As one of the world’s most valuable Big Tech companies, alongside

Microsoft,

Alphabet Inc.,

Amazon,

Meta Platforms, and

NVIDIA, Apple Inc. continues to anchor global equity markets. As of late December 2025, Apple shares trade near $271, up over 8% year-to-date, reflecting sustained investor confidence driven by the iPhone ecosystem, Apple Silicon, and a high-margin services business spanning the App Store, iCloud, and Apple Pay.

Apple (AAPL) stock performance | Source: Google

In this guide, you’ll learn what tokenized Apple stocks AAPLX and AAPLON are, how Apple’s tokenized stocks work, how they are issued and backed, their real-world use cases, benefits and risks, and how to buy or trade Apple tokenized stocks on BingX.

What Is Apple Tokenized Stock and How Does It Work?

Apple tokenized stock is a blockchain-based digital asset that tracks the real-world price of Apple Inc. common stock (AAPL). Instead of buying shares through a traditional brokerage, you gain on-chain economic exposure to Apple’s price via tokens such as AAPLX (xStock) and AAPLON (Ondo tokenized stock). These tokens mirror AAPL’s market value in near real time but do not grant shareholder rights like voting or direct dividends.

Regulated issuers such as

Backed Finance and Ondo Finance create tokenized representations of Apple stock that are fully backed or economically linked to real AAPL shares held with qualified custodians. Tokens are minted when exposure is created and burned upon redemption to help keep prices aligned with the underlying stock.

Because these tokens live on public blockchains like

Ethereum,

Solana, and

BNB Chain, Apple tokenized stocks can be traded 24/7, transferred globally, held fractionally, and integrated with crypto trading platforms and DeFi infrastructure.

Apple (AAPL) Stock vs. Tokenized Apple Stock AAPLon and AAPLx

Apple Inc. (AAPL) trades on NASDAQ under traditional equity market rules, with fixed trading hours, brokerage access, and T+ settlement cycles. In contrast, Apple tokenized stocks AAPLX and AAPLON closely track AAPL’s real-time price but trade on-chain, 24/7, without being constrained by U.S. market hours. While tokenized versions do not provide shareholder rights or direct dividend payouts, they offer continuous liquidity, faster settlement, and fractional access, allowing global and crypto-native investors to react before and after traditional markets close.

As of late December 2025, Apple Inc. (AAPL) currently trades near $271, up 8.21% year-to-date, reflecting steady investor demand for Apple’s hardware, services, and ecosystem-driven cash flows. Apple tokenized stocks mirror this price action on-chain. AAPLON (Ondo) trades at a net asset value of around $274, with a total on-chain asset value of $3.1 million, 1,866 holders, and $21.7 million in monthly transfer volume, highlighting strong usage among non-U.S. investors. AAPLX (xStock) also tracks AAPL at a similar NAV of $274, with a slightly higher total asset value of $3.2 million, a broader base of 8,500+ holders, and $5.2 million in monthly on-chain transfers. Together, these figures show how Apple’s traditional stock performance increasingly translates into measurable, liquid activity across tokenized equity markets, operating continuously beyond NASDAQ trading hours.

What Is Apple xStock (AAPLX)?

