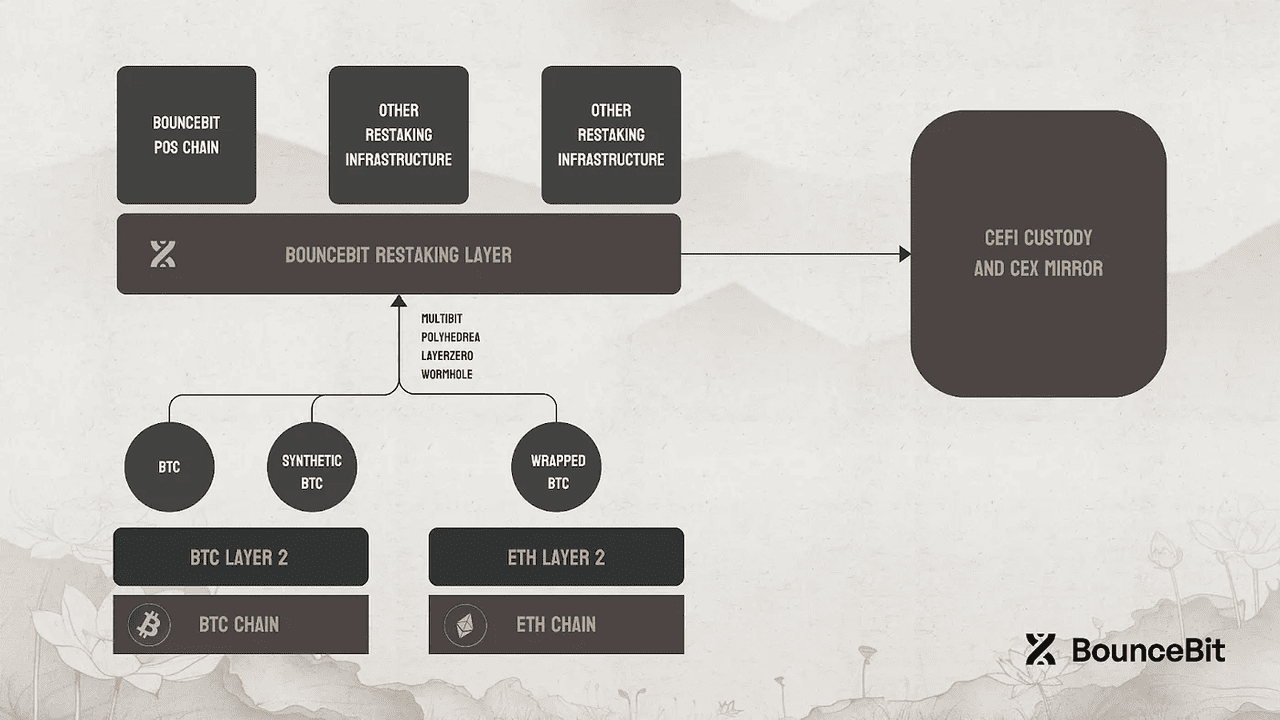

3. BounceBit (BB): Native BTC Restaking L1 with Dual-Token Security

How BounceBit restaking works | Source: BounceBit blog

BounceBit is an EVM-compatible Layer 1 that anchors its security model on dual staking with BTC and

BB tokens. Instead of relying on wrapped assets, users can delegate native BTC alongside BB to secure the network and earn staking rewards. This setup is supported by integrations with custodians like Ceffu, which issue Liquidity Custody Tokens (LCTs). These tokens unlock a hybrid model called CeDeFi, where users simultaneously earn yield from centralized finance channels (like treasury bill strategies) and decentralized restaking opportunities on-chain. By design, BounceBit brings institutional-grade yield strategies, once limited to hedge funds and asset managers, into an accessible, retail-friendly format.

What makes BounceBit stand out is its focus on practical yield and compliance. Beyond restaking, the chain offers access to real-world asset (RWA) yields, structured products like Dual Investment, and even meme token trading through its BounceClub aggregator. With regulated fund management licensing, multi-layer custody protections, and full EVM compatibility, it positions itself as a bridge between CeFi and DeFi. For users, this means their BTC doesn’t just sit idle or get bridged but it also actively participates in consensus, supports restaking, and generates layered income across multiple channels, making BounceBit one of the most versatile

BTCFi platforms in 2025.

