Buying Bitcoin via Peer-to-Peer (P2P) in Russia has undergone a massive shift in 2026. While the Central Bank’s new regulatory framework, finalized in early 2026, now recognizes digital currency as property, it has also introduced stricter oversight. For most retail buyers, this means operating within an annual purchase limit of 300,000 rubles through regulated intermediaries and facing mandatory risk-awareness tests.

Despite these hurdles, P2P remains the heartbeat of the Russian crypto market. With traditional cross-border bank transfers restricted, P2P marketplaces provide the necessary liquidity to move between the ruble and global assets like USDT.

What Is P2P Crypto Trading and How Does It Work?

Peer-to-Peer (P2P) crypto trading is a direct exchange between two individuals without a central intermediary, like a bank or a traditional exchange order book, managing the trade. In Russia, where many international payment gateways are restricted, P2P has become the primary bridge between the Russian Ruble (RUB) and digital assets.

Instead of buying from an exchange, you are buying directly from a user. The platform simply acts as a secured marketplace that hosts advertisements and provides an escrow service to ensure both parties fulfill their end of the deal.

How P2P Trading Works with Ruble (RUB): A Step-by-Step for Russian Users

Trading crypto via P2P is designed to be as simple as a local bank transfer, typically taking 5 to 15 minutes to complete.

1. Select an Offer: You browse a list of ads on a platform like BingX. You filter by your preferred currency (RUB) and your specific bank, such as Sberbank, T-Bank/Tinkoff, or FPS.

2. Locking the Crypto (Escrow): Once you initiate a trade to buy, for instance, 10,000 RUB worth of USDT, the platform automatically "locks" that USDT from the seller's account. The seller cannot withdraw it until the trade is resolved.

3. The RUB Transfer: You send the 10,000 RUB directly to the seller’s bank account using your mobile app.

Note: Because this is a standard person-to-person transfer, the bank often sees it as a regular domestic payment, not a "crypto purchase."

4. Confirmation: After sending the rubles, you click Paid on the P2P platform. Once the seller checks their bank app and confirms the 10,000 RUB has arrived, they release the USDT.

5. Settlement: The platform instantly moves the USDT into your wallet.

An Overview of Russia’s P2P Landscape in 2026: Risks and Regulations

The Russian P2P market has transitioned into a "high-trust, high-verify" environment, driven by the country’s climb to Europe's largest crypto market with over $376 billion in annual transaction volume. Since July 2024, the State Duma has aggressively targeted "dropper" accounts and money laundering, shifting P2P from a "grey" zone to a regulated sector where transparency is the baseline for access to RUB liquidity.

By mid-2026, a comprehensive regulatory framework will strictly define the boundaries for retail users. Non-qualified investors are limited to an annual purchase cap of 300,000 RUB per intermediary, while systematic P2P trading is legally classified as "entrepreneurial activity," making traders liable for business taxes. While BTC is legally recognized as property, its use for domestic payments remains prohibited, focusing its role strictly on cross-border settlement and personal investment.

What are the Top 5 Crypto P2P Platforms in Russia?

When choosing a P2P platform in 2026, focus on escrow reliability, merchant verification, and anti-scam protection. Here are the five most practical options for Russian users.

1. BingX

BingX has cemented its status as a leading global exchange and Web3–AI platform in 2026, offering a powerful blend of traditional finance reliability and next-generation crypto infrastructure. Russian users can access deep RUB liquidity through a focused set of high-usage payment rails optimized for speed and reliability. The most commonly supported methods include T-Bank (formerly Tinkoff Bank) as the dominant option across most merchants, СБП (Fast Payment System) for instant phone-based transfers, and standard bank transfers for larger ticket sizes. Some advertisers also support cash-in-person settlements for local transactions. In practice, most RUB to USDT trades on BingX P2P are executed via T-Bank/Tinkoff and СБП, typically completing within 15–30 minutes, offering users a fast and flexible on-ramp into the global crypto market.

Beyond crypto, BingX has emerged as a

TradFi and AI-driven trading powerhouse. In early 2026, its TradFi 24-hour trading volume surpassed $1 billion, allowing users to

trade USDT-settled perpetuals on gold, oil, forex, and major global indices from a single account. This is reinforced by an advanced

BingX AI suite, AI Bingo and AI Master, powering a world-class

copy trading ecosystem with more than 11.5 million users, alongside top-tier security standards including a

$150 million Shield Fund,

100% Proof of Reserves, and a landmark

Scuderia Ferrari HP partnership that underscores BingX’s global credibility and performance focus.

BingX is best suited for: Russian traders seeking a high-performance, all-in-one ecosystem that offers P2P security, AI-driven insights, and a bridge to global traditional markets.

