SVM rollup infrastructure is seeing strong builder demand as teams seek verifiable throughput, low fees, and cross-chain messaging without wrapped assets.

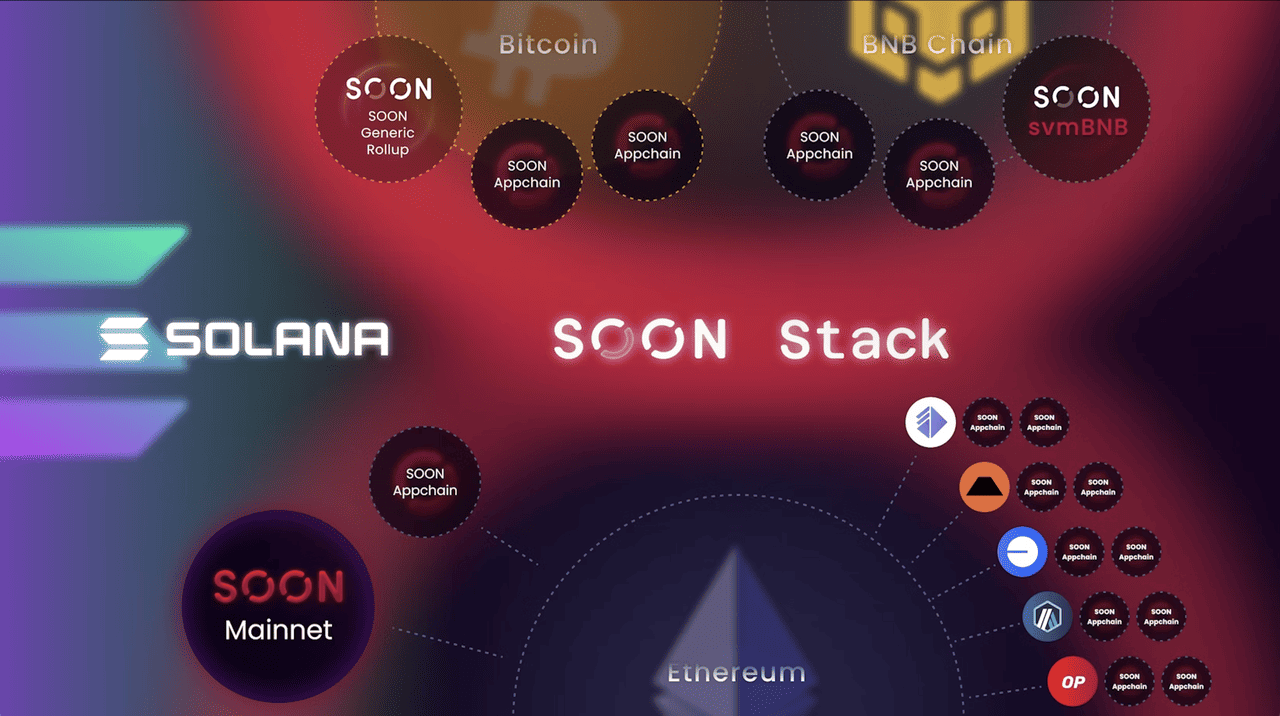

SOON Network’s pitch centers on a decoupled SVM execution layer, InterSOON messaging, and horizontal scaling, packaged as a stack for launching SVM rollups across major base layers.

