Palantir Technologies has become a key AI stock as governments and enterprises increase adoption of large-scale data analytics and AI-driven decision tools. Its expanding partnerships, including recent collaboration with Nvidia on GPU-accelerated AI workflows, have strengthened market confidence and supported Palantir’s price momentum heading into 2026.

Against this backdrop, many global investors are looking for easier ways to access Palantir’s market performance.

Palantir Ondo tokenized stock (PLTRON) is a blockchain-based version of Palantir Technologies stock that tracks the live market price of PLTR shares. It provides economic exposure to Palantir through a digital asset issued by

Ondo Global Markets, although it does not include shareholder rights such as voting or governance. PLTRON is available on BingX, allowing users to gain Palantir exposure with simple

USDT settlement and flexible, round-the-clock trading.

What Is Palantir (PLTR) and What Does Palantir Do?

Palantir is an AI company focused on operational decision software | Source: Palantir

Palantir Technologies is an American software and

AI company led by CEO Alex Karp, co-founded with Peter Thiel, and backed early by In-Q-Tel, the venture arm of the CIA, with later institutional support from Founders Fund. The company builds platforms used by governments and global enterprises to integrate complex data, apply machine learning, and run AI-driven operations across high-stakes environments.

On October 28, 2025, Palantir and

Nvidia (NVDA) announced an expanded AI partnership at an event in Washington, D.C. Nvidia CEO Jensen Huang detailed how Nvidia’s GPU-accelerated compute, CUDA-X libraries, and Nemotron AI models would be integrated into the Palantir AI Platform. This 2025 update strengthened both companies’ efforts to deliver next-generation operational AI for defense, government, and commercial customers.

Palantir’s business spans several major AI-focused areas:

• AI and Data Platforms: Tools for building, deploying, and managing large-scale AI models, predictive analytics, and LLM-based workflows.

• Defense and Government AI Systems: AI-enhanced mission planning, threat detection, intelligence analysis, and battlefield logistics used by the U.S. Department of Defense, intelligence agencies, and allied governments.

• AI-Powered Commercial Solutions: AI applications that optimize supply chains, manufacturing operations, risk modeling, and real-time decision workflows for global enterprises.

• AI Deployment Infrastructure: Palantir Apollo, a system that supports continuous delivery and scaling of AI models across cloud, hybrid, and secure environments, now strengthened through Nvidia’s accelerated computing stack.

With global demand for enterprise and defense AI accelerating, Palantir has become a foundational software layer that complements Nvidia’s leadership in accelerated computing and AI infrastructure.

Palantir vs. Nvidia: Which Is the Best AI Stock in 2026?

Palantir and Nvidia play different roles in the AI ecosystem, which naturally leads investors to compare their long-term potential.

Nvidia (NASDAQ: NVDA) dominates AI hardware and accelerated computing, supplying the GPUs and CUDA stack that power model training and enterprise-scale AI systems. Palantir (NYSE: PLTR) operates at the software layer, helping governments and commercial enterprises deploy AI models, analyze data, and make real-time operational decisions.

Their relationship strengthened in October 2025, when Jensen Huang and Alex Karp announced an expanded partnership that brings Nvidia’s accelerated compute and model libraries deeper into the Palantir AI Platform. This update positions the two companies as increasingly complementary, with Nvidia providing the core compute layer and Palantir providing the operational AI layer on top of it.

| Category |

Nvidia (NYSE: NVDA) |

Palantir (NYSE: PLTR) |

| Core Strength |

Leader in GPUs and AI compute infrastructure |

Leader in operational AI and enterprise decision platforms |

| Primary Demand Drivers |

Strong demand from hyperscalers, enterprises, and government AI programs |

Growing adoption across defense, government, healthcare, and commercial sectors |

| Growth Model |

Revenue driven by hardware upgrade cycles and data center expansion |

Growth driven by AI software adoption, long-term contracts, and platform deployment |

| Investment Profile |

Viewed as the more stable, infrastructure-focused AI investment |

Viewed as higher-upside exposure as more industries adopt AI-driven workflows |

For 2026, Nvidia is typically preferred by investors seeking exposure to AI infrastructure and global compute demand. Palantir may appeal more to those who believe in long-term growth of AI-driven operations, government adoption, and the deepening integration between Palantir’s software stack and Nvidia’s accelerated compute ecosystem.

