Bitcoin and

gold are increasingly compared as alternative stores of value in a world shaped by record government debt, geopolitical conflict, and persistent monetary uncertainty. But in 2025, the two assets delivered very different outcomes for investors.

Gold emerged as one of the top-performing global assets, surging around 70% year-to-date and setting a new all-time high of $4,523 per ounce on December 24, 2025. The rally was fueled by aggressive central-bank buying, safe-haven demand, and expectations of lower interest rates. Over the past 12 months alone, gold added more than $1,800 per ounce, reinforcing its role as a capital-preservation asset during periods of macro stress.

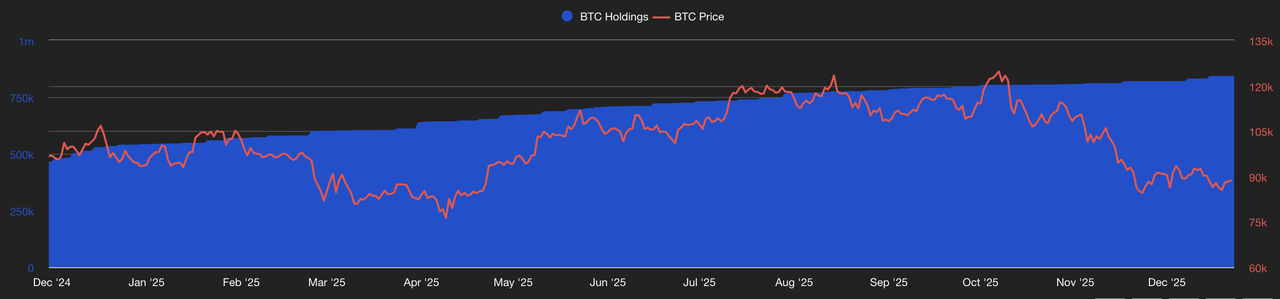

Bitcoin vs. Gold Price Chart YTD as of December 2025 | Source: TradingView

Bitcoin, in contrast, experienced a far more volatile year. After reaching a cycle peak and all-time high of $126,240 on October 6, 2025,

BTC retraced more than 30%, ending the year trading in the $85,000–$90,000 range. On a one-year basis, Bitcoin was down roughly 8–12%, underperforming gold, equities, and several commodity benchmarks, despite maintaining a $1.7 trillion market capitalization, the largest in crypto.

As you look toward 2026, the debate is no longer about whether Bitcoin will “replace” gold. Instead, the real question is how each asset behaves across different macro regimes, and what role Bitcoin and gold should play in a modern, diversified portfolio.

This guide reviews how Bitcoin and gold performed in 2025, explains the Bitcoin-to-gold ratio, highlights key macro and institutional drivers for 2026, and outlines practical ways to trade gold futures and Bitcoin on BingX as the market enters its next market cycle.

Why Bitcoin Is Considered Digital Gold: Key Similarities

Bitcoin is frequently described as digital gold, but this label can be misleading if taken at face value. The comparison comes from a shared economic role, not from identical behavior or risk profiles. To understand why investors make this comparison, and where it breaks down, it helps to look at scarcity, sovereignty, and portfolio function.

1. Scarcity: Limited Supply in a World of Expanding Money

Scarcity is the strongest link between Bitcoin and gold, as both assets have supply constraints that limit dilution over time. Gold’s global supply grows slowly at about 1.5–2% per year due to costly and increasingly marginal mining, while Bitcoin’s supply is hard-capped at 21 million coins, with annual issuance falling below 0.8% after the 2024 halving. In an era of expanding money supply driven by deficits, wars, and stimulus, this predictable scarcity is why institutions increasingly view Bitcoin as a digital counterpart to gold for long-term value preservation.

2. Non-Sovereign Assets: Outside Government Control

Both Bitcoin and gold are non-sovereign assets, meaning they exist outside direct government issuance and control. Gold cannot be printed or debased by policy decisions, while Bitcoin operates on a decentralized network with no central bank or state authority controlling its supply. When confidence in fiat currencies weakens due to inflation, rising debt, or sanctions, investors often turn to assets like gold, and increasingly Bitcoin, that do not depend on trust in a single issuer.

3. Portfolio Diversification: Alternative Assets With Distinct Cycles

Gold and Bitcoin are increasingly used to diversify portfolios away from traditional stocks and bonds, but they play different roles. According to data cited by the World Gold Council, gold has historically reduced portfolio volatility and delivered positive real returns during periods of crisis, inflation, and geopolitical stress, reinforcing its role as a defensive hedge. Bitcoin, meanwhile, has shown its strongest relative performance during liquidity expansions and risk-on cycles, a pattern highlighted by Fidelity Digital Assets, making it a complementary asset that adds asymmetric upside, while gold provides stability.

Bitcoin vs. Gold Key Differences: Where the “Digital Gold” Label Breaks Down

Despite shared traits, Bitcoin and gold behave very differently in practice.

| Factor |

Gold |

Bitcoin |

| History |

5,000+ years |

Around 15 years |

| Volatility |

Low–moderate |

Very high |

| Market role |

Defensive hedge |

Hybrid: risk asset + store of value |

| Regulation |

Widely accepted |

Still evolving |

| Liquidity behavior |

Stable |

Highly cyclical |

1. Volatility and Risk Profile

Gold is a relatively low-volatility asset, with annualized volatility typically around 10–15%, according to long-term data from the World Gold Council. Bitcoin, by contrast, has historically shown 50–80% annualized volatility, even though this has trended lower as institutional participation has grown.

What this means for beginners: Gold is primarily used to preserve capital, while Bitcoin is prone to rapid repricing, offering higher upside, but also deeper drawdowns.

2. Market Maturity and Track Record

Gold has served as a monetary and reserve asset for thousands of years and remains widely held by central banks, which collectively own over 35,000 tonnes of gold globally. Bitcoin, with just over 15 years of history, is still in the process of integrating into mainstream finance through ETFs, custodial platforms, and corporate treasuries. This gap in maturity explains why gold tends to attract conservative, institutional capital, while Bitcoin appeals more to growth-oriented and risk-tolerant investors.

3. Behavior Across Market Cycles

Gold vs. Bitcoin market performance in Q4 2025 | Source: TradingView

Gold typically performs best during risk-off environments, such as recessions, geopolitical crises, or periods of

falling real interest rates. Bitcoin often underperforms during market stress but has historically delivered outsized gains during recoveries and liquidity expansions, a pattern highlighted by multiple market studies from firms like Fidelity Digital Assets. In 2025, this divergence was clear: gold rose nearly 70% year-to-date, while Bitcoin fell more than 30% from its October peak, reflecting tighter liquidity and elevated risk aversion.

Gold vs. Bitcoin: A Clear Recap of 2025 Performance

The performance gap between gold and Bitcoin in 2025 clearly illustrates how differently the two assets respond to changing macro conditions. As global markets grappled with geopolitical tension, slowing growth, and tighter liquidity, gold emerged as a top defensive asset, posting one of its strongest annual gains in decades, while Bitcoin struggled to sustain momentum after an early-cycle peak. This divergence provides critical context for investors assessing risk, timing, and portfolio positioning as they head into 2026, especially when deciding whether to prioritize capital preservation or asymmetric growth potential.

