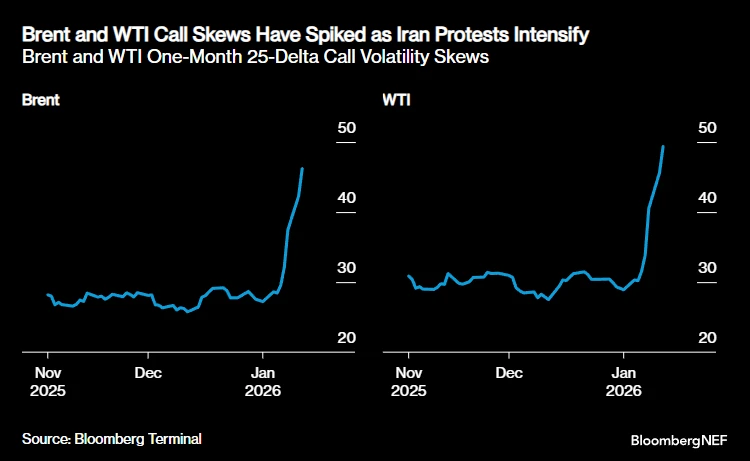

Crude oil is back in focus in 2026 as markets balance structural oversupply against rising geopolitical risk. A Reuters poll of economists expects Brent to average about $61 per barrel and WTI around $58 this year, reflecting pressure from ample production and modest demand growth; yet tail risks remain elevated, with BloombergNEF warning that severe disruptions, such as a prolonged loss of Iranian exports, could push Brent toward $91 per barrel in late 2026.

Crude oil exhibits volatility in January 2026 | Source: WTI oil price chart on BingX

What Is Crude Oil and Why Is It a Popular Asset to Trade?

Crude oil is a raw fossil fuel extracted from underground reservoirs and refined into products such as gasoline, diesel, jet fuel, and petrochemicals. It is priced globally using benchmarks like

WTI (U.S.) and

Brent (international), and it sits at the center of the global economy, fueling transport, industry, power generation, and supply chains. In 2026, global oil consumption is expected to exceed 102 million barrels per day, making crude one of the most liquid and closely watched commodities in the world.

Crude oil is popular to trade because it combines deep liquidity, strong volatility, and clear macro drivers. Prices react quickly to events such as OPEC+ decisions, geopolitical conflicts, sanctions, inventory data, and shifts in global growth or interest rates. For traders, this creates frequent opportunities to go long or short, hedge portfolios, or trade short-term momentum. When accessed via crypto markets, such as oil perpetuals or on-chain oil-themed tokens, crude oil becomes even more practical to trade, offering 24/7 access, leverage, and fast execution without owning or storing physical oil.

What Are WTI and Brent Crude Oil, and Why Do Traders Watch Both?

WTI (West Texas Intermediate) is the primary U.S. crude oil benchmark, representing “light sweet” crude priced at Cushing, Oklahoma, and is widely used to gauge U.S. oil market fundamentals such as domestic supply, inventory levels, and regional demand dynamics. Because it reflects U.S. production conditions and refinery flows, traders monitor WTI price action to trade macro shifts, inventory reports, and regional supply changes.

Brent serves as the global benchmark, priced from a blend of light crude from North Sea fields and used to set prices for roughly 80% of internationally traded crude, especially across Europe, Asia, and Africa. Its price tends to react more strongly to geopolitical developments, global supply disruptions, and broader international demand trends,

They often move in tandem because WTI and Brent are both key crude benchmarks, but the Brent–WTI spread reflects differences in regional supply and demand dynamics such as U.S. inventory levels, export capacity, and infrastructure costs, which can cause one to trade at a premium or discount to the other. Recent market moves show that increased Venezuelan crude flowing into U.S. markets has widened WTI’s discount to Brent, illustrating how supply flows and geopolitical developments can materially shift the spread in 2026.

Oil Market Outlook for 2026: What to Expect

Surge in crude oil prices in January 2026 | Source: Bloomberg

Historically, crude oil prices have moved through long boom–bust cycles, reflecting shifts in global supply, demand, and geopolitical stress. Brent crude traded mostly between $20–40 per barrel in the early 2000s, surged to an all-time high above $140 per barrel in 2008 during the commodities supercycle, then collapsed below $40 during the global financial crisis. Prices recovered to the $90–110 range between 2011 and 2014, before plunging again to around $30 per barrel in 2016 amid U.S. shale oversupply.

In more recent years, oil has remained volatile: prices briefly turned negative in 2020 during the COVID-19 demand shock, rebounded above $120 per barrel in 2022 following the Russia–Ukraine war, and then declined roughly 19–20% in 2025 as supply growth outpaced demand. Entering 2026, consensus forecasts place Brent in the $55–65 range, highlighting how oil prices tend to oscillate between surplus-driven compression and sharp, event-driven spikes rather than follow a smooth long-term trend.