Is Palantir a Strong Buy in 2026?

Palantir’s stock surged more than 165% in 2025 | Source: Google Finance

Palantir delivered exceptional performance in 2025, climbing from roughly $75 in January to highs above $200 by October–November 2025, representing an increase of about 165 percent in less than a year. This surge was driven by accelerating AI adoption, expanding commercial revenue, major U.S. defense contracts, and Palantir’s strengthened partnership with Nvidia.

Heading into 2026, Palantir remains a high-growth candidate for investors who believe in operational AI, long-term government contracts, and enterprise-scale AI deployment. However, its rapid appreciation also brings higher volatility, making PLTR more suitable for investors who are comfortable with elevated risk in exchange for potential upside.

What Is Palantir Ondo Tokenized Stock (PLTRON)?

Palantir Ondo tokenized stock (PLTRON) is a blockchain-based version of Palantir Technologies stock that mirrors the live market price of PLTR shares. It provides economic exposure to Palantir through a digital asset issued by

Ondo Global Markets, allowing users to follow Palantir’s price movements without using a traditional brokerage account. PLTRON does not grant voting rights or shareholder privileges, but it reflects the underlying economic value of the stock.

Tokenized equities such as PLTRON are part of the fast-growing

real-world asset (RWA) sector. According to RWA.xyz, the tokenized RWA market surpassed 1 billion dollars in circulating value in 2025, driven primarily by demand for on-chain access to U.S. treasuries,

index trackers, and major blue-chip stocks. PLTRON contributes to this trend by offering a crypto-native way to hold exposure to Palantir using

USDT and

digital wallets.

PLTRON trades 24/7 and is issued on

Ethereum and

BNB Chain, giving investors global access and flexibility beyond traditional market hours.

Ondo supports the token with regulated custodial structures designed to keep PLTRON aligned with the real price of Palantir shares during U.S. trading hours, while enabling round-the-clock buying and selling on platforms such as BingX.

How Does Ondo’s Palantir Tokenized Stock (PLTRON) Work?

Ondo’s Palantir tokenized stock (PLTRON) is designed to mirror the economic performance of Palantir Technologies stock by linking a blockchain-based token to the real market price of PLTR shares. The mechanism combines traditional equity exposure with on-chain flexibility, giving global users a way to trade Palantir through a digital asset.

Here is how PLTRON works:

1. Price Tracking: PLTRON follows the live price of Palantir stock during U.S. market hours, and the token’s value adjusts accordingly as PLTR moves.

2. Backed Exposure: The token represents economic rights tied to the underlying equity. Ondo uses regulated custodians and financial instruments to keep the token aligned with the value of Palantir shares.

3. Minting and Redemption: Eligible users can mint new tokens by depositing assets equivalent to the value of Palantir stock, and redeem tokens back into underlying exposure during designated settlement windows.

4. 24/7 Trading Access: Although the underlying stock trades during regular market hours, PLTRON itself can be bought and sold 24 hours a day, 7 days a week on supported exchanges, giving users full-time liquidity and flexibility.

5. Crypto-Native Settlement: PLTRON is traded and settled using stablecoins such as USDT, allowing investors to access Palantir exposure directly from a digital wallet without needing a traditional brokerage.

This structure allows PLTRON to deliver the economic performance of Palantir stock in a digital, globally accessible format that fits naturally into both centralized and decentralized trading environments.

What Are the Other Palantir Tokenized Stocks, PLTRx and DPLTR?

Beyond Ondo’s PLTRON, Palantir also has other tokenized versions issued by different providers, most commonly PLTRx and DPLTR. All three tokens provide on-chain exposure to the price of Palantir Technologies (PLTR), but they differ in their backing model, blockchain network, and liquidity profile.