Gold Gains Around 65% in 2025, a Historic Safe-Haven Rally

Gold delivered one of its strongest performances in decades in 2025, firmly establishing itself as a top defensive asset. Prices surged by approximately 65% year-to-date, climbing from below $2,700 at the start of the year to a new all-time high of around $4,523 per ounce in late December. Throughout the year, gold set more than 50 record highs, reflecting sustained and broad-based demand across institutional, sovereign, and retail investors.

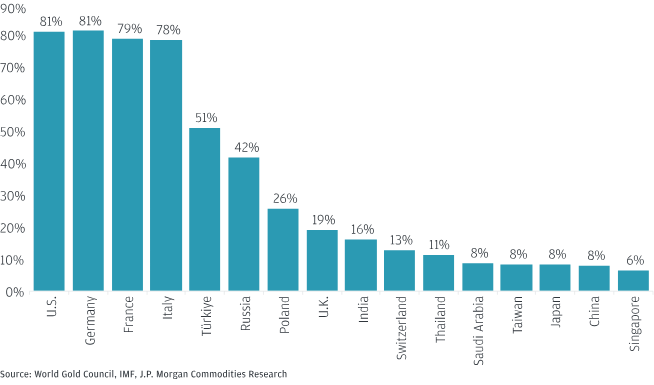

Gold as a percentage of total reserve holdings across leading central banks | Source: JP Morgan

Several powerful macro forces drove this rally. Persistent geopolitical conflicts, slowing global economic growth, and growing expectations of interest-rate cuts increased demand for safe-haven assets. At the same time, central banks, particularly in emerging markets like China, India, and Turkey, continued to accumulate gold as part of long-term reserve diversification strategies, while investors sought protection against inflation, currency debasement, and market volatility. Looking ahead, Goldman Sachs Research expects gold prices to rise another 6% by mid-2026, with upside scenarios above $5,000 per ounce if macroeconomic and geopolitical stress intensifies.

Bitcoin Loses Over 6% of Its Value in 2025, Volatile and Disappointing vs. Gold

Bitcoin delivered a far more turbulent, and ultimately underwhelming, performance in 2025 compared with gold. After rallying to a new all-time high of around $126,240 in October 2025, BTC failed to sustain momentum and declined by roughly 30% into year-end, trading mostly in the $85,000–$90,000 range. On a one-year basis, Bitcoin finished down about 6% YTD, a stark contrast to gold’s near-70% surge, despite Bitcoin maintaining a market capitalization of roughly $1.7 trillion, the largest in the crypto sector.

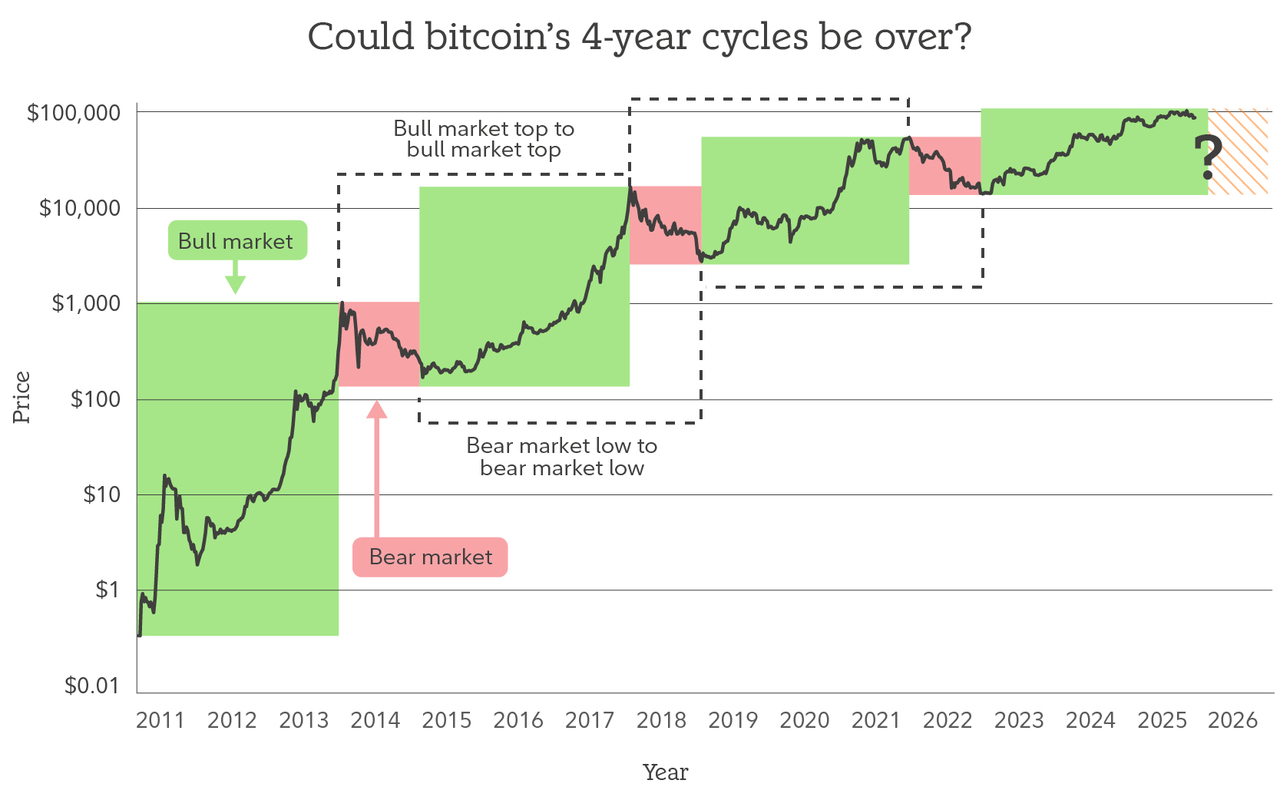

Bitcoin's four-year cycle may no longer be relevant | Source: Fidelity

Several macro and market factors weighed on Bitcoin throughout the year. Global liquidity tightened in late 2025, risk assets broadly consolidated, and spot Bitcoin ETF inflows slowed, reducing a key source of structural demand. As a result, Bitcoin increasingly traded in line with macro risk sentiment, behaving more like a high-beta asset than a defensive hedge. As Alex Thorn, head of research at Galaxy Digital, put it: “Bitcoin is maturing into a macro asset. That means less explosive upside, but also fewer catastrophic crashes.”

What Is the Bitcoin-to-Gold Ratio and Why Investors Track It?

