Source: total crypto market capitalization 2026

CoinGecko

Centralized exchanges and custodial platforms handle billions in user assets, making it essential for users to verify that their funds are secure and fully backed. Crypto

Proof of Reserves (PoR) has emerged as a critical tool to address these concerns, providing cryptographic evidence that platforms hold sufficient assets to cover user deposits. As of February 2026, according to CoinGecko, the total crypto market capitalization hovers around $2.3 trillion to $2.5 trillion amid ongoing volatility and regulatory scrutiny, which means understanding PoR is vital for investors, traders, and institutions alike.

This article explores the fundamentals of

PoR, its mechanisms, benefits, challenges, and applications in modern crypto ecosystems, including specific implementations like BingX's approach and extensions to cross-chain assets.

What are Crypto Proof of Reserves (PoR)?

Crypto Proof of Reserves is a verification process used by centralized cryptocurrency exchanges,

wallets, and other custodial services to demonstrate that they hold enough assets to match user deposits on a 1:1 basis. Unlike traditional financial statements,

PoR leverages blockchain technology and cryptography to provide transparent,

auditable proof of solvency. It typically involves publishing public

wallet addresses and using data structures like

Merkle trees to aggregate user balances without revealing individual details.

The primary goal of PoR is to prevent scenarios where platforms misuse customer funds, such as lending them out without consent or facing insolvency due to poor management. High-profile exchange failures, such as the 2022 collapse of FTX, which resulted in an $8 billion shortfall and widespread losses, underscored the need for such mechanisms. By making reserves verifiable on the blockchain, PoR fosters user confidence and reduces the risk of "bank runs" in volatile markets. It is not a full financial

audit but a focused check on asset backing, often conducted periodically or in real time with advanced tools.

