Hex Trust and

LayerZero have launched wrapped XRP (wXRP) on

Solana on December 12, 2025, issuing a 1:1 backed, fully redeemable version of

XRP held in regulated custody. The launch went live with over $100 million in initial liquidity, making it one of 2025’s largest wrapped-asset deployments. Support for

Ethereum,

Optimism, and other chains is planned next.

This move plugs XRP directly into Solana’s fast-growing DeFi markets. Solana’s TVL surged from $1.1 billion in early 2023 to more than $5.7 billion by late 2025, while XRP Ledger tokenized assets reached $394.6 million and stablecoin liquidity exceeded $1.2 billion. wXRP now connects XRP to a network that consistently processes 30M+ daily transactions, offering sub-second settlement and deep liquidity. With cross-chain activity up 280% in the past two years, wXRP positions XRP for multi-chain adoption, improved liquidity routing, and broader institutional use.

In this article, you will learn how wXRP brings XRP onto Solana through institutional custody and LayerZero interoperability, unlocking new cross-chain trading, liquidity, and DeFi opportunities.

What Does It Mean for XRP to Enter the Solana Ecosystem?

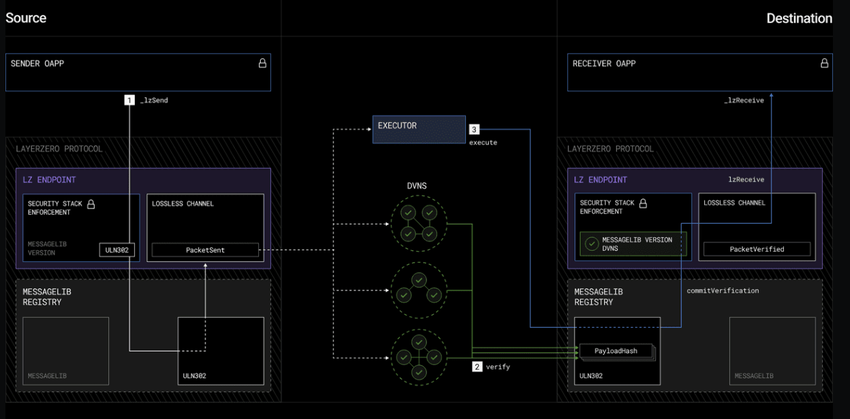

How LayerZero works | Source: LayerZero docs

XRP’s arrival on Solana expands the asset far beyond the XRP Ledger, enabling participation in an ecosystem that generated $1.2 trillion in cumulative DeFi volume in 2025. At Solana Breakpoint 2025, Ripple highlighted cross-chain liquidity, regulated on/off-ramps, and omnichain settlement as core to its 2025–2026 strategy.

Hex Trust provides institutional custody for the underlying XRP, while LayerZero connects wXRP across 70+ chains via secure cross-chain messaging. This combination creates a compliant, scalable path for XRP to move into lending, DEX trading, perpetual markets, and institutional DeFi programs.

What Is Wrapped XRP (wXRP)?

wXRP is a Solana-compatible, custody-backed representation of XRP created in December 2025. Each wXRP is redeemable for native XRP held by Hex Trust. Wrapped assets have become a core component of multi-chain liquidity, with wrapped Bitcoin exceeding $10 billion circulating supply in 2024.

wXRP launches into a DeFi market that processed over $40 billion in monthly DEX volume in Q4 2025 and serves a Solana user base of more than 15 million active wallets. With the wrapped-asset sector growing 230% between 2023 and 2025, wXRP enters a high-demand market.

How wXRP Works on Solana

wXRP uses Hex Trust’s institutional custody and LayerZero’s Omnichain Fungible Token (OFT) standard. The OFT model avoids traditional bridge risks, bridges accounted for over 50% of major cross-chain exploits historically, by maintaining a unified supply view across chains.

Solana’s throughput frequently exceeds 50,000 TPS, enabling low-latency trading and real-time liquidity operations. LayerZero processed over 85 million cross-chain messages in 2025, proving the scalability needed for wXRP’s expansion.