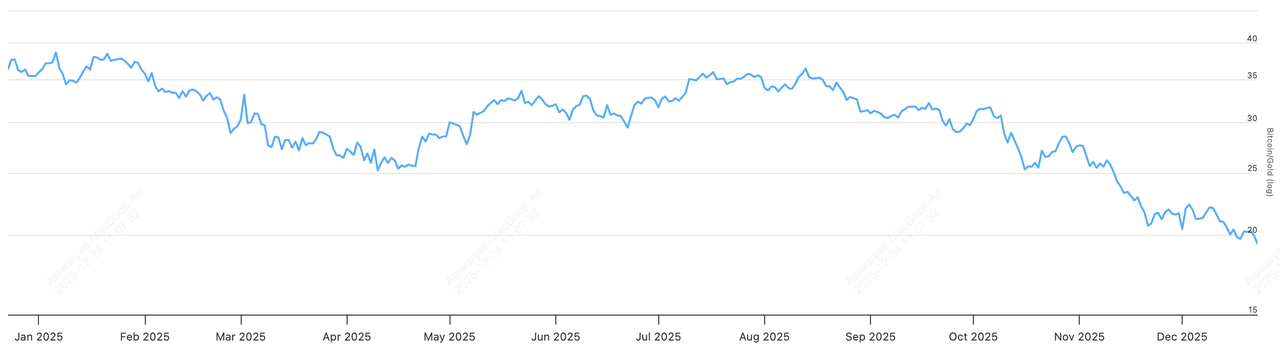

Bitcoin-to-Gold ratio falls from 37 to under 20 in 2025 | Source: LongTermTrends

The Bitcoin-to-Gold ratio measures how many ounces of gold one Bitcoin can buy and is calculated by dividing Bitcoin’s price by gold’s spot price per ounce. As of December 24, 2025, with Bitcoin above $87,000 and gold around $4,517/oz, the ratio sits at 19.36, meaning 1 BTC buys about 19 ounces of gold. This simple metric helps beginners compare the relative strength of the two assets: a rising ratio signals Bitcoin outperforming gold in a risk-on scenario, while a falling ratio indicates gold gaining ground during a risk-off market mood.

The Bitcoin-to-gold ratio has become a key signal as markets head into 2026. Mike McGlone, senior commodity strategist at Bloomberg Intelligence, warns the market may be entering a “Great Reversion.” With gold up about 65% in 2025 and Bitcoin lagging equities, McGlone argues the ratio, already down from 40 oz at the 2024 peak to under 20 oz, could fall into the mid-teens if equity volatility resurfaces. In that scenario, Bitcoin could lose another 30–50% relative to gold, implying $60,000–$65,000 BTC at current gold prices, especially if risk assets reprice and volatility rebounds. The assets’ low 12-month correlation of 0.14 underscores that this divergence wasn’t synchronized selling; it was a rotation toward defensive exposure.

Source: Mike McGlone on X

On the other side, JPMorgan sees a bullish countercase if the “debasement trade” persists. Its analysts estimate Bitcoin could rise roughly 40% on a volatility-adjusted basis toward $165,000, which would push the BTC/gold ratio back toward 40 oz, levels last seen during risk-on phases. JPMorgan’s thesis hinges on renewed liquidity, easing financial conditions, and continued demand for scarce assets.

How to Use the Bitcoin-to-Gold Ratio

Investors should treat the Bitcoin-to-gold ratio as a rebalancing compass, not a timing tool. When the BTC/gold ratio surges, consider trimming Bitcoin or adding gold to lock in relative gains. When the ratio compresses sharply, as it did in 2025, it may favor gradual BTC re-accumulation for long-term investors who can tolerate volatility.

What’s Driving the Value of Gold and Bitcoin in 2026?

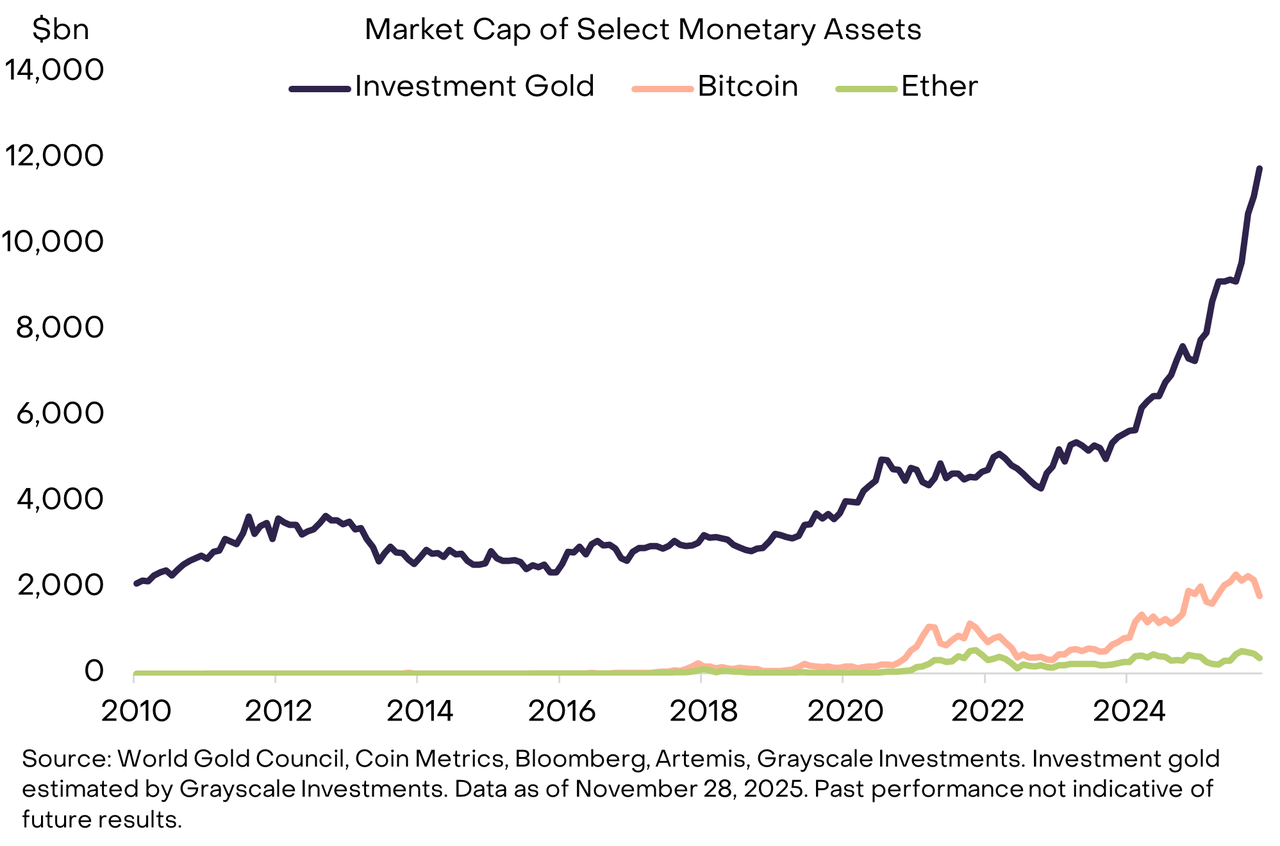

Bitcoin and gold see rising demand as store of value | Source: Grayscale

As 2026 approaches, both gold and Bitcoin are being shaped less by hype and more by macro fundamentals. With gold trading near $4,500/oz after a nearly 70% gain in 2025 and Bitcoin consolidating around $85,000–$90,000, investors are watching how interest rates, liquidity conditions, fiscal deficits, geopolitical risk, and institutional flows evolve. While gold continues to respond primarily to real yields, central-bank demand, and risk aversion, Bitcoin’s outlook hinges on liquidity cycles, ETF flows, regulatory clarity, and its growing role as a macro-sensitive asset, setting up two distinct but interconnected value drivers for 2026.

Could Gold Head Higher and Cross $5,000 in 2026?

Gold historically performs best in defensive macro environments, and many of the forces that drove its outsized gains in 2025 remain relevant as markets move into 2026.