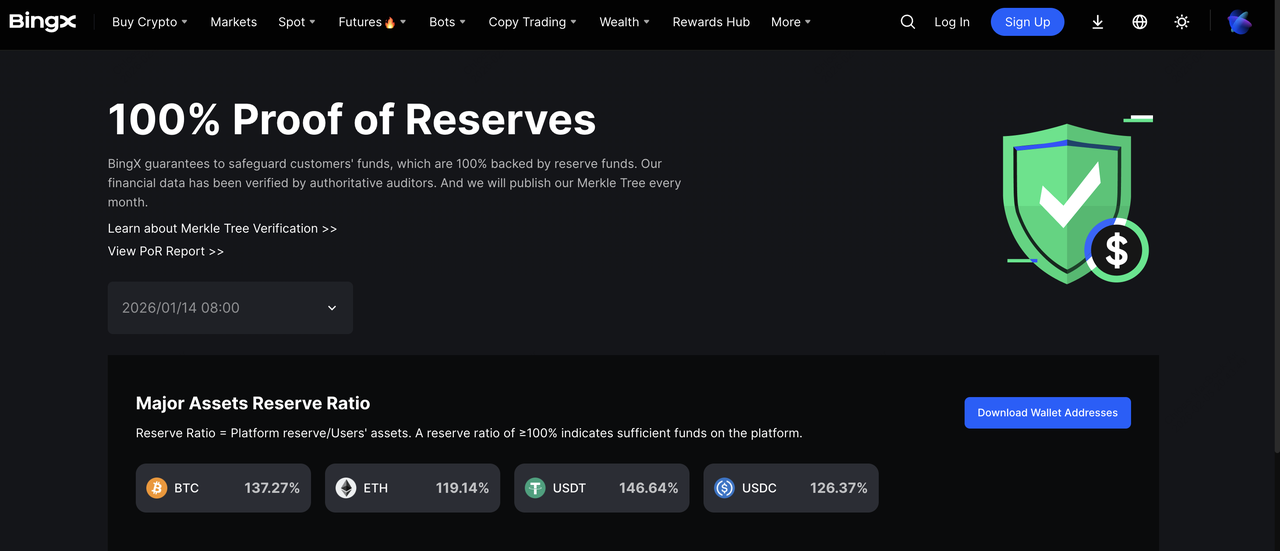

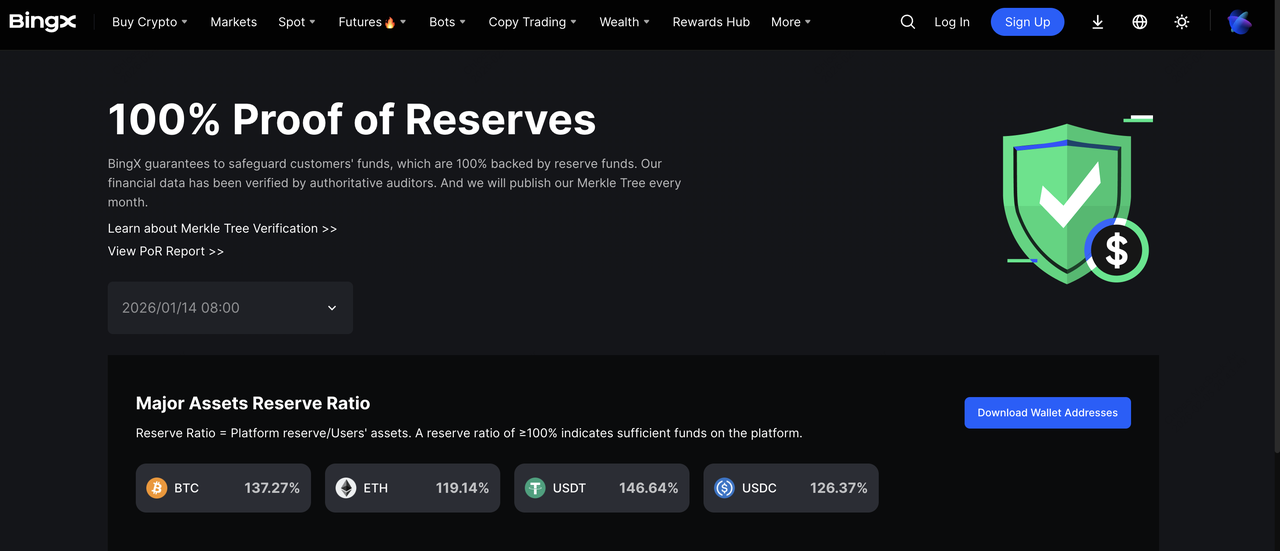

What Is BingX Proof of Reserves (PoR)?

BingX is a global cryptocurrency exchange known for its social trading features and has implemented a robust Proof of Reserves system to ensure 100% backing of user assets. As of the latest update in January 2026, BingX releases monthly snapshots of its

Merkle Tree PoR, allowing users to verify asset security through an online tool.

