The impact is measurable. Uniswap alone has paid out more than $4.8 billion in fees to its liquidity providers since 2018, distributing millions in rewards every day. PancakeSwap has returned about $3.3 billion to its community since 2020, while Aave depositors have earned roughly $1.45 billion through lending interest and fees. Across decentralized exchanges (DEXs) alone, trading fee distributions since 2020 are estimated at $7–8 billion, cementing liquidity mining as one of crypto’s largest wealth-sharing mechanisms.

By 2025, liquidity mining is no longer a short-term experiment. It has matured into a structural pillar of DeFi, ensuring that exchanges,

stablecoins, and lending protocols remain liquid while giving participants consistent, protocol-aligned rewards.

What Is Liquidity Mining and How Does It Work?

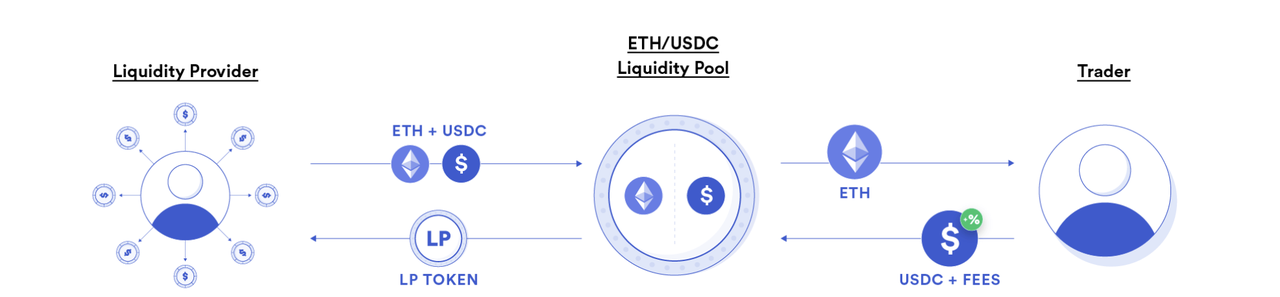

Liquidity mining is the process of providing assets to a liquidity pool on a decentralized exchange (DEX) or

lending platform. These pools replace the order books used in traditional markets, allowing users to swap or borrow assets directly from shared reserves.

When you deposit tokens into a pool, you receive liquidity provider (LP) tokens that represent your share of the pool. These LP tokens can be redeemed later for your initial deposit plus any rewards earned. Rewards typically come from three sources:

• Trading fees paid by users swapping assets in the pool

• Interest payments on lending and borrowing platforms

• Native or governance tokens distributed by the protocol to incentivize participation

This mechanism keeps decentralized markets liquid while giving participants a way to earn passive income. It has become a cornerstone of DeFi because it aligns the incentives of both protocols that need liquidity and users who want yield.

5 Main Types of Liquidity Pools in DeFi and How They Work

Liquidity pools are the backbone of decentralized finance, but not all pools serve the same purpose. Each type is designed with different mechanics, risks, and rewards, giving liquidity providers a range of options depending on their strategy. The main categories include:

1. Automated Market Maker (AMM) Pools: Found on decentralized exchanges like Uniswap, Balancer, or PancakeSwap. These pools allow token swaps directly between assets without order books, using algorithms to set prices. LPs earn a share of trading fees.

2. Stablecoin Pools: Built for assets such as

USDT,

USDC, or

DAI. These pools minimize price volatility, offering lower but more stable yields. Curve is the best-known example, specializing in efficient stablecoin swaps with minimal

slippage.

3. Lending Pools: Offered by platforms like Aave and Compound. Users deposit tokens into a shared pool, which borrowers can draw from by providing collateral. Liquidity providers earn interest on their deposits while supporting lending activity.

4. Yield Aggregator Pools: Platforms like Yearn Finance or Beefy Finance automate yield strategies. They move assets across different protocols to maximize returns, making them popular for users who prefer a hands-off approach.

5. Specialized or Incentivized Pools: Common in newer ecosystems and Layer 2 networks. These pools often provide additional rewards, such as governance tokens, restaking incentives, or ecosystem-specific benefits, to encourage long-term liquidity provision.

