Superform is a cross-chain DeFi wealth management protocol that aggregates yield opportunities across multiple blockchains into a single non-custodial interface. In

Decentralized Finance (DeFi), fragmentation remains a major barrier to adoption. Users are often required to manage multiple wallets, bridge assets across different blockchains, and manually track yields across a wide range of protocols. These liquidity silos increase operational complexity and make efficient capital allocation difficult.

As of February 2026, Superform has evolved into a user-owned on-chain

neobank, enabling users to save, earn, swap, and transfer value while retaining full control of their assets. The UP token represents governance and economic participation in the protocol and is accessible to global users through platforms such as BingX.

What Is Superform (UP)?

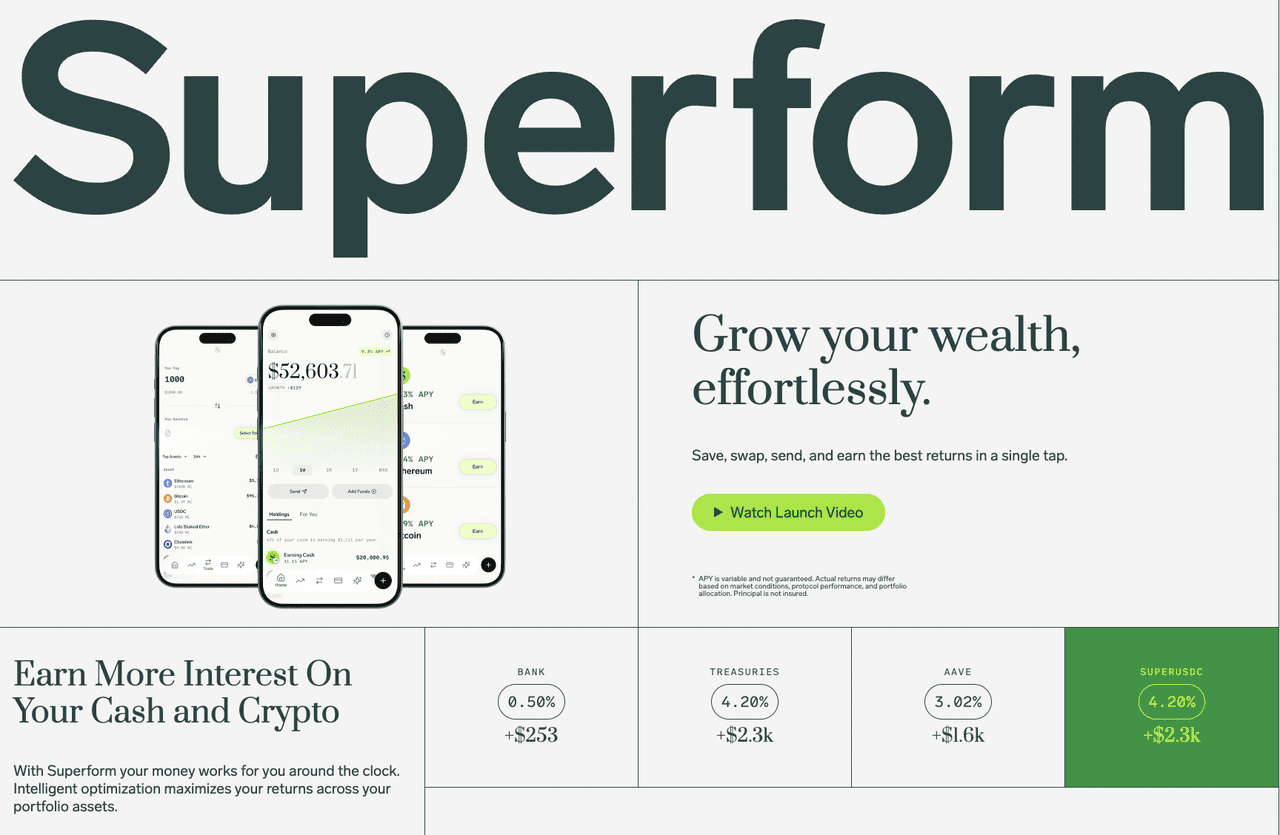

Source: Superform Website

Superform is the first user-owned neobank designed to simplify how users grow their crypto portfolios. It acts as a "financial layer" for the internet, providing a unified interface to access over 1,000 earning opportunities across 50+ protocols and 7+ major chains. By aggregating the fragmented DeFi landscape, it offers a "one-stop-shop" experience that mirrors the convenience of modern fintech apps like Revolut or Chime, but with the transparency and efficiency of blockchain.