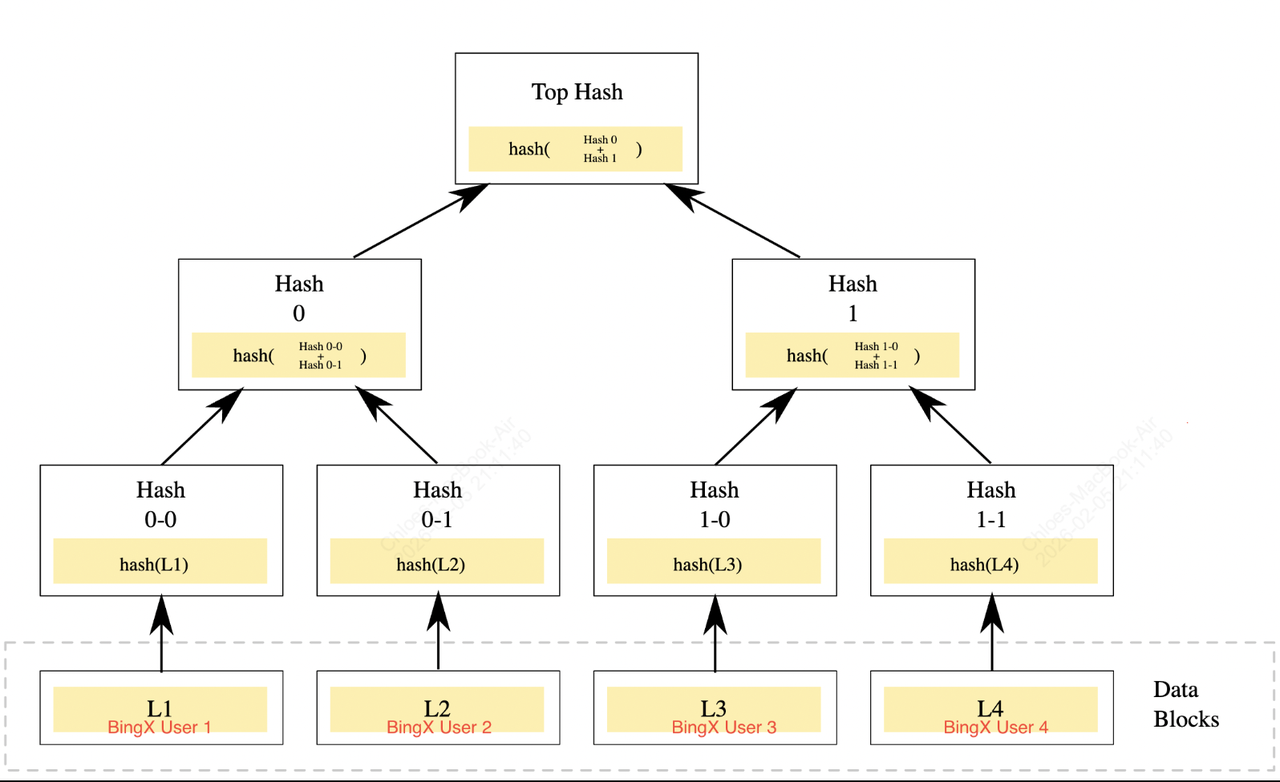

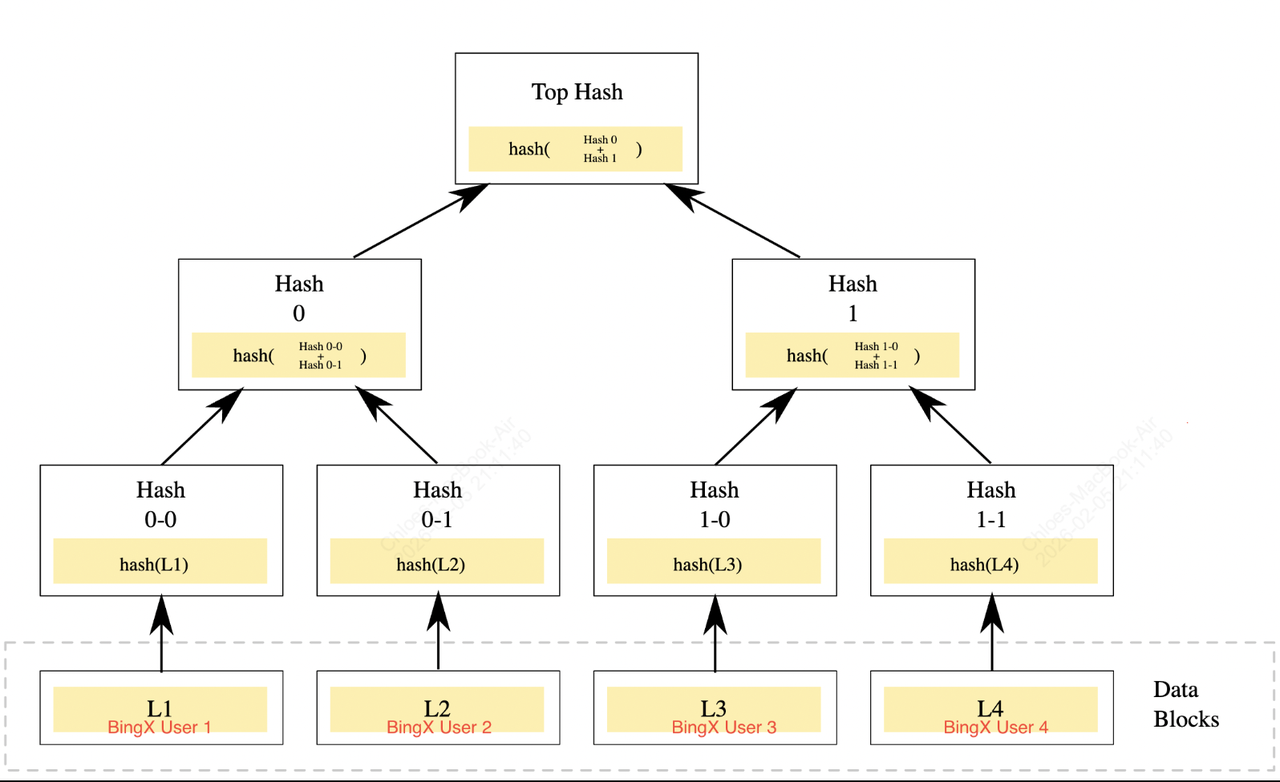

BingX proves 100% reserves using a Merkle Tree, a binary hash tree structure introduced by Ralph Merkle in 1980, to cryptographically verify full backing of user assets. The process starts with confirming control of hot and cold wallets by transferring random amounts to auditor-specified addresses, then captures an anonymized snapshot of user balances across spot, futures, and copy trading accounts (excluding unrealized PnL). These encrypted user IDs and balances form the leaf nodes of the Merkle Tree, hashing upward to a single root that summarizes total liabilities.

Any data change alters the root hash. Users can independently verify their inclusion and balance accuracy via BingX’s online tool (supporting

BTC,

ETH, USDT, USDC) by entering their Hash ID. The platform conducts regular

audits by independent third-party firms and provides bi-weekly

Merkle tree updates to maintain transparency. Users can log in to BingX's platform to check their individual balances against the total reserves, confirming inclusion in the aggregated data.

This system covers a wide range of crypto, with recent reserve ratios including 137.27% for BTC, 119.14% for ETH, and 146.64% for USDT as of January 15, 2026. BingX's commitment to PoR underscores its focus on security, especially in an era where exchange failures have highlighted the need for verifiable solvency. This transparent, tamper-proof method builds trust by allowing users to confirm their funds are securely and fully backed without exposing personal details.

Source: BingX Merkle Tree Diagram

Furthermore,

BingX security controls like anti-phishing code, withdrawal whitelist, emergency account lock help keep your funds safe, so you can trade with confidence.