Bullish Factors Supporting Gold Rally in 2026

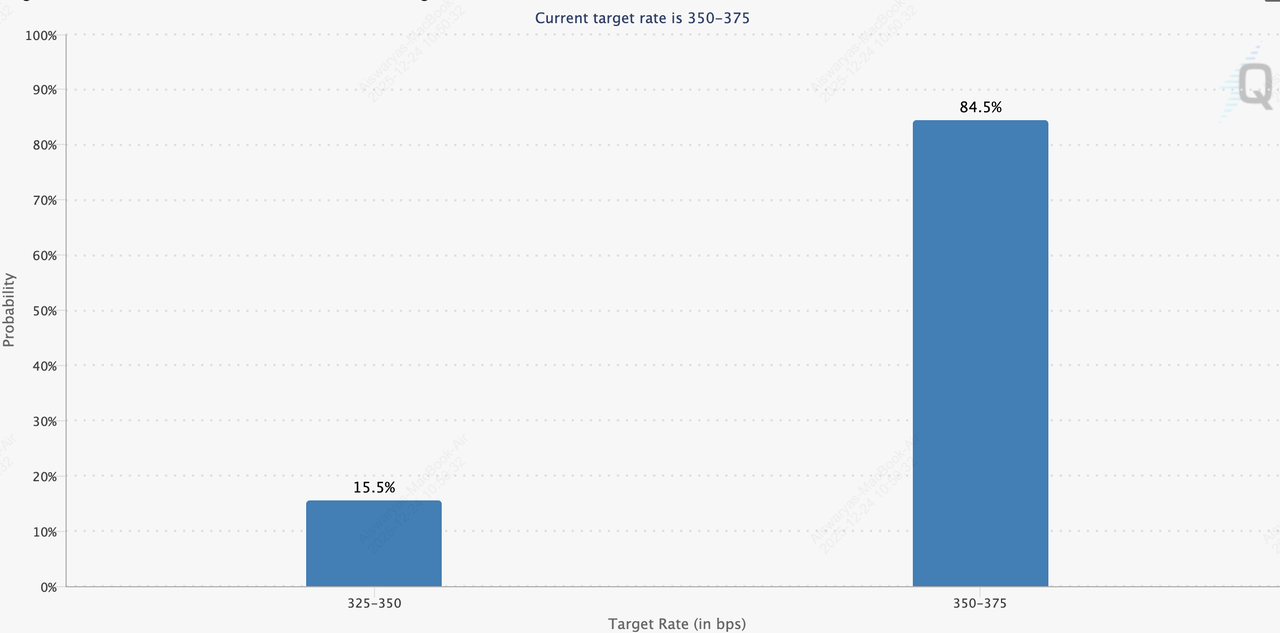

Fed rate cut expectations in January 2026 | Source: CME FedWatch

1. Rate cuts and falling real yields: Gold typically benefits when real yields decline, because the opportunity cost of holding a non-yielding asset falls. While markets currently expect the Federal Reserve to hold rates steady at the January 2026 meeting, prediction markets on

Polymarket still assign a meaningful probability of around 15% to rate cuts by early 2026, with easing odds increasing later in the year as growth slows. This outlook underpins Goldman Sachs’ forecast that gold prices could rise about 6% by mid-2026, with upside above $5,000/oz if the Fed pivots toward cuts and macro or financial stress intensifies, conditions that historically compress real yields and favor gold.

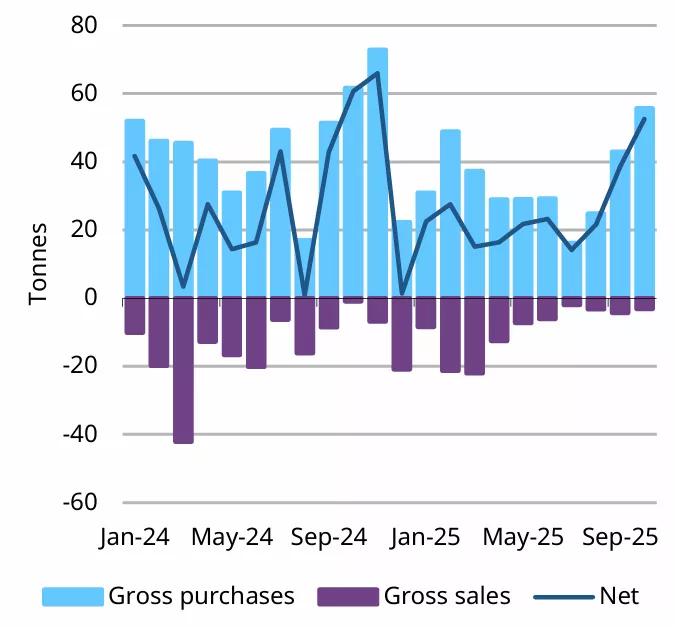

Central bank gold purchases | Source: World Gold Council

2. Central-bank diversification away from the U.S. dollar: Central banks have been buying gold at a record pace of roughly 60–80 tonnes per month in 2025, driven largely by emerging-market reserve managers seeking to reduce dollar exposure and sanctions risk. According to the World Gold Council, over 95% of surveyed central banks expect global gold reserves to rise in the next 12 months, with likely buyers in 2026 including the People’s Bank of China, Reserve Bank of India, Central Bank of Turkey, and several Middle Eastern and ASEAN central banks. This ongoing shift reflects a structural move toward neutral reserve assets amid geopolitical fragmentation, and remains a key pillar supporting gold demand into 2026.

3. Geopolitical instability: Ongoing conflicts, trade fragmentation, and sanctions risk continue to boost demand for gold as a neutral reserve asset. These dynamics were a major driver behind gold’s 70% rally and 50+ all-time highs in 2025.

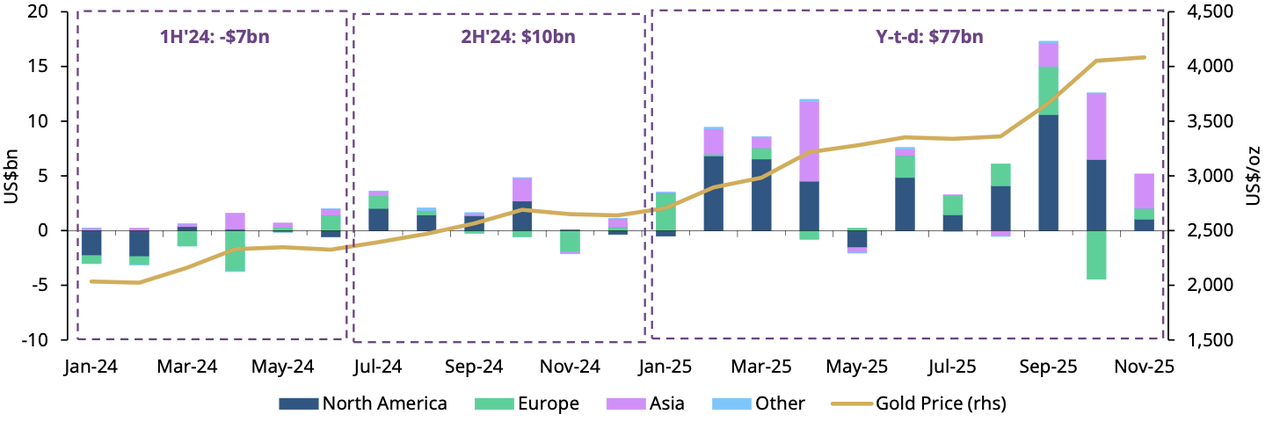

Gold ETF inflows in November 2025 | Source: World Gold Council

4. Gold ETFs and institutional demand: Gold-backed ETFs continued to attract strong capital in late 2025, signaling durable institutional demand. According to the World Gold Council, global gold ETFs recorded their sixth consecutive monthly inflow in November, adding $5.2 billion and pushing total AUM (assets under management) to a record $530 billion, with holdings at an all-time high of 3,932 tonnes. Asia led inflows of $3.2 billion, driven by China and India, while Europe turned positive at $1.0 billion inflows and North America added around $1.0 billion in gold ETF inflows. These sustained ETF inflows provide a structural price floor for gold during equity drawdowns and support resilience into 2026.