2. Telegram Wallet

Integrated directly into the Telegram interface, this bot-based marketplace offers unparalleled convenience for RUB users, allowing for P2P transactions without leaving the messenger. In 2026, it serves as a streamlined gateway where transactions are secured by an automated escrow system that reserves assets the moment an order is initiated. While the platform is accessible to all, it distinguishes between standard "Merchants" and "Trusted Merchants," elite sellers who have undergone additional vetting and often maintain a security deposit, typically 50 USDT, to ensure higher performance and reliability.

• Key Consideration: Convenience comes at a cost; exchange rates here can be 1% to 3% less favorable than global exchanges. Additionally, while the wallet supports multiple networks, withdrawal fees can be steep, up to $3.50 USDT for TRC20, and users must carefully verify they are using the official @wallet bot to avoid phishing.

• Best for: Beginners and casual users making quick RUB-to-crypto purchases or sending instant, fee-free transfers to friends within their Telegram contact list.

3. NoOnes

NoOnes is a privacy-centric financial super-app that has surpassed 2 million global users by positioning itself as a leading alternative for the "Global South" and markets with restricted banking access. In Russia, it is heavily utilized for its support of over 500 payment methods, including local bank transfers like Sberbank, RUB-denominated cards and an extensive gift card marketplace. The platform operates with a unique focus on radical transparency, publishing real-time growth data on a public CEO dashboard while allowing users to start trading without mandatory KYC for transactions under $50,000.

• Key Consideration: While NoOnes offers 0% fees for buyers, sellers face tiered fees or up to 1% for bank transfers and 5% for gift cards. Its "no-KYC" policy provides high privacy, but the decentralized nature of its ads means users must be highly vigilant against wide spreads and potential fraud in the gift card sector.

• Best for: Privacy-conscious traders and unbanked users who need to convert alternative assets, like gift cards, into liquid BTC or USDT.

4. p2p.me (p2pdotme)

P2P.me is a high-speed, non-custodial protocol designed to facilitate near-instant RUB-to-USDC swaps while bypassing the centralized vulnerabilities of traditional exchanges. By 2026, the platform has processed over $23.7 million in volume across 270,000+ orders, utilizing a decentralized network of liquidity providers. It distinguishes itself with ZK-Social Verification, a privacy-first technology that allows users to verify their identity via

Zero-Knowledge proofs, meaning your sensitive ID details are never shared with third parties or the protocol itself. This approach has reduced fraud rates to a staggering 1 in 25,000, offering a significant shield against bank freezes commonly associated with P2P trading.

• Key Consideration: While P2P.me provides "fraud-proof" infrastructure, it operates on a decentralized model where you retain absolute ownership of your assets. This requires a higher level of technical comfort with non-custodial wallets. Additionally, the platform encourages users to act as Liquidity Providers, offering a 2% return on every swap processed through their own bank accounts.

• Best for: Advanced traders and privacy advocates who want a decentralized, on-chain solution to avoid bank censorship and earn passive income as a liquidity provider.

5. Matbea

Matbea is a long-standing pillar of the Russian crypto market, operating since 2014 and serving over 200,000 global clients. By 2026, it has evolved into a comprehensive ecosystem that processes over 22,000 orders per week, with a historical turnover reaching 3.8 billion rubles. The platform is uniquely tailored for RUB users, offering a triple-threat of services: a multi-currency wallet supporting 61 assets, a P2P marketplace integrated with Sberbank and FPS, and Matbea Swap, a feature allowing instant crypto-to-fiat conversion without registration. To combat the 2026 "Black Triangle" risks, Matbea employs a mandatory address scoring system, which automatically blocks transactions involving high-risk or "dirty" funds, ensuring your portfolio remains compliant with local AML standards.

• Key Consideration: While Matbea offers high domestic security through its verified merchant system and three-factor authentication, its liquidity for larger trades can be less competitive than global exchanges. Additionally, its technical support operates on a fixed schedule of 08:00 to 22:00 Moscow time, which may cause delays for night traders.

• Best for: Beginner-to-intermediate Russian users who prioritize legal "cleanliness" of their coins and a simple, RUB-optimized interface for frequent, mid-sized transactions.

How to Buy Bitcoin and Crypto via P2P on BingX: Step-by-Step Guide

Buying USDT through BingX P2P is the fastest entry point into the global crypto market for RUB users. Once your

USDT is in your account, it acts as your "base currency," allowing you to trade over 1,000 listed cryptocurrencies on the spot and futures markets. You can also use these funds for high-level strategies like Copy Trading, setting up automated Trading Bots, or simply transferring your assets to a

non-custodial wallet for long-term security.

