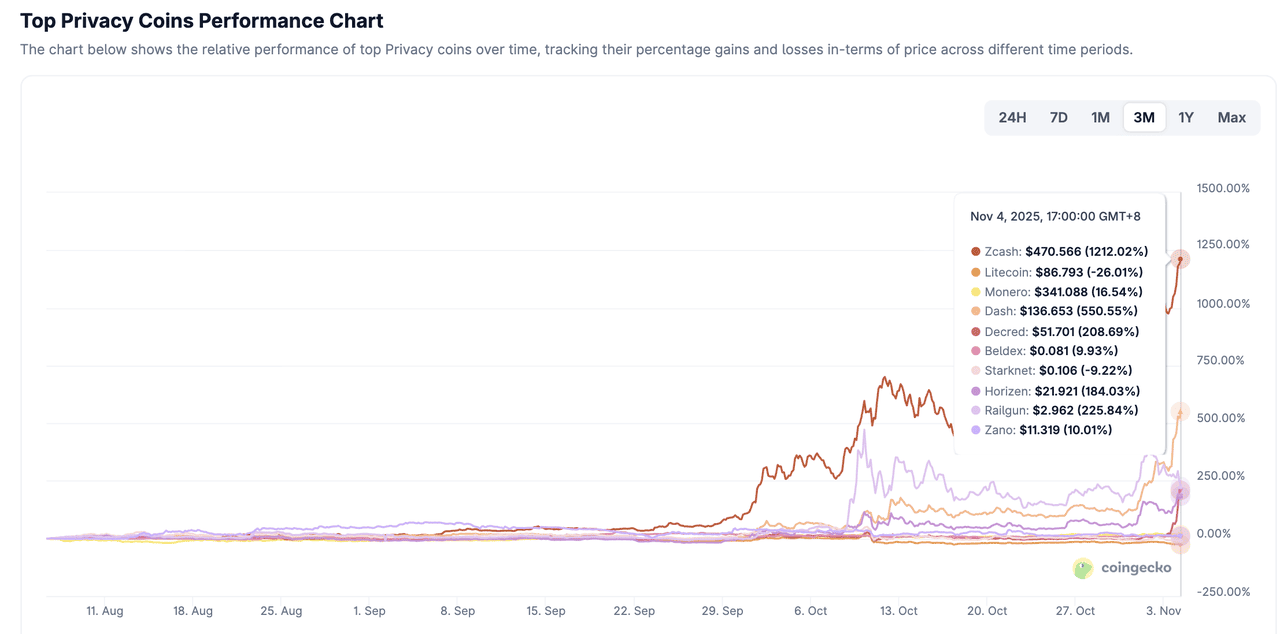

Dash (DASH) is once again in the spotlight, surging over 485.94% in 2025 to trade at $136.32 as of November 4, 2025, according to CoinMarketCap. Its 24-hour trading volume rose 82.96% to $1.63 billion, pushing market capitalization to $1.59 billion, the highest level in nearly three years.

The rally comes amid a renewed wave of interest in

privacy-focused cryptocurrencies.

Zcash (ZEC) has also gained over 1,189% in the past two months, now trading near $458.41, reflecting what analysts describe as a broader return to digital assets that prioritize user autonomy and discretion.

Dash is a cryptocurrency designed for fast, low-cost payments with optional privacy features, and its strong recovery illustrates a growing market preference for digital money that combines speed, usability, and self-sovereignty. As noted by Nansen senior research analyst Jake Kennis, privacy in crypto is “increasingly viewed as a necessity rather than a feature,” highlighting how investor sentiment is shifting toward assets that balance functionality with confidentiality.

What Is Dash (DASH) and How Does It Work?

Dash (short for “Digital Cash”) is a cryptocurrency created in 2014 to make digital payments faster, cheaper, and easier to use. Built as a fork of

Bitcoin, Dash was designed to improve transaction speed, reduce fees, and make crypto practical for everyday spending.

Unlike many cryptocurrencies that serve mainly as investment assets, Dash is payment-focused, enabling users to send and receive money almost instantly with very low fees. It also offers optional privacy features through its PrivateSend function, giving users control over how much of their transaction data is shared on the blockchain.

