What is StakeStone?

StakeStone is a decentralized omnichain liquidity infrastructure protocol designed to optimize yield generation, supply omnichain liquidity, and provide flexible asset management across blockchain ecosystems. The project introduces several innovative financial products including STONE (yield-bearing

ETH token), SBTC and STONEBTC (liquidity index and yield-bearing

BTC, respectively), and LiquidityPad, which enables users to unlock omnichain liquidity while earning optimized and sustainable yields.

As a foundational layer for omnichain liquidity distribution, StakeStone’s innovative Omnichain Liquidity Layer and highly compatible accounting mechanism addresses critical challenges in the decentralized finance (

DeFi) space, including liquidity fragmentation, inefficient yield strategies, complex user processes, and limited interoperability between blockchains.

The project's mission is to revolutionize efficient, organic, and sustainable liquidity distribution within

blockchain networks. With a commitment to transparency, security, and scalability, StakeStone aims to establish itself as a key infrastructure layer serving diverse blockchain ecosystems, driving the next evolution of DeFi.

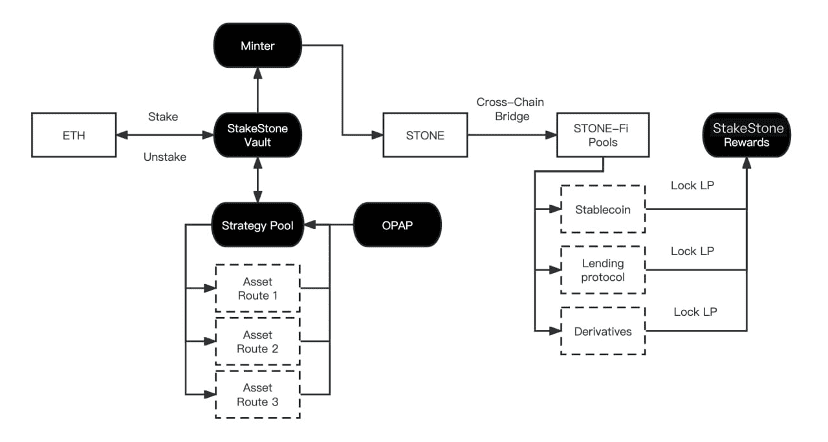

How Does StakeStone Work?

At its core, StakeStone solves a fundamental problem in the cryptocurrency space: the trade-off between staking rewards and providing liquidity. Traditionally, crypto holders had to choose between locking their assets for staking rewards or providing them as liquidity for trading. StakeStone eliminates this dilemma through an innovative approach that allows users to do both simultaneously.

Importantly, STONE's price is determined by smart contracts rather than by market dynamics on decentralized exchanges (

DEXs) or information from platforms like CoinGecko. This contract-based pricing mechanism ensures stability and predictability, protecting users from market volatility and manipulation.

The general flow of StakeStone's mechanism is elegantly simple:

1. Users deposit ETH into the platform

2. Their ETH is converted to stETH (Lido's staked ETH) and other yield-generating assets behind the scenes

3. They receive STONE tokens that continuously increase in value based on contract-determined rates

4. The underlying stETH and other assets are automatically allocated to optimized yield strategies

5. The system manages cross-chain liquidity and rebalancing behind the scenes

6. Users can withdraw their ETH (with accumulated yields) whenever needed at the current contract-determined exchange rate

How Yields Are Generated in StakeStone?

STONE Token: Your Appreciating Asset

Think of STONE as a receipt for your ETH that grows in value over time. When you deposit 100 ETH into StakeStone, you receive 100 STONE tokens. Behind the scenes, your ETH is converted to stETH (Lido's staked ETH) and stored in StakeStone's strategy pools, where it begins earning staking rewards immediately.

Unlike some staking tokens that increase in quantity (rebase tokens), STONE increases in value instead. After a year of

staking, your 100 STONE might be worth 104 ETH, reflecting the 4% yield earned from the underlying stETH and other yield-generating strategies.

This approach provides a cleaner accounting experience—your token balance stays the same, but each token becomes more valuable over time. The system is similar to how a certificate of deposit works in traditional finance, but with the added benefits of blockchain technology.

