Learning how to trade doesn’t have to mean risking your hard-earned money. BingX Demo Trading lets you experience real-market conditions using virtual funds, giving both new and experienced traders a safe way to practice strategies and sharpen their skills.

Powered by VST (Virtual USDT), a simulated token with no real-world value and no withdrawal option, the BingX demo environment mirrors live market behavior without financial risk. You can explore

perpetual futures, test different

order types, and analyze price movements just like in a

real trading account.

Whether you’re a beginner learning how to place your first order or a seasoned trader fine-tuning an advanced strategy, BingX Demo Trading provides the ideal risk-free learning space to grow your confidence before moving to live markets.

What Is BingX Demo Trading?

BingX Demo Trading lets users practice crypto trading in a realistic, simulated market using virtual funds (VST) instead of real money. Every price, chart, and order behaves just like in live trading, only without financial risk. In demo mode, trades are placed with VST (Virtual USDT), BingX’s built-in practice currency.

• VST can’t be withdrawn or converted to real money.

• Each new user receives 100,000 VST automatically to start trading.

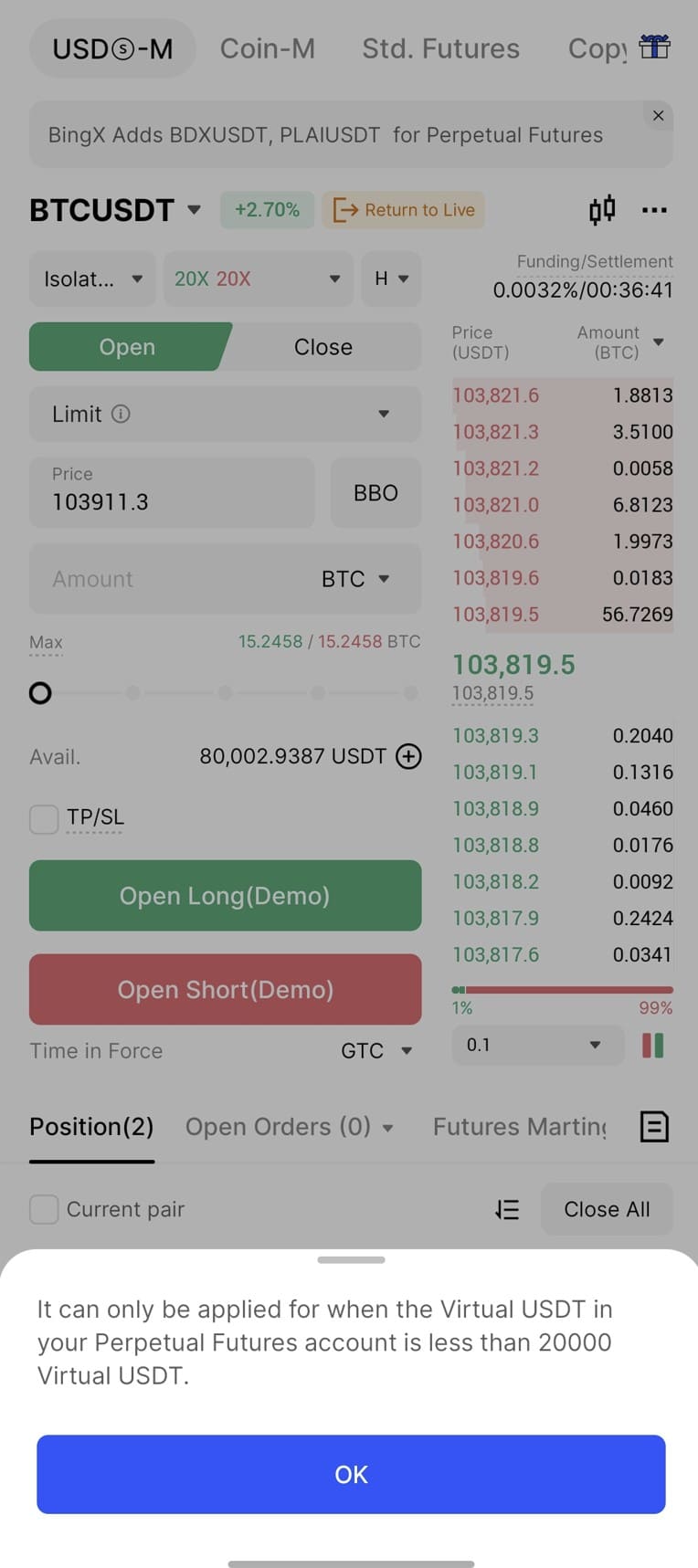

• You can request more funds if your balance drops below 20,000 VST.

The demo account supports Perpetual Futures trading on BingX, allowing users to explore leverage, long and short positions, and margin rules in a fully simulated environment. Every order, chart, and price movement reflects live market conditions, helping traders gain practical experience before moving to real trading.

• Learn how order types (limit, stop, OCO) work in real-time.

• Understand leverage and margin without risking loss.

• Test trading tools, chart setups, and strategies safely.

• Analyze market behavior under live price conditions.

In short, it’s a practice ground for both beginners and pros, ideal for mastering execution before trading with real assets.

Why Use a Demo Account Before Live Trading

A demo account is the safest and most effective way to build trading confidence before committing real capital. It lets you practice execution, test strategies, and understand market conditions, all in a risk-free environment that mirrors live trading behavior.

Here’s why most traders start here:

1. Learn Core Trading Functions

A demo account helps you master the mechanics of

order execution. You can practice how to:

• Place, modify, and close market, limit, and stop orders.

• Understand how leverage, margin, and liquidation levels affect your positions.

• Calculate fees, PnL (profit and loss), and available margin before trading live.

This foundational knowledge prepares you to react faster and avoid errors when real money is involved.

2. Test Strategies Risk-Free

BingX’s demo mode lets you experiment with different trading approaches using real-time market data:

• Try trend-following, scalping, or swing trading setups.

• Explore breakout, mean reversion, or momentum-based strategies.

• Adjust position size and

leverage to see how risk exposure changes outcomes.

Since trades use virtual funds, you can refine tactics without the pressure of financial loss, perfect for developing consistency before going live.

3. Master Charting Tools and Indicators

Another key advantage is mastering technical analysis tools. BingX’s demo platform includes the same advanced charting suite used in live trading.

4. Understand Crypto Market Behavior

Demo trading replicates real-world market conditions such as volatility, liquidity, and order book depth. You can observe how prices react to high-volume trades, economic news, or sudden volatility spikes, insights that are crucial when transitioning to live markets.

5. Build Trading Discipline

A demo environment is ideal for developing emotional control and risk management habits:

• Set stop-loss and take-profit targets for every trade.

• Practice maintaining a consistent risk-to-reward ratio.

• Simulate daily or weekly routines as if managing a live portfolio.

Traders who practice discipline in demo mode tend to make better, more rational decisions in live trading, reducing impulsive behavior and overtrading. Whether you’re a beginner learning execution or an advanced trader testing automation or new systems, a demo account gives you the space to experiment, learn, and adapt safely.

How to Start Demo Trading on BingX App and Web

Setting up demo trading on BingX takes only a few taps. You’ll be using VST (Virtual USDT), BingX’s trial funds that simulate real USDT for practice trading. Each new user receives 100,000 VST automatically, which can be topped up later if the balance drops below 20,000 VST.

