Crypto scalping is a short-term trading strategy where traders aim to profit from small price movements by opening and closing positions within seconds or minutes. It works best in highly liquid and volatile markets like Bitcoin and Ethereum, where frequent price fluctuations create repeated trading opportunities throughout the day.

In the current

crypto market, volatility remains elevated due to macro uncertainty,

ETF-driven flows, and rapid sentiment shifts. This environment favors scalping strategies that focus on speed, discipline, and risk control rather than long-term price predictions. Instead of waiting for large trends to develop, scalpers look to stack small, consistent gains across many trades.

Scalping is not about chasing big wins. It is about execution,

tight stop-losses, and maintaining favorable risk-to-reward ratios. When applied correctly, it allows traders to stay active in the market while limiting exposure to sudden news-driven moves.

What Is Crypto Scalping and How Does It Work?

Crypto scalping involves entering and exiting trades on very short timeframes, typically using 1-minute or 5-minute charts to capture small price movements multiple times per session. Scalping is a trading method where positions are opened and closed within very short periods, often seconds to a few minutes. The objective is to capture small changes in price rather than waiting for large moves.

Scalpers usually rely on high trade frequency. Instead of a handful of trades per day, they may place dozens or even hundreds of trades. Some use leverage to amplify returns, but this also increases risk if trades move against them.

Cryptocurrency markets are well-suited for scalping because of their constant volatility. Digital assets often experience sharp intraday swings, creating many opportunities for short-term traders to enter and exit quickly.

For example, if BTC/USDT moves from $115,700 to $115,850 on a one-minute chart, a scalper might buy at $115,700 and exit seconds later at $115,850 to capture the $150 swing. While the profit per trade is small, repeating this process across many trades can build steady returns.

What Are the Pros and Cons of Crypto Scalping?

Scalping can be rewarding in the right conditions, but it also comes with challenges. Traders should weigh the advantages and drawbacks before deciding if this style fits their goals.

Advantages

• Quick results: Trades are short-lived, and profits or losses are realized within minutes. A scalper might buy BTC/USDT at $116,800 and sell at $116,850 within minutes, locking in a $50 move without waiting hours or days.

• Frequent trades: On a volatile day, prices may swing dozens of times, offering multiple entry and exit points.

• Limited exposure: Because trades are short, a sudden news release is less likely to catch a scalper holding a position compared to a swing trader.

Disadvantages

• High risk: Using leverage on small moves can magnify losses just as quickly as gains. For instance, using 10x leverage on that same $50 BTC move means a small reversal could quickly wipe out gains or even the account balance.

• Time-intensive: Scalpers must monitor charts closely. Missing a single move in a 1-minute candle could mean missing the trade entirely.

• Trading costs: Fees add up quickly. For example, if a trader makes a $10 profit on a scalp but pays $3 in combined trading fees and spreads, the net gain drops to $7. After many trades, these costs can significantly reduce overall returns.

Scalping often fits experienced traders who can handle pressure and apply strict

risk management. Beginners may find the pace overwhelming, so practicing on a demo account is usually the best way to explore this style safely. Usually, Quantum trading and AI bots offer advanced tools that can complement scalping strategies for more efficient execution.

What Are the 5 Best Crypto Scalping Strategies?

Scalping can be approached in many ways, but some methods are more reliable than others. Below are five strategies that traders often use to capture quick moves in the crypto market. Most of these setups are applied on very short timeframes, such as the 1-minute or 5-minute chart.