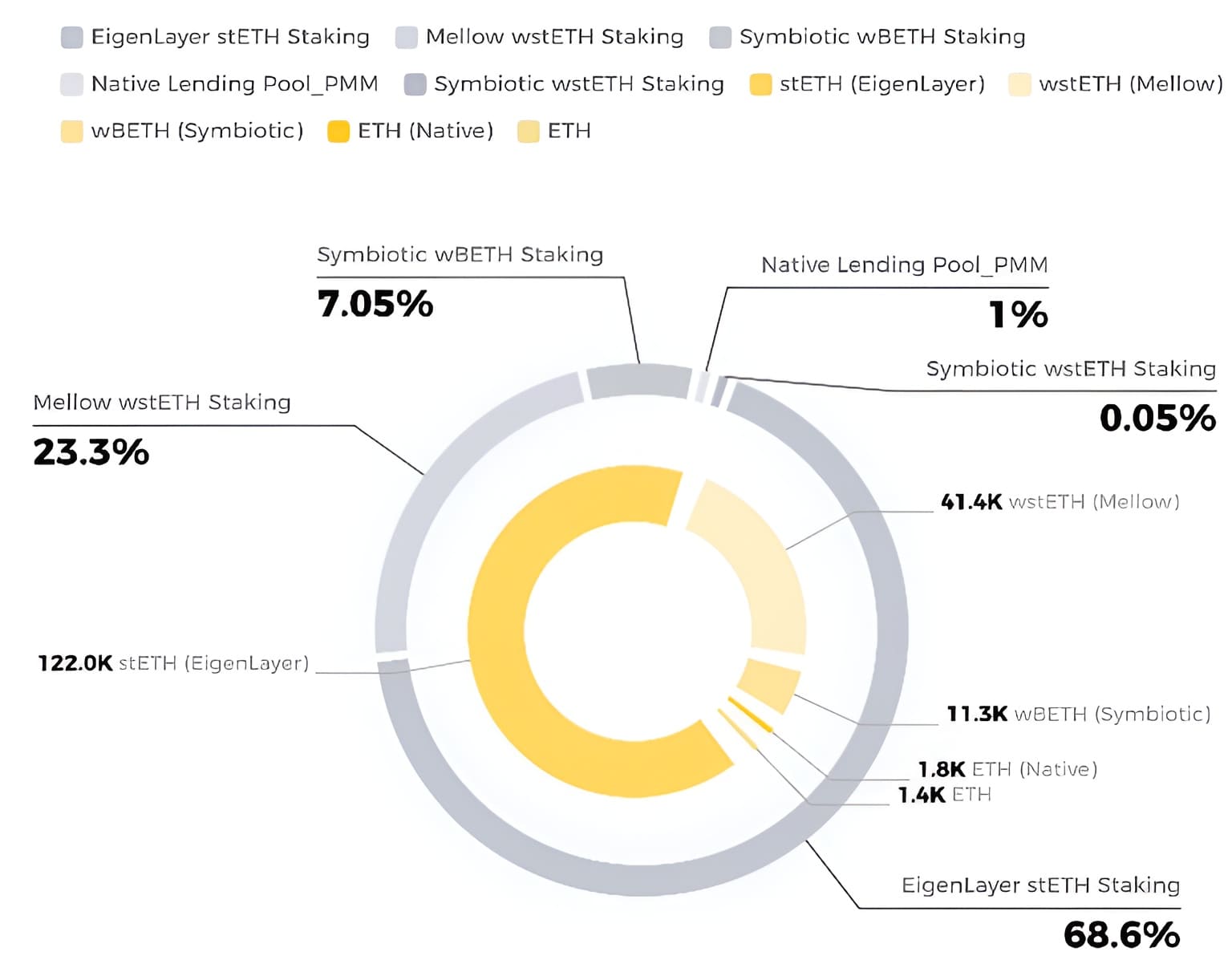

Smart Yield Optimization (OPAP)

StakeStone doesn't just stake your ETH in one place. After converting your ETH to stETH, the system employs the Optimizing Portfolio and Allocation Proposal (OPAP) mechanism—essentially a smart system that continually searches for the best yields across the cryptocurrency ecosystem.

The OPAP mechanism might, for example, take the stETH and re-stake it into EigenLayer for additional yields, or allocate it to other strategy pools depending on which offers the best returns at any given time. This stETH can be withdrawn from these strategies and returned to the StakeStone Vault as needed.

Imagine having a financial advisor who constantly monitors different investment opportunities and adjusts your portfolio to maximize returns without charging management fees. That's what OPAP does automatically. It moves your assets between different yield-generating strategies based on market conditions, saving you the time and expertise needed to manage complex DeFi strategies yourself.

Seamless Cross-Chain Experience

One of StakeStone's most powerful features is its cross-chain functionality. Using

LayerZero technology, StakeStone allows your assets to work across multiple blockchains without you having to deal with complicated bridge processes.

This is similar to having a global bank account that works seamlessly in any country without currency exchange hassles. Your STONE tokens can be used across different blockchain ecosystems, opening up more opportunities for yield and utility without requiring you to manage separate wallets or navigate different blockchain interfaces.

Flexible Withdrawal Options

When you want your ETH back (along with the yields earned), StakeStone offers two straightforward options:

1. Instant Withdrawal: If you need your ETH immediately, you can convert STONE back to ETH in one click. This works as long as there's sufficient ETH in the platform's buffer pool, similar to a bank keeping cash reserves for immediate withdrawals.