1. Demo Trading on the BingX App

i. Log in to your BingX account

Open the BingX app and sign in with your registered email. Once logged in, you’ll see your profile under the Assets tab.

ii. Navigate to Futures

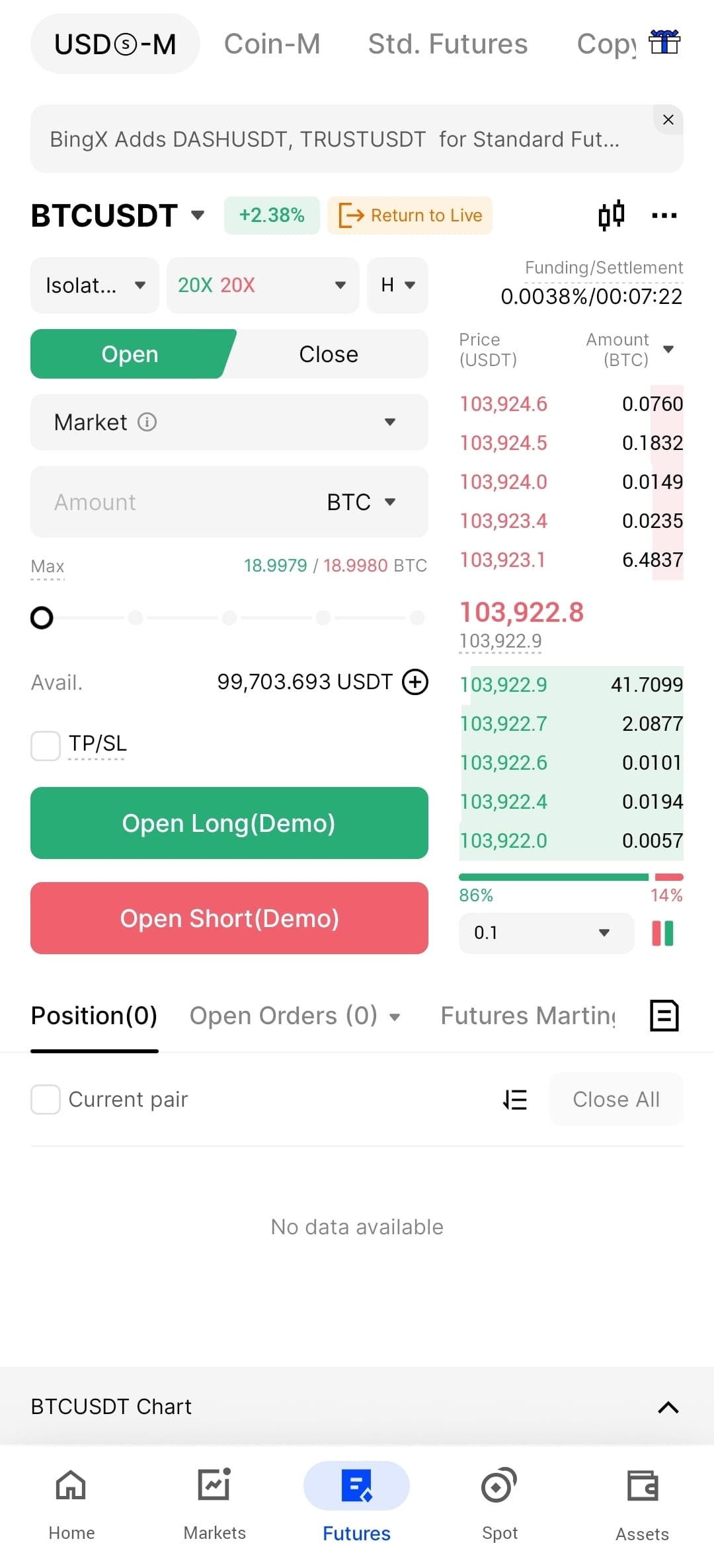

From the bottom navigation bar, tap Assets → Futures → USDM Perp. This opens the Perpetual Futures interface where demo trading is available. Here, you’ll find your available balance, order types, and charting tools similar to live trading.

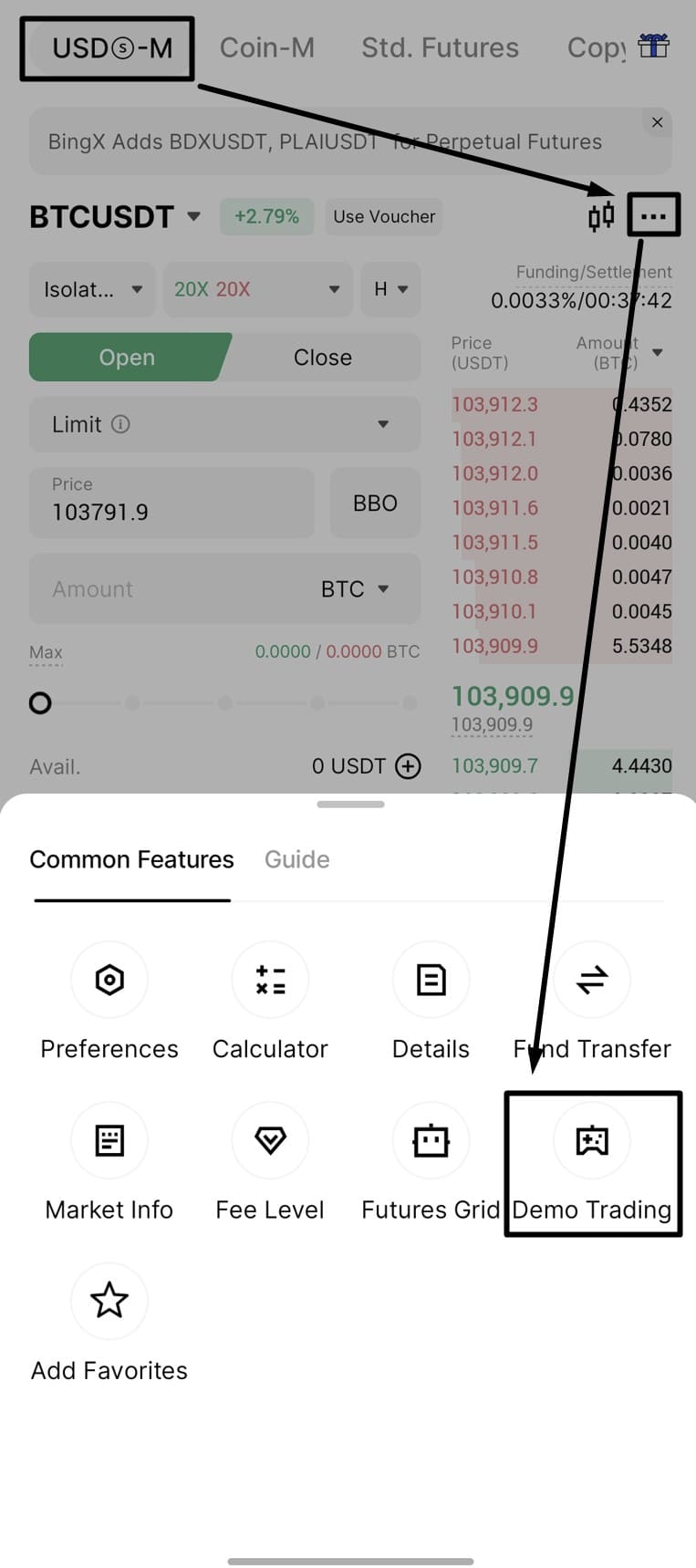

To enter demo mode, tap the three-dot menu (⋯) at the top right and select Demo Trading from the Common Features panel.

iii. Activate VST Funds

On the USDM Perp page, tap the three-dot menu (⋯) in the upper-right corner, then select Demo Trading under Common Features. You’ll then enter the demo trading interface, where all trades use VST (Virtual USDT), BingX’s virtual token for practice.