5 Steps to Buying USDT with RUB on BingX P2P

1. Register and Verify: Create your

BingX account and complete the mandatory

Identity Verification (KYC). In 2026, this is essential for accessing P2P and ensuring your transactions count toward your legal RUB purchase limits.

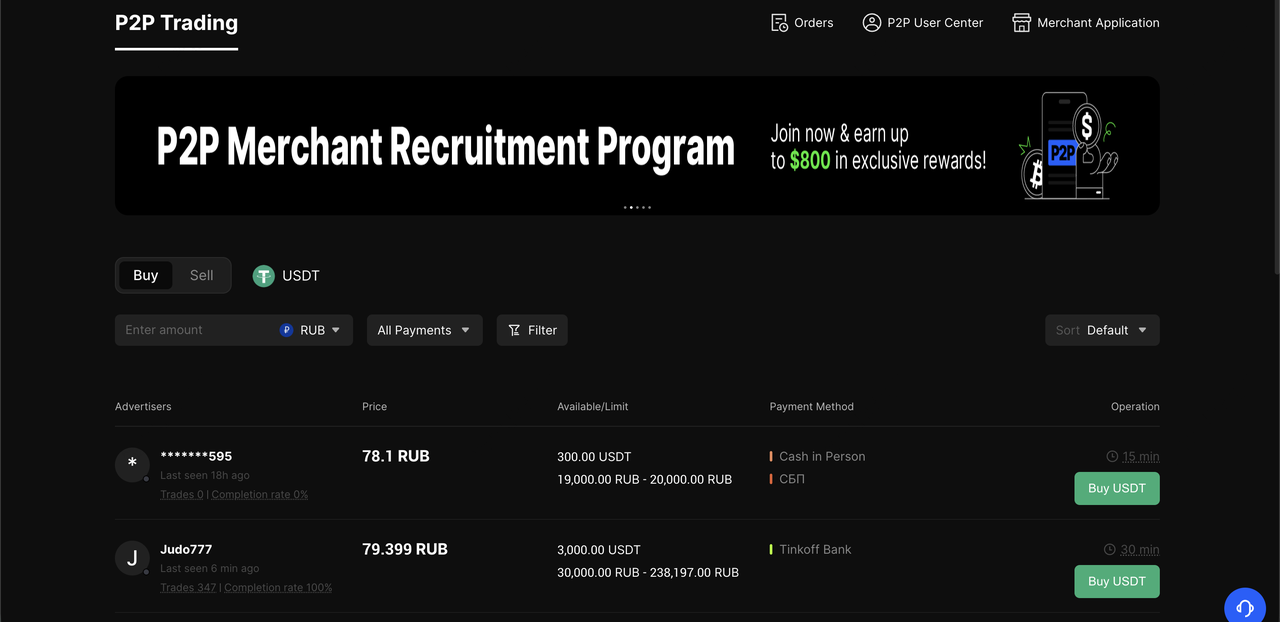

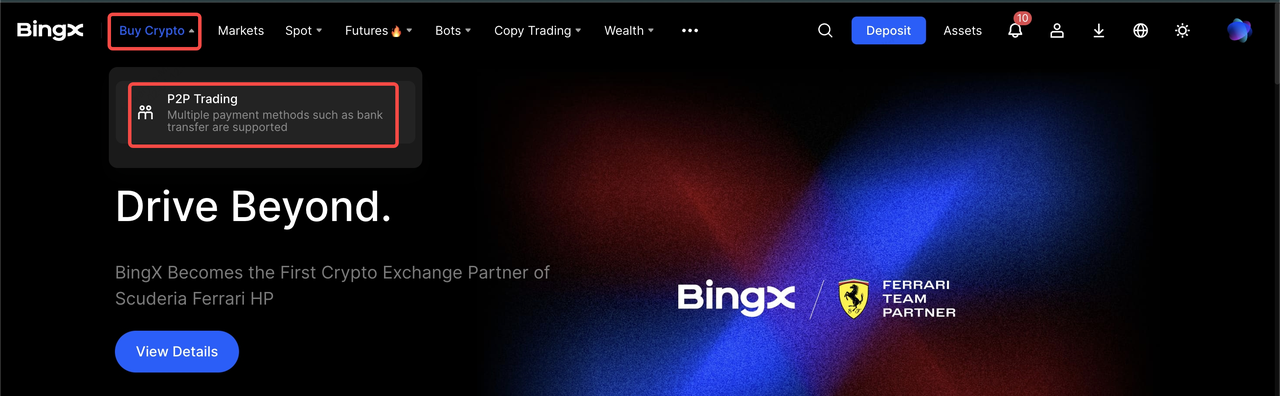

2. Access P2P Trading: Navigate to the "Buy Crypto" menu and select "P2P Trading." Ensure your currency is set to RUB.

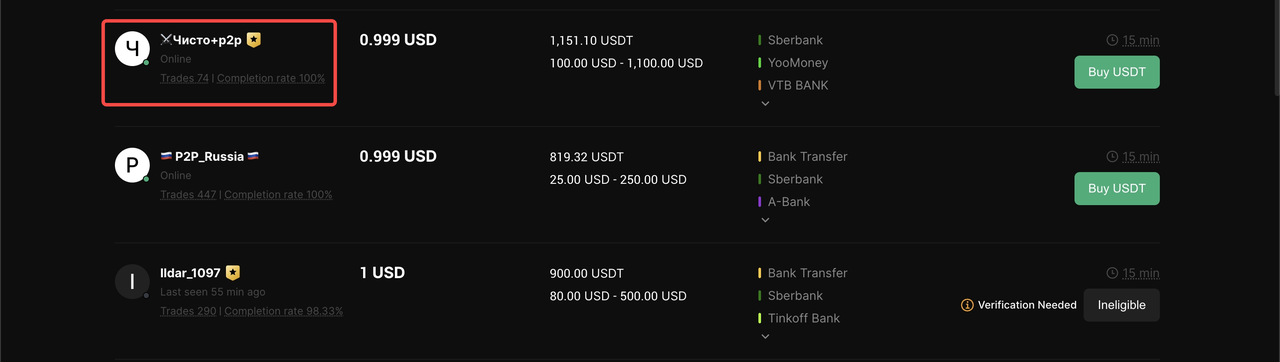

3. Filter and Select a Merchant: Use the filter tool to select your payment method (e.g., T-Bank, Sberbank, or FPS). Look for merchants with a "Yellow Tick" (Verified) and a completion rate of 95% or higher. Enter the amount you wish to spend in RUB and click "Buy USDT."

4. Transfer RUB Directly: The platform will display the seller's bank details. Open your banking app and transfer the exact RUB amount.

Crucial: The name on your bank account must match your BingX KYC name to avoid order cancellation or funds being flagged.

5. Confirm and Receive: Once the transfer is successful, go back to BingX and click "Transferred, Notify Seller." The seller will verify the receipt of funds in their bank app and release the USDT from escrow into your Fund Account.

Top 4 Safety Tips for Crypto P2P Trading in Russia (2026)

In 2026, Russia’s crypto landscape is defined by the July 1st regulatory deadline, where digital assets are strictly property and P2P trading is under the lens of the 115-FZ (Anti-Money Laundering law). The primary threat today is the "Black Triangle," a sophisticated scam where a fraudster acts as a middleman, funneling stolen RUB into your account in exchange for your crypto. If the bank flags the stolen funds, your card is blocked, and you become the primary suspect in a money-laundering investigation.

To trade safely in this "high-trust, high-verify" environment, follow these essential security protocols:

