AI agents are one of 2025’s defining themes. That’s why DeAgentAI moved into the spotlight in early November, following a collaboration with Pieverse Payments and a wave of new listings that broadened access and liquidity.

According to CoinGecko, the market capitalisation reached $1.3 billion on 7 November. Momentum was amplified by heavier derivatives activity and a break from

Bitcoin’s direction, but the next phase depends on whether real inflows and usage can keep pace with the price.

Here is what DeAgentAI actually builds on-chain, how AIA fits in, and what drove the move.

What Is DeAgentAI (AIA) and How Does It Work?

DeAgentAI is infrastructure for running verifiable, stateful agents on public networks. It targets three blockers for autonomous on-chain systems: consensus (turn many possible outputs into one agreed result), identity (keep one consistent agent persona), and continuity (record past actions so future decisions have context).

Each agent bundles a Lobe (logic), Memory (genesis state plus history), and Tools (allowed capabilities). An agent goes live when this definition is published on a network, inheriting immutability and finality. Finality means a confirmed transaction cannot be reversed.

Execution splits across roles: Executors run the logic and submit candidate results with proofs; Committers finalize exactly one result per interaction and write it to Memory. This preserves identity and creates an auditable trail.

Agents can also message each other. One agent sends a structured call to another’s address; the receiver processes it like a user request and, if finalized, updates its state. The design targets

DeFi strategies, evolving on-chain games, information products, and governance where outcomes must be reproducible and traceable.

It locks in a single result and spans

Sui,

BNB Chain, and Bitcoin, reducing trust requirements for interoperability because verifiable proofs can move between networks and be checked anywhere.

AIA Token Utility

• Network fees: Pay in AIA to create agents, subscribe to them, invoke services, and unlock premium features.

• Staking and reliability: Stake AIA to support validation and data integrity across the network and receive staking rewards.

• Governance: Use AIA to vote on key parameters and foundation decisions that guide protocol development.

• Community incentives: AIA funds ecosystem growth initiatives and user programs that encourage creators, validators, and users to participate.

Why Did DeAgentAI Gain Spotlight in Early November?

New payments catalyst

A collaboration with Pieverse introduced invoice payments via Binance Wallet. That added a clear, real-world hook for agent use, sharpened the narrative, and pulled fresh speculative flows into AIA.

Broader access and deeper liquidity

A run of new exchange listings, including spot and AIAUSDT perpetuals with leverage, expanded the trading venue set and deepened order books. A short promotional window around the launch further concentrated attention and activity.

Derivatives-driven momentum and market structure

Reported spikes in perpetual volume and leaderboard ranks signaled aggressive leverage, which can turbocharge upside when spot demand jumps. At the same time, AIA decoupled from Bitcoin with a negative correlation reading, allowing the move to play out despite wider market noise, while on-chain flow gauges showed optimism even as sustained inflows were still building.