2. Request Withdrawal: For larger amounts, you may need to request a withdrawal, which takes a bit longer but ensures you get your full value back.

In both cases, the amount of ETH you receive is based on the current value of STONE as determined by smart contracts—not market speculation—ensuring fairness and predictability.

What's the Use of STO Token?

As the protocol grows and expands its

TVL (Total Value Locked), STO captures value as an integral part of StakeStone's financial ecosystem. The multi-token Treasury approach strengthens cross-ecosystem relationships while enabling STO to expand in utility through the very governance mechanisms it enables.

STO is the governance token that powers StakeStone's omnichain liquidity infrastructure. It serves as the cornerstone of the protocol's governance while creating sustainable value for all participants in the ecosystem through a carefully designed vote-escrowed token model (veSTO).

Governance Powers

STO holders can lock their tokens into veSTO to gain voting rights proportional to their locked tokens. This gives them direct influence over:

• Emission Allocation: veSTO holders vote on how to distribute veSTO emissions across STONE-Fi pools, BTC-Fi pools, and LiquidityPad vaults

• Protocol Parameters: They control key settings including platform fees and the percentage of bribes burned

• Strategic Direction: Governance participants help shape StakeStone's development roadmap and initiatives

• Asset Routes: Decisions about which strategies receive allocations and their corresponding weights within the Strategy Pool

Yield and Rewards

The veSTO mechanism aligns incentives between liquidity providers, governance participants, and protocols within the StakeStone ecosystem:

• Yield Boosting: Liquidity providers who lock veSTO receive boosted yields on their provided liquidity. The boost is proportional to the amount of veSTO locked relative to the liquidity provided.

• Bribe Rewards: veSTO voters earn a portion of bribes from the pools and vaults they voted for, creating direct economic incentives for active governance.

• veSTO Emissions: Holders secure proportional claims to veSTO rewards by voting on specific pools or vaults for emission allocation.

• Treasury Asset Access: STO represents proportional rights to assets in the StakeStone Treasury through the Swap & Burn mechanism.

Value Capture Mechanism

StakeStone integrates interconnected mechanisms designed to drive sustainable growth while ensuring consistent value accrual for STO holders:

1. Platform Fees: Exit fees from STONE vaults, SBTC & STONEBTC vaults, and LiquidityPad flow to the Treasury, consisting of blue-chip assets like ETH, Bitcoin, and stablecoins.

2. Bribe Mechanism: Ecosystem builders can purchase STO tokens to deposit as bribes into various pools, creating targeted incentives for liquidity. When STO serves as the bribe currency, a portion is immediately burned, generating deflationary pressure that benefits all token holders.

How to Earn Yield from StakeStone: A Step-by-step Guide

StakeStone offers a straightforward staking process to earn yields:

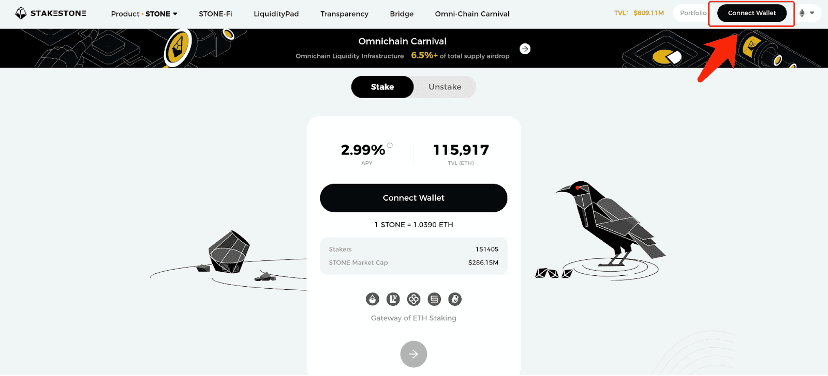

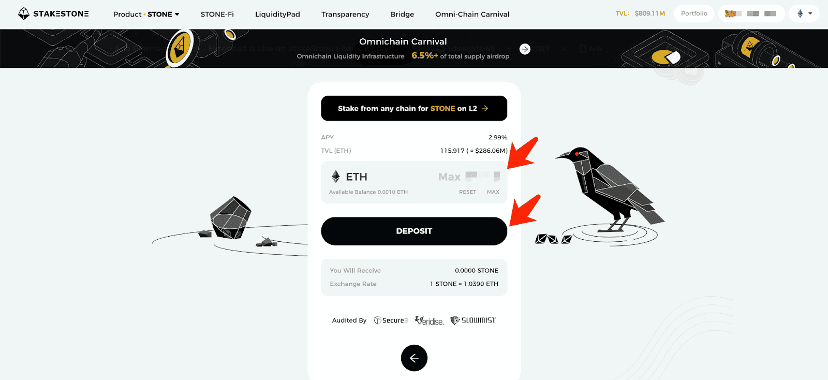

Step 1: Access the StakeStone Platform

Visit the official StakeStone staking interface at https://app.stakestone.io/u/stake to begin the staking process.