4. Lorenzo Protocol (BANK): The “Bitcoin Liquidity Finance Layer”

Lorenzo Protocol positions itself as a BTC liquidity and financing hub built specifically for the restaking era. Instead of focusing solely on staking, Lorenzo develops a financial abstraction layer that routes Bitcoin into optimized yield and security opportunities across more than 20 blockchains. At its core, Lorenzo issues two key tokens: stBTC, a reward-bearing

liquid staking token tied to Babylon yields, and enzoBTC, a wrapped 1:1 BTC standard used as a cash-like asset across its ecosystem. Together, these instruments give users access to on-chain traded funds (OTFs), structured yield products, and secondary markets for restaking receipts, effectively bridging CeFi-style financial strategies into DeFi.

What makes Lorenzo stand out is its focus on liquidity depth and institutional readiness. With nearly $550M TVL and close to 5,000 BTC staked, it has already become one of the larger players in Bitcoin DeFi by mid-2025. The platform integrates top custody providers like Ceffu, Safe, and Cobo for asset protection, while working with

Chainlink and

LayerZero to ensure secure cross-chain transfers. For institutions, Lorenzo offers tailored asset management and compliance-grade infrastructure; for power users, it provides liquid restaking receipts and access to advanced strategies. In short, Lorenzo is carving out the role of a Bitcoin liquidity layer, ensuring restaked BTC is not just locked for yield but actively tradable, financed, and deployed across the broader crypto economy.