How Crypto Proof of Reserves Works

Proof of Reserves operates through a series of cryptographic steps to balance transparency with privacy. Here is a breakdown of the typical process:

1. Snapshot of Liabilities: The platform captures an anonymized list of all user balances at a specific timestamp.

2. Merkle Tree Construction: These balances are hashed and organized into a

Merkle tree, a binary tree where each leaf represents a user's balance, and the root hash summarizes the total liabilities.

3. Reserve Verification: The platform discloses its public wallet addresses holding the reserves. An independent auditor or users themselves verify ownership by signing messages with the corresponding private keys.

4. Comparison and Attestation: The total reserves are compared against the Merkle root. If they match or exceed liabilities, the PoR is confirmed, often with a third-party attestation.

Advanced implementations may use zero-knowledge proofs for enhanced privacy, allowing verification without exposing data. This method ensures users can independently

audit their inclusion using tools provided by the platform.

What Are the 5 Key Benefits of Using Crypto Proof of Reserves?

Adopting Proof of Reserves offers numerous advantages for both platforms and users in the crypto space:

1. Enhanced Transparency: PoR provides a public, verifiable view of a platform's holdings, moving beyond opaque assurances to cryptographic evidence.

2. Building Trust: By proving 1:1 asset backing (or often higher, as seen in reports exceeding 100%), platforms reassure users that funds are not being misused, fostering loyalty and attracting new participants.

