Fanable is a leading

Real-World Asset (RWA) platform dedicated to the collectibles industry. It allows users to digitize, trade, and securely vault physical items, ranging from vintage trading cards to graded comics, using blockchain-backed transparency. As of February 2026, the platform has surpassed $1.65 million in revenue within its first 60 days of launch and supports a growing catalog of over 100,000 unique items.

In this article, you will learn what Collect on Fanable is, the "phygital" workflow that secures your assets, the role of the COLLECT token in the ecosystem, why major backers like Michael Rubin (Fanatics) and Ripple are betting on tokenized nostalgia, and how to buy COLLECT tokens on BingX.

What Is Collect on Fanable (COLLECT) RWA Marketplace?

Collect on Fanable (COLLECT) is an institutional-grade RWA protocol designed to unlock liquidity in the $450 billion global collectibles market. Unlike traditional NFT projects that rely on speculative digital art, Fanable tokenizes authenticated physical assets, such as Pokémon cards, comic books, and vintage video games, transforming them into high-velocity, on-chain financial instruments. The Collect on Fanable RWA protocol tokenizes authenticated physical collectibles, turning them into liquid, tradable digital assets. Unlike speculative NFT projects, every digital token on Fanable is backed 1:1 by a physical item stored in a professional, fully insured vault.

As of February 2026, COLLECT has shown notable relative strength despite a weak broader crypto market. After touching an all-time high of $0.1163 in mid-January 2026, the token recently posted a 7.79% gain in 24 hours while the total crypto market declined by more than 7%, highlighting asset-specific buying pressure rather than market-wide beta. 24-hour trading volume crossed $15 million, representing a Vol/Market Cap ratio above 64%, a sign of strong liquidity and active price discovery for a mid-cap RWA token. COLLECT’s market capitalization stands near $25 million, with a fully diluted valuation of around $140 million, reflecting that only 537 million tokens or 17.9% of the 3 billion max supply are currently in circulation.

How Does Collect on Fanable Work?

The Fanable ecosystem utilizes a "vault-and-trade" model that eliminates the traditional friction of physical marketplaces. Collectors ship authenticated, graded items, such as PSA, CGC, Beckett, to high-security, insured Brink’s vaults, where they undergo secondary verification. Once cleared, Fanable mints a Digital Ownership Certificate (DOC), a blockchain-based digital twin that is delivered to the user’s wallet. This allows the physical asset to remain securely stationary while its digital representation becomes instantly tradable on the global marketplace.

Trading occurs in seconds using $COLLECT or

stablecoins, providing immediate liquidity for high-value collectibles. At any time, a DOC holder can choose to "burn" their digital certificate to trigger physical redemption. Fanable then handles the secure out-take and delivery from the vault directly to the user's doorstep. For assets exceeding $50,000 in value, the platform provides professional armored transport, ensuring institutional-grade security for the entire lifecycle of the investment.

The Fanable ecosystem operates through three data-backed pillars:

1. Secure Custody and Armored Infrastructure

Physical items are housed in state-of-the-art Brink’s vaults, which provide full insurance and climate-controlled protection. For high-net-worth transactions, Fanable utilizes armored transport for any asset valued over $50,000, ensuring that the physical "backing" of the digital token is never compromised.

2. Digital Ownership Certificates (DOCs)

Every vaulted item is represented by a Digital Ownership Certificate (DOC). This

on-chain deed provides 24/7 transparency into:

• Provenance: A verifiable chain of custody since the item entered the vault.

• Real-Time Valuation: Automated price discovery based on secondary market sales.

• Authenticity: Direct linkage to grading reports from industry leaders like PSA, CGC, and Beckett.

3. The $COLLECT Economy and Market Performance

The $COLLECT token serves as the ecosystem’s native utility layer. Following a successful $11.5 million funding round in late 2025, backed by

Ripple,

Polygon, and Michael Rubin from Fanatics, the token has achieved significant market milestones:

By bridging the gap between tangible nostalgia and Web3 infrastructure, Collect on Fanable is positioning itself as a cornerstone of the emerging RWA sector, catering to both traditional collectors and crypto-native investors.

What Is the COLLECT Token Used for?

The COLLECT token is the utility and governance backbone of the ecosystem. It is designed to align the interests of collectors, traders, and the platform.

• Currency of Access: Each asset on the Fanable marketplace is listed in $COLLECT, making it the primary medium of exchange.

• Staking and Yield: Holders can stake $COLLECT to earn a portion of marketplace fees and unlock "VIP" access to limited-edition drops.

• Creator & Reseller Royalties: Fanable enables a 2% royalty on secondary sales, ensuring that original vault-owners benefit from the long-term appreciation of their items.

• Governance: The Collect Foundation allows token holders to vote on platform upgrades, such as adding new collectible categories, e.g., luxury watches or sneakers, or adjusting burn rates.

Note: $COLLECT is an RWA utility token. Its value is fundamentally tied to the volume of transactions and the total value of assets vaulted within the Fanable ecosystem.

COLLECT Tokenomics: Supply and Allocation

The $COLLECT token has a fixed maximum supply of 3,000,000,000 tokens, ensuring long-term scarcity as the Fanable ecosystem scales.

• Ecosystem and Community Rewards (40%): The largest portion is dedicated to user incentives, staking rewards, and marketplace participation to drive organic growth.

• Treasury and Strategic Partnerships (25%): Reserved for future development, operational costs, and onboarding major brand partners to expand the RWA catalog.

• Founding Team and Advisors (15%): Allocated to the core contributors with a multi-year vesting schedule to ensure long-term alignment with the project’s success.

• Private and Institutional Investors (15%): Distributed to early backers like Ripple and Polygon Labs who provided the initial $11.5 million in seed funding.