PLTRON is Ondo’s institutional-grade version, offering 1:1 economic exposure backed through Ondo’s regulated infrastructure. PLTRx is an

xStocks-issued token that is fully backed by real Palantir shares held with licensed custodians. DPLTR, by contrast, is a synthetic asset on DeFiChain that uses crypto collateral and oracle pricing rather than holding underlying PLTR shares.

These structural differences affect how each token trades, where it is available, and what type of user it is best suited for.

PLTRON vs. PLTRx vs. DPLTR: Key Differences

| Category |

PLTRON |

PLTRx |

DPLTR |

| Backing Model |

1:1 economic exposure backed through Ondo’s institutional framework. |

1:1 asset-backed token tied to real Palantir shares held by custodians. |

Synthetic token collateralized by crypto, not backed by actual PLTR shares. |

| Networks |

Ethereum and BNB Chain. |

Ethereum and Solana. |

DeFiChain only. |

| Liquidity & Use |

Strong liquidity on CEXs like BingX, ideal for active trading. |

Good liquidity within xStocks and Solana DeFi venues. |

Limited liquidity, mainly for users within the DeFiChain ecosystem. |

How to Buy Palantir Ondo Tokenized Stock (PLTRON) on BingX

Buying PLTRON on BingX is a simple way to gain crypto-native exposure to Palantir stock using USDT. Follow these steps to get started:

Step 1: Create and verify your BingX account: Sign up on the BingX website or app and complete the basic registration. Finish identity verification (

KYC) to unlock full trading limits and enable deposits, trading, and withdrawals.

Step 2: Deposit USDT or other supported assets: Go to the “Deposit” section and add funds to your BingX wallet. You can transfer in USDT or other supported cryptocurrencies, or use available fiat on-ramps such as card payments or bank transfers, depending on your region.

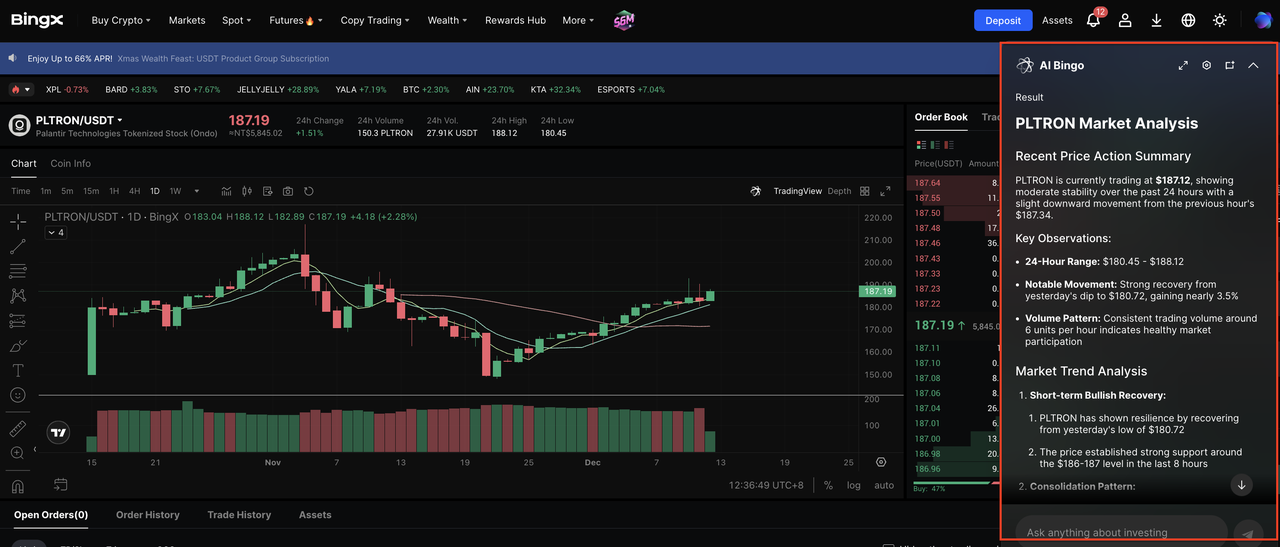

Step 3: Find the PLTRON trading pair: Open the

BingX Spot Trading page and search for PLTRON. Select the

PLTRON/USDT pair to view the live order book, recent trades, and current price before placing your order.