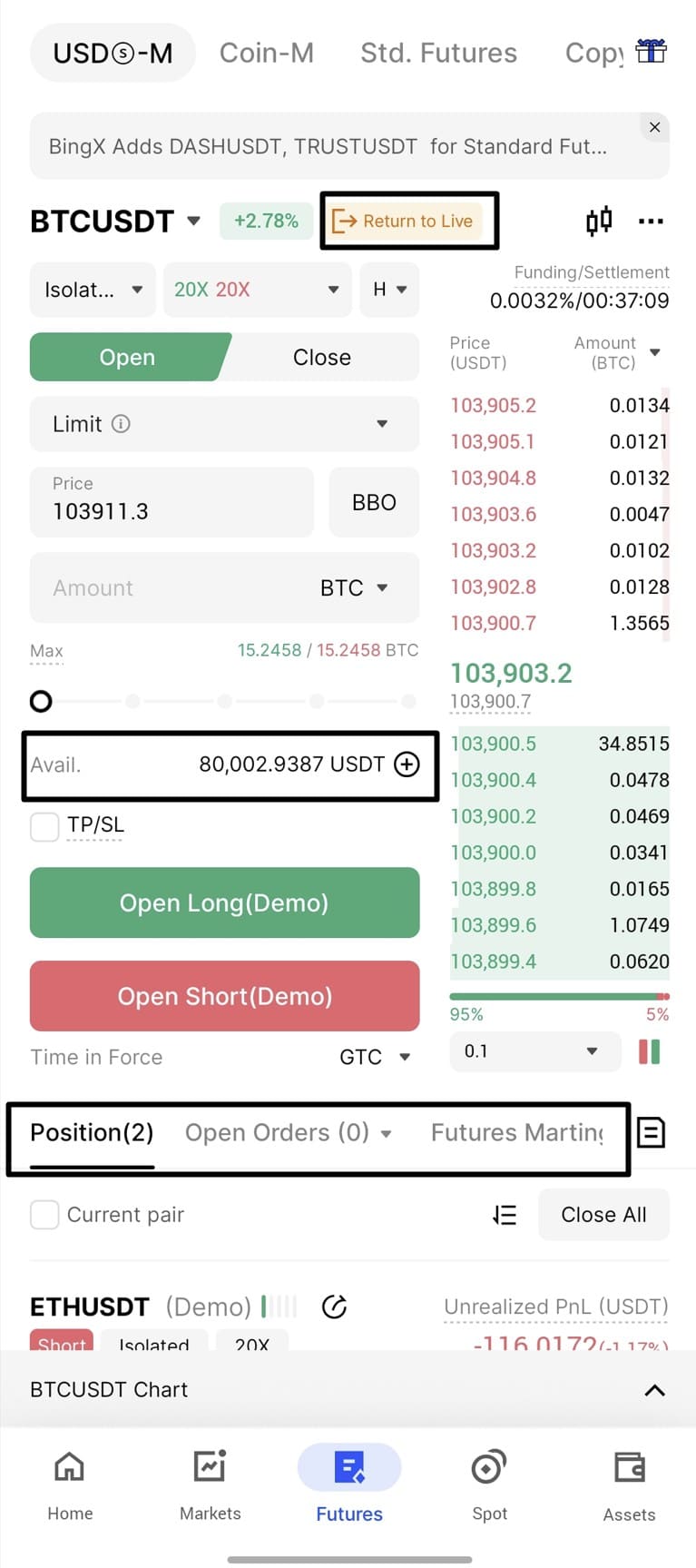

New users automatically receive 100,000 VST as trial funds. If your balance appears lower, such as 80,000 VST, it’s simply because some margin is already being used from earlier demo trades, as shown in the example screenshot.