Oil markets in 2026 are shaped by a base-case surplus with asymmetric upside risk, meaning prices are expected to stay pressured most of the year, but remain highly sensitive to geopolitical shocks.

• Base-Case Surplus-Driven Forecast: A December poll cited by Reuters projects Brent crude to average $61.27 per barrel and WTI to average $58.15 per barrel in 2026, reflecting expectations that global supply will exceed demand by roughly 0.5–3.5 million barrels per day as OPEC+, U.S., and non-OPEC production remains elevated.

• Downside Pressure drivers: The same Reuters survey notes that 2025 already saw 19–20% declines in Brent and WTI, and analysts expect continued pressure in 2026 from steady output, modest demand growth, and limited willingness among producers to enact deep cuts unless prices fall sharply.

• Upside Risk Due to Geopolitical Shock: BloombergNEF highlights Iran-related disruption as the key tail risk; in an extreme but low-probability scenario where Iranian exports are fully removed for an extended period, Brent could average $91 per barrel in Q4 2026, driven by a renewed “war premium” despite an otherwise well-supplied market.

Bottom line: For oil traders, 2026 favors a strategy built around mean reversion under surplus conditions, while staying positioned for short-lived, event-driven spikes triggered by geopolitics, sanctions, or supply chokepoints.

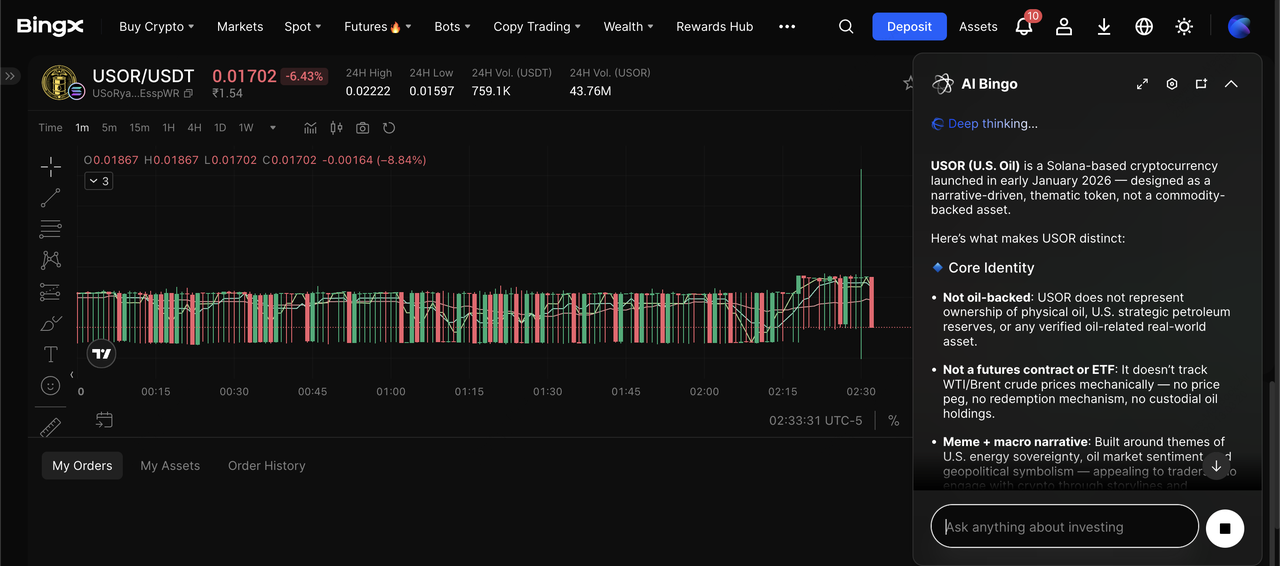

What Is U.S. Oil Reserve (USOR) and How Does It Work?

U.S. Oil Reserve (USOR) is a

Solana-based crypto token built around the narrative of U.S. oil reserves and energy markets, designed to give traders oil-themed exposure in a crypto-native format. It is not a futures contract or a physical oil-backed asset; instead, USOR trades like a standard crypto token, with its price driven by market supply and demand, liquidity conditions, and broader sentiment around oil prices, geopolitics, and

real-world asset (RWA) narratives.

USOR price chart on BingX

From a market perspective, USOR has shown high short-term volatility, trading with a market cap and FDV of roughly $18 million as of January 2026, 24-hour volume above $7 million, and a fully circulating supply of 1 billion tokens, including a gain of nearly 200% over the past 7 days, underscoring its speculative, momentum-driven nature rather than benchmark oil tracking.

USOR leverages on-chain liquidity within the Solana ecosystem and can be accessed on BingX through ChainSpot, which allows users to trade on-chain tokens directly from their BingX account. Because it does not track oil prices mechanically, USOR may diverge from WTI or Brent benchmarks, making it more suitable for traders looking to express thematic or short-term views on oil-related narratives, rather than precise hedging or benchmark tracking.