Unlike traditional banks, Superform is strictly

non-custodial. All funds are held in the user's individual smart wallet, which can be created instantly via email, Apple, or Google login thanks to Account Abstraction. The protocol's vision is total financial freedom through a "set-and-forget" experience. In a world of high inflation, Superform delivers yields that consistently outperform traditional benchmarks like T-Bills or high-yield savings accounts, essentially democratizing professional-grade wealth management.

How Does Superform Work?

Superform combines advanced blockchain architecture with a user-friendly interface to solve the biggest pain points in crypto. Here are the five key innovations powering the protocol:

1. Universal One-Click Execution: Superform abstracts multi-step cross-chain operations, including bridging, asset swaps, and vault deposits, into a single user authorization. Execution is coordinated through the Core infrastructure, removing the need for manual interaction with

multiple bridges,

exchanges, or intermediate protocols.

2. Omnichain Savings (SuperAssets): SuperAssets such as SuperUSD and SuperETH allow users to hold assets on their preferred settlement chain, including

Ethereum or

Base, while yield generation occurs on other networks such as

Arbitrum or

Optimism. The protocol automatically routes capital to

yield opportunities across chains and streams the resulting returns back to the user’s originating chain without requiring manual rebalancing.

3. Validator-Secured Safety: Superform relies on a decentralized network of bonded validators to safeguard protocol integrity. Validators are required to stake capital and are subject to slashing if they submit inaccurate or malicious vault performance data, creating strong economic incentives for accuracy and reliability.

4. Smart Account Freedom: Built on the ERC-7579 standard, Superform wallets operate as programmable smart accounts rather than externally owned accounts (EOAs). This architecture enables features such as account abstraction–based login methods, gas-sponsored transactions, and modular security hooks that can be configured to meet different user requirements.

5. On-Chain Verifiability: All protocol activity on Superform is fully transparent and verifiable

on-chain. Users can track capital allocation, vault positions, and execution paths in real time through SuperScan, eliminating reliance on opaque, off-chain reporting.

How to Start Managing Wealth with Superform: Step-by-Step Guide

Superform provides an on-chain wealth management experience designed to be intuitive, programmable, and transparent. The platform is structured around four core functions that guide users from initial capital onboarding to long-term portfolio management.

1. Save: Moving Capital On-Chain

Before generating yield, capital must first be brought on-chain. Superform enables users to connect a traditional bank account through its integrated Bridge feature, allowing fiat funds to be converted into

yield-bearing stablecoins. This process emphasizes low transaction costs and near-instant settlement, ensuring that capital becomes productive immediately after conversion.

2. Earn: Accessing Global Yield Opportunities

Once funds are held within a Superform wallet, users can deploy capital across the protocol’s yield marketplace. The Earn interface provides access to over 1,000 SuperVaults spanning multiple risk profiles, from conservative stablecoin strategies to higher-yield liquidity provisioning. Deposits across more than seven supported chains can be executed through a single authorization without requiring users to manage cross-chain steps manually.

3. Swap: Portfolio Rebalancing and Asset Allocation

Effective portfolio management requires the ability to reallocate assets efficiently as market conditions evolve. Superform allows users to swap between supported tokens using smart routing that sources optimal pricing while automatically managing any required cross-chain execution. This design removes the need for manual bridging and reduces operational risk during asset transfers.

4. Send: On-Chain and Off-Chain Payments

Superform supports both crypto-native transfers and fiat settlement. Users can send assets directly to other on-chain addresses or use the off-ramp feature to transfer funds to traditional bank accounts. This enables users to settle international payments or cover everyday expenses directly from their on-chain balance, including yield generated through the protocol.

