In this guide, you’ll learn what BABAON is, how Ondo’s

tokenized stocks work, what makes BABAON different from other synthetic Alibaba products, and how to buy and store BABAON safely using BingX and Web3 wallets.

What Is Ondo’s Alibaba Tokenized Stock (BABAON)?

BABAON is Ondo Finance’s tokenized version of Alibaba Group Holding Ltd. stock, designed to mirror the economic performance of BABA shares listed on U.S. markets. Instead of holding traditional brokerage shares, you hold an ERC-20 / BEP-20 token that reflects BABA’s price and assumes dividends are reinvested back into the position.

As of December 2025, BABAON has grown into one of the fastest-expanding tokenized equities on Ondo Global Markets, with a total asset value of $1,963,306, up +64.44% over the past 30 days. Its net asset value (NAV) sits at $150, reflecting a modest 2.41% dip month-over-month, while the holder base has expanded to 475 users, a +13.64% increase that underscores rising global interest in tokenized Alibaba exposure.

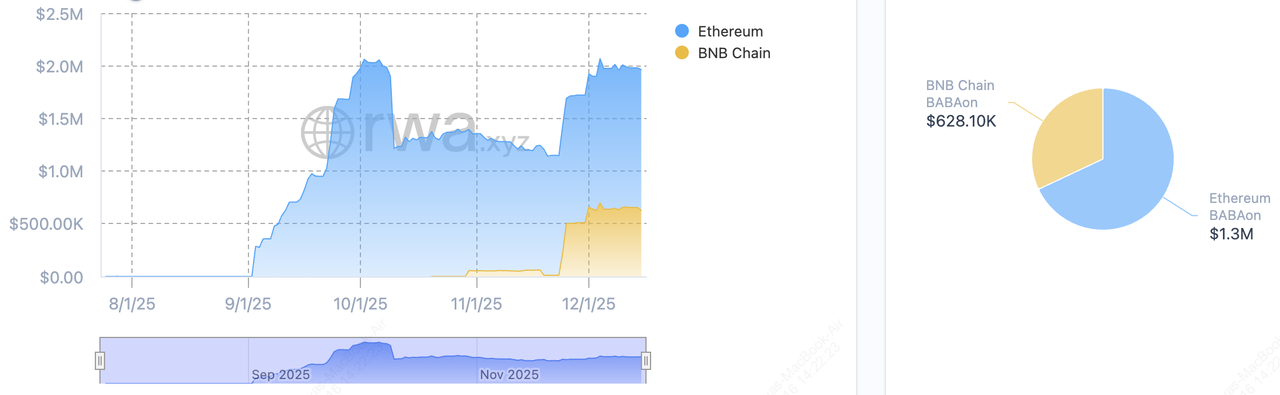

Total value of Alibaba tokenized stock BABAON | Source: RWA.xyz

On-chain activity has surged as well, with $3,492,440 in monthly transfer volume, representing a +174.94% jump driven by heightened trading across supported networks. BABAON’s liquidity is distributed across $1.3 million on and over $628,000 on BNB Chain, giving users multi-chain flexibility and deeper access to decentralized markets.

Ondo issues BABAON through its

Ondo Global Markets platform for eligible non-U.S. investors. The tokens are fully backed by U.S. securities and cash held with regulated broker-dealers, with a structure aimed at being bankruptcy-remote and protected by an independent security agent. You can mint and redeem BABAON 24 hours a day, five days a week, while traders on exchanges like BingX access secondary liquidity around the clock.

Quick Overview of BABAON Tokenized Shares

BABAON brings Alibaba’s public-market performance onto the blockchain, giving global users seamless, crypto-native access to its economic exposure.

• Underlying asset: BABAON tracks the price performance of Alibaba Group Holding Ltd. (NYSE: BABA, HKEX: 9988).

• Issuer: The token is issued by Ondo Global Markets, part of the

Ondo Finance ecosystem.

• Blockchains: BABAON exists on

Ethereum as an ERC-20 token and on

BNB Chain as a BEP-20 token.

• Backed by: Each token is economically backed by Alibaba shares and cash equivalents held with U.S. custodial broker-dealers.

• Trading hours: Users can mint and redeem BABAON 24/5, while secondary markets allow 24/7 trading depending on platform availability.

• Use cases: BABAON can be used for spot trading, portfolio diversification, and eligible DeFi strategies such as collateralization and structured products.

How Does Alibaba's Tokenized Stock BABAON Work?

BABAON works by converting real Alibaba stock exposure into a fully backed, on-chain token that mirrors BABA’s economic performance through regulated custody, instant minting/redemption, and blockchain-based trading.