1. Scrutinize Merchant Stats and Names: Only trade with "Yellow Tick" verified merchants who have a 95%+ completion rate and at least 500 successful trades. Crucially, ensure the bank account name matches the merchant’s verified identity on BingX. Never accept third-party payments, as these carry the highest risk of "Black Triangle" fraud.

2. Enforce Platform Integrity: Keep all communication within the BingX P2P chat. If a counterparty pressures you to move to Telegram or WhatsApp to "speed things up," it is a red flag for social engineering. Additionally, enable 2FA (Two-Factor Authentication) using app-based authenticators for all logins and withdrawals to prevent account takeovers.

3. Document for Legal Defense: Treat every trade as a business transaction. Save a digital PDF or screenshot of every bank receipt. Under current 2026 regulations, these receipts are your only evidence to prove a "legitimate economic purpose" if your account is flagged by Rosfinmonitoring or the Central Bank.

4. Prioritize Self-Custody: While P2P platforms are essential for liquidity, they are not long-term storage solutions. Move your purchased crypto to a safe exchange like BingX or a non-custodial hardware wallet immediately after purchase.

Final Thoughts: Choosing the Right P2P Crypto Trading Platform in Russia

In 2026, the ideal P2P platform in Russia is one that bridges the gap between local RUB convenience and global liquidity while prioritizing asset security. BingX remains a practical all-around entry point, scaling with users from their initial ruble-to-USDT purchase to high-level AI trading and diversification into tokenized assets. However, the choice of platform should always be dictated by your specific needs, whether it is the mobility of Telegram Wallet, the specialized local safety of Matbea, or the broad payment flexibility of NoOnes.

Risk Reminder: Peer-to-peer trading carries inherent counterparty and regulatory risks. Despite platform safeguards, you are responsible for vetting merchants and maintaining strict operational security. As Russian regulations continue to solidify through mid-2026, ensure you stay updated on tax obligations and annual purchase caps to maintain a compliant and secure portfolio.

Related Reading