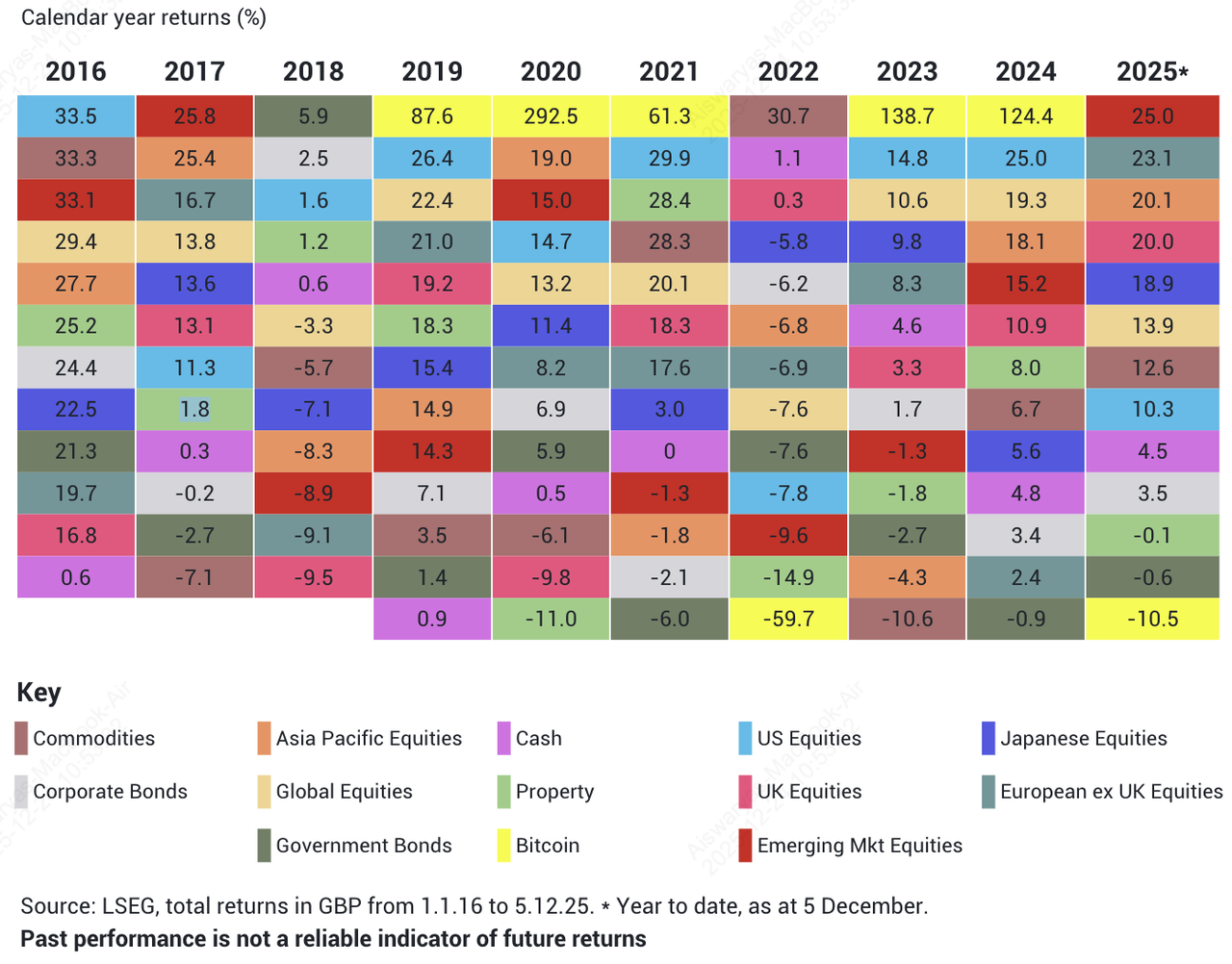

Performance of global equity markets in 2025 | Source: Fidelity

5. Equity market volatility: Gold’s defensive role was reinforced in 2025, even as equity markets delivered double-digit gains across most regions. According to analysis by Fidelity International, gold recorded 50 all-time highs and outperformed global equities, despite stocks rising, a rare outcome the Bank for International Settlements described as the first time in 50 years that both assets entered “explosive territory” simultaneously. This unusual coexistence highlights why gold remains a critical portfolio hedge: when equity valuations appear stretched or policy shocks, such as tariffs or geopolitical risks, resurface, capital continues to rotate toward gold for downside protection and diversification, a view reaffirmed by the World Gold Council in its 2026 outlook.

Bearish Risks to Monitor When Trading Gold in 2026

1. Stronger-than-expected economic growth, which could revive risk appetite and reduce demand for safe havens.

2. Rising real interest rates, which historically pressure gold prices by increasing carry costs.

3. A sustained rebound in the U.S. dollar, as gold is dollar-denominated.

4. Easing geopolitical tensions, which would weaken gold’s insurance premium.

Base case: most institutional outlooks suggest gold remains resilient and range-bound in 2026, supported by central-bank demand and macro uncertainty, with asymmetric upside if growth slows, volatility rises, or financial conditions deteriorate.

Can Bitcoin Test $150,000 in 2026?

Bitcoin’s outlook in 2026 is highly path-dependent, meaning its performance will hinge on liquidity conditions, institutional behavior, and broader risk sentiment rather than a single narrative.