Dash operates on a two-layer network that enhances both speed and governance. The first layer consists of miners, who validate and secure transactions through a Proof-of-Work system. The second layer is powered by masternodes, which provide advanced functions like InstantSend (for real-time payments), PrivateSend (for optional privacy), and governance voting on network proposals. This structure helps Dash maintain a balance between decentralization, scalability, and utility.

Dash Coin's Key Features

• InstantSend: Enables near-instant payment confirmations for real-world transactions.

• PrivateSend: Provides optional transaction privacy through mixing mechanisms.

• Low Fees: Typical fees remain under one cent per transaction.

• Masternode Governance: Network participants can vote on proposals and allocate treasury funds to development and marketing.

• Decentralized Structure: Operates globally without central control, making Dash secure, transparent, and censorship-resistant.

In short, Dash combines speed, affordability, and user choice in a single network. It offers the convenience of modern digital payments while preserving the privacy and independence of cash, positioning it as one of the most practical cryptocurrencies for everyday use.

Why Is DASH Surging in November 2025?

Dash’s strong rise in November 2025 is part of a broader rebound across the privacy-coin sector. Over the past month, DASH gained about 190%, reaching its highest level in three years despite a weak crypto market. The surge reflects renewed demand for privacy networks, institutional interest, and investor rotation toward proven legacy assets.

1. Zcash (ZEC) Leads the Privacy Coin Rally Driving Dash Momentum

Dash’s rally unfolded alongside a major comeback in the privacy-coin market, led by Zcash (ZEC). The total market capitalization of privacy coins climbed nearly 80%, surpassing $24 billion, while the broader market fell. The trend began on October 1, when

tech investor Naval Ravikant called Zcash “insurance against Bitcoin,” sparking a 60% jump in 24 hours and a 400% rally over the next four weeks.

Zcash’s fundamentals reinforced the move. The shielded pool surpassed 4.9 million ZEC, or about 27% of total supply, showing rising demand for private transactions. These catalysts positioned Zcash as the sector leader, lifting sentiment across privacy assets and drawing liquidity into Dash as traders sought faster, more accessible alternatives.

2. Institutional Demand for Privacy Coins Strengthens Dash’s Surge

Source: CoinGecko

Institutional and retail investors are increasingly recognizing privacy as a practical necessity rather than a niche feature. Growing concerns about data tracking and financial surveillance have pushed capital toward assets that provide both autonomy and regulatory flexibility. This shift has been underscored by the Grayscale Zcash Trust (ZCSH), which saw assets under management increase from $4.9 million to $13.8 million in just 30 days, a 180% rise that signaled institutional confidence returning to privacy assets. Although focused on Zcash, this wave of institutional inflows lifted the entire privacy sector and contributed to renewed interest in Dash as a more accessible and transaction-focused alternative.

3. Investor Rotation Toward Legacy Privacy Tokens Like Dash and Zcash

Following the September correction, investors rotated into established networks with strong communities and real-world use cases. Dash and Zcash stood out as credible privacy coins with consistent development and reliable liquidity. Traders viewed them as undervalued compared to newer, untested projects.

Monero (XMR), though technically advanced, continues to face exchange restrictions in Europe, limiting access. Dash’s wider listings and user-controlled privacy make it more practical for global trading. As the EU AMLR 2027 approaches, restricting fully anonymous tokens, investors are favoring adaptable projects like Dash and Zcash that combine privacy with compliance, reinforcing Dash’s role as one of the most stable and accessible privacy networks.

ZEC vs. XMR vs. DASH: What’s the Difference?

Privacy coins have become a focal point of the 2025 market narrative as investors look for digital assets that balance confidentiality with usability. Among the most recognized names in this category are Zcash (ZEC), Monero (XMR), and Dash (DASH). While they share a common goal of enhancing privacy and autonomy, each approaches it differently.

| Feature |

Dash (DASH) |

Zcash (ZEC) |

Monero (XMR) |

| Privacy Model |

Optional (PrivateSend) |

Optional (zk-SNARKs) |

Always-on (RingCT) |

| Transaction Speed |

Instant |

Moderate |

Slower |

| Governance |

Masternodes & Treasury |

Foundation-led |

Community-driven |

| Institutional Presence |

Limited |

Strong (Grayscale Trust) |

Minimal |

| Regulatory Accessibility |

Moderate |

High |

Low |

| Core Use Case |

Payments + User Choice |

Privacy + Compliance |

Full Anonymity |

1. Dash (DASH): Optional Privacy and Everyday Usability

Dash focuses on practical, fast, and low-cost payments with optional privacy features. Its PrivateSend function lets users choose whether to obscure transaction details, while InstantSend enables near-instant payments. Dash’s self-funding model and masternode governance system make it unique among privacy coins, allowing it to maintain development independently of external funding.