1. Custody and Backing

Ondo Global Markets holds real Alibaba shares and associated cash at one or more U.S.-registered custodial broker-dealers. Each BABAON token represents a claim on the economic value of a basket of BABA stock plus reinvested dividends, after any taxes and fees, rather than a direct share certificate in your name.

The structure uses a special purpose vehicle with at least one independent director and a first-priority security interest held by a third-party security agent. This design aims to keep token collateral segregated from the issuer’s balance sheet and protect tokenholders even in an insolvency scenario.

2. Total Return Tracker Design

BABAON is a total return tracker, not a simple “1 token = 1 share” wrapper. Over time, as dividends are treated as reinvested, one BABAON token may correspond to more than one underlying share’s worth of value. This means the token’s price is linked to, but not always numerically identical with, the live BABA share price.

You don’t receive shareholder voting rights or formal dividend payouts from Alibaba. Instead, the token is engineered so its value reflects the performance of BABA, assuming dividends are compounded in the position.

3. Minting, Redemption, and Liquidity

Eligible non-U.S. users can mint BABAON through Ondo Global Markets using USDon, Ondo’s dollar-backed

stablecoin, with atomic swaps from

USDC built into the flows. When you redeem, you receive stablecoins equal to the then-current cash value of the underlying exposure.

On secondary markets, BABAON trades like any other crypto token.

Arbitrageurs help keep BABAON close to BABA’s fair value by buying or selling tokens when the on-chain price diverges from the stock’s value, taking advantage of Ondo’s instant, low-friction mint and redemption to close gaps.

Why Tokenize Alibaba Stock at All?

Alibaba is a global e-commerce and cloud giant with businesses spanning Taobao, Tmall, AliExpress, Lazada, Cainiao logistics, Alibaba Cloud, and digital media platforms like Youku and Amap.

For many investors outside the U.S. and Hong Kong, direct access to Alibaba shares is limited by local brokerage availability, FX friction, and market-hour constraints. BABAON lets you gain Alibaba price exposure using a crypto account, with fractional sizing, stablecoin settlement, and 24/7 crypto-style execution, while still being tied to underlying public equity markets.

How Is BABAON Different from Other Tokenized Alibaba Products?

Several platforms offer synthetic or tokenized exposure to Alibaba, including products labeled BABA on other tokenization platforms or legacy “Bittrex” wrapped stocks. BABAON stands out in three main ways:

• Full on-chain mint / burn with traditional-market routing: BABAON is created and redeemed directly against real BABA securities via Ondo’s broker network, rather than being purely derivative exposure.

• 24/5 primary liquidity + 24/7 crypto trading: Arbitrage between Ondo’s primary market and exchanges helps keep prices aligned with the underlying stock, reducing slippage and persistent discounts/premiums common in earlier tokenized equity experiments.

• Investor protections: BABAON uses a bankruptcy-remote SPV, independent security agent, daily verification of collateral, and audited smart contracts, positioning it closer to an institutional

RWA product than a casual synthetic.

Who Can Invest in BABAON Tokenized Stock?

Ondo Global Markets currently targets non-U.S. investors, subject to jurisdiction checks and KYC/AML requirements. Residents or entities from certain countries, including the U.S., mainland China, Canada, Russia, and several sanctioned or embargoed jurisdictions, are prohibited from subscribing, acquiring, or redeeming Ondo Global Markets tokens directly.

If you trade BABAON on BingX or other exchanges, you still need to comply with both your local regulations and the exchange’s compliance rules. Always check whether tokenized equities are permitted in your country and whether you meet any required investor qualifications.

How to Buy Alibaba Tokenized Stock (BABAON) on BingX: Step-by-Step Guide

BABAON/USDT trading pair on the spot market powered by BingX AI insights

BABAON is listed on BingX Spot Trading and can be traded against USDT.

Step 1: Create and Verify Your BingX Account

Go to the official BingX website or app. Sign up with your email or phone number. Complete

KYC verification as required in your region.

Step 2: Deposit Funds or Buy USDT

You need

USDT to trade the BABAON/USDT pair. You can:

•

Deposit USDT or other supported crypto from an external wallet or exchange, then convert to USDT if needed.

Step 3: Navigate to the BABAON/USDT Spot Pair

In the Spot section, search for “BABAON.” Select the

BABAON/USDT trading pair.

Step 4: Place a Buy Order

Choose

Market order if you want to buy at the current price, or Limit order if you prefer a specific entry price. Enter the amount of USDT you want to spend or the quantity of BABAON you want to buy.

Confirm the order. BingX supports small trade sizes, so you can start with around $10 worth of BABAON if you want to test the waters.

