The

Beast Financial Services (BFS) token has emerged as a phenomenon within the

Solana ecosystem in early 2026. Combining the high-velocity nature of

memecoin trading with the massive social reach of the "MrBeast" brand, BFS has become a focal point for retail speculation. While the token is a community-driven initiative with no official ties to Jimmy Donaldson (MrBeast), its viral trajectory has made it a priority for traders seeking early-stage opportunities.

This comprehensive guide explores every facet of BFS, from its controversial origin story to the technical steps required to purchase it via both centralized and decentralized methods.

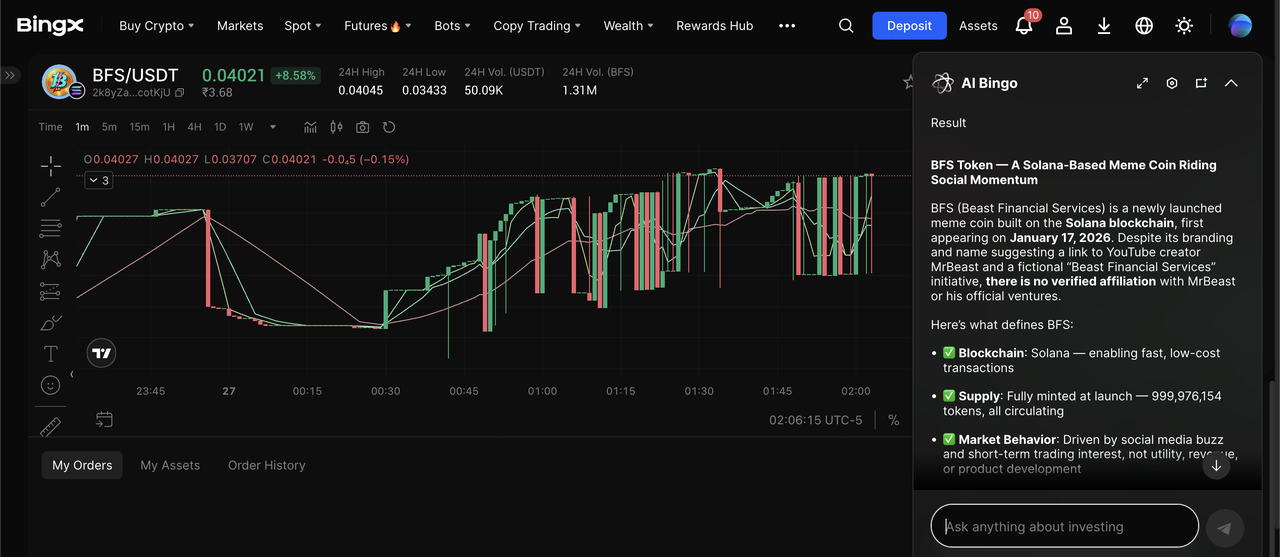

What Is BFS, the MrBeast Narrative,and On-Chain Reality?

In the 2026 crypto market, attention acts as a measurable liquidity driver, and BFS is a clear example of that dynamic in action. The token launched on January 17, 2026, shortly after renewed media coverage around Beast Industries, including reports of a $200 million strategic investment by BitMine into MrBeast’s broader media ecosystem. Within 72 hours of launch, BFS saw rapid wallet growth and trading volume spikes as social engagement surged across TikTok and X, demonstrating how off-chain headlines can quickly translate into on-chain speculation.

Was the MrBeast Memecoin Launched by the MrBeast Team?

The viral narrative suggested that MrBeast was preparing to launch a DeFi project tied to financial inclusion, amplified by edited clips from his 2026 Super Bowl teaser circulating on social platforms. In contrast, the MrBeast team issued a clear denial on January 19, 2026, with a public statement reiterating there was no official token and warning users about fake coins. Despite this clarification, BFS continued to rally and briefly reached a local market capitalization above $26 million on January 20, 2026, underscoring a recurring pattern in memecoin markets: price can follow attention and momentum even when the underlying narrative is explicitly disproven.

Where Can You Buy BFS Meme Token?

For the majority of traders, the most streamlined way to purchase BFS is through BingX ChainSpot. This "CeDeFi" (Centralized-Decentralized Finance) solution bridge the gap between exchange security and on-chain accessibility. It allows you to trade Solana-based tokens directly from your BingX account without managing a separate

Web3 wallet or manual bridging.

Why Use ChainSpot to Trade BFS Memecoin: 3 Key Benefits

• Unified Balance: Trade using your existing

USDT; no need to buy

SOL separately for gas.

• No Private Key Management: Avoid the risk of losing seed phrases associated with external wallets.

• Fast Speed: Direct routing to on-chain liquidity providers or

DEXs ensures you get the current market price instantly.

How to Buy BFS on BingX ChainSpot: Step-by-Step Guide

With

BingX AI-powered risk insights and market tools integrated into the platform, ChainSpot lets you trade BFS with a familiar spot-style experience while reducing on-chain complexity and execution friction.

