Coinbase is the largest U.S.-based cryptocurrency exchange and a publicly listed company on Nasdaq, and in recent years it has further strengthened its position as a core pillar of the crypto financial system. Coinbase has expanded its role in institutional crypto infrastructure, including providing custody services for multiple U.S.

spot Bitcoin ETFs and continuing to grow its

Base Layer 2 ecosystem. These developments have reinforced Coinbase’s strategic importance as crypto markets mature and institutional participation increases.

Against this backdrop, global investors are increasingly looking for more flexible ways to access Coinbase’s market performance without relying on traditional brokerage accounts. Coinbase tokenized stocks, such as

COINX (xStock) and

COINON (Ondo), are blockchain-based representations of Coinbase (COIN) shares that track the stock’s market price. These tokens provide economic exposure to Coinbase through digital assets issued by regulated tokenization providers, while typically excluding shareholder rights such as voting or dividends. Available on platforms like BingX, Coinbase tokenized stocks allow users to gain COIN exposure using USDT, with fractional access and crypto-native trading flexibility.

What Is Coinbase (COIN) and What Does Coinbase Do?

2025 COIN Price YTD Performance | Source: Google Finance

Coinbase is a U.S.-based cryptocurrency exchange founded in 2012 by Brian Armstrong and Fred Ehrsam, originally created to make

Bitcoin accessible to everyday users. Over the past decade, Coinbase has grown into one of the most influential companies in the global crypto industry, serving tens of millions of users across more than 100 countries. The company went public on Nasdaq in 2021 under the ticker COIN, and in 2025 it became part of the

S&P 500, marking a major milestone for both Coinbase and the broader crypto sector as digital asset companies continue to integrate into traditional financial markets.

From its early days, Coinbase attracted backing from prominent investors including Andreessen Horowitz (a16z), Union Square Ventures, Tiger Global, and Y Combinator, helping it scale into a regulated and institutionally trusted platform. Today, Coinbase operates not only as a crypto exchange, but also as a diversified blockchain infrastructure provider supporting trading, custody, payments, and on-chain applications.

Core Coinbase Platforms and Products

• Crypto Exchange: The Exchange is the company’s core trading platform, offering spot trading for a wide range of cryptocurrencies. It serves both retail and professional users and supports fiat-to-crypto and crypto-to-crypto transactions. Trading fees and spreads from this platform remain a primary revenue source for Coinbase.

• Crypto Custody: Its Custody provides institutional-grade asset storage and security services for asset managers, hedge funds, and financial institutions. In 2024 and 2025, Coinbase was selected as the custodian for multiple U.S. spot Bitcoin ETFs, strengthening its position as a trusted infrastructure provider within regulated financial markets.

• Base Network: Base is Coinbase’s

Ethereum Layer 2 network built using the

OP Stack and led by

Jesse Pollak, Coinbase’s Head of Protocols. Base is designed to support decentralized applications,

Base DEXs,

stablecoins, payments, and on-chain financial products with lower fees and faster settlement. Coinbase has also introduced the

Base App, a consumer-facing application that helps users explore Base-native apps, tokens, and on-chain activity more easily.

• Wallet and Payments: Coinbase offers a

self-custodial wallet that enables users to interact directly with decentralized applications,

NFTs, and

DeFi protocols. Alongside the wallet, Coinbase continues to expand crypto payment tools to support faster and more accessible digital asset transfers across networks.

Together, these platforms position Coinbase not only as a leading crypto exchange, but also as a foundational company building infrastructure for the on-chain economy.

What Are Coinbase Tokenized Stocks and How Do They Work?

COIN Tokenized Stocks Market Cap | Source: RWA.xyz

Coinbase tokenized stocks are digital assets that provide on-chain price exposure to Coinbase (COIN) shares. Rather than purchasing COIN through a traditional brokerage, investors access its market performance via blockchain-based tokens issued under different structures, including centralized exchange listings, regulated

real-world asset (RWA) frameworks, and DeFi-native or synthetic models. These tokens track COIN’s price movements but typically do not include shareholder rights such as voting or dividends.