3. Risk Mitigation: Regular PoR reduces the likelihood of insolvency events, as users can monitor solvency and withdraw if discrepancies arise, helping prevent contagion from failures like FTX.

4. Regulatory Compliance: In jurisdictions with increasing oversight, PoR helps platforms meet transparency requirements, potentially avoiding fines or shutdowns.

5. User Empowerment: Individuals can verify their own balances, democratizing financial oversight in a way traditional systems rarely allow.

What Are the Challenges and Limitations of Crypto Proof of Reserves?

Despite its strengths, Proof of Reserves is not infallible and faces several hurdles:

1. Point-in-Time Nature: PoR audits capture a single moment, allowing platforms to temporarily inflate reserves (ex., via short-term borrowing) before returning to normal operations.

2. Incomplete Scope: It focuses on on-chain assets but may overlook off-chain liabilities, such as loans or derivatives, leading to an incomplete solvency picture.

3. Collusion Risks: Auditors or platforms could collude, or assets might be pledged as collateral elsewhere without disclosure.

4. Technical Complexity: Not all users have the expertise to verify PoR independently, potentially limiting its effectiveness.

5. Evolving Threats: As crypto innovations grow, PoR must adapt to new risks like flash loans or sophisticated hacks.

These limitations highlight the need for complementary measures, such as full financial audits and real-time monitoring.

Crypto Proof of Reserves vs. Traditional Banking Audits

Proof of Reserve in Traditional Markets and Tokenized Real-World Assets

Crypto Proof of Reserves differs significantly from traditional banking audits, reflecting the decentralized ethos of blockchain versus the centralized nature of legacy finance.

• Approach and Transparency: PoR uses public cryptographic proofs, enabling anyone to verify reserves in real time or periodically. In contrast, traditional audits involve private third-party reviews of financial statements, often conducted quarterly or annually, with results shared selectively.

• Frequency and Scope: PoR provides frequent snapshots focused on asset backing, while banking audits offer a comprehensive assessment of the entire balance sheet, including debts and off-balance-sheet items.

In traditional markets, "proof of reserve" analogs exist in reserve requirements for banks, enforced by regulators like central banks. However, these are less transparent than crypto PoR. For tokenized

real-world assets (RWAs), such as real estate, commodities, or securities represented on blockchain, PoR plays a pivotal role in verifying that digital tokens are backed by tangible reserves.

This bridges traditional and crypto worlds, ensuring

tokenized assets like real estate NFTs or

stablecoins tied to physical goods maintain integrity through on-chain attestations. Auditors use AI-powered tools for real-time verification across blockchains, enhancing trust in RWAs. Unlike banking audits, PoR for RWAs emphasizes programmability and independent verifiability, accelerating adoption in

DeFi.

Proof of Reserve for Cross-Chain Assets and Wrapped Token Bridges

As cryptocurrency ecosystems expand across multiple blockchains, Proof of Reserves extends to cross-chain assets and wrapped token

bridges, ensuring interoperability without compromising security. Wrapped tokens, like wBTC (wrapped Bitcoin on Ethereum), represent assets from one chain on another, locked in reserves via

bridges. PoR verifies that these reserves match issued tokens, preventing undercollateralization.

For

bridges, PoR involves segregating funds in multi-signature vaults and publishing proof of assets. This mitigates risks in cross-chain transfers, where hacks have historically caused significant losses. By incorporating zero-knowledge proofs, PoR maintains privacy while confirming solvency across chains, supporting the growth of multi-chain

DeFi.

Conclusion

Crypto Proof of Reserves represents a cornerstone of trust in the digital asset space, offering a transparent alternative to traditional opacity. From basic implementations to advanced applications in cross-chain environments and tokenized

RWAs, PoR empowers users and platforms alike. While challenges remain, ongoing innovations like real-time verification promise to enhance its efficacy.

As the industry matures amid a multi-trillion-dollar market, adopting robust PoR standards will be essential for sustainable growth, ensuring that cryptocurrency fulfills its promise of financial empowerment. Investors should prioritize platforms with strong PoR practices to safeguard their assets in this dynamic landscape.

Related Reading