iv. Start Trading in Demo Mode

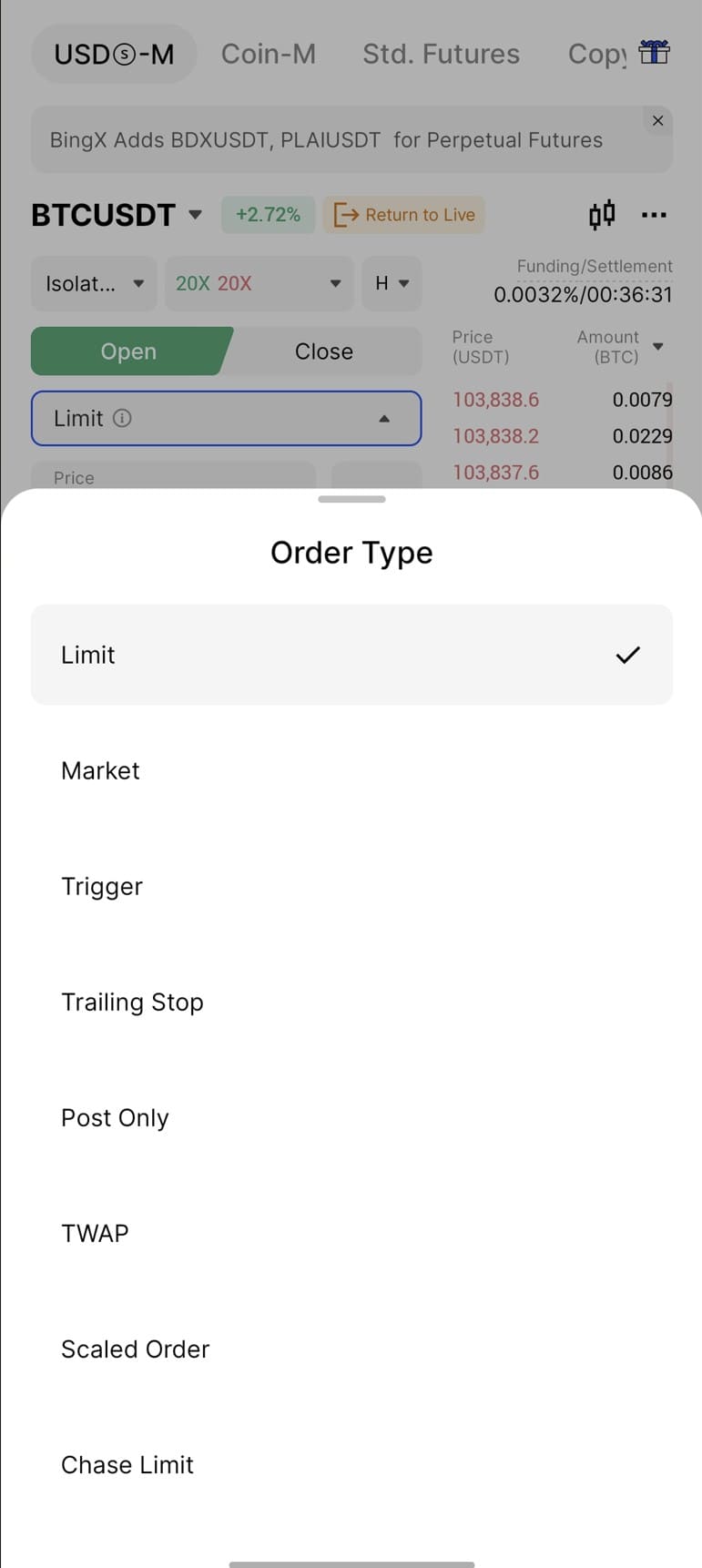

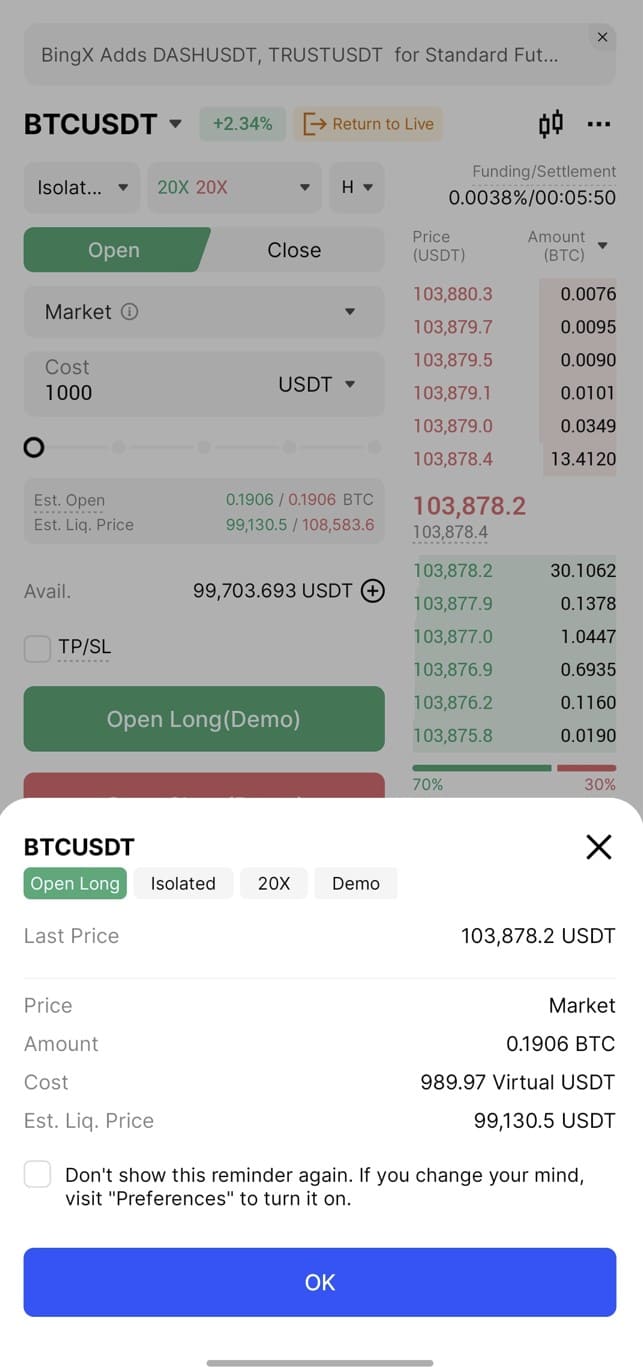

Tap “Open Long or Open Short” to open the demo trading dashboard. Here, you can choose your trading pair (e.g., BTCUSDT), adjust leverage, and select an order type: Limit, Market, Trigger, Trailing Stop, Post Only, TWAP, or Scaled Order.

v. Start Placing Demo Trades

Start by choosing your order type, Market, Limit, Trigger, Trailing Stop, or TWAP.

A Market Order executes immediately at the best available price, while a Limit Order lets you set a preferred entry price.

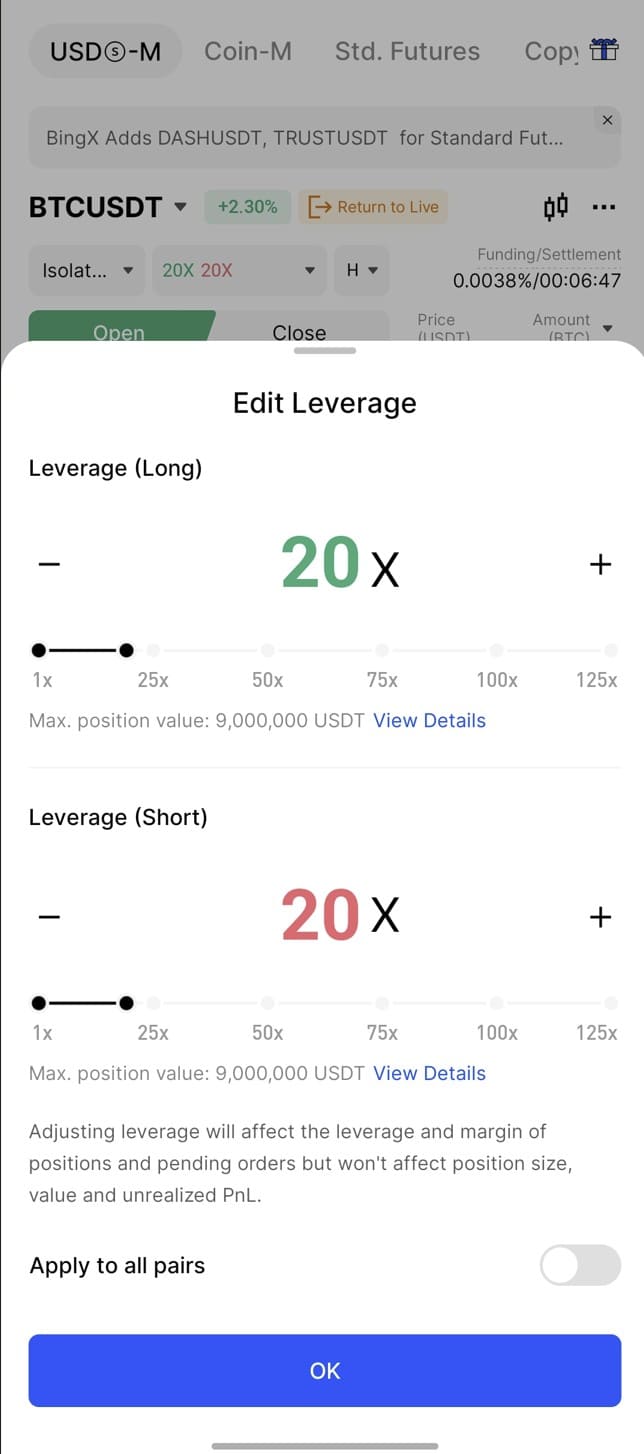

Next, set your leverage by tapping the 20x box beside “Isolated.” You can adjust leverage anywhere from 1x up to 125x. Higher leverage increases both potential returns and risk, so demo trading is a great place to learn how margin levels and liquidation prices react.