Bullish Factors Supporting a Bitcoin Rally in 2026

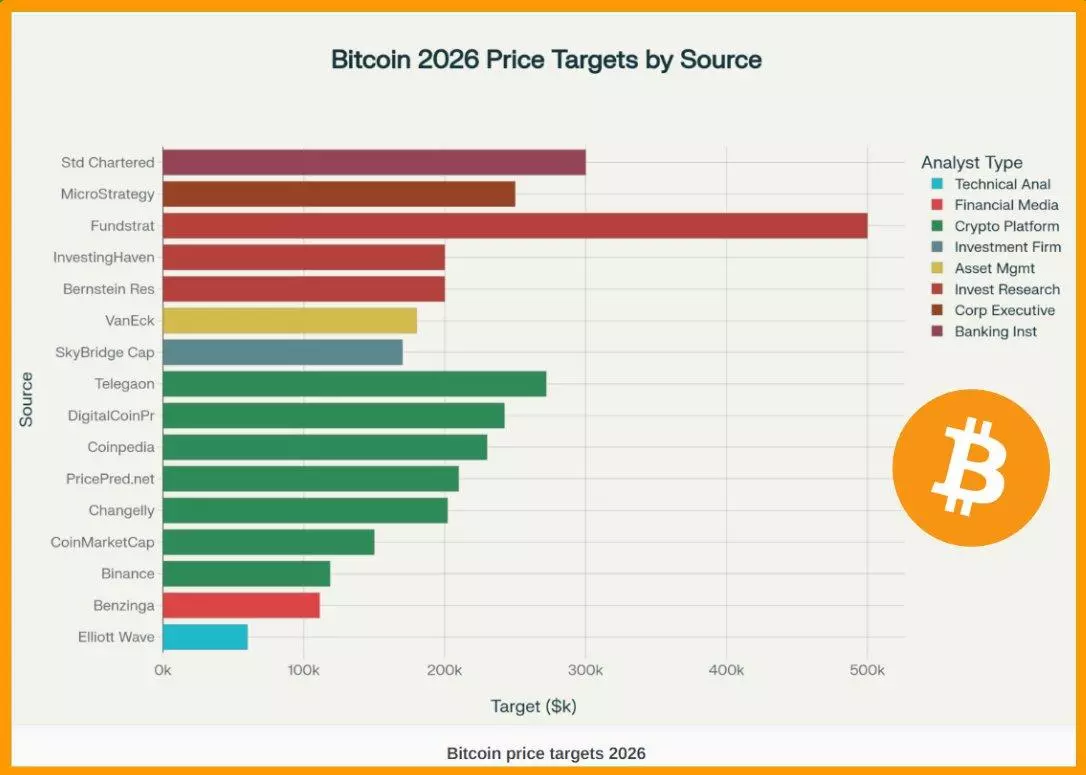

Bitcoin price targets in 2026 | Source: IG

1. Liquidity expansion: Historically, Bitcoin performs best when global liquidity improves and real rates fall. As major central banks move closer to rate cuts, the opportunity cost of holding non-yielding assets like BTC declines, a setup that has fueled past post-halving rallies.

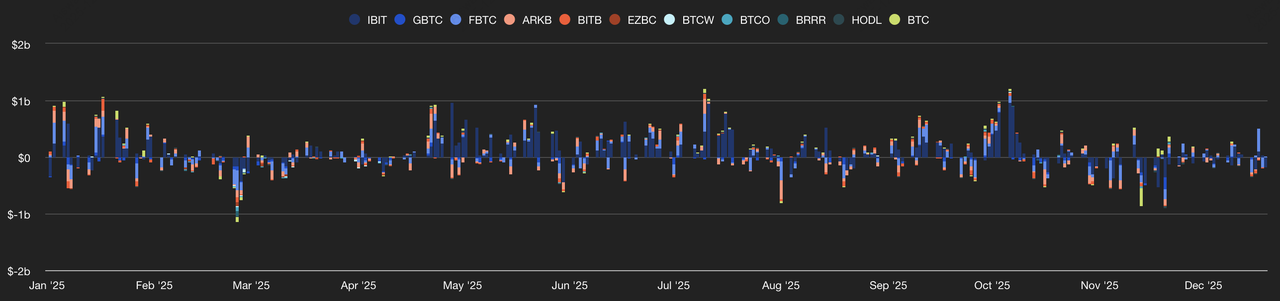

Bitcoin ETF flows in 2025 | Source: TheBlock

2. Bitcoin ETF inflows resuming: More than $50 billion flowed into

spot Bitcoin ETFs during 2024–2025, creating a structural demand base. If inflows resume after late-2025 consolidation, they could again act as a persistent bid for BTC.

3. Institutional allocation into model portfolios: Bitcoin is increasingly being treated as a macro asset, supporting its inclusion in diversified institutional portfolios rather than short-term trades. Research from Galaxy Digital shows structurally declining long-term BTC volatility, with options markets now pricing puts more expensively than calls, a pattern typical of mature macro assets. Alex Thorn notes this reflects rising institutional access and yield strategies, positioning Bitcoin as a potential non-dollar hedge alongside gold, even as near-term outcomes remain wide, options imply roughly $70k–$130k by mid-2026 and up to $250,000 by 2027.

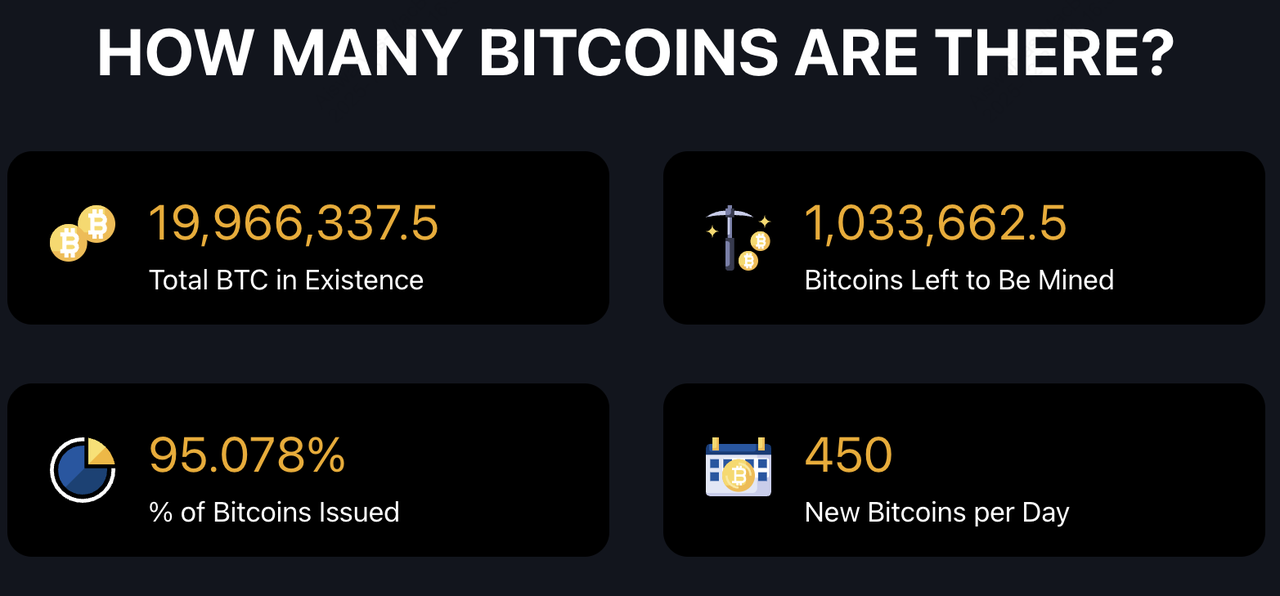

Bitcoin supply issuance: How many Bitcoins are there | Source: Bitbo

4. Post-halving supply constraint: Following the

April 2024 halving, Bitcoin issuance dropped to roughly 450 BTC per day, pushing annual supply growth below 0.8%, far lower than most fiat currencies and even gold.

Corporate Bitcoin treasuries vs. BTC price | Source: TheBlock

5. BTC corporate treasury adoption: Over 1 million BTC is now held by publicly listed companies as of December 2025, a trend that has reduced liquid supply and increased long-term holding behavior.

Bearish Risks That Could Hold Back Bitcoin From Rallying in 2026

1. ETF outflows or stalled inflows, which could remove a key support pillar.

2. Risk-off macro shocks, including recession fears or sharp equity drawdowns, where Bitcoin has historically underperformed in the short term.

3. Regulatory setbacks, especially around custody, taxation, or derivatives access.

4. Equity market downturns, as Bitcoin has increasingly traded in correlation with high-beta risk assets.

5. Extended consolidation below all-time highs, which could dampen speculative demand and momentum.

Summing up the asymmetric setup, David Schassler, head of multi-asset solutions at VanEck, noted: “Bitcoin’s underperformance in 2025 sets it up as a potential top performer in 2026, if liquidity returns.”