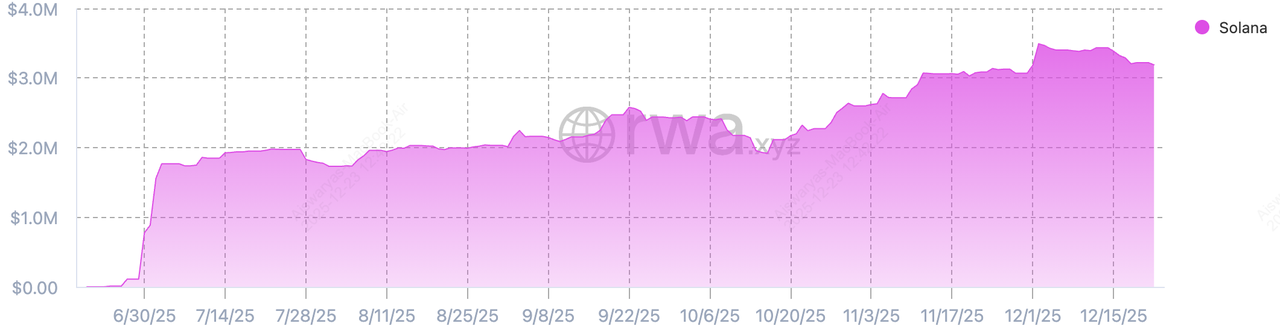

AAPLX total value | Source: RWA.xyz

AAPLX is the xStock (tracker certificate) version of Apple Inc. shares, issued by Backed Finance under Swiss financial regulations. It is deployed on public blockchains like Solana, enabling near-instant settlement, low transaction costs, and seamless integration with DeFi liquidity venues. Structurally, AAPLX

tokenized stock on Solana is designed to track Apple’s share price in near real time while maintaining regulated issuance and custody standards suitable for on-chain equity exposure.

From a market perspective, AAPLX currently trades at a net asset value of approximately $274, closely mirroring AAPL’s spot price. The token represents around $3.22 million in total on-chain asset value, held by more than 8,500 wallets, indicating broad retail participation. Monthly on-chain transfer volume of roughly $5.18 million reflects active trading and liquidity, even outside traditional U.S. market hours. At present, AAPLX charges no ongoing management fee, though users should account for issuance and redemption fees of up to 0.5%, which may apply depending on market and platform conditions.

What Is Apple Ondo Tokenized Stock (AAPLON)?

AAPLON total value | Source: RWA.xyz

AAPLON is the

Ondo Global Markets' tokenized version of Apple Inc. stock, issued by

Ondo Finance for non-U.S. retail and institutional investors. It is designed to provide economic exposure equivalent to holding AAPL, including dividend reinvestment equivalents, while leveraging Ondo’s institutional mint-and-redeem framework. Eligible users can create or redeem AAPLON 24 hours a day, five days a week, with transactions routed to traditional exchange liquidity, bridging on-chain access with off-chain market depth.

From a usage and liquidity perspective, AAPLON currently trades at a net asset value of around $274, closely aligned with Apple’s spot price. The token represents approximately $3.10 million in total on-chain asset value, held by over 1,860 wallets. Monthly transfer volume of about $21.7 million, up 56% month-over-month, indicates strong trading activity relative to its size, especially compared with xStock counterparts. Issued primarily on Ethereum and BNB Chain, AAPLON is gradually expanding to additional blockchains, reflecting growing institutional and DeFi demand for regulated, on-chain exposure to U.S. blue-chip equities.

How Do AAPLX and AAPLON Apple Tokenized Stocks Work?

Apple’s tokenized stocks rely on a regulated issuance and collateral framework bridging traditional finance with blockchain infrastructure:

1. Custody and Backing

• AAPLX is structured as a tracker certificate referencing Apple shares held with regulated custodians.

• AAPLON is issued via Ondo Global Markets and backed through qualified custodial arrangements mirroring Apple’s economic performance.

2. Minting and Redemption: Tokens are minted when exposure is created and burned upon redemption to maintain parity with AAPL’s price. Ondo enables institutional-grade mint/redemption windows.

3. Price Tracking: Tokens track AAPL using institutional pricing feeds, exchange references, and on-chain liquidity across DEXs and CEXs.

4. On-Chain Utility: AAPLX and AAPLON can be traded, transferred, and, where supported, used in DeFi strategies such as liquidity provision or

collateralized lending.

xStocks' AAPLx vs. Ondo's AAPLon: Key Differences

While both AAPLX and AAPLON track the price of Apple (AAPL), they are designed for different trading environments and user needs.

AAPLX (xStocks) is issued on Solana, prioritizing speed, low fees, and DeFi-native usability. Solana’s high throughput makes AAPLX well-suited for frequent trading, smaller position sizes, and integration with on-chain liquidity pools, aggregators, and automated strategies. In practice, AAPLX is often favored by retail and crypto-native users who want fast settlement and lower transaction costs when trading Apple exposure on-chain.

