The UAE, a global leader in fintech innovation, is witnessing a surge in crypto adoption not just among retail users but also businesses and institutions. As the nation pursues its Dubai Cashless Strategy and D33 Economic Agenda, Stablecoins are emerging as a key aggregator for online payments, offering stability, speed, and low costs. The UAE has the highest percentage of crypto ownership among internet users, with 27.18% of its online population holding cryptocurrency, according to a research study by Triple A and GWI. With high adoption, traders, expatriates, and businesses are increasingly turning to stablecoins for remittances, e-commerce, and everyday transactions.

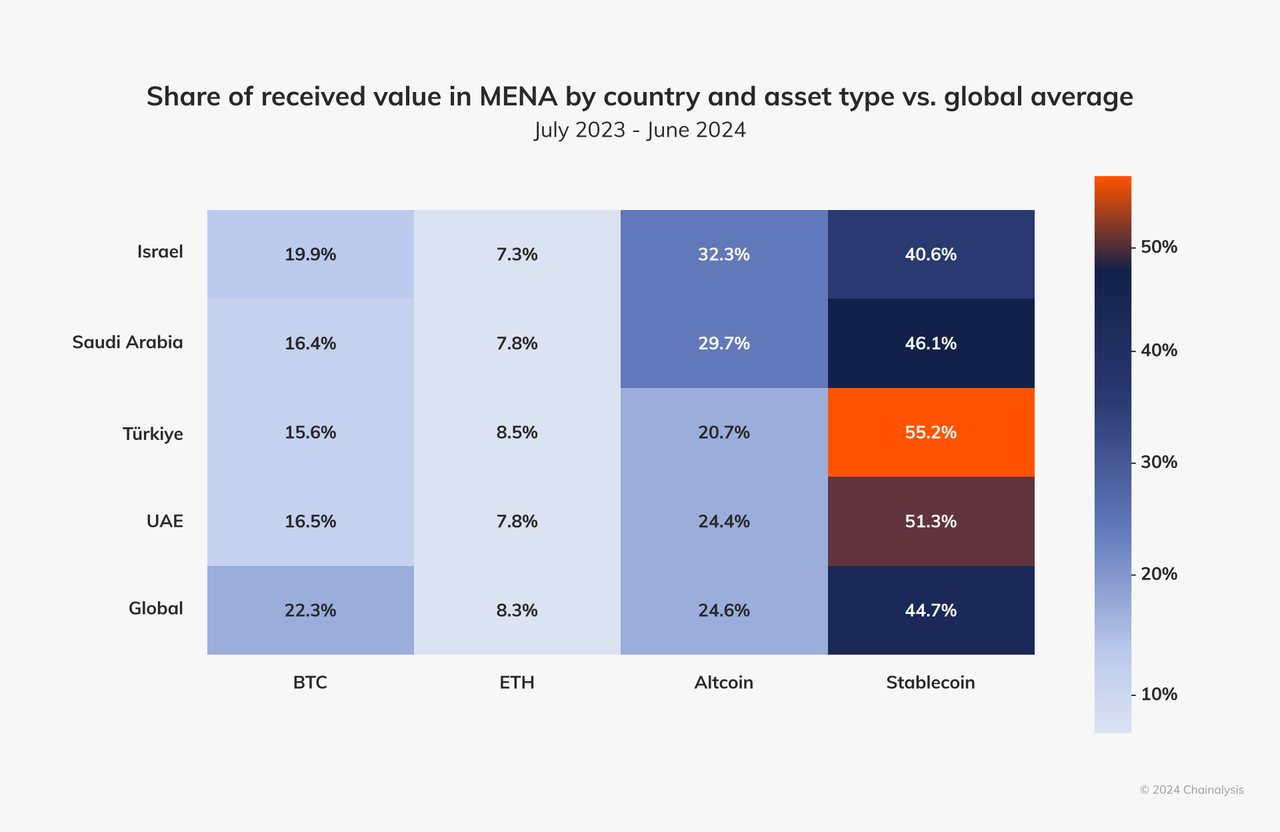

Stablecoins, cryptocurrencies pegged to assets such as the US dollar or gold, offer a stable alternative to volatile tokens like Bitcoin or Ethereum. In the UAE, where 88% of the population drives significant remittance flows and businesses seek efficient cross-border payments, stablecoins address key pain points: high fees, slow transfers, and currency fluctuations. According to Chainanalysis’s research study, stablecoins dominate MENA crypto transactions, accounting for a significant portion of the UAE’s $30 billion in 2023-24. This popularity stems from their ability to combine blockchain’s speed and transparency with fiat-like stability.

Study by Chainanalysis, 2024

Recent developments in the crypto space reinforce stablecoin’s relevance. Circle’s USDC expansion in 2025 and the UAE’s Decentralized Physical Infrastructure Network (DePIN) sandbox, signal growing support for digital payment innovations.

Stablecoin Use Cases for UAE Users

Stablecoins are transforming online payments across various scenarios in the UAE. Some include:

- Remittances for Expats: Stablecoins like USDT or USDC enable low-cost, near instant transfers compared to traditional banking, where fees can go up to 7%.

- E-commerce and Merchant Payments: UAE businesses are adopting stablecoins for online sales. Emarat gas station’s acceptance of crypto payments highlights this trend. Once again, stable pricing protects merchants from volatility.

- Cross Border Business Transactions: UAE’s heavy trade economy benefits from stablecoin’s fast settlement times (seconds vs. Days for SWIFT transfers).

These use cases align with the UAE’s goal of achieving 90% of digital transactions under the Dubai Cashless Strategy, positioning stablecoins as a key driver of financial inclusion.

As the Virtual Asset Regulatory Authority (VARA) refines regulations and businesses like Emarat adopt crypto in everyday use, stablecoins will drive seamless, cost-effective transactions. The UAE’s $40 billion Bitcoin holdings and a significant crypto adoption growth in 2024 underscore its readiness for the shift. Stablecoin usage for remittances is expected to continue growing, further integrating them into the digital economy. As the UAE leads the world with a 25.3% crypto ownership rate, stablecoins are not just a trend; they are the future of payments.