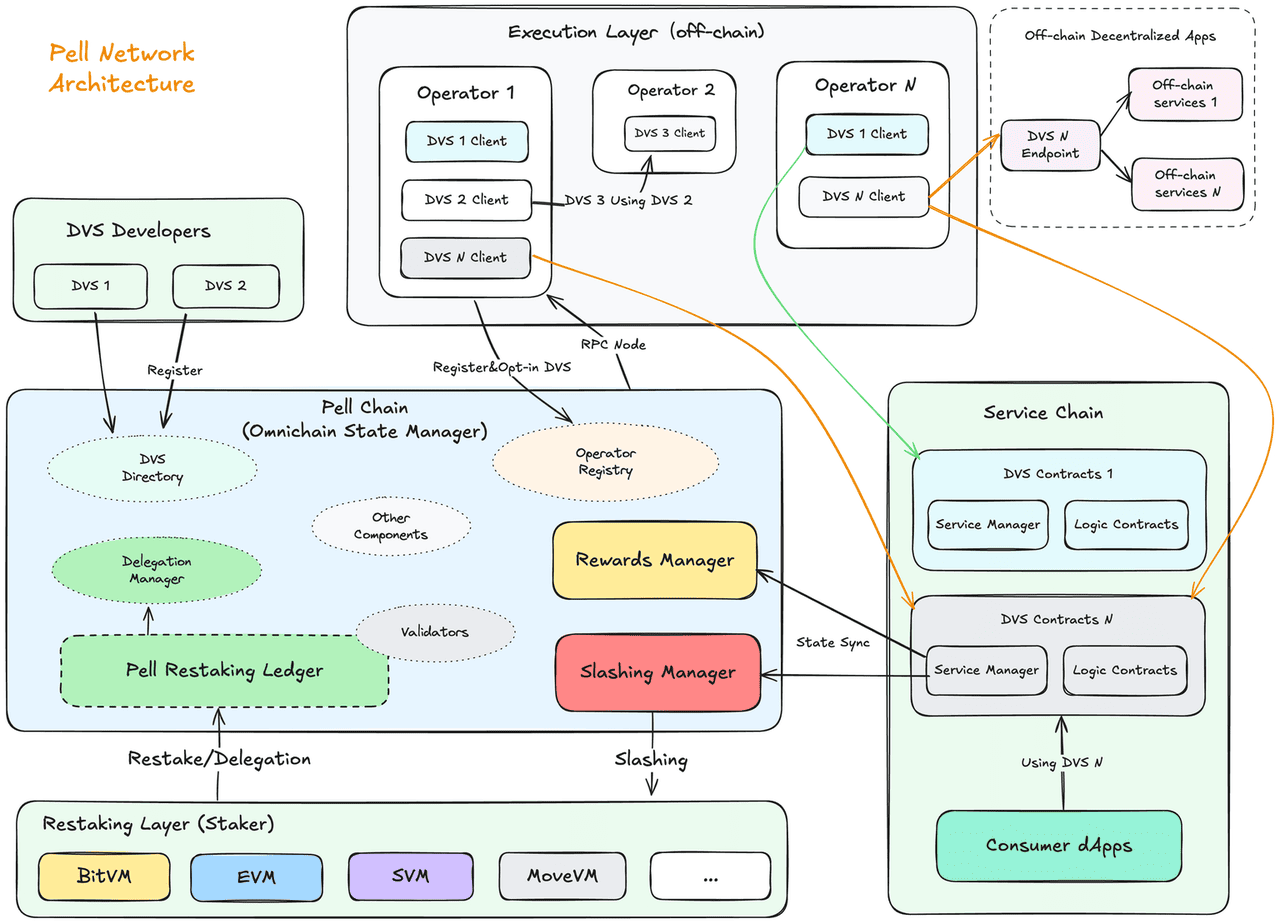

5. Pell Network (PELL): Omnichain BTC Restaking & DVS Hub

Pell Network architecture | Source: Pell Network docs

Pell Network brands itself as the first omnichain Bitcoin restaking platform, designed to extend BTC’s economic security across multiple ecosystems. At its core, Pell provides a Decentralized Validated Services (DVS/AVS) layer, allowing developers to plug restaked BTC directly into services such as oracles, data availability, AI compute, and cross-chain bridges. As of 2025, Pell reported more than $530M in restaked tokens from over 500,000 users, showing strong early adoption. It also runs regular incentive campaigns and airdrops, making participation accessible for both retail stakers and institutions looking for yield from their Bitcoin holdings.

What makes Pell important is its role as a distribution layer for Bitcoin security. Instead of every new protocol bootstrapping its own validator set, Pell lets them rent BTC-backed security through an omnichain framework. This lowers costs for builders while ensuring decentralization and stronger trust guarantees. For stakers, it opens multiple streams of yield by delegating BTC into Pell’s ecosystem and supporting new services across different chains. With integrations into platforms like Babylon, Rootstock, and

ZKsync Era, Pell is positioning itself as a central hub in the emerging BTCFi landscape, where Bitcoin powers not only its own network but also a broad range of decentralized applications.