Step 1: Fund Your Spot Account

Ensure you have completed Advanced KYC on BingX. Deposit or trade to ensure you have a balance of USDT in your Spot Account.

Step 2: Navigate to ChainSpot

• Mobile App: Tap the Spot icon on the bottom navigation bar, then select the

ChainSpot tab at the top.

• Desktop: Hover over the Spot menu in the main navigation bar and click on ChainSpot.

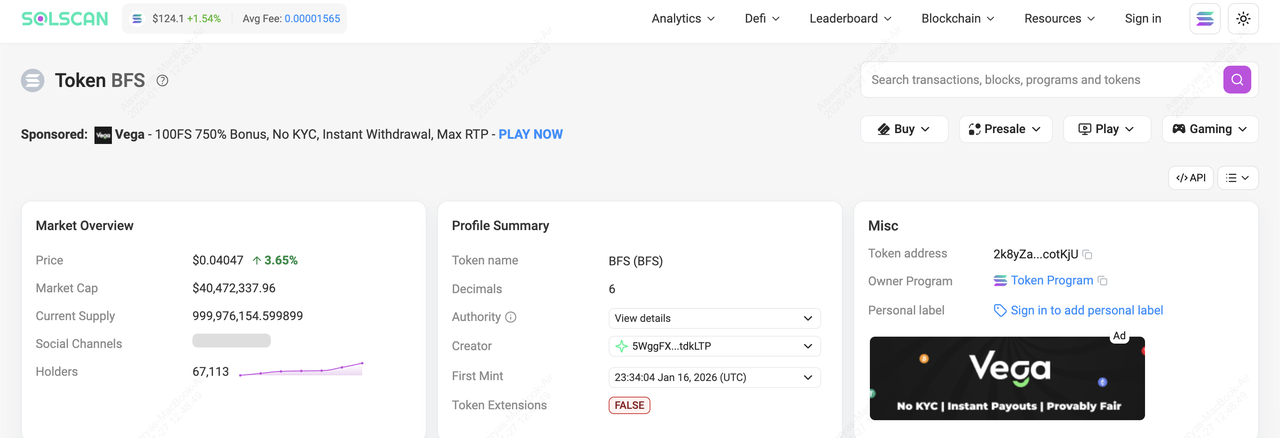

Step 3: Search for BFS

Enter the official BFS contract address on Solana, 2k8yZaJjf61unHriuqdmvbxe7CUhEYML5kVJDbcotKjU, into the search bar to find the

BFS/USDT trading pair. This is critical to avoid "copycat" scam tokens.

Source: Solscan

Step 4: Configure the Swap

1. Select USDT as your "From" asset.

2. Select BFS as your "To" asset.

3. Enter the amount you wish to spend. ChainSpot will automatically estimate the gas fee (deducted in USDT) and the slippage.

4. Review the transaction and click "Confirm Swap."

Your BFS tokens will be credited directly to your BingX Spot Account once the Solana network confirms the transaction, usually within 60 seconds.

Alternative Option: Buying BFS via Solana Decentralized Exchanges (DEXs)

For power users who prefer full

self-custody and want to interact directly with the Solana blockchain, using a DEX like

Jupiter or

Raydium is the preferred path.

Step 1: Prepare a Solana Wallet

Safety Warning: Write down your 12-word recovery phrase on paper and store it in a secure location. Never enter it on any website that asks for it.

Step 2: Send SOL for Gas

Every transaction on Solana requires SOL to pay for network fees.

Buy SOL tokens on BingX and withdraw the SOL to your Phantom/Solflare wallet address.

Step 3: Connect to a DEX Like Jupiter or Raydium

• Jupiter: The leading aggregator on Solana. It scans multiple liquidity pools to find you the best price.

• Raydium: A primary liquidity provider where many memecoins, including BFS, host their initial pools.

Step 4: Execute the Trade

1. Connect your wallet to the DEX.

2. In the "To" section, click "Select Token" and paste the BFS contract address: 2k8yZaJjf61unHriuqdmvbxe7CUhEYML5kVJDbcotKjU.

3. Set Slippage: For high-volatility memecoins, a slippage of 1% to 5% is often necessary to ensure the trade doesn't fail during a price surge.

4. Approve the transaction in your wallet.

ChainSpot vs. Solana DEX: What’s the Practical Difference for BFS Traders?

Both options let you access Solana-based tokens like BFS, but they differ sharply in ease of use, risk responsibility, and execution flow, making the choice especially important for first-time or narrative-driven memecoin traders.

1. User Experience

• BingX ChainSpot: The interface mirrors traditional spot trading, making it intuitive even for users new to on-chain assets. You trade BFS directly from your BingX balance without setting up wallets, signing transactions, or switching between apps.

• Solana DEX: You must connect a Web3 wallet, approve each transaction, and manage slippage manually. These extra steps can slow execution and increase error risk during fast-moving BFS price action.

2. Security Model

• BingX ChainSpot: Assets are protected by BingX’s exchange-grade custody, monitoring systems, and account-level security controls. This reduces operational risk for users who prefer not to manage private keys themselves.