Superform vs. Traditional Neobanks: What Are the Key Differences?

The fundamental difference between Superform and legacy banking lies in the removal of the middleman. While traditional banks utilize your deposits to generate profit for shareholders through opaque lending practices, Superform routes that same capital efficiency directly to the user through audited smart contracts. This shift from institutional custody to user-owned liquidity changes the mathematical reality of your savings.

| Feature |

Superform Neobank |

Traditional Neobank (HSBC, Chase, etc) |

| Control |

Self-Custodial (You own your keys) |

Custodial (Bank can freeze assets) |

| Avg. Yield |

~8.4% APY (DeFi Strategies) |

~0.01% - 4.25% APY |

| Onboarding |

Instant (Email/Social Login) |

1-5 Days (Manual KYC & Paperwork) |

| Accessibility |

Permissionless (Global) |

Geographically Restricted |

| Transparency |

Real-time On-chain (SuperScan) |

Opaque (Quarterly Statements) |

What Is the UP Token used for?

The UP token is the heart of the Superform ecosystem, acting as the primary coordination and security asset.

• Governance & Direction: UP holders are the "owners" of the neobank. They vote on which protocols are integrated, how fees are distributed, and which SuperVaults receive liquidity incentives.

• Validator Bonding: To secure the network, validators must stake UP tokens. This "Skin in the Game" ensures that the price and yield data reported to the user is 100% accurate.

• Staking & Protocol Revenue: Users who stake UP receive a portion of the protocol's transaction and management fees. Additionally, staking UP unlocks "Boosted APYs," allowing users to earn higher interest rates on their savings compared to non-stakers.

What Is Superform (UP) Tokenomics?