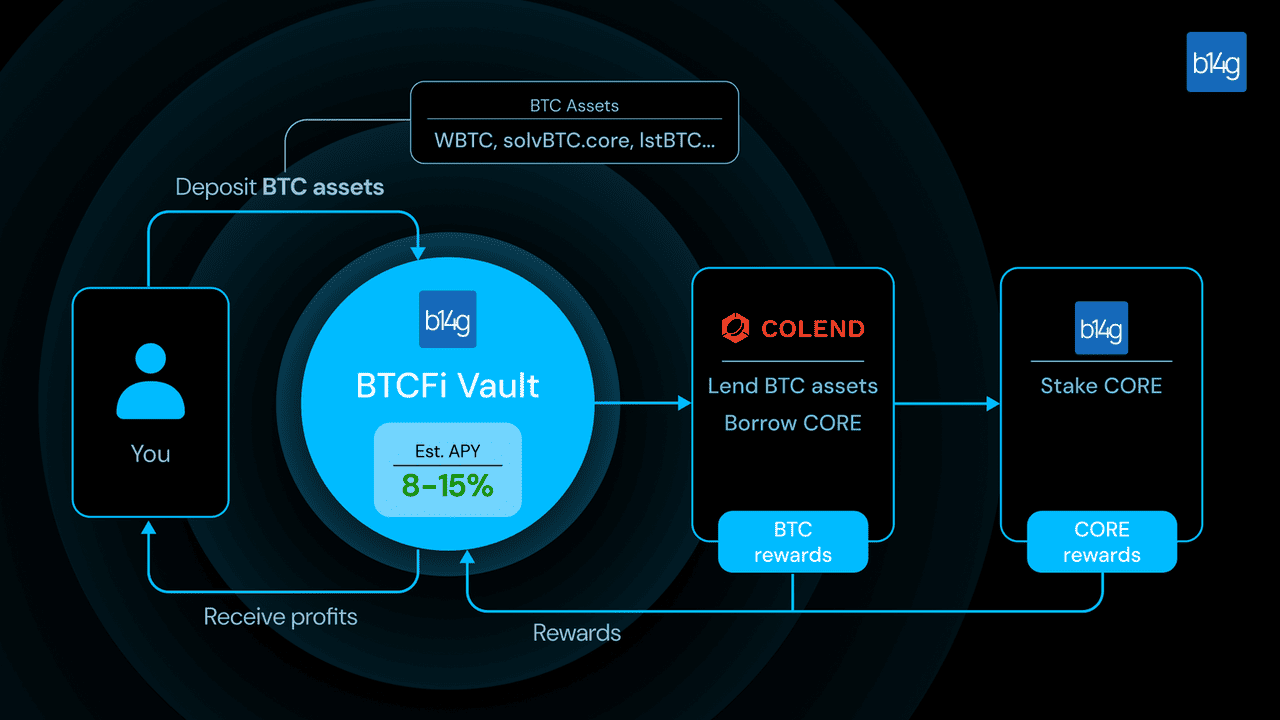

6. b14g: Dual-Staking Design Without Slashing

How b14g works | Source: b14g docs

b14g introduces a dual-staking model where users stake both BTC and a protocol’s native token together to secure the network. Unlike traditional restaking, which often pays out rewards in newly minted tokens (leading to inflation and sell pressure), b14g makes the native token a core part of network security. This locks up supply, aligns incentives between BTC holders and token communities, and reduces the risk of immediate token dumping. Importantly, b14g uses non-custodial Bitcoin time-locks; BTC stays in the user’s wallet, with no wrapping, bridging, or slashing risks, making it a safer alternative for stakers who want predictable participation without exposure to validator failures.

For protocols, b14g offers a plug-and-play modular framework that can be customized to fit their tokenomics and security needs. This design appeals to token issuers who want BTC-secured validation but also need to preserve the value of their native token. For users, it provides a straightforward way to earn yield from Bitcoin while also tapping into new token ecosystems, all without sacrificing custody of their BTC. With less than 0.3% of total Bitcoin currently staked, b14g is targeting a market with massive growth potential, arguing that dual-staking could unlock a $500B opportunity if BTC staking adoption moves closer to Ethereum’s 28% staking rate.

7. Chakra: Cross-Chain Settlement With Restaked BTC

Chakra is a modular settlement network designed to unlock Bitcoin’s liquidity across multiple blockchains. Using a cross-chain Proof-of-Stake (PoS) architecture and a shared security layer, it enables the bridging of native BTC and BTC-derived assets across more than 20 chains. By mid-2025, Chakra reported over $120M in TVL and more than 50,000 users, positioning itself as a major player in the Restaked BTC category. Its design emphasizes speed and efficiency, with settlement finality achieved in just a few seconds through innovations like Merkle Root voting and optimized validator roles.

The protocol’s importance lies in solving interoperability for Bitcoin restaking. Instead of BTC liquidity being trapped within isolated ecosystems, Chakra routes it where applications and networks need it most, whether that’s L2s, execution layers, or DeFi protocols. This creates deeper markets for liquid staking tokens (LSTs) and liquid restaking tokens (LRTs), while giving apps the ability to tap into Bitcoin’s security without building new validator sets. For both developers and users, Chakra acts as a universal BTC settlement layer, reducing fragmentation and making Bitcoin a more integrated part of the multi-chain economy.

How to Restake BTC: A Step-by-Step Guide

Here’s a simple step-by-step guide to getting started with Babylon, a leading trustless Bitcoin restaking protocol:

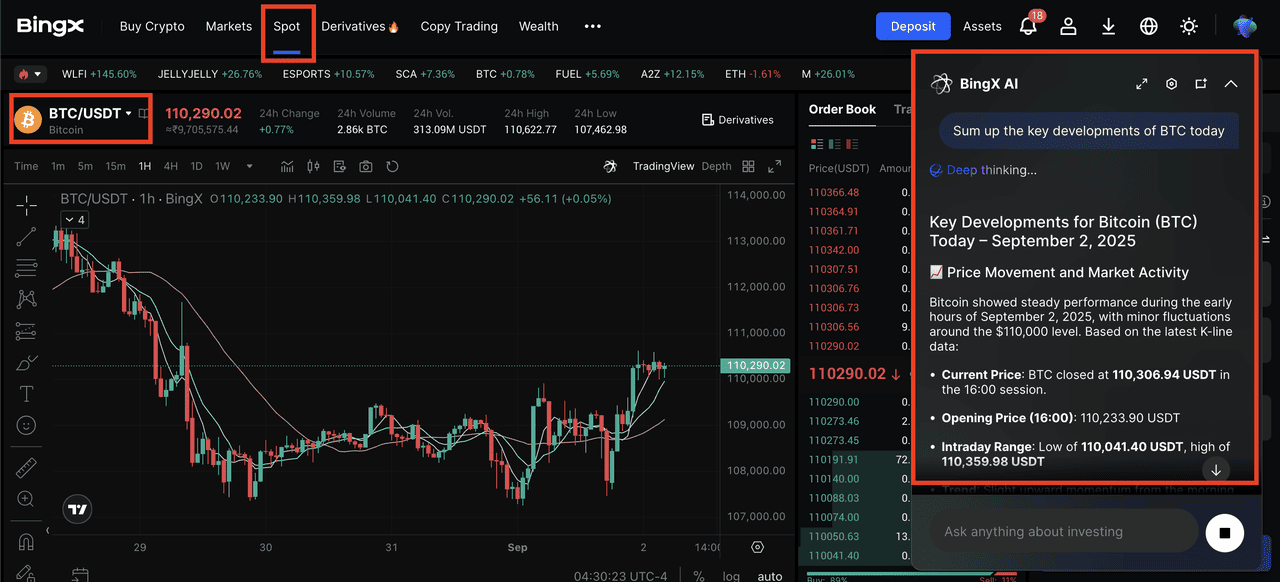

1. Buy BTC on BingX Spot. Create/verify your BingX account, buy BTC on the Spot market, and use

BingX AI to to assess risk, position diagnostics and market insights.