How to Trade U.S. Oil Reserve (USOR) on BingX ChainSpot

BingX ChainSpot is an on-chain trading feature that lets you trade DeFi/on-chain tokens directly from your BingX account, no external wallet switching or DEX transfers, with execution sourced from on-chain liquidity and settlement into your Spot balance.

USOR is a Solana-based token tied to an “oil reserve” narrative, and it is tracked across major crypto data platforms.

How to Buy USOR Token on BingX ChainSpot: A Step-by-Step Guide

USOR/USDT trading pair on ChainSpot powered by BingX AI insights

Here's how you can easily buy US Oil Reserve (USOR) tokens on ChainSpot, powered by insights from BingX AI:

2. Fund your Spot account with

USDT. ChainSpot uses your Spot USDT balance for

on-chain trading.

3. Go to Spot tab and select ChainSpot.

4. Search

USOR/USDT trading pair, then verify you’re selecting the correct token by reviewing network, ticker, and listing details.

5. Enter the amount, review the quote, including any on-chain costs shown, and confirm the trade.

6. After execution, your USOR is reflected in your Spot balance, ready to hold or trade.

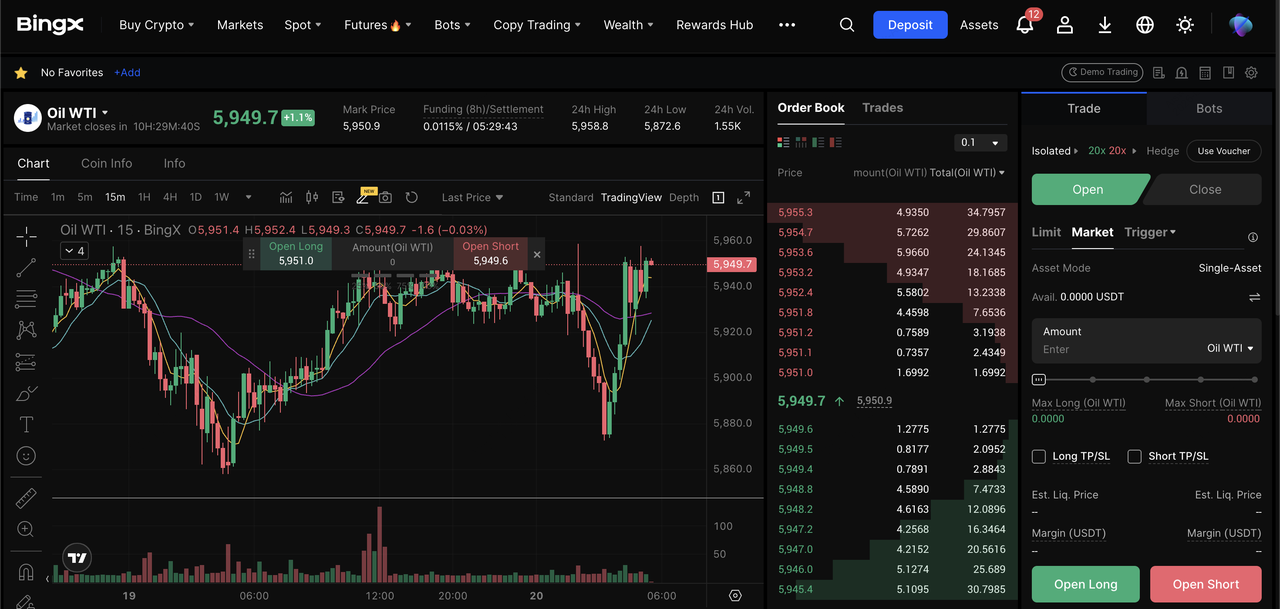

What Are Oil Perpetual Futures and How Do They Work on BingX TradFi?

Different from USOR token, oil perpetual futures are derivative contracts that track crude oil prices and allow you to trade price movements without owning physical oil or dealing with contract expiry. Through BingX TradFi, traders can access Oil WTI and Oil Brent perpetual contracts using USDT collateral, making it possible to trade global oil markets with the same crypto balance, interface, and risk tools used for

BTC or

ETH futures.

Designed for macro-driven traders, BingX’s oil perpetuals combine traditional commodity exposure with crypto-native flexibility, letting you react quickly to OPEC+ decisions, geopolitical headlines, inventory data, or supply disruptions, all without leaving the crypto ecosystem. These contracts are particularly useful in 2026, when oil prices are expected to oscillate between surplus-driven pressure and event-driven spikes.

How Crude Oil Perpetual Futures Trading with Crypto Works

• Long / Short: You can go long if you expect oil prices to rise or short if you expect them to fall, enabling directional trades and portfolio hedging.