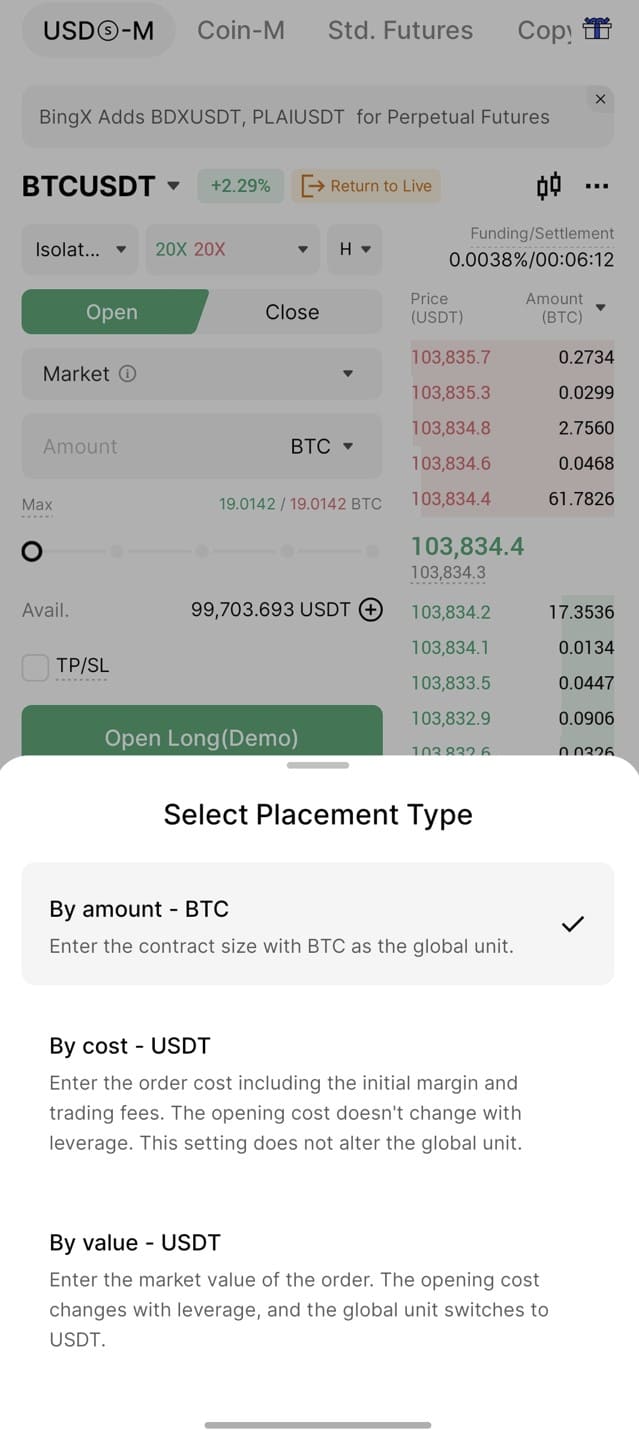

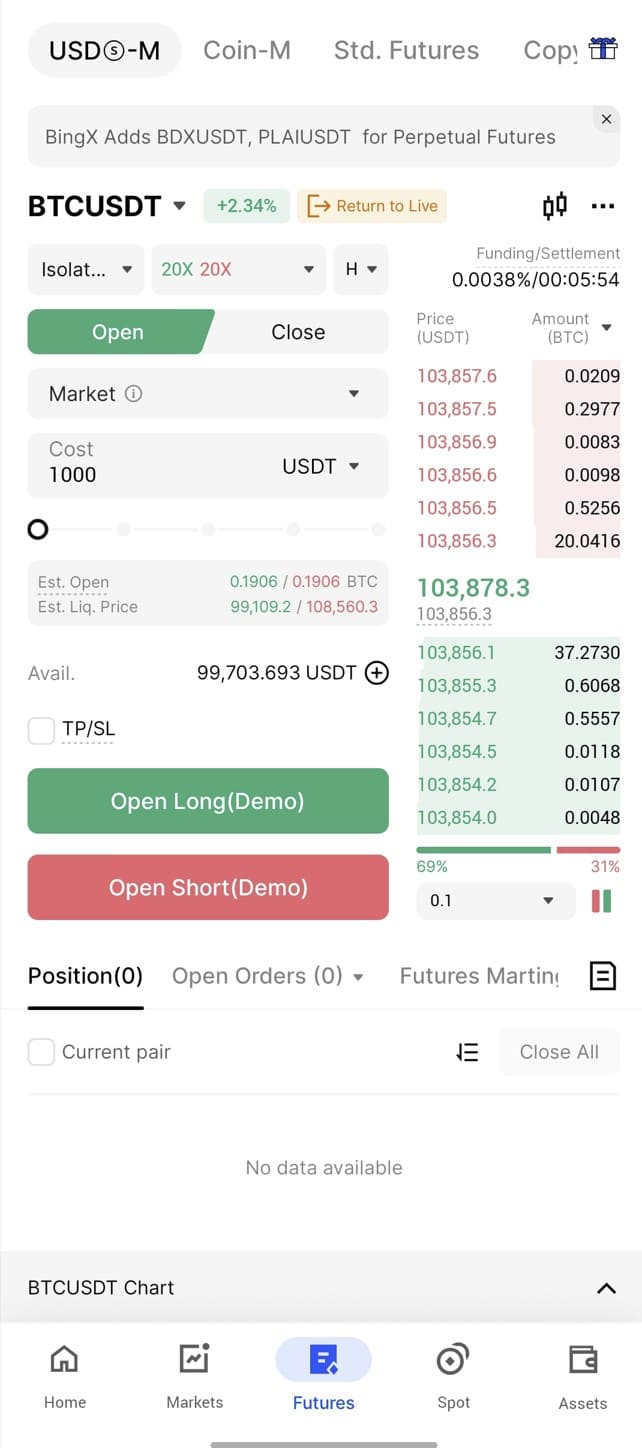

You can also choose how to define position size:

• By amount (BTC): Set the contract size is set in

BTC.

• By cost (USDT): Enter how much USDT you wish to allocate.

• By value (USDT): Base it on the total market value of the position.

After confirming your setup, tap Open Long (Demo) if you expect the price to rise, or Open Short (Demo) if you expect it to fall. A confirmation window will display your entry price, margin used, and estimated liquidation price. Tap OK to place the order.

vi. Managing Open Positions

Once your order is filled, you can monitor it under the Position tab at the bottom of the trading screen. Here, you’ll see details like:

• Position size (BTC)

• Margin used (USDT)

• Mark price

• Unrealized PnL (profit or loss)

• Estimated liquidation price

You can close the trade manually by tapping Close, Reverse, or by setting a TP/SL (Take-Profit / Stop-Loss) target.

The demo mode mirrors live trading in every aspect, including fees, leverage behavior, and PnL calculations, so every action you take simulates a real market outcome.