Step 2: Connect Your Wallet

Click on the wallet connection button in the top-right corner of the interface and complete the signature verification process.

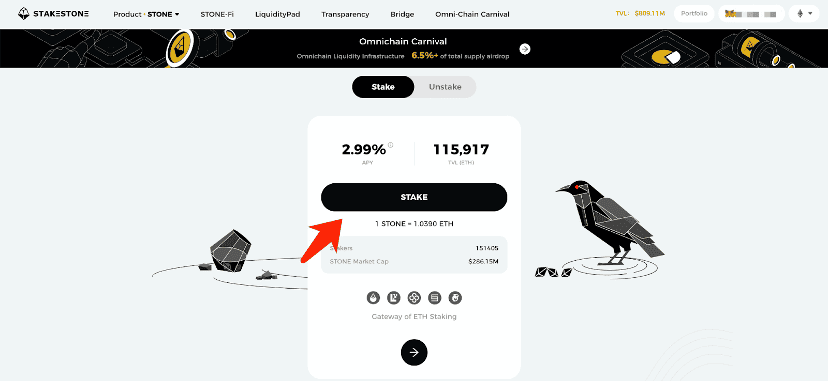

Step 3: Stake ETH

Click the "STAKE" button on the platform and input the amount of ETH you wish to stake (minimum 0.01 ETH is required). Then click the "DEPOSIT" button and complete the wallet signature request. Wait for the "Succeed" confirmation to verify your staking is complete.

Step 4: Receive and Earn Yields

When you stake ETH, the system automatically mints and sends STONE tokens to your wallet based on the amount of ETH staked. Once staked, your assets will be stored as stETH in StakeStone's strategy pools and potentially be further staked into various strategy pools to maximize returns.The platform may then allocate this stETH to different yield strategies to maximize your returns.

StakeStone's transparent system lets you monitor your assets and earnings in real-time. For those seeking additional yields, you can use your STONE tokens in STONE-Fi pools or lock LP tokens within the protocol for higher rewards.

Future Roadmaps

StakeStone has an ambitious roadmap planned for 2025, with specific goals for each quarter.

Q1 2025

• Introduce more projects like GOAT and GAIB on LiquidityPad

Q2 2025

• Collaborate with the Ethereum Foundation to launch Pebbles payment product on MegaETH. StakeStone will serve as the underlying yield manager for Pebbles stablecoin and ETH assets, continuing to attract more retail users.

Q3 2025

• Upgrade SBTC and STONEBTC tokens with new features and improvements

• Build a comprehensive token governance system for the entire ecosystem

Q4 2025

• Release StakeStone V2, representing a major platform upgrade

Will There Be an Airdrop for $STO?

Currently, there is no announced

airdrop specifically for STO governance tokens. StakeStone has established an airdrop program for STONE tokens (the yield-bearing ETH tokens), but this is distinct from STO.

However, with StakeStone's roadmap highlighting plans to "build a comprehensive token governance system" in Q3 2025, there may be opportunities for STO token distribution as this governance system develops. Projects often distribute governance tokens to early users and community members when launching or expanding their governance systems.

While specific distribution mechanisms haven't been announced yet, StakeStone's focus on community engagement and their established incentive structures suggest that some form of community-based distribution could be considered as the governance system matures.

For the most up-to-date information about potential future STO token distribution, users should:

• Monitor official StakeStone channels including their website (

https://stakestone.io/), Twitter, Telegram, and Discord

• Be cautious of unofficial sources claiming to offer STO airdrops

• Stay engaged with the project, particularly as they approach the Q3 2025 governance system development

As with any evolving project, the plans for token distribution may develop over time, making it worthwhile for interested participants to follow StakeStone's official announcements.

Conclusion

StakeStone stands at the forefront of DeFi innovation by solving the critical challenge of balancing staking rewards with liquidity needs. With strong backing from Polychain Capital, Binance Labs, and OKX Ventures, the project has quickly gained market traction, reaching $1.2 billion TVL by March 2024.

The platform's key strengths lie in its OPAP yield optimization mechanism, LayerZero-powered cross-chain functionality, and transparent non-custodial architecture. These features provide users with an unprecedented combination of security, flexibility, and optimized returns.

While challenges exist in maintaining infrastructure costs and deepening community engagement, StakeStone is strategically positioned to capture significant value as Ethereum's PoS ecosystem and cross-chain demand continue to grow. The project represents a meaningful advancement in making DeFi more accessible and efficient for users across the blockchain landscape.