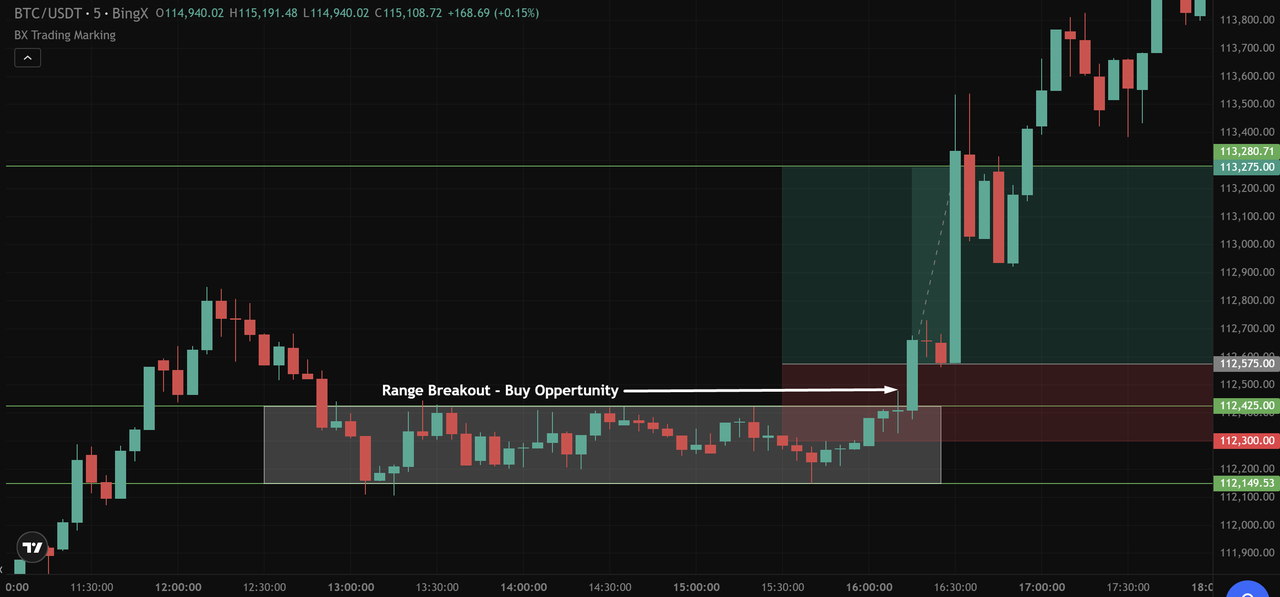

1. Range Trading: Scalping Between Support and Resistance

Range trading is a scalping strategy that focuses on price moving between two levels:

support and resistance. Support is where buying pressure tends to prevent further declines, while resistance is where selling pressure caps upward moves.

In the chart above, BTC/USDT is trading between $112,160 (support) and $112,440 (resistance) on the 5-minute timeframe. A scalper might go long at support around $112,160 with a stop-loss at $112,120, risking $40, and set a target at resistance near $112,440 for a potential $280 gain.

That creates a

risk-to-reward (R:R) ratio of 1:7, which is favorable for short-term trading. The same logic applies in reverse for short trades at resistance with exits at support.

This method works best in sideways markets where price consolidates instead of trending. Stop-loss orders are usually placed just outside the range to protect against breakouts, ensuring losses are controlled when the market moves unexpectedly.

2. Breakout Scalping: Trading Momentum After Key Levels Break

Breakout trading is a scalping method where traders enter a position when price breaks through a defined support or resistance level. The logic is that once the barrier is cleared, momentum often accelerates in the breakout direction. In crypto markets, this acceleration is often reinforced by

short squeezes or liquidation cascades. When resistance breaks, short positions may be forced to close, triggering buy orders that push price even higher. Scalpers aim to enter early in this process while keeping stops tight in case the move fails.

In the chart above, BTC/USDT had been consolidating between support at $112,150 and resistance near $112,425 on the 5-minute timeframe. When price broke above resistance with a strong green candle, it signaled a buy opportunity. Scalpers could enter at the breakout point around $112,425 and set a stop-loss just below the range at $112,300 to control risk.

If the target is placed at the next key level near $113,280, the potential gain is $855, while the risk is about $125. This creates a risk-to-reward (R:R) ratio of roughly 1:7, which makes the setup attractive. Traders who prefer more confirmation may wait for a pullback to the broken resistance before entering.

Breakout scalping is most effective in highly volatile assets where ranges often lead to sharp moves. However, false breakouts are common, so managing stops and sticking to predefined R:R rules is essential.

3. Chart Pattern Scalping: Flags, Triangles, and Channels

Chart patterns help scalpers anticipate whether price is likely to continue in the same direction or reverse. Common setups include wedges, triangles, and flags. These structures form naturally in the market and give traders entry, stop-loss, and take-profit levels with defined risk.

In the first chart, BTC/USDT formed a

descending channel. A scalper could enter a short at the upper boundary around $112,500, place a stop-loss just above resistance, and target the lower boundary near $111,120.

This setup offers a clear R:R structure, as the potential reward from top to bottom of the channel is far greater than the risk of a small breakout above resistance.

In the second chart, BTC/USDT showed a

descending triangle pattern. A sell entry at $111,500 with a stop-loss above $111,850 and a take-profit around $110,900 would create a manageable setup. The triangle pattern gives clear levels for trade planning, helping scalpers avoid guesswork.

Scalping with chart patterns is effective because entries are well-defined, and risk is limited to clear boundaries. However, false breakouts are possible, so scalpers should focus on maintaining favorable risk-to-reward ratios, usually 1:2 or better, to stay profitable over multiple trades.

4. RSI and Moving Averages for Scalping Confirmation

Some scalpers prefer to combine technical indicators to refine entries and exits. A common setup is using the

Relative Strength Index (RSI) with

moving average crossovers. Together, they help confirm momentum shifts and reduce false signals.

In the chart above, BTC/USDT showed an RSI bullish crossover (RSI rising above 30 from oversold levels) at the same time as a short-term moving average crossing above a longer-term moving average. This dual signal marked a buy entry at $109,400.

With a stop-loss placed just below support at $108,330, the risk on the trade was about $1,070. The take-profit target at $110,700 offered a potential gain of $1,300, giving an R:R ratio close to 1:1.2. While modest, scalpers can repeat this type of setup multiple times per session to compound results.

The strength of this method is in confirmation: instead of relying on RSI alone, the moving average crossover adds extra evidence that momentum is shifting. However, like all indicators, signals can lag, so fast execution and tight risk management are still essential.