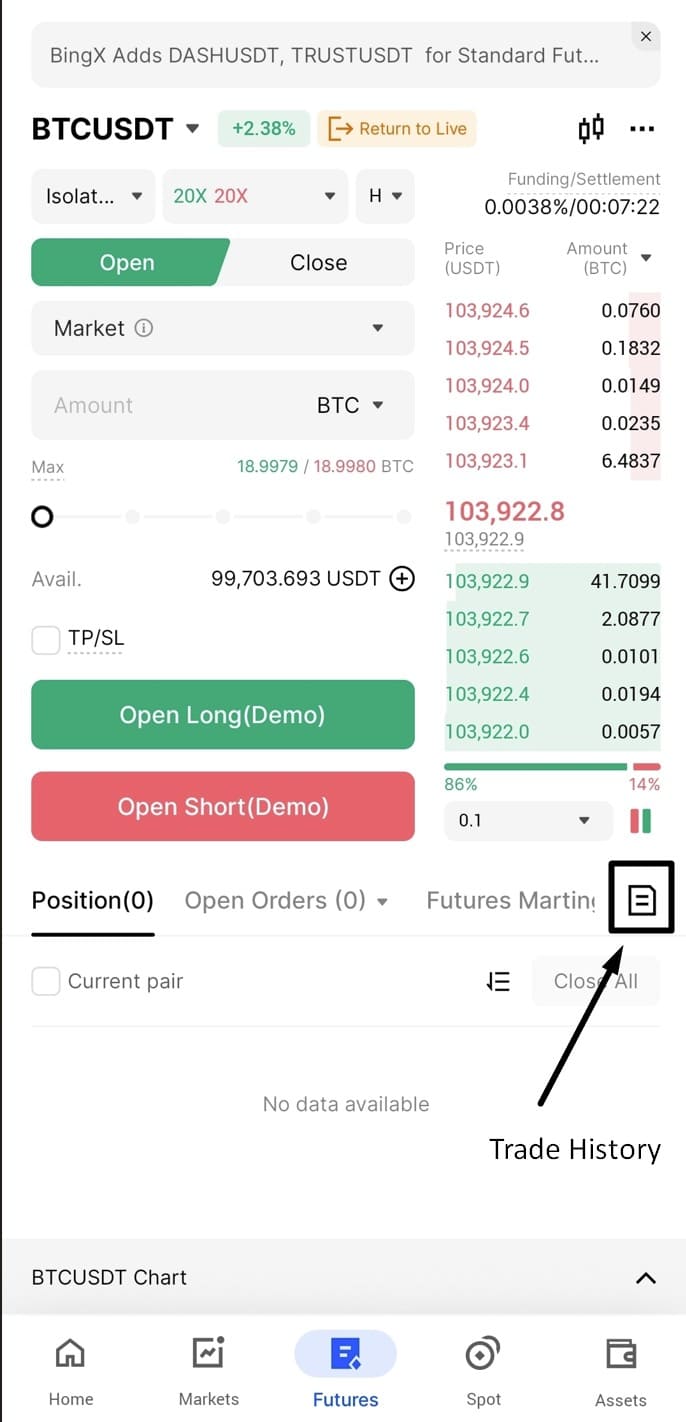

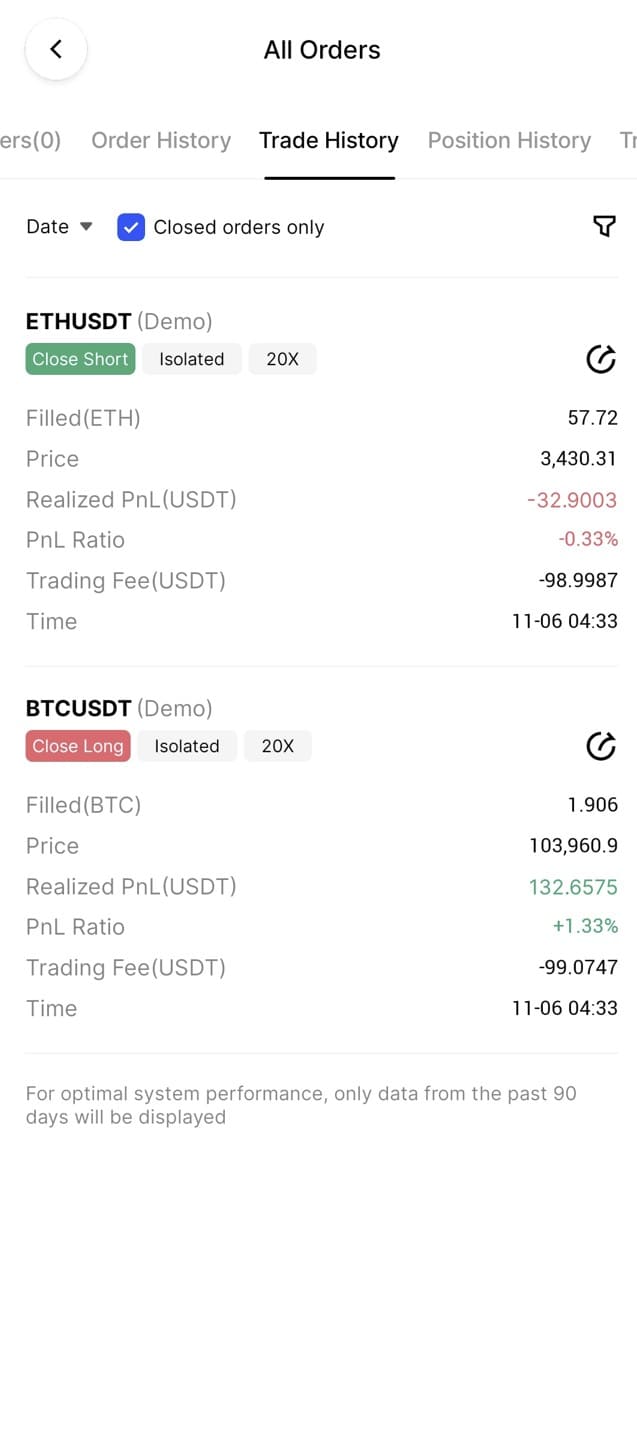

vii. Reviewing Your Trade History

To review your performance, tap the Trade History icon (📜) in the lower-right corner of the Futures screen. This section displays yours:

• Filled and closed orders

• Realized PnL (profit and loss)

• Trading fees

• Entry and exit prices

• Execution time

You can filter to show closed orders only or review specific pairs like

BTCUSDT (Demo) or

ETHUSDT (Demo). Analyzing your trade history helps identify what worked, what didn’t, and how leverage, timing, or order types affected results.

2. Demo Trading on the BingX Web Platform

If you’re trading from a desktop or laptop, the process of enabling Demo Trading on BingX Web is nearly identical to the mobile app. The same principles apply, you’ll use VST (Virtual USDT) as your demo balance and access the interface through the USDM Perp page.

i. Log in to Your BingX Account

Visit the official

BingX website and sign in using your registered email or Google account. Once logged in, you’ll see your main dashboard with quick access to Markets, Derivatives, and Copy Trading tabs.

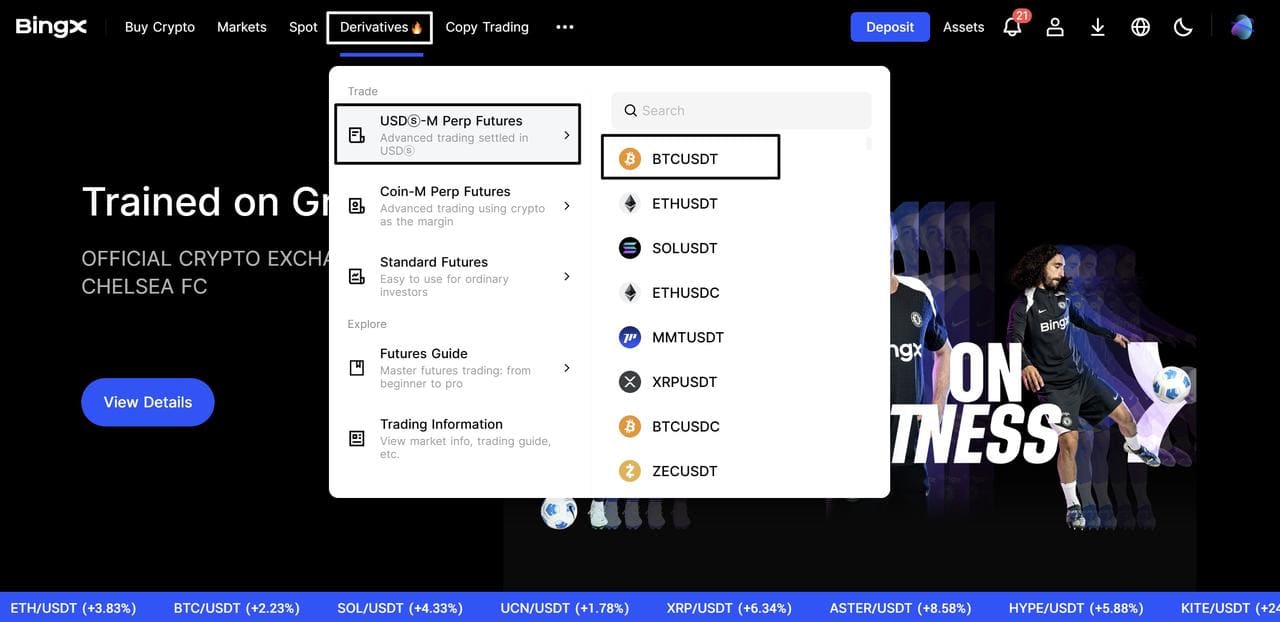

1. Access the Futures Dashboard

From the top navigation bar, hover over Derivatives and select USDⓈ-M Perp from the dropdown menu. This opens the Perpetual Futures trading interface, where you can choose any trading pair such as BTCUSDT, ETHUSDT, or others.

You can pick your preferred trading pair (for example, BTCUSDT) from the list or search bar on the left-hand side.

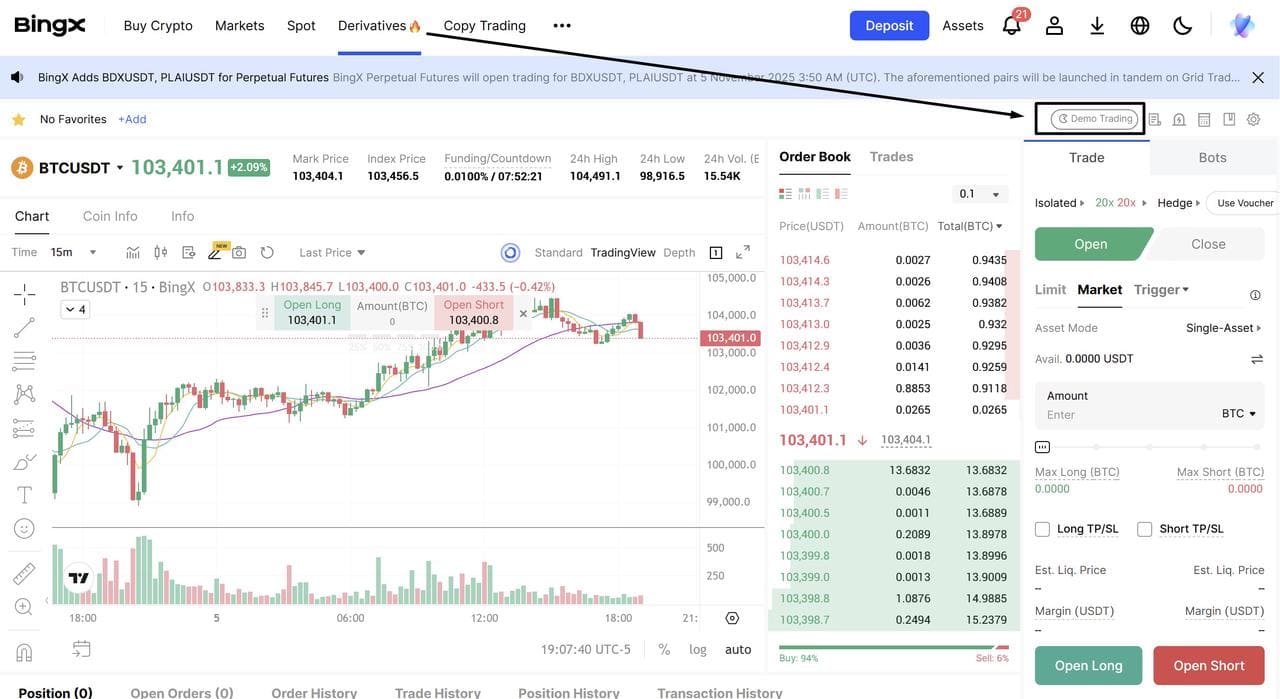

ii. Enter Demo Mode

On the right-hand trading panel, locate the Demo Trading button above the order section. Clicking it will switch your workspace from live to demo trading mode.