• Public Liquidity and Exchanges (5%): Designated for exchange listings and liquidity pools to ensure smooth trading and price stability across platforms like BingX.

How to Trade Collect on Fanable (COLLECT) on BingX

Powered by

BingX AI insights, BingX combines real-time candlestick patterns, sentiment data, and on-demand token research to help you navigate the $COLLECT market with institutional-grade clarity.

How to Buy or Sell COLLECT Tokens on the Spot Market

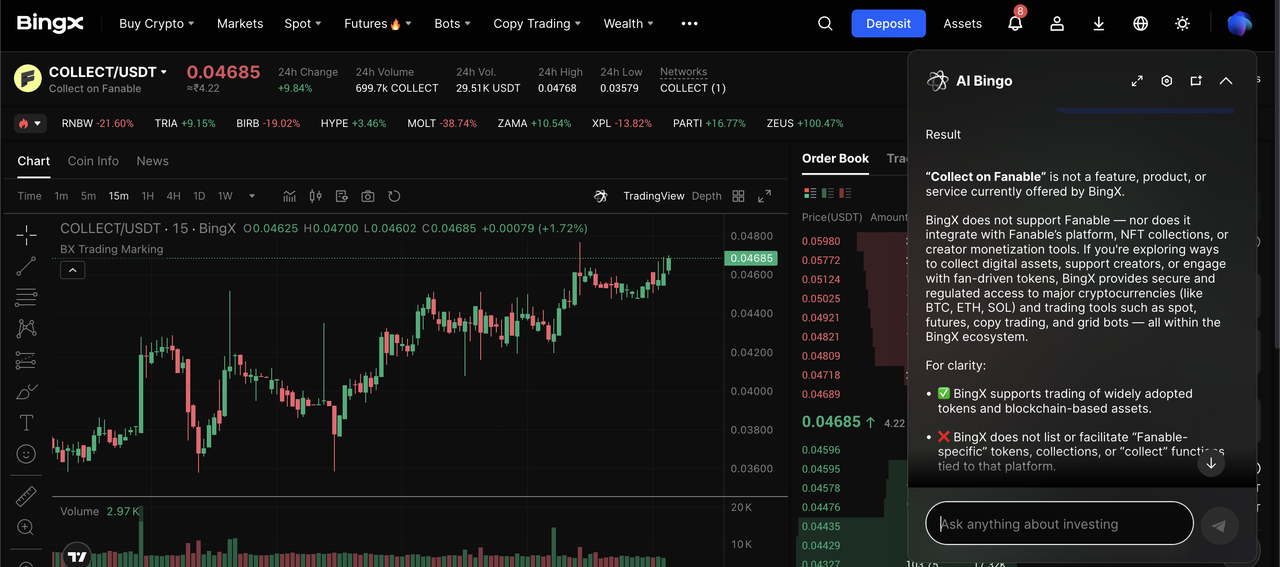

COLLECT/USDT trading pair on the spot market powered by BingX AI insights

1. Fund Your Account: Log in to BingX, complete your identity verification (

KYC), and ensure you have

USDT in your Spot Account.

2. Locate the Pair: Go to the

Spot tab and search for the

COLLECT/USDT trading pair.

3. Use AI Insights: Tap the BingX AI icon on the chart to receive an automated breakdown of current support and resistance levels for $COLLECT.

4. Execute Your Trade: Select a

Market Order for instant execution or a Limit Order to set your preferred entry price, then confirm your purchase.

Long or Short COLLECT with Leverage on the Futures Market

COLLECT/USDT perpetual contract on the futures market featuring BingX AI insights

1. Transfer Margin: Move your USDT from the Fund Account to your Perpetual Futures account.

3. Set Your Strategy: Choose "Long" if you expect the collectibles market to surge or "Short" to profit from a price correction.

4. Manage Risk: Use the BingX AI Position Analysis tool to evaluate your risk-to-reward ratio, set your leverage (e.g., 2×–5×), and always include a

Stop-Loss order to protect your capital.

3 Key Considerations Before Investing in COLLECT Token

Before adding $COLLECT to your portfolio, it is essential to evaluate the unique market dynamics and structural risks associated with the tokenized collectibles sector.

• Market Adoption and "Phygital" Scaling: The token’s long-term value is fundamentally tied to the "phygital" transition of the $450 billion collectibles market. While Fanable’s $1.65 million initial revenue and 100% monthly inventory growth are strong bullish indicators, sustained growth depends on successfully onboarding traditional collectors who may be wary of blockchain-based custody.

• Speculative Volatility & Futures Impact: Following its late 2025 and early 2026 listings on BingX and other platforms, $COLLECT has transitioned from a niche utility asset to a high-velocity speculative instrument. Traders must account for 20x leverage risks and a volatility index near 20%, where liquidations in the perpetual futures markets can trigger sharp price corrections independent of the platform's fundamental performance.

• Regulatory & Compliance Complexity: As a pioneer in the RWA space, Fanable operates under increasing scrutiny from global frameworks like the EU’s MiCA and the

U.S. GENIUS Act. While its partnership with Brink’s and the use of Digital Ownership Certificates (DOCs) provide a compliant "clean start," future jurisdictional shifts regarding the classification of tokenized physical goods could impact global accessibility and redemption workflows.

Final Thoughts: Should You Buy COLLECT in 2026?

Collect on Fanable is transforming how we perceive "value" in the 21st century. By turning a Charizard card or a first-edition Spider-Man comic into a liquid digital asset, it captures the $450 billion nostalgia market for the blockchain era.

If you believe that the future of collecting is digital ownership with physical security, $COLLECT offers a unique way to gain exposure to that transition. However, like all small-cap RWA tokens, it should be treated as a strategic component of a diversified portfolio rather than a standalone investment.

Related Reading