5. Bid-Ask Spread Scalping in Low-Liquidity Markets

The

bid-ask spread is the difference between the highest price buyers are willing to pay (bid) and the lowest price sellers are willing to accept (ask). In highly liquid pairs like BTC/USDT, spreads are usually tight, often just a few dollars. But in lower-liquidity assets, spreads can widen, creating opportunities for scalpers.

For example, if a token is quoted with a bid at $10.00 and an ask at $10.20, the spread is $0.20. A scalper who buys at the bid and sells at the ask can capture this gap for profit. While the gain per trade is small, repeating the process across multiple trades can accumulate returns.

This approach is more common in less liquid cryptocurrencies, where spreads are naturally wider. However, traders must be careful: low liquidity also means orders may not always fill at the desired price, and slippage can reduce profits.

How to Build a Crypto Scalping Strategy Step by Step

Every scalper develops their own system, but most strategies share the same building blocks. Here are the key steps to create one that fits your style:

1. Choose a short timeframe: Scalping works best on 1-minute to 5-minute charts, where price movements are frequent enough to provide multiple trades per session.

2. Identify support and resistance: Use horizontal levels, trendlines, or recent highs and lows to spot entry and exit points. These zones act as the backbone of any scalp trade.

4. Apply risk management: Always define stop-loss levels, size positions correctly, and aim for a favorable risk-to-reward ratio (at least 1:2). This keeps losses small and profits scalable.

5. Backtest and refine: Review past price action, test your rules, and record trades in a journal. This helps identify strengths and weaknesses so the strategy can be improved over time.

Enhance Scalping with BingX AI: Real-Time Insights & Risk Tools

A disciplined scalping plan is less about finding the “perfect” setup and more about applying consistent rules with strict risk control. Modern scalpers can gain an edge by integrating

BingX AI tools into their workflow.

What BingX AI brings to scalpers:

• Real‑time sentiment tracking to catch shifts in the market mood before they show up on charts.

• Automated pattern recognition that flags setups like double tops, channels, and breakouts instantly.

• Risk alerts and trade simulations to test strategies under different market conditions without risking capital.

By blending your manual scalping rules with BingX AI’s insights, you can trade faster and with more confidence, filter out weak or low‑probability setups and stay disciplined under pressure, even in volatile sessions.

In short, BingX AI doesn’t replace your strategy, it sharpens it.

Is Crypto Scalping Right for You as a Trader?

Scalping isn’t a one-size-fits-all approach. It demands specific traits and habits that not every trader is comfortable with.

Scalping requires constant attention and the ability to react within seconds. Unlike swing trading, where positions may last days, or

day trading, which focuses on a few setups per session, scalping involves dozens of rapid trades. This pace can be stressful and mentally draining, especially if discipline slips.

For beginners, demo accounts are the safest way to test whether scalping suits their style. This lets traders feel speed and pressure without risking real capital.

Automating Scalping with BingX

While BingX doesn’t offer a dedicated “scalping bot,” several built‑in tools mimic scalping behavior:

• Grid Trading Bots: Place multiple buy/sell orders within a range, capturing small moves automatically.

•

Martingale Bot: Adjusts positions after dips to recover faster in volatile markets.

•

BingX AI Assistant: Provides real‑time sentiment analysis, pattern recognition, and risk alerts.

These features reduce emotional stress and allow traders to capture frequent small profits without constant screen time

Conclusion: What Makes a Successful Crypto Scalping Strategy

Scalping in crypto offers a way to take advantage of the market’s constant volatility by capturing small but frequent price moves. Strategies such as range trading,

breakouts,

chart patterns, indicator signals, and spread opportunities give traders multiple ways to approach short-term setups.

Success in scalping comes down to discipline. Clear entry and exit rules, strict risk management, and a consistent focus on favorable risk-to-reward ratios are what separate profitable scalpers from those who rely on luck.

For traders ready to explore this fast-paced style, BingX provides the tools and liquid markets to put these strategies into practice. Start with a demo account to build confidence, refine your approach, and move into live trading once your system proves reliable.

Related Reading

FAQs on Crypto Scalping

1. Is scalping good for beginners in crypto?

Scalping is fast-paced and risky, so it can be overwhelming for beginners. It’s better to start with a demo account to practice before trading live.

2. How much time does crypto scalping require?

Scalping demands constant attention. Trades last only seconds to minutes, so scalpers need to monitor charts closely throughout their session.

3. What is the best timeframe for scalping crypto?

Most scalpers use the 1-minute or 5-minute chart because these provide frequent opportunities and quick trade setups.

4. Do scalpers always use leverage?

Not always. Many scalpers use leverage to amplify small moves, but this increases risk. Beginners are advised to trade without leverage until confident.

5. Which crypto pairs are best for scalping?

High-volume pairs like BTC/USDT and

ETH/USDT are popular because of their liquidity and tight spreads. Some scalpers also look at smaller altcoins with wider spreads for opportunities.