FTX’s native token,

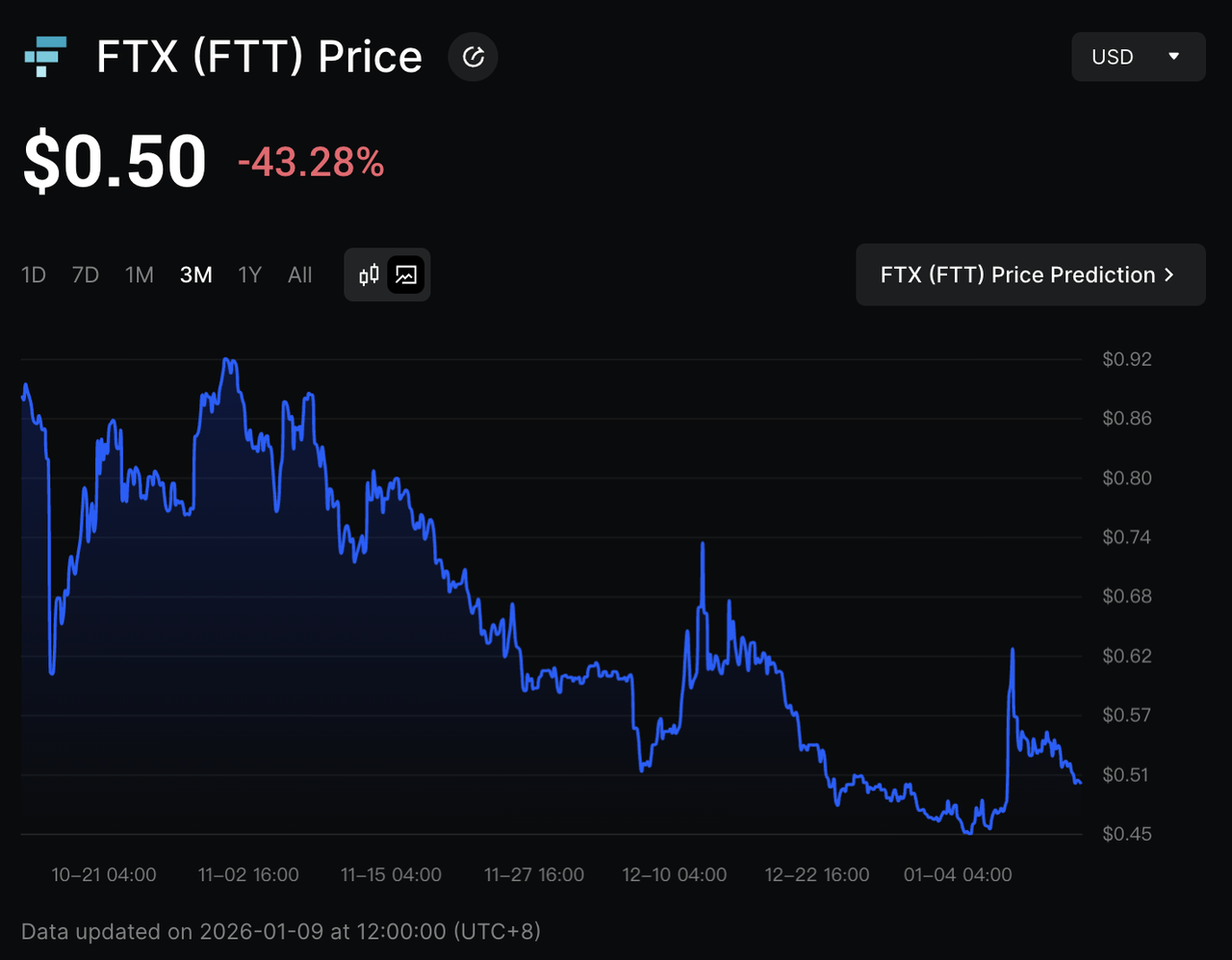

FTT, has remained highly sensitive to headlines rather than underlying fundamentals. On January 9, 2026, U.S. President Donald Trump stated in an interview with

The New York Times that he will not pardon former FTX CEO Sam Bankman-Fried (SBF), ending public speculation around potential clemency. Earlier in the month, FTT showed a modest rebound alongside

Bitcoin and the broader crypto market, and the January 9 announcement has had no observable impact on FTT’s price so far.