Step 5: Monitor and Manage Your Position

View your BABAON holdings in the Spot portfolio. Set conditional orders like

Take-Profit (TP) and Stop-Loss (SL) on related pairs, or manually adjust positions based on Alibaba and broader market moves.

Note: Availability of BABAON trading pairs and advanced features may vary by region and account tier. Always confirm the latest listings on the BingX Markets page.

Can You Buy BABAON with Web3 Wallets and DEXs?

Yes. Because BABAON is an ERC-20 / BEP-20 token, you can store and trade it from compatible

Web3 wallets like

MetaMask,

Trust Wallet, and hardware solutions like

Ledger, often via CEXs or DEXs that support the token.

You may also interact directly with Ondo Global Markets (for eligible institutional users) to mint or redeem BABAON using USDon/USDC, or trade it on

decentralized exchanges like

Uniswap where liquidity is available. However, this typically requires more technical familiarity, gas fees, and careful contract verification.

Benefits of Investing in BABAON

BABAON combines Alibaba’s equity story with crypto-native flexibility:

1. Access to U.S. equities via crypto rails: You can get Alibaba exposure even if local brokers do not offer U.S. stock trading.

2. Fractional exposure and low minimums: Start with small amounts and build a position over time instead of buying full lots of stock.

3. 24/7 crypto trading with 24/5 primary liquidity: React to news, earnings guidance, or macro events outside traditional market hours.

4. DeFi compatibility (where supported): Use BABAON as collateral, in structured products, or within automated strategies that combine RWAs and crypto assets.

Risks to Consider Before Buying BABAON

Tokenized stocks come with their own risk profile. Before you buy BABAON, keep in mind:

1. No direct shareholder rights: You don’t receive traditional shareholder rights such as voting, direct dividend distributions, or meeting participation. Your exposure is economic only.

2. Regulatory uncertainty: Tokenized securities sit in a fast-evolving legal environment. Changes in securities or crypto rules could affect where and how BABAON can be offered or traded.

3. Issuer and custody risk: BABAON’s safety depends on Ondo’s operational robustness, broker-dealer partners, and smart contract security. While the structure aims for bankruptcy remoteness and uses daily attestations, these protections are not risk-free.

4. Liquidity and slippage: BABAON’s on-chain trading volume is smaller than Alibaba’s traditional stock markets. During volatile periods, spreads may widen and larger orders may experience slippage, even though Ondo’s mint/redeem design works to limit extreme price dislocations.

5. Jurisdictional restrictions: Residents of certain countries, including the U.S. and multiple sanctioned regions, are restricted from directly accessing Ondo Global Markets tokens, and exchanges like BingX may have their own geo-fencing.

As always, this information is for educational purposes only and does not constitute financial, legal, or tax advice. You should do your own research and consider speaking with a professional advisor before making investment decisions.

Final Thoughts: Should You Buy BABAON Tokenized Alibaba Shares?

BABAON offers a convenient, crypto-native way to gain economic exposure to Alibaba’s stock, pairing traditional equity value with blockchain settlement, fractional sizing, and global accessibility. For non-U.S. users who already trade on BingX or manage portfolios in USDT and other stablecoins, BABAON can be a practical bridge into U.S. tech equity narratives without opening a conventional securities account.

However, BABAON is still a tokenized security operating within an evolving regulatory and market structure. It does not replace direct share ownership, and it adds layers of issuer, custody, and smart-contract risk on top of Alibaba’s own business and market risks. If you choose to invest, consider position sizing carefully, monitor both Alibaba fundamentals and tokenized-equity regulations, and use tools like TP/SL orders on BingX to manage downside risk.

Related Reading

FAQs on Alibaba Ondo Tokenized Stock (BABAON)

1. Is BABAON backed by real Alibaba shares?

Yes. BABAON is structured to be fully backed by Alibaba stock and cash equivalents held with U.S. custodial broker-dealers, with daily verification of collateral.

2. Do I get dividends or voting rights with BABAON?

No. You don’t get direct dividends or corporate voting rights. Instead, BABAON is designed as a total return tracker where dividends are effectively reflected in the token’s economic exposure over time.

3. What blockchains does BABAON use?

BABAON exists on Ethereum as an ERC-20 token and on BNB Chain as a BEP-20 token, both managed by Ondo’s Global Markets infrastructure.

4. Can U.S. investors buy BABAON?

Ondo Global Markets tokens, including BABAON, are generally not available to U.S. persons or anyone transacting from U.S. soil, alongside several other restricted jurisdictions. You must check your eligibility and your exchange’s compliance policies.

5. Can I buy BABAON on BingX with $10?

Create and verify your BingX account, buy or deposit at least 10 USDT, search for BABAON/USDT in the Spot market, and place a market or limit buy order for the amount you want.