AAPLON (Ondo), by contrast, is issued on Ethereum and BNB Chain, focusing on regulated global access and institutional-grade liquidity routing for non-U.S. investors. Ethereum provides deeper integration with established DeFi protocols and institutional infrastructure, while BNB Chain offers lower fees and broader retail reach. AAPLON also supports minting and redemption tied to traditional market liquidity, making it more suitable for larger trade sizes and institutional participation.

Both tokens deliver Apple price exposure, but AAPLX optimizes for on-chain speed and cost efficiency, while AAPLON emphasizes regulatory structure, liquidity depth, and cross-chain accessibility.

What Are the Use Cases of Apple Tokenized Stocks?

Apple tokenized stocks unlock practical, on-chain ways to access Apple’s market performance beyond the limits of traditional equity trading.

1. 24/7 Trading Access: Trade AAPL exposure continuously, including nights, weekends, and during major market-moving events outside U.S. stock market hours.

2. Fractional Ownership: Gain Apple exposure with smaller amounts of capital by buying fractions of a share rather than a full AAPL stock.

3. Global Accessibility: Access Apple-linked assets from most regions without opening or maintaining a traditional brokerage account.

4. DeFi Integration: Use Apple tokenized stocks in supported DeFi workflows such as liquidity pools, collateral strategies, or automated trading.

5. Portfolio Diversification: Combine blue-chip Big Tech exposure with crypto assets to build more balanced, multi-asset portfolios.

How to Buy Apple Tokenized Stock AAPLX and AAPLON on BingX

You can buy and trade Apple tokenized stocks on BingX, which supports tokenized equities across spot and derivatives markets, with

BingX AI providing real-time market insights, trend analysis, and

risk-management tools to help you make more informed trading decisions.