What Are the Pros and Cons of Investing in Gold vs. Bitcoin?

Gold and Bitcoin serve different financial purposes, and understanding their strengths and weaknesses helps set realistic expectations. Gold is designed to protect purchasing power, while Bitcoin is built to capture upside from structural change, making each asset suitable for different risk profiles and market conditions.

Pros and Cons of Investing in Gold (XAU)

Pros

1. Capital preservation: Gold has maintained purchasing power for centuries and delivered around 70% gains in 2025 during a risk-off environment.

2. Low volatility: Annualized volatility typically sits around 10–15%, making it one of the most stable alternative assets.

3. Crisis hedge: Gold historically outperforms during recessions, geopolitical shocks, and periods of falling real yields.

4. Universal acceptance: Held by central banks and institutions globally, gold remains a trusted reserve asset with deep liquidity.

Cons

1. Limited upside: Gold rarely delivers exponential returns; long-term gains are typically incremental rather than explosive.

2. No yield: Gold does not generate income unless paired with lending or derivatives strategies.

3. Underperforms in strong growth cycles: During equity booms or high real-rate environments, capital often rotates away from gold.

Pros and Cons of Investing in Bitcoin (BTC)

Pros

1. Asymmetric upside: Despite drawdowns, Bitcoin rose from under $1,000 in 2017 to a $126,000 peak in 2025, showcasing its long-term growth potential.

2. Programmatic scarcity: Supply is capped at 21 million, with annual issuance now below 0.8% post-halving.

3. Rising institutional adoption: Spot ETFs, corporate treasuries, and regulated custodians have strengthened Bitcoin’s market structure.

4. Compelling long-term thesis: Bitcoin benefits from trends in digital finance, monetary debasement hedging, and alternative asset allocation.

Cons

1. High volatility: Bitcoin’s annualized volatility has historically ranged from 50–80%, far exceeding gold’s risk profile.

2. Deep drawdowns: Corrections of 30–70% are common, even within long-term uptrends.

3. Sentiment-driven cycles: Bitcoin often reacts sharply to liquidity shifts, ETF flows, and macro headlines.

4. Requires active risk management: Position sizing, diversification, and time horizon discipline are critical for long-term success.

Key takeaway: Gold stabilizes portfolios, while Bitcoin stretches outcomes. Pairing them thoughtfully can balance resilience with growth potential heading into 2026.

Bitcoin vs. Gold: What Role Should Each Play in a Portfolio?

Bitcoin and gold play distinct, measurable roles in a modern portfolio, and the right mix depends on your risk tolerance, time horizon, and return objectives. Data from multi-asset portfolios consistently shows that combining low-correlation assets, like gold and Bitcoin, which had a 12-month correlation near 0.14 in 2025, can improve risk-adjusted returns.

Invest in Gold for Stability and Capital Protection with 10-15% Volatility

Gold functions as a portfolio stabilizer due to its relatively low annualized volatility of 10–15%, significantly below that of equities and crypto assets. In 2025, it proved its defensive value by rising roughly 70% during a risk-off environment, outperforming most major asset classes as investors prioritized capital preservation. As a result, gold is typically allocated 5–15% in diversified portfolios, often higher during periods of macro uncertainty, and is best suited for investors focused on reducing drawdowns and protecting wealth during recessions or geopolitical stress.

Invest in Bitcoin for Growth and Asymmetric Upside with Double-Digit Moves

Bitcoin serves as a high-impact growth asset, having reached an all-time high near $126,000 in 2025 despite ending the year in consolidation. While its volatility and drawdowns can be significant, Bitcoin has historically delivered asymmetric upside during liquidity expansions, outperforming most asset classes in bull phases. Typical allocations range from 1–5% in conservative portfolios to 5–15% or more for growth-oriented investors, making Bitcoin most suitable for those with a long-term horizon and tolerance for volatility.

How to Invest in Gold (XAU) and Bitcoin (BTC) on BingX

BingX makes it easy to gain exposure to both Bitcoin and gold from a single platform, combining spot markets, tokenized assets, futures trading, and BingX AI-powered tools to help you analyze trends,

manage risk, and execute strategies efficiently. Whether your goal is long-term holding, hedging, or short-term trading, BingX allows you to access digital and traditional stores of value side by side, with real-time data, deep liquidity, and flexible trading options.

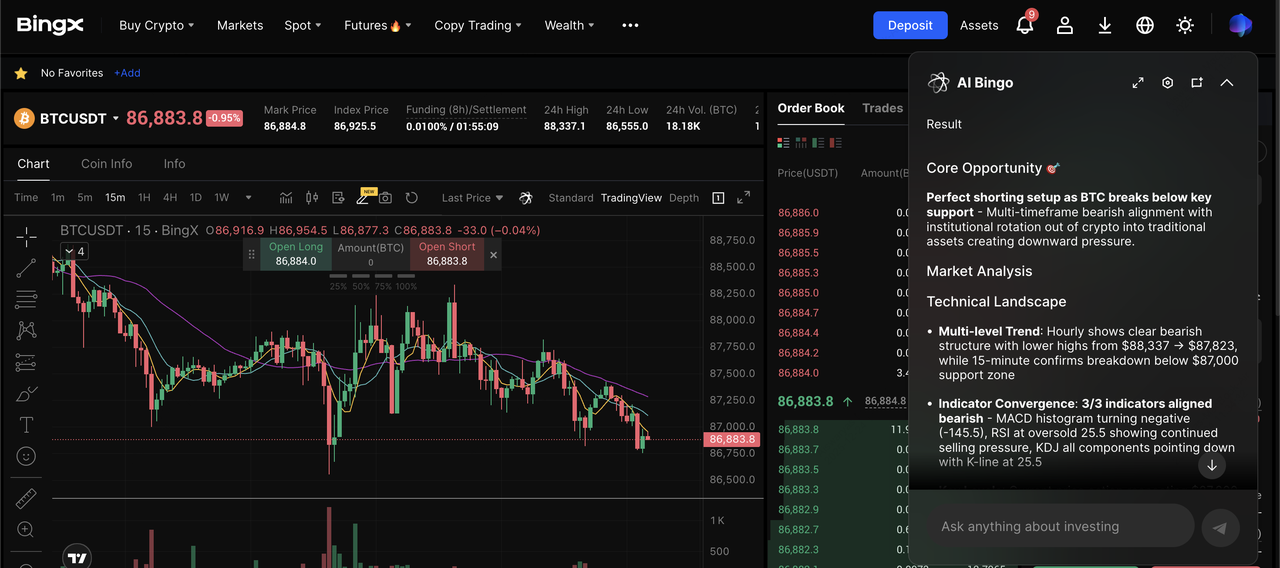

How to Trade Bitcoin (BTC) on BingX

BingX lets you buy, hold, and actively trade Bitcoin through both spot markets and BTC/USDT perpetual futures, giving you flexible exposure to long-term growth or short-term price movements with

BingX AI–powered risk and market insights.

Buy and Sell BTC on the Spot Market

BTC/USDT trading pair on the spot market powered by BingX AI insights

2. Choose a

market order for instant execution or a limit order to set your preferred price.