RWA.xyz data shows that on-chain demand for Coinbase tokenized stocks has expanded meaningfully, with total on-chain value growing by approximately 60–80% from mid-2024 to 2025, reaching around USD 7–9 million and peaking near USD 9–10 million. This exposure is currently distributed across several tokenized formats, each reflecting a distinct tokenization approach, with custodial-backed models accounting for the majority of value and liquidity.

COINX xStock vs. Ondo's COINON: Different Types of Coinbase Tokenized Stocks

Each version offers exposure to Coinbase’s stock price, but differences in issuance model, custody structure, and trading venue can significantly affect transparency, liquidity, and risk.

1. COINX (xStock): COINX is a tokenized version of Coinbase stock issued under the

xStocks framework. It is designed to track the market price of COIN shares and is commonly listed on centralized exchanges. COINX is typically traded on spot markets using USDT, offering fractional exposure and a straightforward exchange-based trading experience.

2. COINON (Ondo): COINON is a Coinbase tokenized stock issued within the

Ondo ecosystem, which focuses on compliant real-world asset tokenization. Ondo’s structure emphasizes regulated custody and institutional-grade backing, allowing COINON to mirror Coinbase’s stock price while remaining distinct from direct equity ownership.

3. dCOIN (DeFiChain): dCOIN is a DeFi-native tokenized stock available on DeFiChain, a blockchain designed specifically for decentralized financial applications. Unlike custodial tokenized stocks, dCOIN does not represent direct ownership of Coinbase shares. Instead, it provides synthetic price exposure to COIN through overcollateralized positions, decentralized liquidity pools, and oracle-based price feeds. This design enables permissionless access and DeFi composability but introduces additional risks related to smart contracts, collateral management, and price oracles.

How Do Coinbase Tokenized Stocks Work?

Despite differences across platforms, most Coinbase tokenized stocks follow a similar process:

1. Price exposure is established: The issuer or protocol establishes exposure to Coinbase stock either by holding real COIN shares with a regulated custodian or by using synthetic mechanisms such as overcollateralized positions and oracle pricing.

2. Blockchain tokens are created: Tokens representing that exposure are issued on a blockchain. Each token is designed to reflect a specific amount or fraction of Coinbase’s stock value.

3. Tokens trade on crypto platforms: Investors trade these tokens on centralized exchanges or DeFi protocols using stablecoins or on-chain liquidity pools. While prices aim to track COIN’s market value, token holders generally do not receive shareholder rights such as voting or dividends.

This structure allows global investors to access Coinbase’s stock performance through crypto markets while remaining separate from traditional equity ownership.

How to Buy Coinbase Tokenized Stocks COINX and COINON on BingX

BingX is one of the global crypto exchanges that supports trading for selected tokenized stocks, allowing users to gain price exposure to U.S. equities like Coinbase without using a traditional brokerage account. On BingX, users can access Coinbase-related exposure through two different product types: spot tokenized stocks and stock price–linked futures.

Availability may vary by region and regulatory requirements, and product offerings can differ between spot and futures markets.

Step 1: Create and Verify a BingX Account

Sign up on the BingX website or app and complete the basic registration. Finish identity verification (

KYC) to unlock full trading limits and enable deposits, trading, and withdrawals.

Step 2: Deposit USDT or Supported Assets

Go to the “Deposit” section and add funds to your BingX wallet. You can transfer in USDT or other supported cryptocurrencies, or use available fiat on-ramps such as card payments or bank transfers, depending on your region.

Step 3: Choose Between Spot Tokenized Stocks or Futures

On BingX, Coinbase exposure is available through different formats:

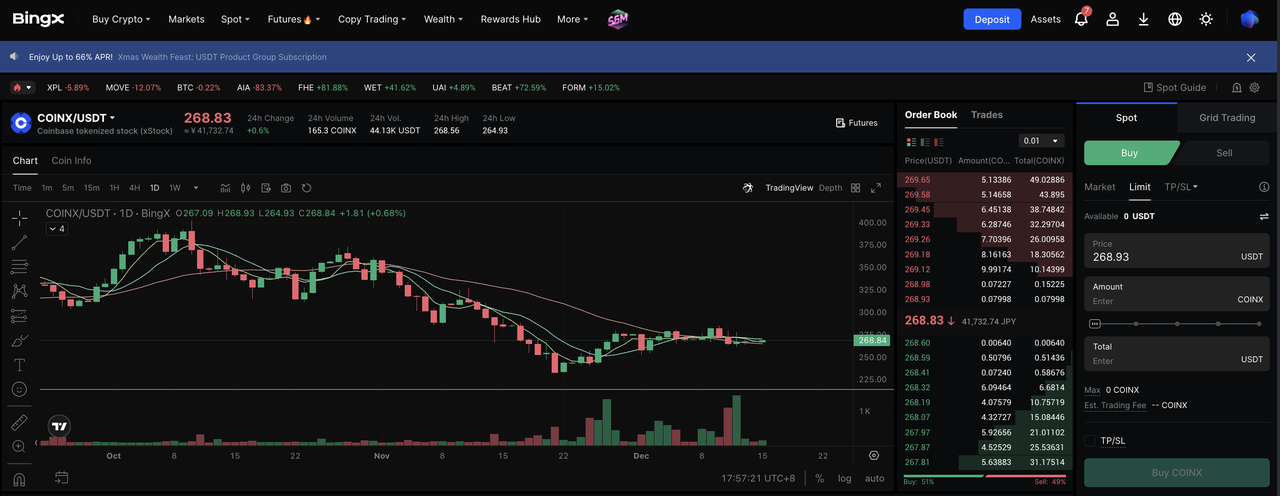

1. Spot Tokenized Stocks (COINX and COINON)

In the

BingX Spot Market, users can buy

COINX/USDT (xStock) or

COINON/USDT (Ondo), which are blockchain-based tokens designed to track the market price of Coinbase (COIN) stock. Spot trading allows users to hold these tokens directly and gain price exposure without leverage.

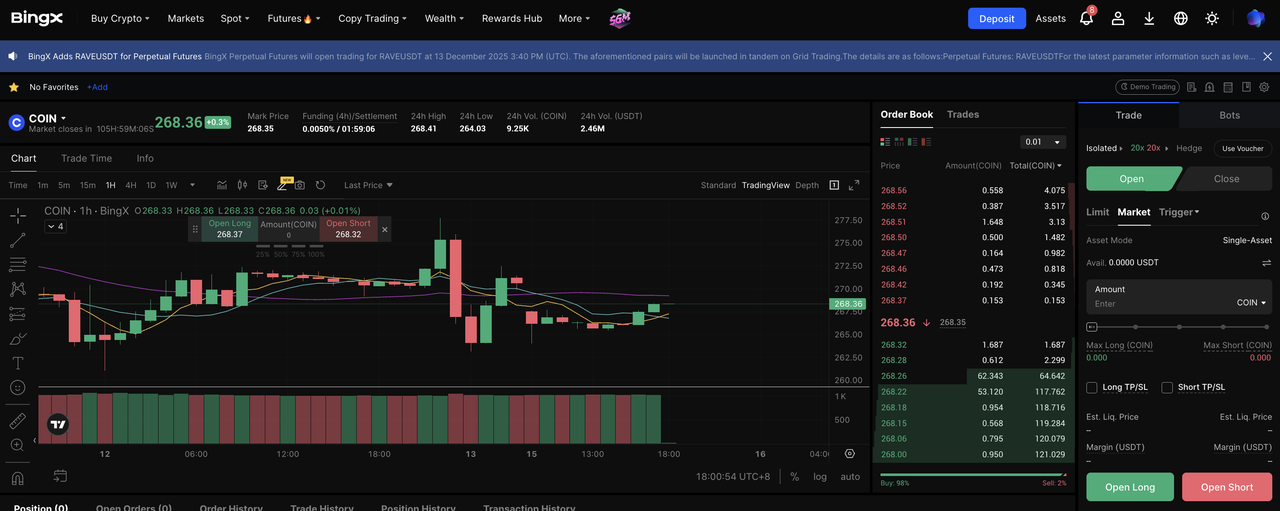

2. Stock Price–Linked Futures (COIN)

In the

Futures market, BingX offers contracts that track the market price of Coinbase (COIN) stock, rather than representing ownership of shares or tokenized stocks. These futures allow users to speculate on COIN’s price movements using leverage and support both long and short positions, without holding any underlying equity or tokenized asset.