Buy AAPLX or AAPLON on the BingX Spot Market

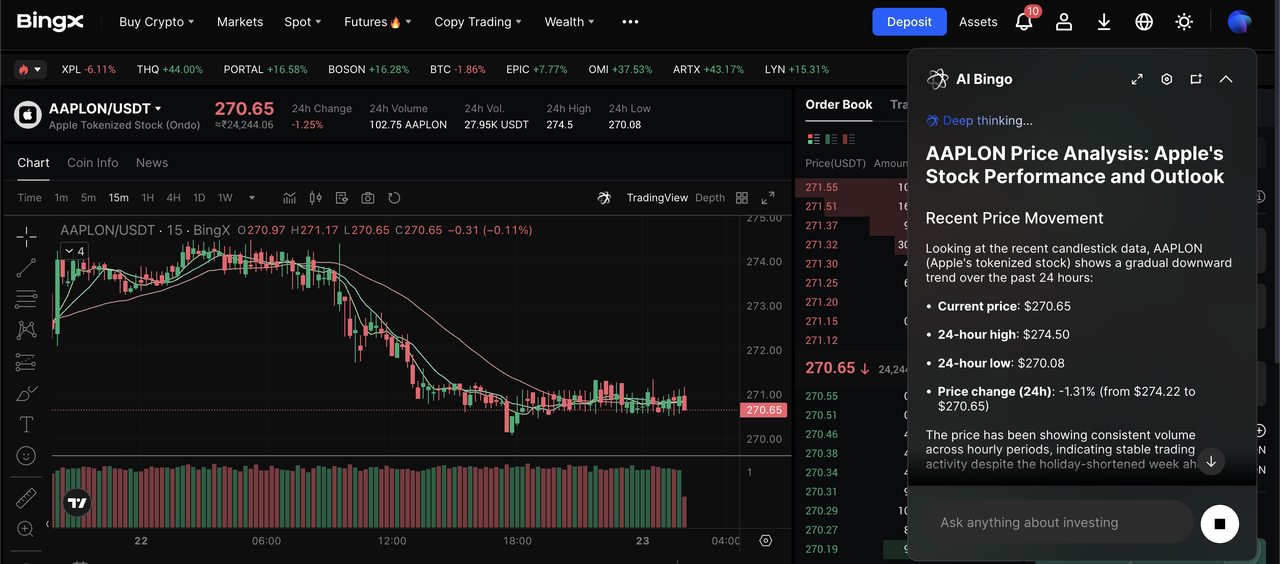

AAPLON/USDT trading pair on the spot market powered by BingX AI insights

1. Log in to your BingX account.

2. Go to Spot Trading and search for AAPLX or AAPLON.

5. Enter the amount and confirm your trade.

Trade Apple (AAPL) Exposure With Leverage on BingX Futures

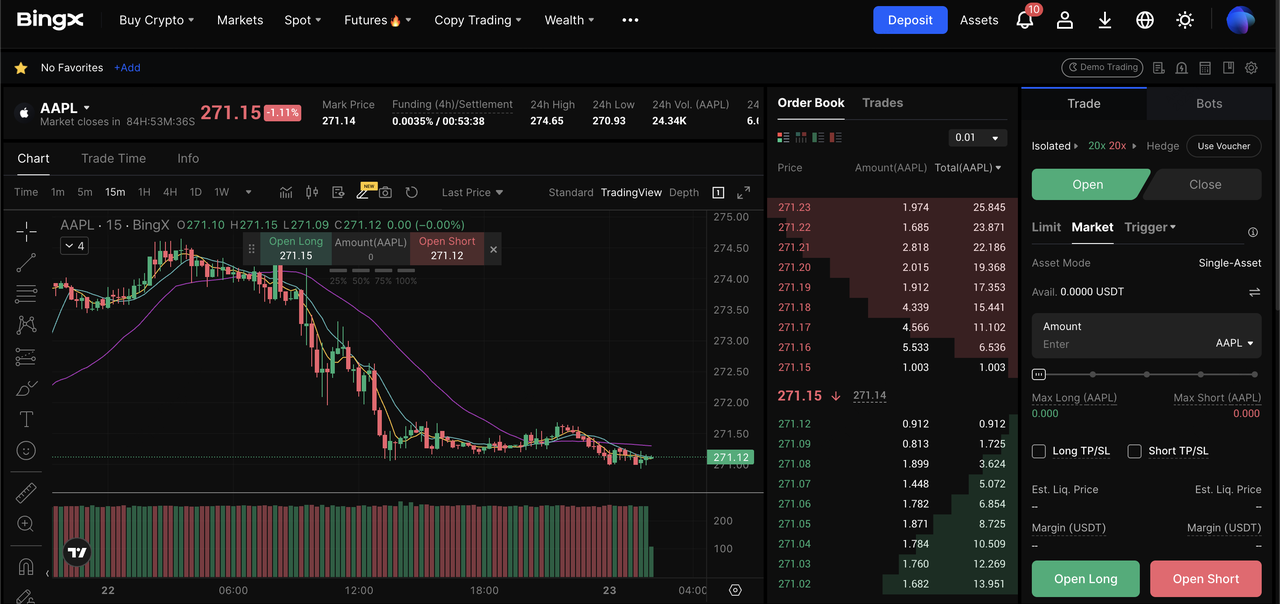

Apple (AAPL) futures contract on BingX futures

BingX supports Apple (AAPL) exposure on the futures market, allowing traders to go long or short AAPL price movements, as well as trade AAPLX-linked futures where available. With BingX Futures, you can apply leverage, set Take-Profit (TP) and Stop-Loss (SL) orders, and use BingX AI insights to analyze trends, volatility, and momentum, making it easier to manage risk while trading Apple exposure beyond traditional market hours.

1. Log in to BingX and open the Futures trading page.

3. Choose your margin mode (Isolated or Cross) and set your leverage based on your risk tolerance.

4. Select your direction: Long (Buy) if you expect the price to rise, or Short (Sell) if you expect it to fall.

5. Pick an order type (Market for instant execution or Limit for a target entry price), enter your position size, and confirm the order.