FTT price movement in 3 months | Source:

BingX

That clarification followed a volatile period in late 2025. On October 24, FTT surged 16.9% during a broader crypto rally, partly driven by unconfirmed rumors that Bankman-Fried might receive a presidential pardon. Market sentiment at the time had also been influenced by Trump’s earlier decision to

pardon Binance founder Changpeng “CZ” Zhao, reinforcing the perception that political developments could move prices even for distressed crypto assets. SBF further sustained short-term trading interest by claiming on October 16, 2025 that his 2022 arrest was politically motivated to prevent testimony on crypto regulation. While such claims did not alter FTX’s collapse or FTT’s lack of operational utility, they continued to shape headline-driven market activity.

This article explains what FTT is, traces its rise and collapse, and outlines the major risks investors should weigh before trading a token whose price action remains closely tied to narrative shifts rather than fundamentals.

What Is FTX Token (FTT) and How Does It Work?

FTT was the native token of the now-defunct crypto exchange FTX. It served as a utility token for fee discounts,

staking perks, derivatives collateral, and a deflationary buy-and-burn mechanism. The tokenomics allocated part of FTX's revenues to repurchase FTT and then destroy it. More than 20 million tokens were removed from circulation before the bankruptcy. The maximum supply is 328.9 million.

Since FTX collapsed in November 2022, its real-world utility has vanished. As of 2025, there is no substantive code development, and the tokenomics are effectively frozen. The former benefits, such as fee tiers, staking rewards, and access features, no longer exist without a platform. Market frameworks also shifted. On May 9, 2025, Binance cut FTT’s portfolio margin collateral ratio from 20% to 10%, which reduced its role in leveraged strategies and tilted sentiment bearish.

In short, FTT now trades as a speculative

altcoin without a functioning ecosystem. If you trade FTT pairs, you are trading narratives rather than fundamentals. Keep positions small, check liquidity, and budget for slippage when managing your

crypto wallets.

The FTX Story

FTX rose rapidly, using innovative derivatives and a centralized collateral pool to become a market leader, reaching a $32 billion valuation in 2021. FTT printed its all-time high at $85.02 on September 9, 2021. High-profile sponsorships and deals, including MLB branding and the LedgerX acquisition, drove visibility. In November 2022 the crash came: a liquidity crisis, bankruptcy, and investigations.

There were isolated reactions in 2023. Talk of a possible reboot briefly lifted FTT in April. In September, Binance listing the FTT/USDT pair added about 8%. None of this fixed the core problem. SBF was convicted on seven counts in November 2023 and sentenced to 25 years, with an expected release date of October 25, 2044. An “FTX 2.0” did not materialize, and development on FTT stalled. Still, speculation flares whenever legal milestones or social media sparks appear.

Oct 31, 2025: SBF’s X account posted a 14-page memo claiming a short-term liquidity crunch, not insolvency. It says FTX in 2022 had $25B in assets plus $16B in equity against $13B in liabilities. If FTX and Alameda had kept their portfolio, it would now be about $136B including a hypothetical $14.3B stake in Anthropic and $7.6B in Robinhood, putting FTT near $22B marketcap.

For many, FTT is a zombie asset: it can be traded, but it lacks a sustainable future. Its price pattern shows sharp, short spikes followed by swift rollovers, making it more akin to

memecoins and news trades than to mature crypto sectors.

Can Politics Push FTT? CZ Pardon and SBF Odds

Here are some factors that continue to influence volatility in the FTX Token (FTT) price:

1. Political Headlines Can Still Move FTT, But the Impact Has Faded

2. Pardon Chatter Briefly Fueled Momentum Before Losing Traction

FTT previously reacted to political developments, particularly after the October 2025 pardon of Binance founder Changpeng “CZ” Zhao, which briefly shifted attention to whether Sam Bankman-Fried could receive similar treatment.

Prediction markets such as

Polymarket and

Kalshi reflected that short-term interest, with implied odds initially rising from around 4% to roughly 12%.

More recently, a new Polymarket poll asking who President Trump might pardon before 2027 shows the implied probability for Bankman-Fried dropping to around 5%, alongside declining trading activity. As of January 2026, related contracts have either closed or lost momentum, reinforcing that speculation around a potential pardon has largely subsided.