• Funding fees: Like crypto perpetuals, oil perps use periodic funding of typically every 8 hours, which can add holding costs for longer-term positions.

• Market hours (WTI & Brent, UTC): Oil perpetuals trade in defined sessions, not 24/7. WTI typically runs from late Sunday to Saturday with short daily breaks and is closed Sunday, while Brent opens later each day and also closes on Sunday. During session breaks you can usually cancel orders, but opening or closing positions may be restricted, and prices can gap at reopen, so manage leverage and stops around these windows.

• Leverage: BingX offers adjustable leverage of up to 500x on oil perpetuals, improving capital efficiency, but higher leverage significantly increases liquidation risk and should be used cautiously.

Together, these features make BingX TradFi oil perpetuals a practical way for crypto traders to gain direct crude oil exposure, manage macro risk, and trade global energy markets using crypto, without physical delivery, brokerage accounts, or traditional commodity platforms.

How to Trade WTI and Brent Oil Perpetuals with Crypto on BingX Futures

WTI Oil perpetual contract on the BingX futures market

BingX lets you trade oil-linked perpetuals using USDT collateral, without brokers, physical delivery, or rolling expiring contracts yourself.

Step 1: Fund Your Futures Wallet with USDT

After signing up for a BingX account and completing KYC, deposit or transfer USDT into your Futures account/wallet so you’re ready to place trades.

Note: USDT is the margin and settlement currency for these contracts.

Step 2: Open the Oil Perpetual Contract to Trade

Step 3: Choose Your Direction to Go Long or Short

• Go long if you expect oil to rise, e.g., disruption risk, supply cuts, shipping constraints.

• Go short if you expect oil to fall, e.g., surplus supply, weak demand, rising inventories.

Step 4: Set Leverage and Place an Order

Pick a conservative leverage level, then choose:

• Limit order for a specific entry price

Oil can gap around macro headlines, so lower leverage usually improves survival.

Step 5: Manage Risk Like a Pro

• session opens/closes (gap risk)

• major headlines (sanctions, OPEC+, conflict risk)

• funding intervals (cost accumulation)

US Oil Reserve (USOR) vs. WTI/Brent Perpetuals: Which Should You Trade?

US Oil Reserve (USOR) is best suited for traders who want on-chain, spot-style exposure tied to oil-related narratives rather than precise crude price tracking. Traded as a Solana token and accessible via BingX ChainSpot, USOR behaves like a crypto asset; its price is driven by liquidity, sentiment, and macro headlines around energy markets, without leverage or perpetual funding fees, but with higher volatility risk and potential divergence from WTI or Brent.

In contrast, WTI and Brent oil perpetuals are derivatives designed to track real crude oil benchmarks, making them more appropriate for macro traders seeking structured exposure to oil prices. These contracts allow you to go long or short, apply leverage, and use stop-loss and take-profit tools, which is useful for trading events like OPEC+ decisions, inventory data, or geopolitical shocks, while requiring disciplined risk management due to leverage and session-based trading hours.

Top 5 Risks to Know Before Trading Crude Oil Assets with Crypto

Trading oil with crypto combines commodity volatility with crypto-style leverage and liquidity, so understanding the risks upfront is essential.

1. Leverage amplifies losses quickly: Oil can move sharply on headlines; high leverage compresses your error margin and can trigger rapid liquidation; start small and keep healthy margin buffers.

2. Funding costs add up: Perpetual contracts charge periodic funding, often every 8 hours, which can materially erode returns if you hold positions through multiple intervals.

3. Session gaps and timing risk: Commodity perpetuals trade in defined sessions (not 24/7); prices can gap at opens/closes, and you may be unable to open or close during breaks; plan entries, exits, and stops accordingly.

4. Macro headline whipsaws: OPEC+ decisions, sanctions, inventory data, and geopolitics can cause sudden reversals that invalidate technical setups within minutes.

5. Narrative vs. benchmark risk (USOR): Tokens like USOR trade as crypto assets; they can diverge significantly from WTI or Brent because prices are driven by liquidity and sentiment, not mechanical tracking of crude benchmarks.

Final Thoughts: Should You Trade Oil with Crypto in 2026?

In 2026, crude oil remains a two-speed market, shaped by surplus-driven price pressure in the base case and sharp, event-driven spikes during geopolitical or supply disruptions. If you’re looking for benchmark-linked exposure with the ability to go long or short and use leverage, WTI and Brent oil perpetuals on BingX Futures offer a structured way to trade macro oil moves; if you prefer on-chain, spot-style access within a centralized workflow, BingX ChainSpot provides exposure to oil-related narratives through USOR.

Risk reminder: Oil and crypto are both volatile. Use strict risk controls, avoid excessive leverage, and only trade what you can afford to lose.

Related Reading