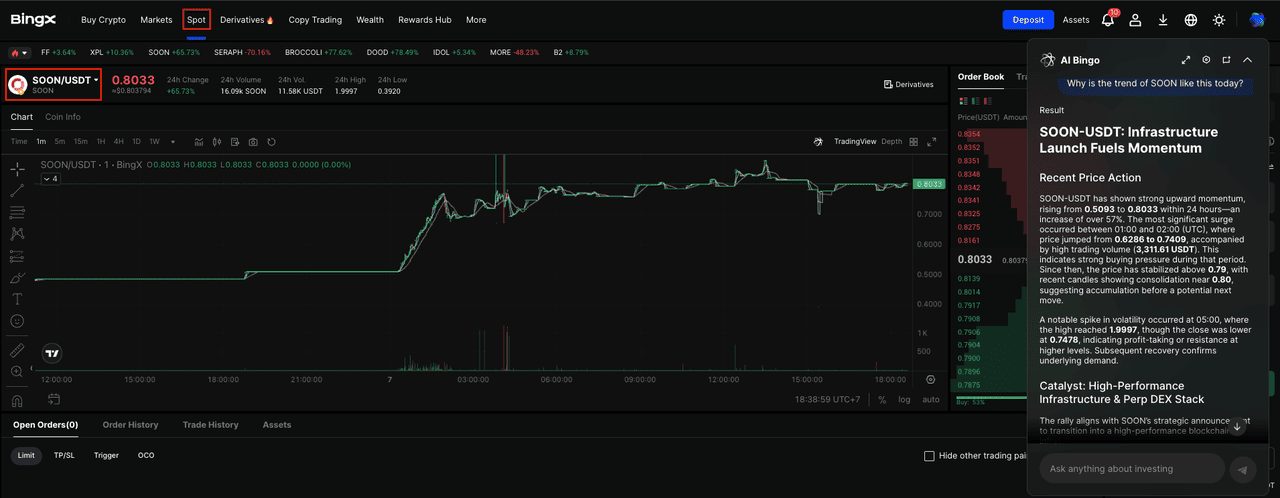

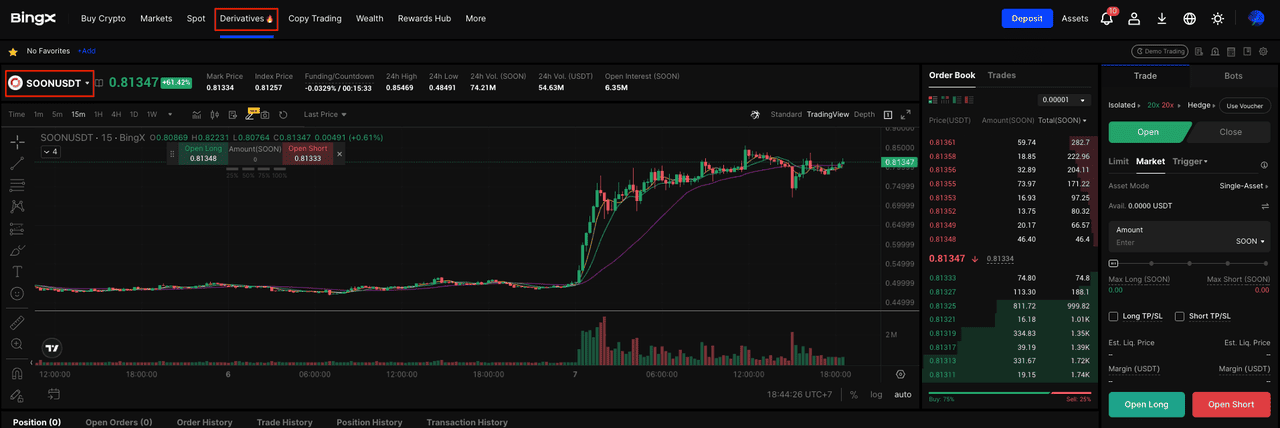

Soon Network price surged in early October | Source: BingX

Against this backdrop, SOON climbed about 60% in 24 hours and over 125% in a week as exchange access expanded: Kraken went live on September 26, and Bitkub set deposits for October 8 with trading on October 9. Network stats show 3,825,645 total active addresses and roughly $65.07 million in total value locked (TVL), reinforcing the move alongside the listings narrative.