• Privacy type: Optional (via PrivateSend)

• Transaction speed: Instant confirmation through InstantSend

• Governance: Masternode voting and treasury system

• Core value: Real-world payments with user-controlled privacy

2. Zcash (ZEC): Privacy with Institutional Accessibility

Zcash offers selective privacy through its zk-SNARKs cryptographic protocol, allowing users to choose between transparent and shielded transactions. This flexibility has made it more acceptable to regulators and institutions. Zcash’s ecosystem gained major traction in 2025 as institutional exposure grew via the Grayscale Zcash Trust (ZCSH), which saw assets under management nearly triple in a month. Its shielded pool exceeded 4.9 million ZEC, showing a growing preference for confidential transfers.

• Privacy type: Optional (transparent or shielded addresses)

• Technology: zk-SNARK zero-knowledge proofs

• Institutional support: Grayscale ZCSH, expanding regulated exposure

• Core value: Privacy and compliance coexistence

3. Monero (XMR): Always-On Privacy and Decentralized Security

Monero provides default privacy for every transaction using a combination of ring signatures, stealth addresses, and RingCT (Ring Confidential Transactions). Unlike Dash and Zcash, users cannot disable privacy. This makes Monero one of the most private cryptocurrencies but also limits its accessibility due to delistings in several regions. It maintains long-term stability through a tail emission of 0.6 XMR every two minutes and sub-1% inflation, supporting miners and network security.

• Privacy type: Default (mandatory)

• Technology: Ring signatures, stealth addresses, RingCT

• Drawbacks: Reduced exchange availability due to regulations

• Core value: Maximum anonymity and censorship resistance

Each project serves a different audience: Dash appeals to users seeking fast, practical transactions; Zcash attracts those balancing privacy with institutional trust; and Monero remains the choice for users demanding absolute anonymity. Together, they define the evolving landscape of privacy and user sovereignty in the cryptocurrency market.

Key Considerations When Investing in Dash Privacy Coin

Although Dash has shown strong momentum in recent months, investors should remain aware of several key risks that could influence its long-term performance and stability.

1. Market volatility: Dash’s price can move sharply in both directions within short time frames. While this creates trading opportunities, it also increases the risk of quick reversals that may erase gains once momentum slows.

2. Regulatory uncertainty: Privacy-focused cryptocurrencies face growing scrutiny. The EU’s upcoming AMLR 2027 will limit anonymity-enhanced tokens on regulated platforms, and Dash’s optional privacy may still lead to compliance challenges or partial delistings in some regions.

3. Competitive pressure: Dash competes with Zcash (ZEC) and Monero (XMR), which continue to advance in privacy and adoption. If Dash fails to match their pace of innovation or maintain relevance in the payments space, its market share could gradually decline.

4. Liquidity risk: Global regulations and exchange policies can affect Dash’s trading activity and availability. Reduced liquidity may cause wider spreads, slower execution, and sharper price swings during volatile periods.

5. Governance challenges: Dash’s treasury and voting system depend on active masternode participation. Concentrated ownership or voter apathy could weaken decision-making and limit the network’s ability to allocate funds effectively.

Final Thoughts

Dash’s resurgence in late 2025 reflects more than just speculative momentum. Its strong rally has been supported by renewed attention to privacy coins, rising on-chain activity, and growing recognition of its unique balance between usability and autonomy. While projects like Zcash and Monero continue to lead the privacy narrative, Dash stands out for its payment efficiency and real-world practicality, qualities that have helped it remain relevant more than a decade after launch.

Looking ahead, Dash’s long-term success will depend on how effectively it adapts to changing regulations and evolving market dynamics. Its self-funding model and active community provide structural resilience, but continued innovation and thoughtful governance will be key to maintaining competitiveness. For investors, Dash offers both opportunity and caution, a reminder that even in a fast-moving industry, sustainability and trust remain the strongest currencies of all.

Related Reading