BTC/USDT trading pair on the spot market, powered by BingX AI insights

2. Set up wallets. You’ll need a

Bitcoin wallet (self-custodial) to time-lock BTC, and a Babylon/

Cosmos wallet (e.g., Keplr) to register the stake / receive on-chain messages. Hardware and mobile options are supported by several guides.

3. Open Babylon’s staking dashboard. Go to Babylon’s official site and click Staking Interface → connect your BTC wallet and your Babylon/Cosmos wallet. Confirm you’re on Bitcoin mainnet in your wallet.

4. Choose how you secure networks. Pick a reputable Finality Provider (FP) or a partner route (e.g., Lombard issues LBTC if you prefer a liquid BTC LST). This is where the network(s) you secure and your reward path are defined.

5. Time-lock your BTC & register the stake. Specify the BTC amount, review the lock period/terms, then sign/broadcast the self-custodial time-lock transaction from your Bitcoin wallet. Next, complete staking registration on Babylon Genesis so the system recognizes your position.

6. Delegate / confirm and monitor. Delegate voting power to your chosen FP(s) if prompted, then track your position and rewards in the dashboard. Multi-staking (one BTC position securing multiple networks) may be available depending on rollout.

7. Unbond when needed. Use the dashboard Unbond option to start withdrawal; observe any waiting period the protocol or service specifies before BTC becomes spendable again.

Babylon keeps BTC on Bitcoin using time-locks (no wrapping/bridging) while exporting its economic security to PoS networks, “Stake → Secure → Receive.” If you prefer a custodial or institutional route, several providers (e.g., Hex Trust, stakefish, Kiln) publish walkthroughs that integrate directly with Babylon’s flow. Always verify the official links.

What Are the Risks in Restaking Bitcoin (BTC)?

Bitcoin restaking in 2025 is one of the fastest-growing narratives in crypto, with billions of dollars locked into platforms like Babylon, Solv, and BounceBit. It promises higher yields and shared security, but these benefits come with new layers of risk that are different from simply holding BTC or even staking ETH. Since restaking relies on experimental infrastructure, users should carefully evaluate how protocols handle penalties, custody, and liquidity. For beginners, understanding these risks is essential before locking up BTC in restaking flows.

Key Risks to Track

• Slashing and penalty models: Some BTC restaking protocols (e.g., Babylon) introduce protocol-specific penalty rules tied to validator behavior or service-level agreements. While native Bitcoin itself cannot be slashed, restaked BTC in these designs can be locked or penalized if terms are breached. Always read each venue’s slashing conditions carefully, as they vary widely.

• Smart contract and bridge risks: Even “trustless” solutions depend on new contract layers, cryptographic proofs, or cross-chain relays. Bugs, governance exploits, or integration failures could lead to partial or total loss of funds. Safer practice is to prefer audited protocols and diversify across multiple venues instead of concentrating BTC in one system.

• Liquidity and peg risk in LSTs/LRTs: Liquid staking and restaking tokens (like stBTC, SolvBTC, or Pell-issued receipts) trade in secondary markets. Under market stress, these tokens can depeg from their underlying BTC, making it harder to exit positions. Users should monitor redemption paths, withdrawal caps, and secondary market liquidity before committing significant amounts.

The Bottom Line

Bitcoin restaking is evolving into a practical security and yield market rather than just a speculative narrative. In 2025, Babylon remains the anchor, while platforms like Solv, BounceBit, Lorenzo, Pell, b14g, Chakra, and pSTAKE provide varied approaches to using BTC for rewards, liquidity, or shared security. For participants, the opportunity is clear, but so are the risks. Start with smaller allocations, check each protocol’s custody model, slashing rules, audits, and TVL growth, and spread exposure across multiple designs to avoid concentration risk.

Remember, restaking is still an emerging sector. TVL, integrations, and product safety can shift quickly, so always confirm the latest details directly from project documentation and trusted dashboards like DeFiLlama. Above all, treat restaking as an experiment with upside, not a guaranteed yield machine, and only commit BTC you can afford to lock in high-risk infrastructure.

Related Reading