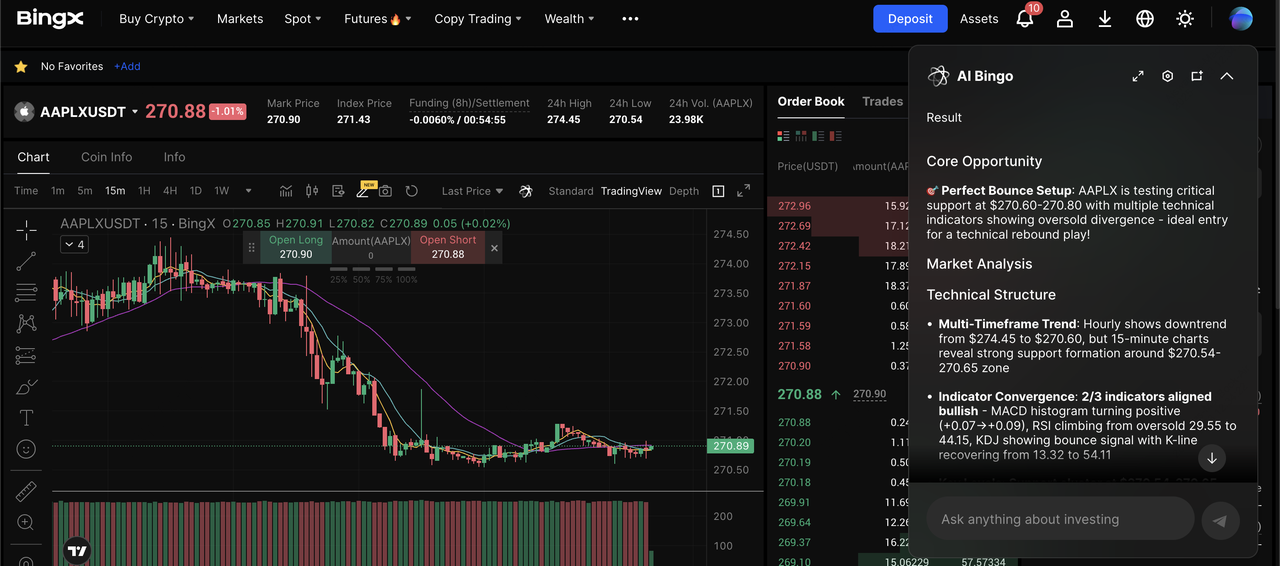

7. Monitor your position using BingX AI insights for AAPLX to track trend strength, volatility, and key levels before adjusting or closing the trade.

AAPLX/USDT perpetual contract on the futures market powered by BingX AI

What Are the Pros and Cons of Investing in Tokenized Apple Stocks?

Apple tokenized stocks offer a modern, on-chain way to access AAPL price movements, but they come with both clear advantages and important limitations that investors should weigh carefully.

Pros of Buying and Selling Tokenized Apple Shares

• 24/7 global access: Trade Apple exposure at any time without being limited by U.S. stock market hours.

• Fractional ownership: Gain exposure to Apple with smaller amounts of capital instead of buying a full AAPL share.

• No traditional brokerage needed: Access Apple-linked assets directly through crypto platforms.

• Transparent, on-chain settlement: Transfers and balances are recorded on public blockchains for verifiable transparency.

• Flexible crypto and DeFi integration: Use Apple tokenized stocks alongside spot trading, futures, and supported DeFi strategies.

Cons of Trading Tokenized Apple Stock

• No shareholder rights: Holding Apple tokenized stocks does not provide voting rights or direct dividend payments.

• Regulatory constraints: Availability and functionality depend on jurisdiction-specific regulations.

• Issuer and custody dependence: Token value relies on the issuer’s compliance and custody of underlying exposure.

• Liquidity variability: Trading depth and spreads can vary across blockchains and platforms.

Final Thoughts

AAPLX and AAPLON represent a modern evolution in accessing blue-chip equities like Apple Inc. They combine Apple’s price exposure with the speed, programmability, and accessibility of blockchain markets. While they are not substitutes for owning real AAPL shares, Apple tokenized stocks offer a compelling option for crypto-native investors, global users, and traders seeking 24/7 access to one of the most important companies in the global technology economy.

Related Reading