3. Hold BTC for long-term exposure or trade price swings without leverage.

Long or Short BTC Perpetuals on the Futures Market

BTC/USDT perpetual contract on the futures market powered by BingX AI

2. Choose Long if you expect prices to rise or Short if you expect a decline.

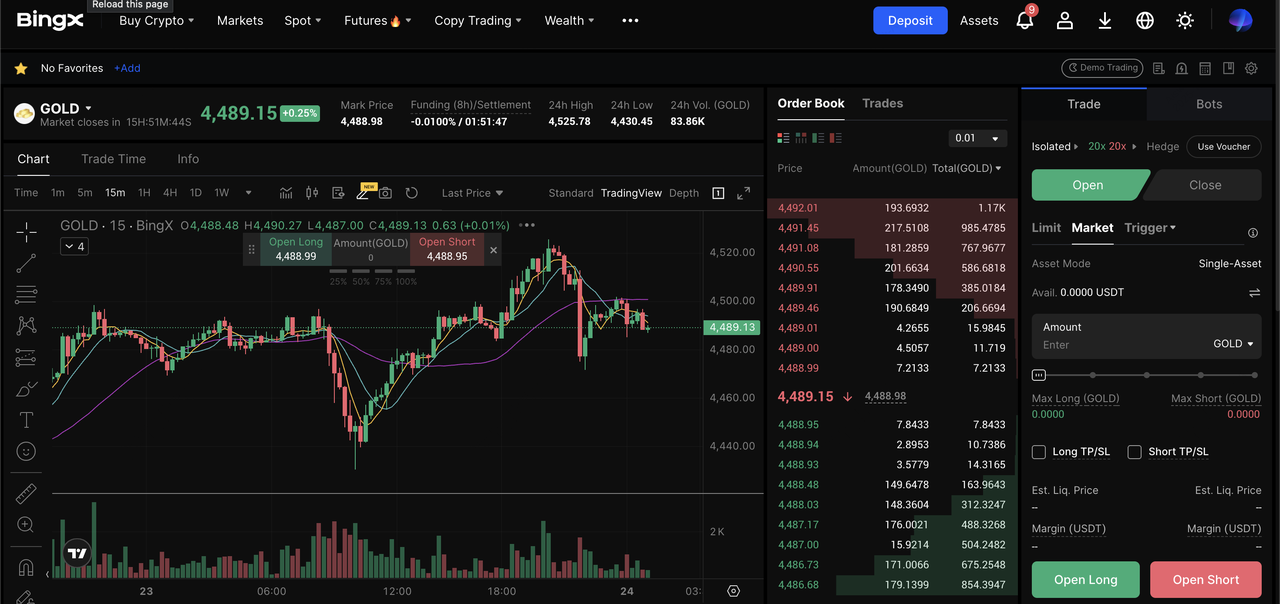

How to Invest in Gold on BingX

BingX provides multiple ways to invest in gold digitally, allowing you to gain direct price exposure or actively trade macro-driven moves without the costs and complexity of holding physical bullion.

Spot Trade Tokenized Gold

XAUT/USDT on the spot market powered by BingX AI

2. Place a market order for immediate execution or a limit order to buy at your desired price.

3. Hold tokenized gold for long-term exposure to gold prices or rotate easily between gold and crypto without physical custody.

Trade XAUT-USDT Perpetuals and Gold Futures

Gold perpetual futures on the BingX futures market

2. Choose Long to benefit from rising gold prices or Short to profit from declines.

3. Use controlled leverage, and set take-profit (TP) and stop-loss (SL) levels to hedge portfolios or trade macro trends such as rate cuts, geopolitical risk, or equity market volatility.

Advanced investors often combine gold and Bitcoin to express macro views rather than betting on a single asset. A long gold + long BTC strategy targets inflation and currency debasement, benefiting if hard assets rise together. A long gold + short BTC setup acts as a risk-off hedge, aiming to protect capital when volatility spikes and risk assets underperform. More tactically, investors can rotate exposure using the Bitcoin-to-gold ratio, increasing Bitcoin when the ratio is compressed and shifting toward gold when Bitcoin becomes relatively expensive.

Why Invest in Both Bitcoin and Gold Through BingX

• Unified portfolio management: Hold and trade Bitcoin and gold in one account, making diversification and rebalancing simpler.

• Flexible strategies: Combine spot investing for long-term exposure with futures trading for hedging or tactical positioning.

• BingX AI-powered insights: Use AI-driven market analysis, sentiment indicators, and risk tools to make more informed decisions.

• Efficient rotation: Seamlessly rotate between BTC, tokenized gold, and futures as macro conditions shift, without leaving the platform.

Conclusion: Should You Buy Bitcoin or Gold in 2026?

There is no single winner heading into 2026, because gold and Bitcoin are designed to solve different investment problems. Gold remains the clearer choice for investors prioritizing stability and capital protection, with historical volatility around 10–15% and strong performance during risk-off periods, evidenced by its almost 70% gain in 2025 amid geopolitical stress and slowing growth. Bitcoin, meanwhile, offers long-term growth and asymmetric upside, but comes with significantly higher volatility; despite reaching an all-time high near $126,000, it also experienced an almost 30% drawdown, reinforcing its role as a higher-risk asset.

For most investors, the data supports a diversified approach rather than an either-or decision. Combining gold’s defensive characteristics with Bitcoin’s upside optionality can improve portfolio resilience, especially given their low correlation of 0.14 in 2025. That said, both assets carry risks; gold can underperform in strong growth and rising-rate environments, while Bitcoin remains sensitive to liquidity shocks, regulation, and sentiment shifts. Before allocating, consider your time horizon, risk tolerance, and rebalancing discipline, and avoid overexposure to either asset based on short-term performance alone.

Related Reading

FAQs on Bitcoin (BTC) vs. Gold (XAU)

1. Is Bitcoin better than gold as a hedge against inflation?

It can be, but with caveats. Bitcoin’s fixed supply makes it theoretically inflation-proof, but its high volatility may cause short-term losses. Gold has centuries of history of holding value during high inflation periods.

2. Is Bitcoin the new gold?

Bitcoin is often called “digital gold” because of its scarcity and role as a store of value. However, unlike gold’s centuries-long history, Bitcoin is still young and more volatile, so it complements rather than replaces gold.

3. Is Bitcoin backed by gold?

No. Bitcoin is not backed by gold or any physical asset. Its value comes from scarcity (21 million max supply), decentralized blockchain security, and market demand.

4. Will Bitcoin replace gold?

Unlikely in the near term. Gold remains the dominant safe-haven asset due to its scale and stability. Bitcoin could capture a share of gold’s role over time, but most investors use both in combination.

5. Could gold’s rally reverse if interest rates rise sharply?

Yes. Rising real yields raise the opportunity cost of holding an asset like gold with no yield. If the Fed or other central banks tighten faster than expected, gold could correct.

6. Should I buy gold or Bitcoin in 2025?

It depends on your goals and risk tolerance. Gold is better for stability and capital preservation, while Bitcoin is suited for higher-risk, higher-reward strategies. Many investors hold both for balance.

7. Can you convert Bitcoin into gold?

Yes. On exchanges like BingX, you can trade Bitcoin for tokenized gold (XAUT/USDT). This gives you exposure to gold without leaving the crypto ecosystem.

8. Are Bitcoin and gold correlated?

They are loosely correlated at times, especially during inflationary or liquidity-driven cycles, but often behave differently. Gold tends to rise during uncertainty, while Bitcoin is more sensitive to liquidity and risk sentiment.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Always assess your risk tolerance and do your own research before investing.