Launch and Liquidity Details

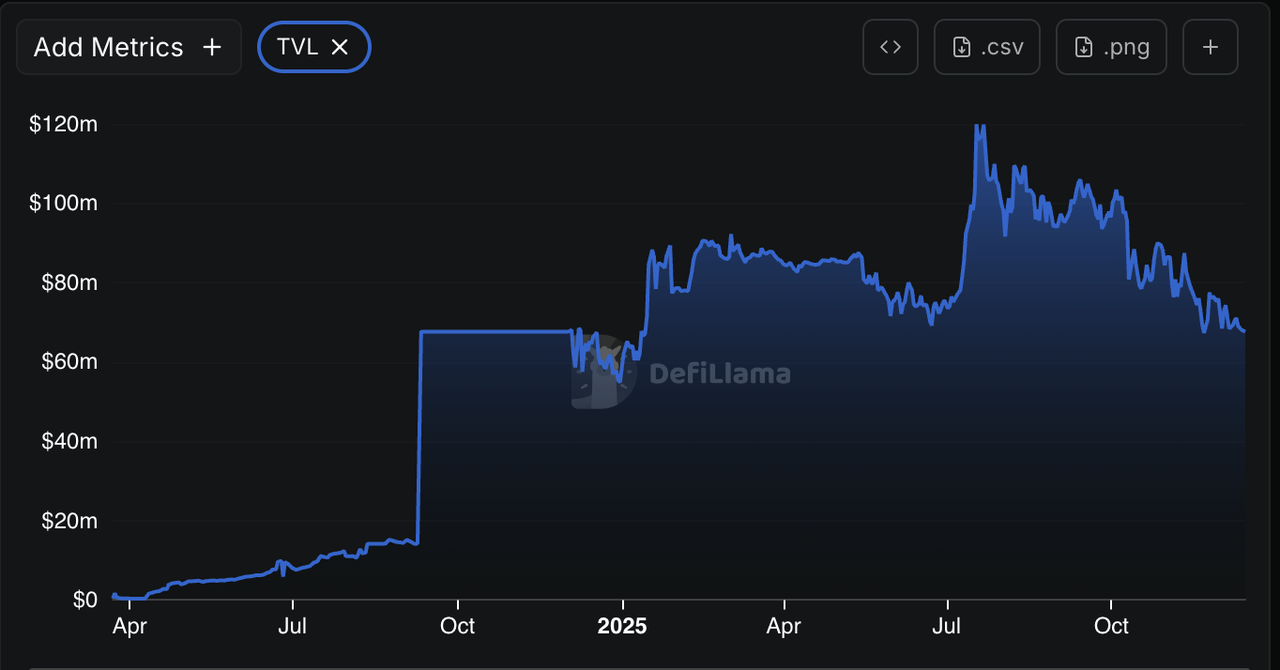

The December 2025 launch introduced $100 million in initial liquidity, supported by leading

Solana DEXs, lending protocols, and liquidity platforms. This went live during a month when Solana added $1.3 billion in new TVL, accelerating the adoption curve.

More than 20 protocols integrated wXRP within the first week, aided by the simultaneous rise in Solana’s stablecoin liquidity, up 60% during the launch window.

Why Did Hex Trust and LayerZero Choose Solana wXRP?

Solana’s DeFi ecosystem expanded 320% YoY by late 2025, supported by fees below $0.001, high-frequency trading infrastructure, and 2,500+ monthly active developers. Solana processes over 30 million daily transactions, making it one of the world’s highest-throughput decentralized networks.

DEX volume increased more than 400% over two years, and the ecosystem now hosts 500+ DeFi protocols, giving wXRP strong integration potential and immediate liquidity pathways.

What Can Users Do With wXRP on Solana?

Users can:

• Trade wXRP across Solana DEXes processing over $40 billion monthly volume

• Supply wXRP to lending markets, joining a credit ecosystem with $1.4 billion in borrowed value

• Provide liquidity in AMMs and earn yield from fee revenue. Solana LPs earned over $500 million in 2025.

• Use wXRP for arbitrage, multi-market routing, leveraged strategies, and DeFi yield vaults

As integrations grow, wXRP will enter structured products, automated rebalancers, and institutional liquidity networks.

How Does wXRP Enable Cross‑Chain Expansion?

Because wXRP follows the OFT standard, it can move across any LayerZero-enabled chain. LayerZero connected 70+ blockchains by late 2025, unlocking access to DeFi markets with over $90 billion TVL across Ethereum,

Avalanche,

BNB Chain, and more.

Cross-chain volume increased 260% from 2023–2025, signaling strong demand for omnichain assets. wXRP is positioned as one of the first institutionally backed OFT assets bridging high-value ecosystems.

What Does wXRP's Launch Mean for the Broader XRP Ecosystem?

wXRP expands XRP beyond payments into full-scale DeFi liquidity, lending, arbitrage, and institutional settlement. It complements

Ripple’s RLUSD stablecoin, which surpassed $1.2 billion circulating supply in late 2025.

XRP’s on-chain payment volume grew 430% between 2023 and 2025, and the ecosystem now hosts 400+ active developer projects. wXRP adds deep, multi-chain liquidity routes at a time when tokenized finance is projected to reach $18.9 trillion by 2033.

How to Buy XRP Directly on BingX

XRP/USDT trading pair on BingX spot market

If you prefer owning XRP tokens directly, for trading flexibility, staking, or using them in the XRP Ledger ecosystem, you can easily buy them on BingX Spot Market, one of the world's leading crypto exchanges. Here's a simple, practical guide for 2025:

1. Sign Up and verify: Go to BingX.com, create an account using your email or phone, and complete KYC verification to unlock full trading and withdrawal limits.

2. Deposit Funds: Add funds through multiple options, bank transfer, credit/debit card, or zero-fee P2P trading for local currency deposits.

3. Buy XRP on Spot Market: Navigate to

Spot →

XRP/USDT, check the real-time price chart, enter the amount you wish to buy, and confirm your order.

4. Secure Your Assets: For long-term holding, you can keep XRP in your BingX Wallet, protected by cold storage and multi-signature security, or transfer it to a

self-custody wallet like

Ledger or Xumm for personal control.

5. Track and Manage: Use BingX's Price Alerts, Portfolio Dashboard, and

Copy Trading tools to monitor XRP performance, set automated alerts, and learn from top traders.

Buying XRP directly on BingX gives you 24/7 global market access, low fees, and the ability to send or use XRP on-chain, ideal for investors who want both control and utility beyond XRPL exposure.

Conclusion: What's Next for wXRP and XRP Interoperability?

wXRP’s launch on Solana marks a key milestone in XRP’s evolution into a multi-chain liquidity asset, supported by $100 million in initial liquidity, institutional-grade custody, and LayerZero’s OFT interoperability standard. As wXRP expands to Ethereum, Optimism,

Cosmos-based networks, and beyond, it is positioned to play a significant role in cross-chain liquidity routing, multi-network payments, and the broader growth of omnichain finance, with global cross-chain liquidity projected to exceed $150 billion by 2027. While the long-term outlook is promising, users should remember that wrapped assets, cross-chain protocols, and DeFi markets carry technical, liquidity, and smart-contract risks that require careful evaluation.

Related Reading