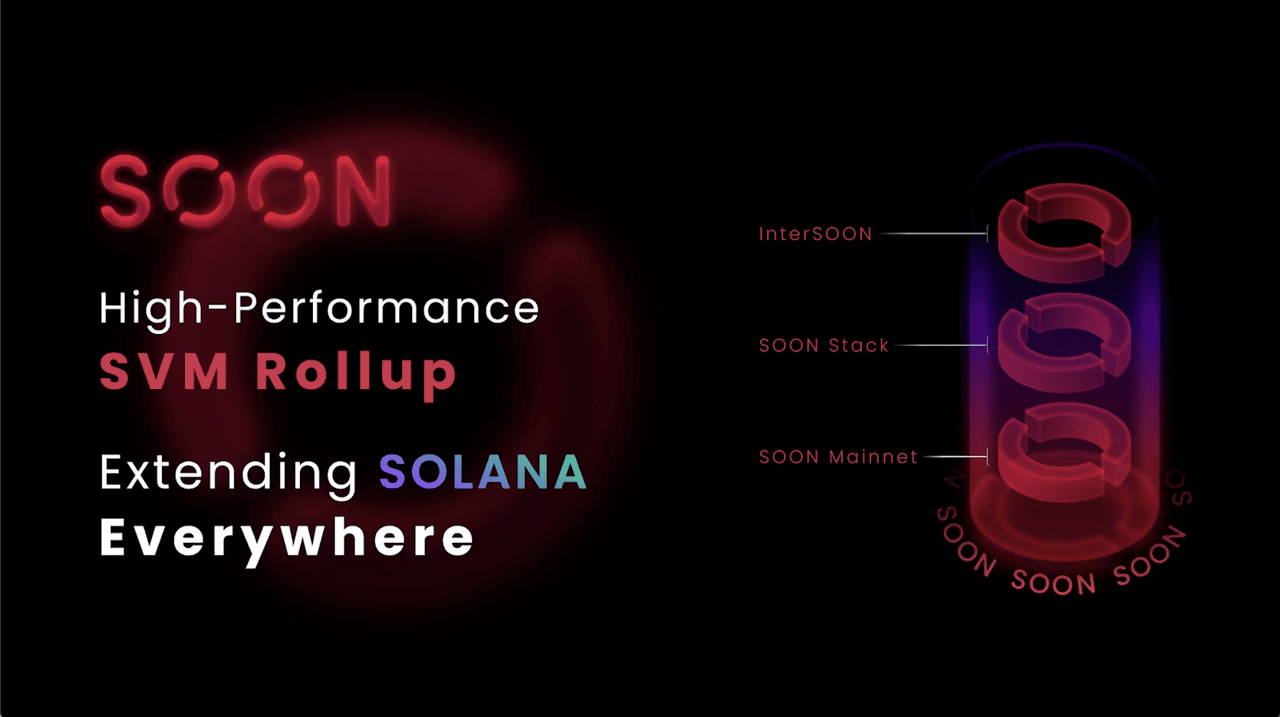

What Is SOON Network (SOON) and How Does It Work?

SOON Network is a Solana Virtual Machine (

SVM) rollup built for what the team calls the Super Adoption Stack. It combines three components: SOON Mainnet, a general-purpose Layer 2 that settles on

Ethereum and runs a decoupled SVM for scalable execution; SOON Stack, the infrastructure to launch SVM

Layer 2 chains on top of different base layers with current support for Ethereum settlement and DA options like Avail or EigenDA via Caldera and

Altlayer; and InterSOON, a cross-chain messaging protocol powered by Hyperlane.

The design pushes computation to the SVM while anchoring finality to a base chain, so projects can tune fees, pursue high throughput, and ship application-specific chains without rebuilding core plumbing. InterSOON handles interoperability at the message layer rather than through wrapped assets, preserving native liquidity and simplifying cross-chain coordination between SOON Mainnet, SOON Stack chains, and other

L1s.

Under the hood, the source highlights Merklization and horizontal scaling to drive performance. Put simply, SVM handles execution, Ethereum or other bases provide settlement and

data availability, and InterSOON ties it all together so contracts and assets can interact across networks through a standardized messaging layer.

Source: SOON Docs

Why Did SOON Spike By 60% in Early October?

1. Major exchange catalysts combined

Kraken turned SOON trading live on September 26, while Bitkub announced deposits for October 8 and trading for October 9 (GMT+7). Together, these listings widened fiat on-ramps and regional access, a classic driver of discovery-phase demand.

2. Product narrative in focus

Official channels highlighted a high-performance “Infra Stack” and “Perp Stack,” while docs emphasize the decoupled SVM execution model, InterSOON messaging, and horizontal scaling. The story gives Trader a concrete reason to look beyond the ticker.

3. Supply backdrop

The foundation

executed SIP-1, burning 30,000,000 SOON, which anchors the supply discussion even if it was not a 24-hour trigger.

What Is the SOON Token Utility?

• Native asset for activity and fees: Powers operations across SOON Mainnet and SOON Stack chains, used by builders and users across

dApps.

• Governance rights: Propose and vote on protocol upgrades, set resource allocation for ecosystem development and community grants, and decide treasury management and contributor rewards.

• Staking and security: Validators stake SOON to support a planned fast-finality settlement mechanism; active validators earn staking rewards, including a 3% annual token incentive.

• Builder and ecosystem incentives: Grants and performance-based rewards in SOON for teams that ship infrastructure, dApps, tools, or integrations that enhance SOON Chains.