• Solana DEX: You operate in a full self-custody environment with no recovery options if something goes wrong. Losing a seed phrase or interacting with a malicious contract can result in permanent loss of funds.

3. Fees and Gas Management

• BingX ChainSpot: All network and execution costs are abstracted away and settled in USDT, keeping the trading process simple. You don’t need to track SOL balances or worry about failed transactions due to insufficient gas.

• Solana DEX: You must maintain a SOL balance to pay for gas, and multiple failed or re-priced swaps can add up quickly. This becomes more costly and frustrating during high volatility.

4. Speed and Execution

• BingX ChainSpot: Trades are executed quickly with optimized routing and no need to manually adjust slippage settings. This is particularly useful when BFS experiences sharp intraday spikes or sudden pullbacks.

• Solana DEX: Execution depends on pool depth, slippage tolerance, and network conditions at the time of the swap. In rapid pumps or dumps, this can lead to failed transactions or worse-than-expected fill prices.

5. Accessibility

• BingX ChainSpot: Trading is available directly within the BingX app and web interface, making it accessible from a single account. This lowers the barrier for users who want exposure without navigating the broader Web3 stack.

• Solana DEX: You need an external wallet such as Phantom and access through a browser or in-app Web3 environment. This adds setup steps and increases complexity, especially for first-time traders.

Bottom line: ChainSpot is designed for speed, simplicity, and reduced operational risk, while Solana DEXs offer maximum self-custody and flexibility, but demand higher technical confidence, especially in volatile memecoin environments like BFS.

BFS Tokenomics and Security Analysis

Before investing, you must analyze the "health" of the token. BFS follows the typical 2026 Solana memecoin blueprint. BFS has a fixed total supply of 1 billion tokens, with 100% already in circulation, meaning there is no future inflation or token unlock risk. The project applies a 0% buy and sell tax, which lowers friction for traders and supports high-velocity speculation. As of late January 2026, BFS has attracted over 52,000 unique on-chain holders, indicating broad retail participation despite its short trading history.

The “MrBeast” Investor Warning

BFS should be treated as a high-risk, narrative-driven memecoin, not a fundamentals-based investment. Price action has already shown extreme volatility, including a around 70% single-day drawdown on January 21, 2026 after a parabolic rally. Its liquidity and relevance depend heavily on sustained social attention around the MrBeast narrative, which carries a clear caveat: MrBeast is not affiliated with the project and has publicly criticized memecoin launches as “icky.” If the narrative fades or denials continue, liquidity can dry up quickly, amplifying downside risk.

Top 7 Risks to Know Before Trading the BFS Meme Token

BFS is a narrative-driven Solana memecoin with extreme upside potential, but it also carries structural, behavioral, and execution risks that traders should actively manage before entering a position.

1. Liquidity and Rug Risk: Always verify the contract and liquidity setup before trading. Tools like RugCheck.xyz help confirm whether the liquidity pool (LP) is locked or burned. If LP tokens are burned, developers cannot remove liquidity, reducing (but not eliminating) rug-pull risk.

2. Whale Concentration Risk: Memecoins are especially vulnerable to large holders. Use Birdeye.so to monitor top wallets and real-time flows; if a small number of addresses control more than 10% of supply, a coordinated sell-off can trigger sudden 50–70% drawdowns.

3. Extreme Volatility Risk: BFS has already demonstrated how quickly price can reverse after parabolic moves. Sharp rallies are often followed by violent corrections, making late entries particularly vulnerable to rapid losses.

4. Narrative Decay Risk: BFS relies heavily on sustained social attention around the “MrBeast” narrative. If public interest fades or denials continue, liquidity and trading volume can drop quickly, amplifying downside pressure.

5. Execution & Slippage Risk: During high-volatility periods, swaps on Solana DEXs may fail or fill at unfavorable prices due to slippage. Even on centralized or hybrid platforms, fast market moves can outpace manual decision-making.

6. Risk Management (TP & SL): In memecoin markets like BFS, waiting for a perfect top or relying on a mental stop is rarely effective. A more disciplined approach is to scale out profits in 25% increments as price rises while setting predefined stop or limit levels to cap downside and protect capital during sharp reversals.

7. Capital Allocation Risk or “Casino Mentality”: BFS should be treated as a speculative trade, not a long-term investment. Only deploy capital you are prepared to lose entirely, viewing participation as high-risk exposure rather than portfolio core allocation.

Conclusion: Is BFS a Good Investment?

The Beast Financial Services (BFS) token highlights how quickly narrative-driven memecoins can gain traction within the Solana ecosystem, especially when linked to high-visibility cultural figures. Whether you trade via the convenience of BingX ChainSpot or the self-custody flexibility of a DEX, basic discipline like verifying contract addresses, monitoring liquidity, and managing position size remains essential.

BFS should be approached strictly as a high-risk speculative asset, not a fundamentals-based investment. Price action can be extremely volatile, liquidity can disappear quickly, and losses can be rapid and irreversible; only trade with capital you can afford to lose and with a clear exit plan in place.

Related Reading