You’ll notice your balance now shows VST (Virtual USDT), this confirms you’re in the simulation environment.

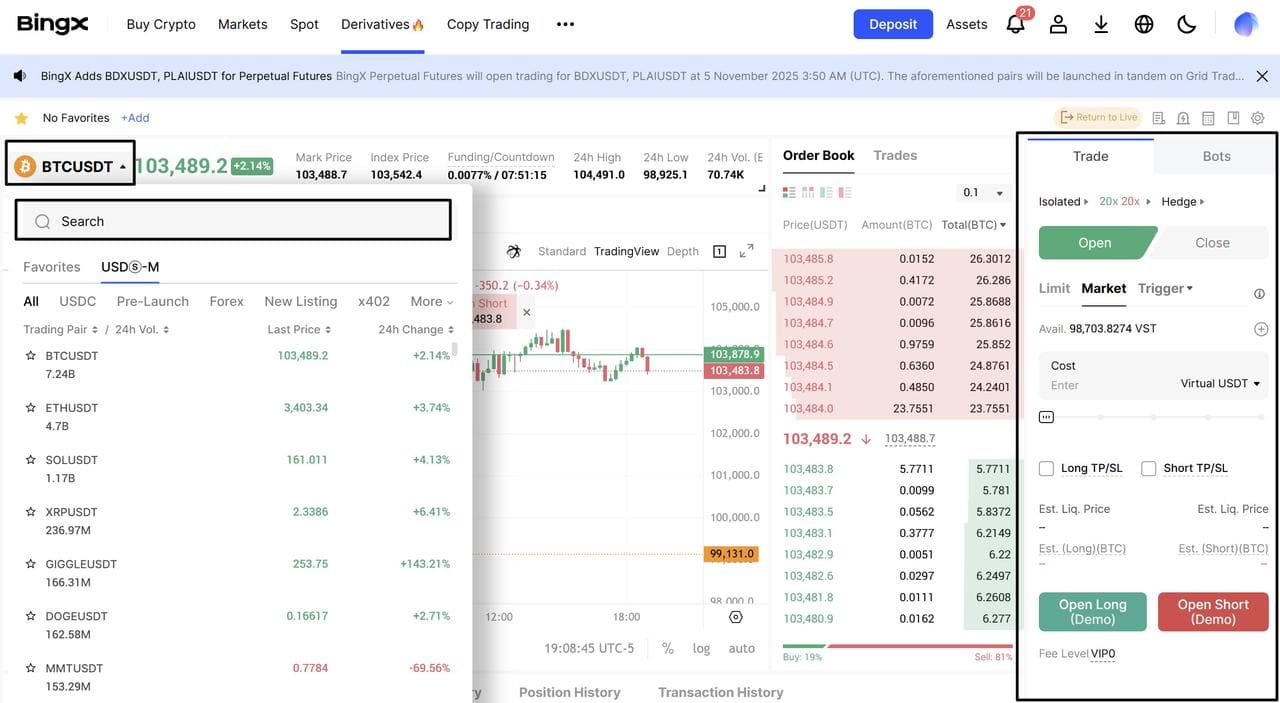

iii. Check Your VST Balance

As we discussed in the above section, new users are automatically credited with 100,000 VST to start demo trading.

iv. Place Your First Demo Trade

Choose your pair (e.g., BTCUSDT), set your order type (Market, Limit, or Trigger), and specify your cost or amount.

You can also adjust leverage (e.g., 20×) and enable optional Long TP/SL or Short TP/SL fields to set automatic exits. When ready, click Open Long (Demo) or Open Short (Demo) to execute.

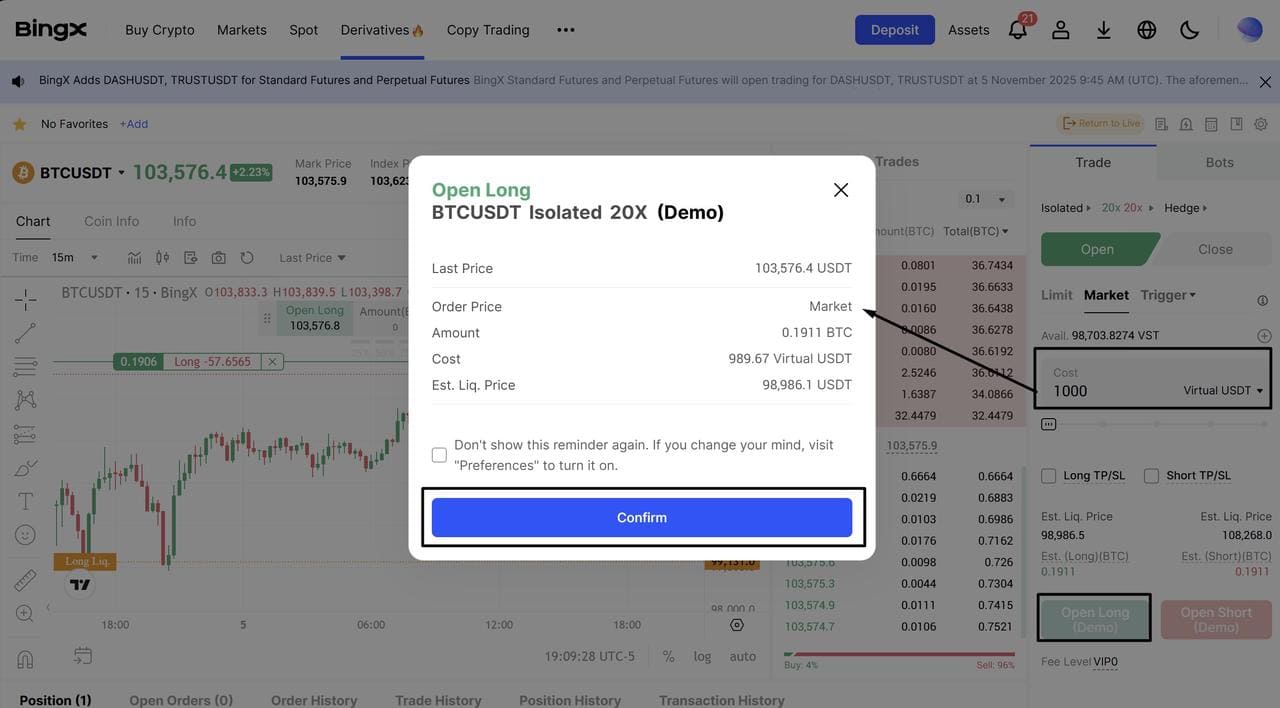

A confirmation box will appear showing the entry price, used margin, and estimated liquidation price, click Confirm to place your order.