Source: SOON Docs

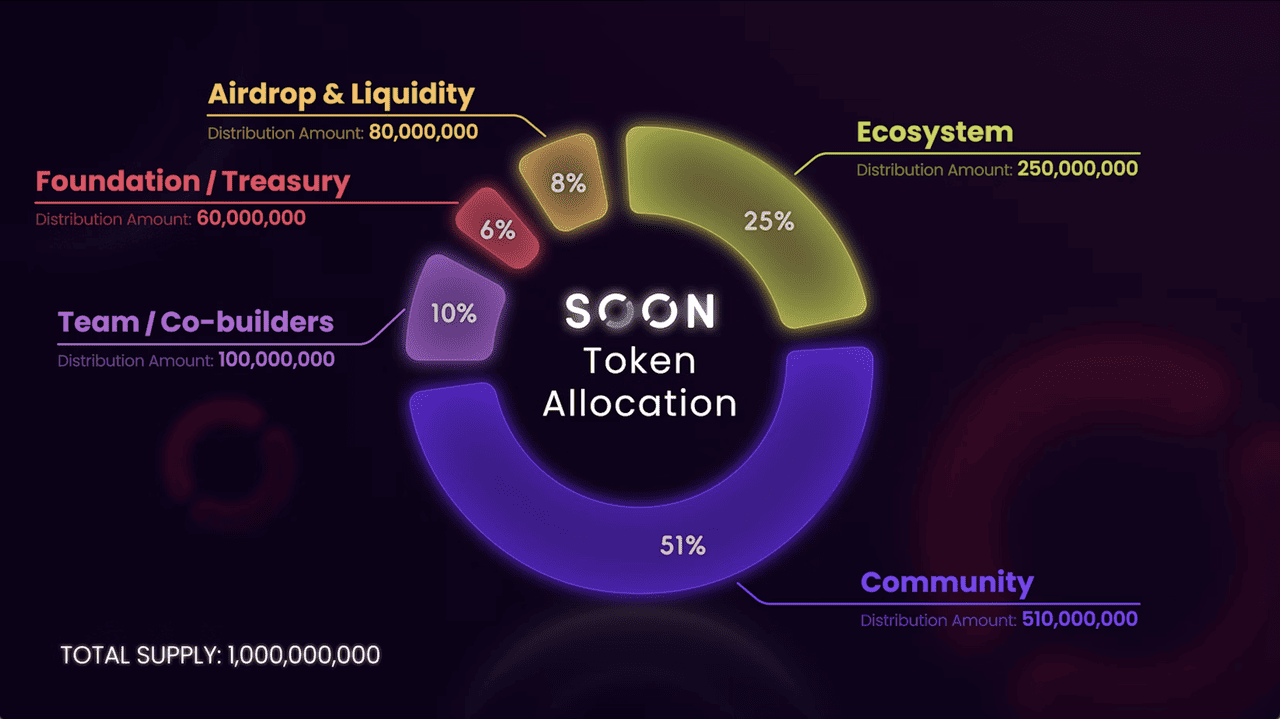

SOON Tokenomics

SOON launches with an initial total supply of 1,000,000,000 SOON and ongoing annual inflation of 3%. The source also records a community-approved action under SIP-1 in which the foundation burned 30,000,000 SOON.

Beyond supply and inflation, the token is split across several buckets aimed at community growth, builder funding, and long-term stewardship.

• Community (51%): Distributed via a fair-launch approach, with the remainder used to reward long-term supporters of the ecosystem.

• Ecosystem (25%): An ecosystem fund for partnerships, developer grants, third-party integrations, and other strategic investments.

• Airdrop and Liquidity (8%): For

airdrops that attract new users and reward early supporters, plus liquidity to enable smoother trading.

• Foundation / Treasury (6%): Reserves for sustainability, operations, research and development, and governance-directed initiatives.

• Team and Co-builders (10%): Incentives for the core team and early contributors to keep key stakeholders aligned with project goals.

SOON token distribution | Source: SOON Docs

How to Trade SOON Network (SOON) on BingX

Whether you are building a long-term SOON position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token.

With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

Buy or Sell Soon Network (SOON) on Spot Market

SOON/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit SOON or USDT and verify the correct network before trading.

Always conduct your own research (DYOR). Diversify your portfolio and never invest more than you can afford to lose.

How to Trade SOON Perpetual Futures

SOONUSDT perpetual contract on BingX futures

Futures, especially perpetual futures, let you trade SOON price movements with leverage; you don’t necessarily need to hold the underlying SOON. You can go long (betting price will rise) or short (betting price will fall). BingX offers a

SOON-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate SOONUSDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk (if losses push margin below maintenance).

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Conclusion

SOON’s jump looks earned: listings widened access while a decoupled SVM plus InterSOON narrative gave traders something concrete. SIP-1’s 30 million burn and 3% annual inflation set the supply path; utility spans fees, planned fast-finality staking, governance, and builder incentives.

Keep it simple from here: verify official portals, track unlocks and the circulating supply, monitor depth and funding, and size positions. If liquidity thins, reversals can be sharp.

Related Reading