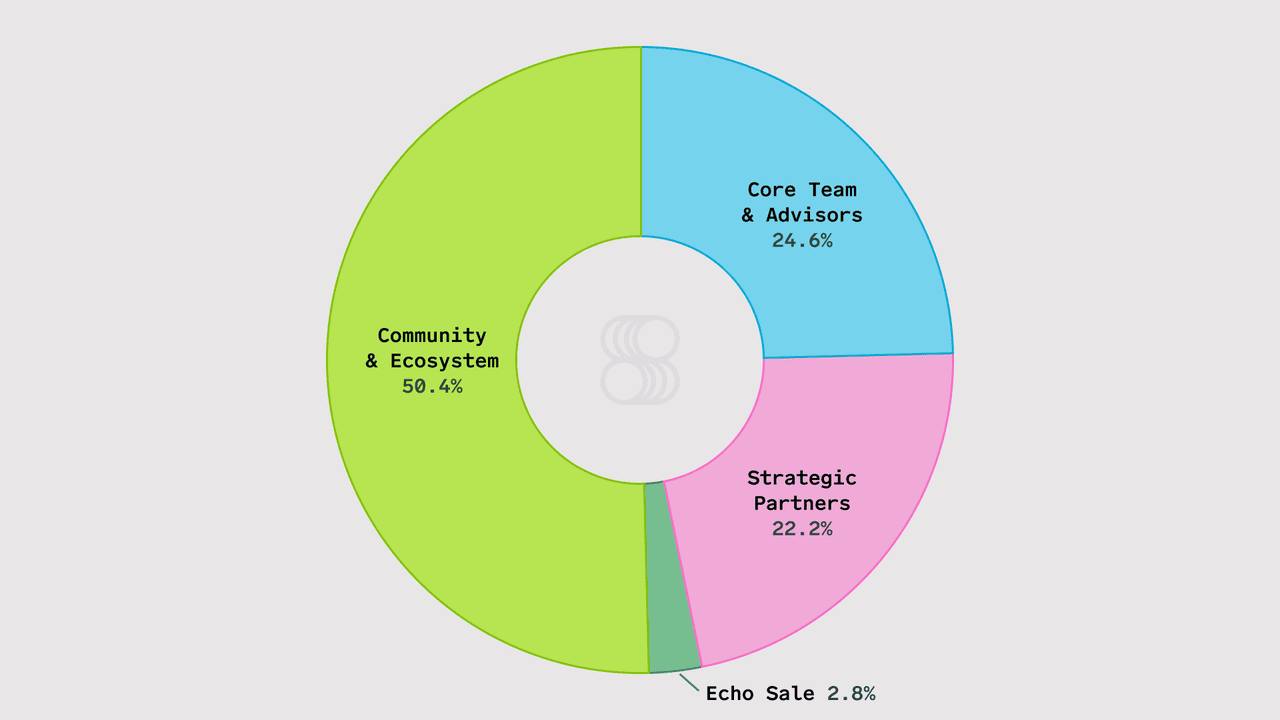

Source: Superform $UP Tokenomics

The UP token features a robust economic design with a fixed maximum supply of 1,000,000,000 (1 Billion) tokens. The allocation, as of February 2026, is as follows:

• Community & Ecosystem (50.4%): The largest portion is dedicated to the users. This funds the Superform Safari rewards, airdrops, and liquidity mining to ensure the protocol remains decentralized.

• Core Team & Advisors (24.6%): Incentivizes the builders who created the infrastructure. These tokens are subject to a strict 12-month cliff followed by 24 months of linear vesting to ensure long-term alignment.

• Strategic Partners (22.2%): Includes early-stage backers like Polychain Capital, Circle Ventures, and VanEck, who provide the institutional bridge for the protocol.

• Echo Sale (2.8%): Tokens allocated for the initial public community sale.

Inflation Guard: There is a strict 0% emission rate for the first 36 months. Any future inflation is capped at 2% and requires a "Super-Majority" governance vote.

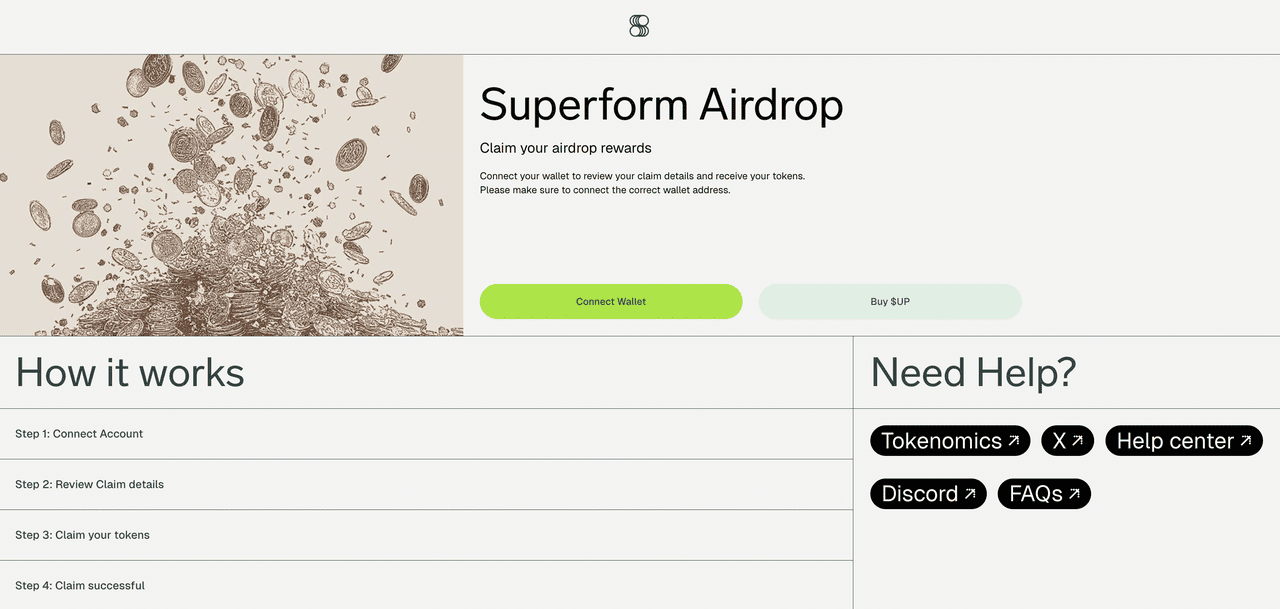

What Is the Superform (UP) Airdrop and How to Claim $UP Tokens?