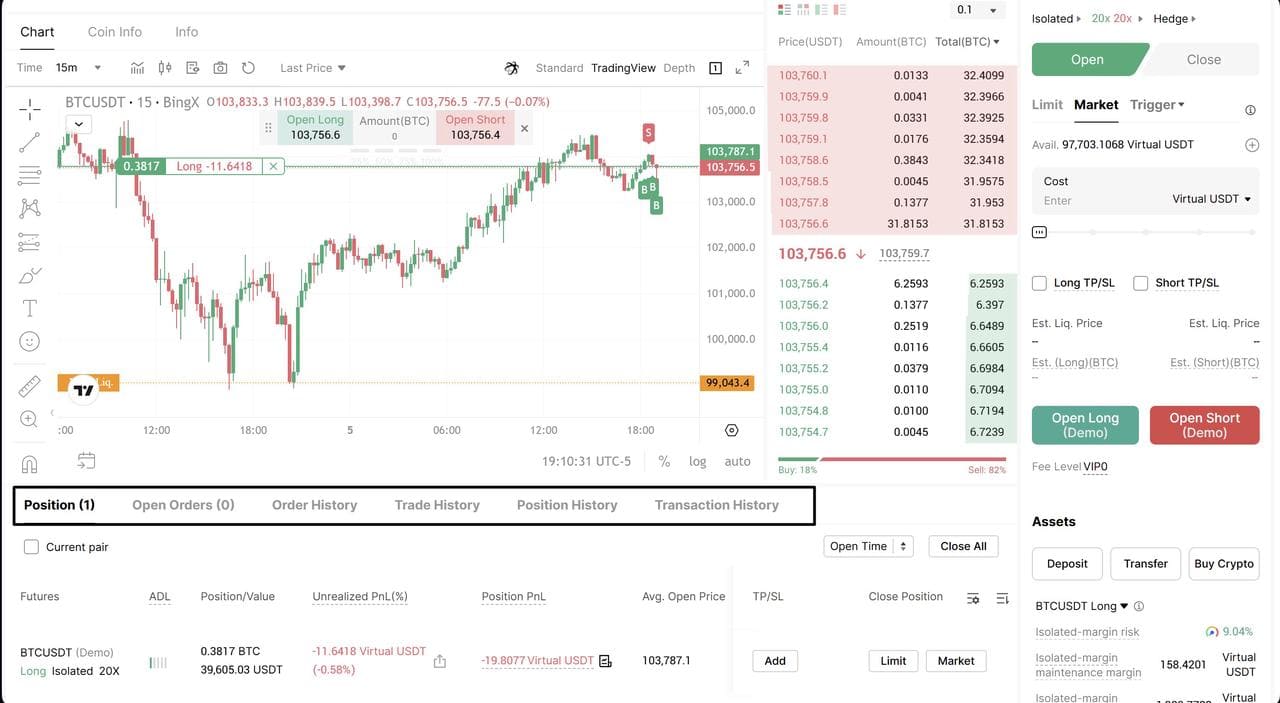

v. Monitor and Manage Positions

Your open demo positions appear under the Position tab below the chart.

Here, you can view:

• Position size and margin used

• Unrealized and realized PnL

• Average open price and mark price

• Estimated liquidation price

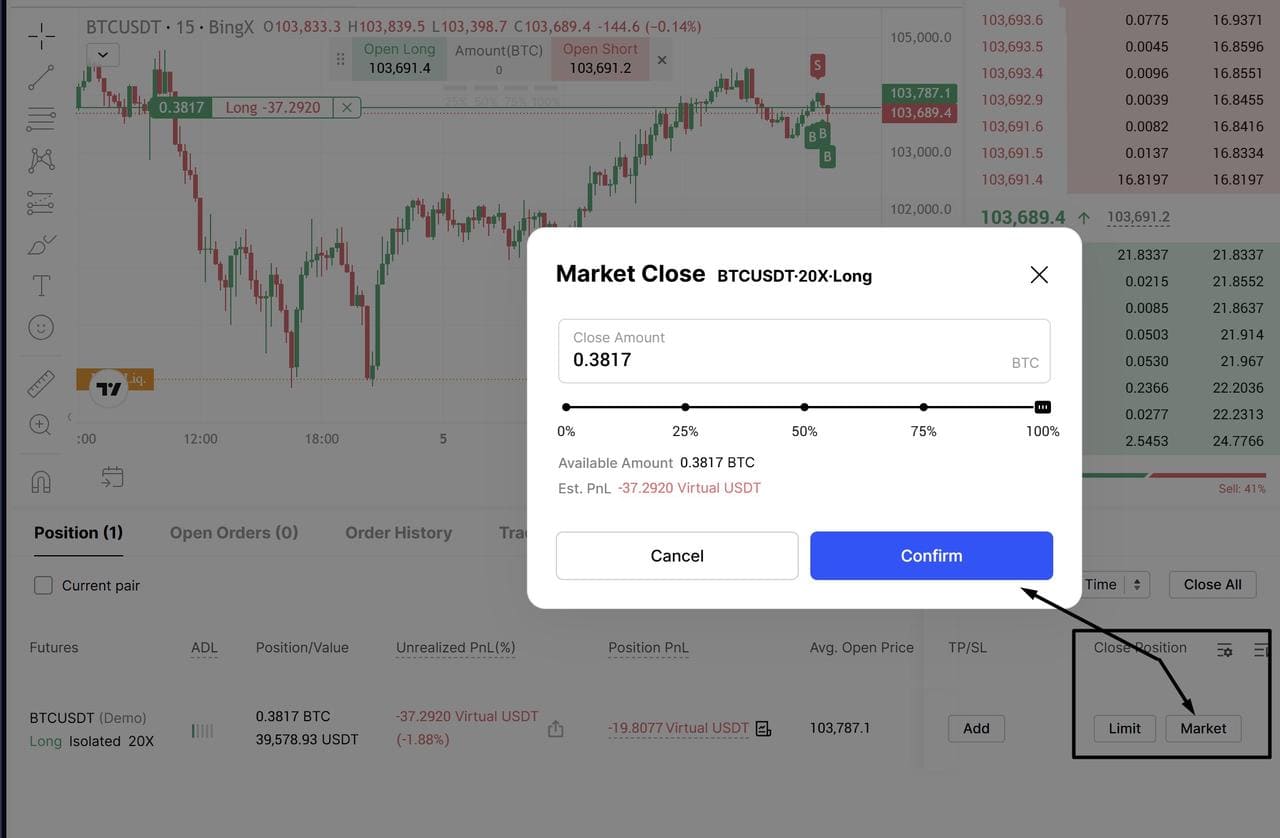

To close a position, click Limit or Market under the Close Position section, choose how much to close (e.g., 50% or 100%), and confirm.

vi. Review Order and Trade History

At the bottom of the interface, you’ll find tabs like Open Orders, Order History, Trade History, Position History, and Transaction History.

The Trade History tab displays completed orders, realized PnL, trading fees, and execution times — identical to what you see on the mobile version.

Conclusion: Build Confidence Before Live Crypto Trading

BingX Demo Trading gives you the space to learn, experiment, and master crypto trading, all without risking real funds. By practicing with VST (Virtual USDT), you can explore how order types, leverage, and margin behave in real market conditions while refining your trading strategy and emotional discipline.

Whether you’re testing a new setup, analyzing volatility, or simply getting familiar with the platform’s tools, demo mode mirrors the live environment closely, helping you build confidence and accuracy before stepping into real markets.

Once you’re comfortable managing trades and understanding risk, transitioning to live trading becomes smoother and more strategic.

Start your BingX Demo Trading journey today and claim 100,000 VST trial funds to practice smarter and trade with confidence.

Related Reading

FAQs on BingX's Demo Trading Feature

1. What is VST in BingX Demo Trading?

VST (Virtual USDT) is BingX’s built-in simulated token for demo trading. It has no real value and can’t be withdrawn. Every new user receives 100,000 VST automatically to practice trading in a realistic, risk-free environment.

2. Can I use BingX Demo Trading on both mobile and desktop?

Yes. BingX Demo Trading is available on both the BingX App and the Web Platform. On mobile, go to Assets → Futures → USDM Perp → Demo Trading. On desktop, open Derivatives → USD-M Perp and click Demo Trading on the trading panel.

3. What markets can I trade in demo mode?

Demo mode mirrors real-market trading conditions using virtual funds. You can explore perpetual futures trading, experiment with leverage, and test strategies under live price data, all without risking real capital.

4. How do I get more demo funds on BingX?

If your balance drops below 20,000 VST, you can request additional demo funds directly on the platform. Simply click Apply for VST or Add VST beside your balance to top up instantly.

5. Why should I use demo trading before going live?

Demo trading helps you understand how orders, leverage, and risk management work in real-market conditions, but without financial exposure. It’s the best way to build confidence, test strategies, and refine decision-making before moving to live trading.