Step 4: Place Your Order with the Help of BingX AI

To support decision-making,

BingX AI provides market insights such as price trends, volatility indicators, and basic market signals, helping users assess market conditions before entering spot or futures positions.

Select a

market or limit order based on your strategy. For futures trading, review leverage settings, margin requirements, and liquidation risks carefully before confirming your order.

Step 5: Manage Your Position

Spot purchases of COINX or COINON will appear in your spot wallet, while futures positions linked to the price of COIN stock can be monitored and managed in the futures dashboard. Users can hold, close, or adjust positions depending on market conditions and risk tolerance.

By clearly separating tokenized stock ownership (spot) from price-linked derivatives (futures), BingX allows users to choose the structure that best fits their investment or trading goals.

Risks and Considerations Before Investing in Coinbase Tokenized Stock

Coinbase tokenized stocks are best viewed as price exposure tools, not direct substitutes for owning COIN shares, and should be evaluated accordingly.

• No share ownership: Coinbase tokenized stocks such as COINX and COINON do not represent legal ownership of COIN shares. Holders do not receive voting rights, shareholder privileges, or guaranteed dividend distributions.

• Issuer and structural risk: Tokenized stocks rely on third-party issuers, custodians, and settlement mechanisms. Disruptions in custody, issuance, or redemption processes could affect liquidity or price tracking.

• Price tracking differences: While designed to follow COIN’s market price, tokenized stocks may experience temporary deviations due to liquidity conditions, platform-specific trading hours, or market volatility.

• Regulatory uncertainty: Tokenized equities operate across both securities and crypto frameworks. Regulatory changes may impact availability, trading conditions, or user eligibility depending on jurisdiction.

• Platform and operational risk: Trading tokenized stocks on crypto exchanges introduces platform-related risks such as withdrawal limits, regional restrictions, or service interruptions that differ from traditional brokerages.

Final Thoughts: Is Coinbase Tokenized Stock a Good Investment?

Coinbase tokenized stocks like COINX and COINON make it easier for global and crypto-native investors to gain exposure to Coinbase’s market performance without a traditional brokerage account. They offer simple, stablecoin-based access to a company that often acts as a high-beta proxy for the broader crypto market, benefiting when prices rise, liquidity improves, and institutional adoption accelerates.

However, these tokens do not provide shareholder rights or long-term ownership benefits; they are trading instruments, not equity. For investors who already believe in Coinbase’s long-term role in crypto infrastructure, tokenized stocks can serve as an alternative entry point, but the underlying investment thesis remains unchanged. Understanding their structure, limits, and risks is crucial before adding them to a portfolio.

Related Reading

FAQs on Coinbase Tokenized Stocks

1. Do COINX or COINON give me voting rights or shareholder privileges?

No. COINX and COINON provide economic price exposure only. They do not include voting rights, governance privileges, or any traditional shareholder benefits associated with owning Coinbase (COIN) shares.

2. Where can I buy COINX and COINON?

COINX and COINON can be purchased on platforms such as BingX, where they are typically traded in spot markets against USDT. Availability may vary by region and platform support.

3. Are COINX and COINON backed 1:1 by real Coinbase shares?

This depends on the issuer. Neither token represents direct share ownership.

• COINX (xStock) is structured to track Coinbase’s stock price through custodial or equivalent financial arrangements designed to mirror COIN’s market value.

• COINON (Ondo) is issued under Ondo’s real-world asset framework, which emphasizes regulated custody and institutional-grade structures to maintain alignment with Coinbase’s stock price.

4. Which blockchain networks are COINX and COINON issued on?

COINX and COINON are issued on supported public blockchains, depending on the issuer and platform integration. Common networks include

Ethereum,

Solana, and other major smart contract chains supported by centralized exchanges and on-chain infrastructure.

5. Are Coinbase tokenized stocks the same as COIN stock futures?

No. Tokenized stocks like COINX and COINON are spot products designed to track COIN’s price through on-chain tokens. Stock price–linked futures track the price movement of COIN without involving tokenized assets or ownership of shares.

6. Can I trade Coinbase tokenized stocks outside U.S. market hours?

Yes. One advantage of tokenized stocks is extended trading availability. On supported platforms, COINX and COINON can often be traded beyond standard U.S. equity market hours, subject to platform liquidity and trading rules.