With the Superform Token Generation Event (TGE) taking place on February 10, 2026, the transition from Safari Safari rewards to liquid UP tokens is officially underway. The protocol has allocated 50.4% of the supply to the community, primarily rewarding those who earned Safari XP, CREDs, or collected SuperFren NFTs during the pre-launch seasons.

Source: Superform $UP Airdrop Claim Portal

How to Claim Your UP Airdrop

2. Claim Tokens: Follow the on-screen instructions to claim your UP allocation. Note that while many tokens are unlocked immediately, some allocations may follow the protocol's linear vesting schedule.

3. Check for Bonus Rounds: If you hold rare SuperFren NFTs, ensure they are in your connected wallet, as these often act as multipliers for final distributions.

How to Buy and Sell Superform (UP) on BingX

The Token Generation Event (TGE) for Superform (UP) is scheduled for February 10, 2026, at 10:00 AM (UTC). Following this launch, BingX will open the spot market for $UP, allowing airdrop recipients and new investors to trade immediately.

Whether you want to accumulate UP for long-term yield generation or trade volatility post-launch, BingX makes it accessible through its spot market. With BingX AI integrated directly into the trading interface, traders can also access real-time market insights to support more informed decision-making.

Step 1: Log in or register. Create a new BingX account or log in to your existing one and complete any necessary identity verification to unlock full trading features.

Step 3: Use BingX AI. Before placing an order, click the AI icon on the chart to activate

BingX AI. The tool highlights

support and resistance levels, potential breakout zones, and suggested entry ranges based on recent price action.

Step 4: Place an order. Choose a

market order for instant execution or a

limit order at your preferred price. Once filled, your UP will appear in your BingX wallet, where it can be held or transferred to your Superform Smart Wallet for on-chain staking.

4 Key Considerations Before Investing in Superform (UP)

Every investment involves risk, particularly in decentralized finance. Users should consider the following factors before interacting with Superform.

1. Smart Contract Risk: Although Superform is audited by firms such as Spearbit and yAudit, it interacts with third-party vaults and protocols. Vulnerabilities in underlying systems, including

Aave or

Curve, could impact user funds.

2. Market Volatility: The UP token’s value is influenced by platform usage and total value locked. Market downturns or reduced DeFi activity may lead to significant price fluctuations.

3. Regulatory Uncertainty: Changes in

stablecoin regulations or compliance requirements for fiat off-ramping may affect certain Superform features.

4. Cross-Chain Infrastructure Risk: Superform relies on third-party bridge infrastructure and its validator network. While bonded validators reduce risk, failures in external cross-chain systems remain possible.

Final Thought: Should You Invest in Superform (UP) in 2026?

As of February 2026, Superform has moved beyond the "experimental" phase. With over $10B in TVL and a user base exceeding 180,000 depositors, it is the leading infrastructure for cross-chain wealth. By solving the UX problems that held DeFi back for years, Superform has positioned itself as the "front-end of finance."

For investors, the UP token represents a stake in a protocol that is effectively capturing the "yield spread" of the entire internet. If the trend of traditional finance moving on-chain continues, Superform is arguably the most important piece of infrastructure in the space.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Superform is not a bank and is not FDIC insured. Always conduct your own research (DYOR) before investing.

Related Reading

Frequently Asked Questions on Superfrom (UP)

1. Which blockchain is the Superform (UP) token deployed on?

The canonical UP token is deployed on Ethereum mainnet. As part of Superform’s omnichain strategy, approximately 15% of the total supply is bridged to Base using

LayerZero OFT technology. This enables cross-chain utility while reducing transaction costs for governance and staking.

2. Which wallets support the UP token?

UP is compatible with standard Web3 wallets, including

MetaMask and Rabby. In addition, Superform supports smart accounts through account abstraction, allowing users to manage UP tokens via a Smart Wallet created directly within the Superform application using email or social login.

3. When is the Token Generation Event for Superform (UP)?

The Token Generation Event is scheduled for February 10, 2026, at 10:00 AM UTC. At this point, the UP token becomes transferable and the airdrop claim portal opens for eligible Safari participants.