Poll: Will Trump pardon SBF in 2027? | Source:

Polymarket3. Unlike CZ, Trump Has Ruled Out a Pardon for SBF

While U.S. President Donald Trump granted a pardon to Binance founder Changpeng Zhao in October 2025, he has taken a different position on Sam Bankman-Fried. Bankman-Fried was convicted on all counts after a full jury trial and sentenced to 25 years for large-scale financial fraud involving widespread customer losses, whereas Zhao pleaded guilty to regulatory violations and did not face allegations related to the misuse of customer funds. In a January 9, 2026 interview with The New York Times, Trump stated that he will not pardon Bankman-Fried, directly addressing months of speculation and explicitly rejecting the possibility of presidential action in SBF’s case.

4. Social media remains an accelerant

A simple “gm” posted from SBF’s account in September 2025 sent FTT up about 46% within minutes. Most of those gains faded soon after, underscoring how quickly sentiment can flip.

How to Trade FTX (FTT) on BingX

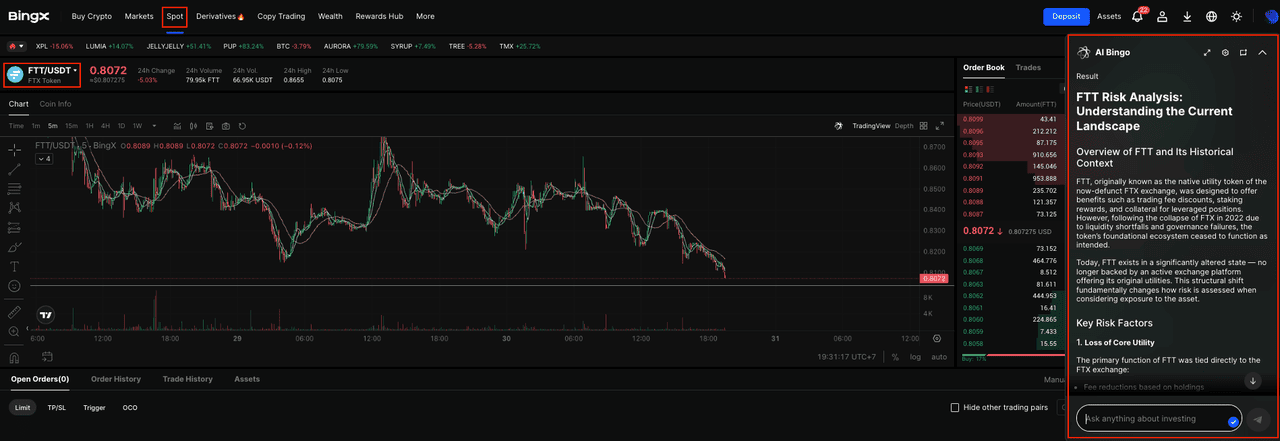

Whether you are building a long-term FTT position, trading short-term volatility. BingX provides flexible ways to trade the token. With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

FTT/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit FTT or USDT and verify the correct network before trading.

Note: This is not financial advice. Crypto assets, especially FTT, carry a very high level of risk. Only ever trade with money that you can afford to lose.

FTT Trading Risk Brief

• No active ecosystem: FTX is wound down; FTT has no functional use case today.

• Frozen code and tokenomics: No meaningful updates since 2022; burn mechanics effectively stopped.

• Exchange policy risk: Collateral rules can tighten without notice. Always confirm your exchange’s margin treatment before

trading.

• News and politics beta: Pardon chatter, court dates, and social posts can trigger 20–60% intraday swings.

• Liquidity traps: Spikes bring slippage and wide spreads, especially with market orders.

• Legal overhang: Ongoing legal processes and potential policy shifts can reshape the setup.

• Creditor flows: Repayment timelines can sway sentiment and perceived sell pressure.

• Narrative-driven price: Price discovery relies on story cycles, not fundamentals. Adjust size, leverage, and holding periods accordingly.

Conclusion

FTT trades less like a utility asset and more like a headline-driven instrument tied to the aftermath of the FTX collapse. In the past, short-lived rallies have emerged around legal developments, political headlines, or viral social media activity, often reversing quickly due to the absence of a functioning ecosystem or clear economic role for the token. With U.S. President Donald Trump explicitly ruling out a pardon for Sam Bankman-Fried, one of the most persistent narrative catalysts has now been removed.

For traders, FTT remains a high-volatility, event-driven asset. Any exposure should be approached with clearly defined setups, strict risk controls, and an awareness of thin liquidity. Key factors to monitor include court-related milestones, creditor distributions, and broader market conditions rather than political speculation. As a long-term allocation, FTT offers limited justification; as a short-term trading instrument, it may still present opportunities if risk is carefully managed.

Related Reading