Step 4: Place your PLTRON buy order: Choose a

market order for instant execution or a

limit order at your preferred price. Enter the amount of USDT you want to spend, review the details, and confirm the trade to receive PLTRON in your spot account.

Step 5: Use BingX AI to track trends and explore insights: After your purchase, you can keep PLTRON on BingX or withdraw it to a compatible external wallet. Use

BingX AI to check market trends, explore price insights, ask trading-related questions, and learn more about tokenized stocks as part of your research process.

Key Considerations Before Investing in Palantir Ondo Tokenized Stock (PLTRON)

Investors should treat PLTRON as a digital wrapper for Palantir stock exposure, with the added convenience of crypto settlement but also the added risks of the crypto trading environment. Before investing in PLTRON, here are the key factors to consider:

• Crypto Market Volatility: Even though PLTRON tracks Palantir’s stock price, it still trades in a crypto environment where spreads,

slippage, or liquidity differences may occur during volatile periods.

• Regulatory Landscape: Tokenized stocks operate in a developing regulatory framework. Availability may vary based on region, and rules around tokenized securities can evolve over time.

• No Traditional Shareholder Rights: PLTRON reflects economic exposure only. It does not grant voting rights, governance privileges, or access to shareholder benefits tied to PLTR.

• Dependency on Issuer Infrastructure: While Ondo’s framework is institutional-grade, the token still depends on custodians, oracles, and blockchain infrastructure for accurate price tracking and redemption.

• Liquidity Differences Across Platforms: PLTRON has strong liquidity on BingX, but liquidity may be lower on smaller exchanges or decentralized venues. Users should check depth and trading volume before placing large orders.

Is Palantir Ondo Tokenized Stock (PLTRON) a Good Investment?

PLTRON may be appealing for investors who want crypto-native access to Palantir without opening a traditional brokerage account. Because the token tracks the real market price of PLTR, its long-term value ultimately depends on Palantir’s business performance, AI adoption, and government contract growth. With the company expanding its role in enterprise AI and strengthening its partnership with Nvidia in 2025, Palantir continues to receive attention from investors looking for exposure to operational AI software.

The tokenized format also offers practical advantages. PLTRON trades 24/7, settles in USDT, and provides easier global access than traditional equities. For users who already hold stablecoins or prefer using centralized exchanges like BingX, PLTRON can be a convenient way to capture Palantir’s price movements.

However, as with any tokenized equity, PLTRON should be viewed as a way to track Palantir’s stock, not as a fundamentally different asset. Its performance mirrors Palantir’s underlying volatility, and its investment case is tied directly to Palantir’s long-term execution in government AI, defense, and enterprise adoption.

Related Reading

FAQs on Ondo Palantir Tokenized Stocks (PLTRON)

1. Does PLTRON give me voting rights or shareholder privileges?

No. PLTRON provides economic exposure only. It does not include voting rights, governance privileges, or any traditional shareholder benefits.

2. Where can I buy PLTRON?

PLTRON can be purchased on platforms such as BingX, where it trades as PLTRON/USDT and supports 24/7 trading with simple USDT settlement.

3. Is PLTRON backed 1:1 by real Palantir shares?

Yes. PLTRON reflects 1:1 economic exposure to Palantir stock through Ondo’s institutional framework, which uses regulated custodians to maintain alignment with the underlying PLTR share price.

4. Which blockchain does PLTRON use?

PLTRON is issued on Ethereum and BNB Chain, allowing users to trade and hold the token across two widely supported networks in both CeFi and DeFi environments.