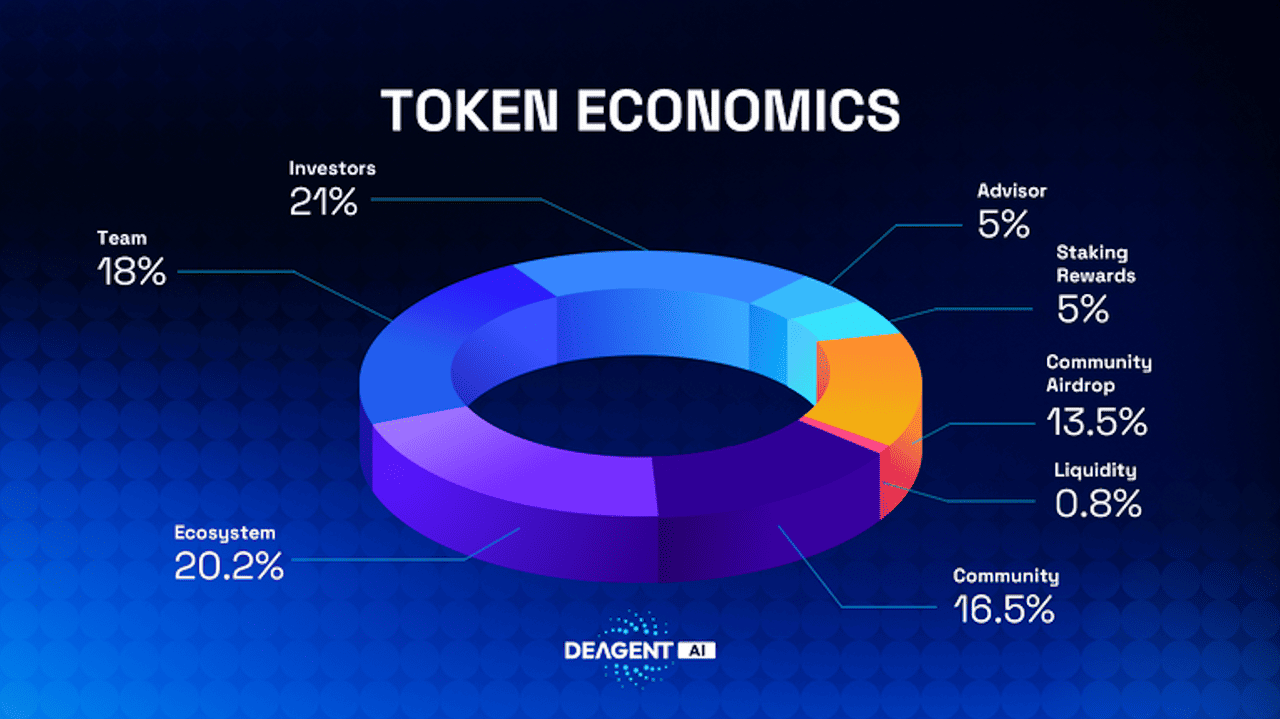

AIA Tokenomics and Allocation

The total supply is fixed at 1,000,000,000 AIA. Distribution is designed to balance broad participation with long-term alignment, with 9.95% initially unlocked at Token Generation Event (TGE).

• Ecosystem Development 20.20%: partnerships, builder incentives, incubation, and broader ecosystem expansion.

• Community Programs 16.50%: user growth and product-driven initiatives steered by governance.

• Early Distribution and Airdrops 13.50%: targeted campaigns to reward early users over time.

• Staking Rewards 5.00%: incentives for long-term participation and network reliability.

• Core Team and Contributors 18.00%: 1 year lock, then 36 months of linear monthly releases.

• Advisors 5.00%: same schedule as the team, with a 1-year lock and 36 months linear.

• Early Backers and Investors 21.00%: 1 year lock, followed by 36 months linear to align long term.

• Liquidity and Market Stability 0.80%: fully unlocked at TGE to support initial market making and price discovery.

How to Trade DeAgentAI (AIA) on BingX

How to Trade AIA on Spot Market

Whether you are building a long-term AIA position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token. With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

AIA/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit AIA or USDT and verify the correct network before trading.

Always conduct your own research (DYOR). Diversify your portfolio and never invest more than you can afford to lose.

How to Trade AIA Perpetual Futures

AIA/USDT perpetual contract on BingX futures powered by AI BingX

Futures, especially perpetual futures, let you trade AIA price movements with leverage; you don’t necessarily need to hold the underlying AIA. You can go long (betting price will rise) or short (betting price will fall). BingX offers a

AIA-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate AIA-USDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk (if losses push margin below maintenance).

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Risks and Considerations

AIA is high risk with violent swings and slippage, and heavy perp activity can trigger liquidation cascades. Its recent break from Bitcoin may reverse without warning. Unlocks for investors, team, and advisors, plus airdrop and staking releases, add supply that can weigh on price.

Multi-chain flows raise operational risk if you pick the wrong network or a faulty bridge, and

smart contract bugs or concentrated governance can compound losses. Watch for phishing and fake claim sites, factor in fees and local taxes, and verify everything on official channels.

Related Reading