Top 7 Platforms for Liquidity Mining in 2025

Choosing the right platform is critical for liquidity providers. The best options combine deep market adoption, reliable security, and sustainable reward structures. In 2025, a handful of protocols stand out as leaders across AMM, stablecoin, lending, and yield aggregator pools. Below are the top seven platforms for liquidity mining, each with its typical APY range, core features, and long-term milestones.

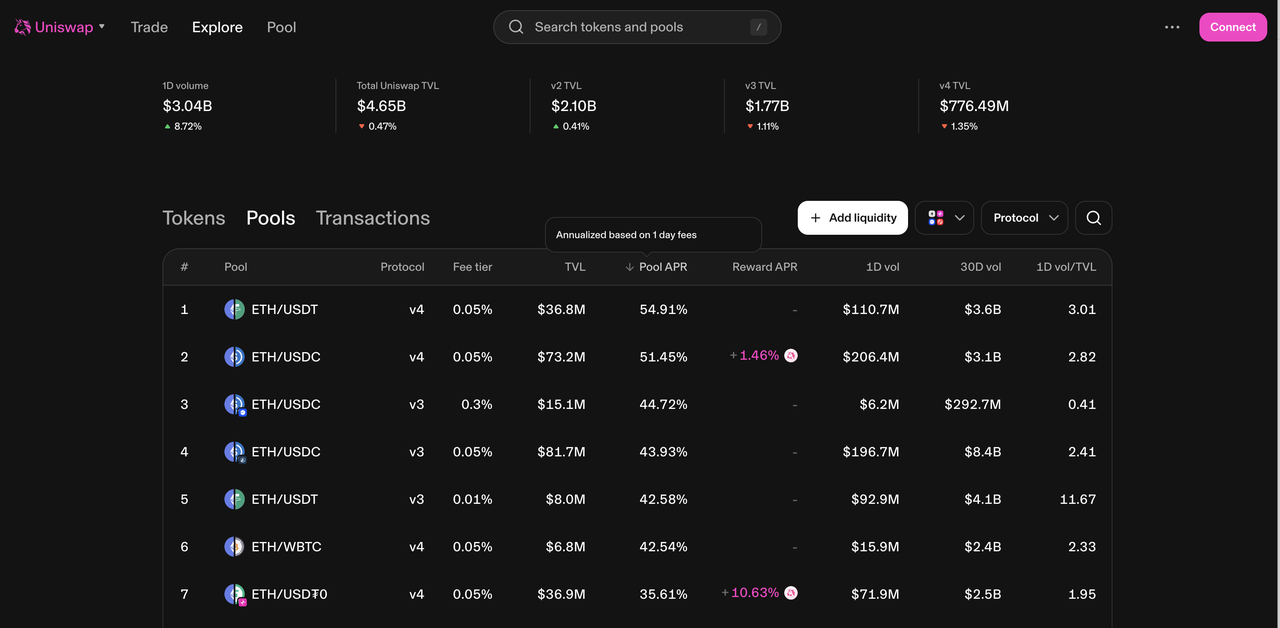

1. Uniswap (UNI) - AMM Pools on Multichain

Typical APY Range: 5-55% (varies by trading volume and pool selection)

Key Metrics: ~$3-5B TVL | 1000+ Active Pools | Zero Major Exploits | $800M-$2B Daily Volume

Uniswap offers liquidity providers the flexibility to earn through both standard pools and concentrated liquidity positions, where users can focus their capital within specific price ranges to maximize fee capture. The platform's multi-chain presence allows users to choose between different networks based on their preferences for transaction costs, with

Ethereum offering the highest liquidity depth while

Layer-2 solutions provide more cost-effective options for smaller positions.

Launched in November 2018, Uniswap pioneered the automated market maker model and has processed over $1 trillion in cumulative trading volume, establishing itself as the most battle-tested DEX in DeFi. The V3 upgrade in May 2021 introduced concentrated liquidity, fundamentally changing liquidity provision across the industry, while its expansion across Ethereum,

Polygon,

Arbitrum, and

Optimism has maintained consistent security with no major exploits throughout its operational history.

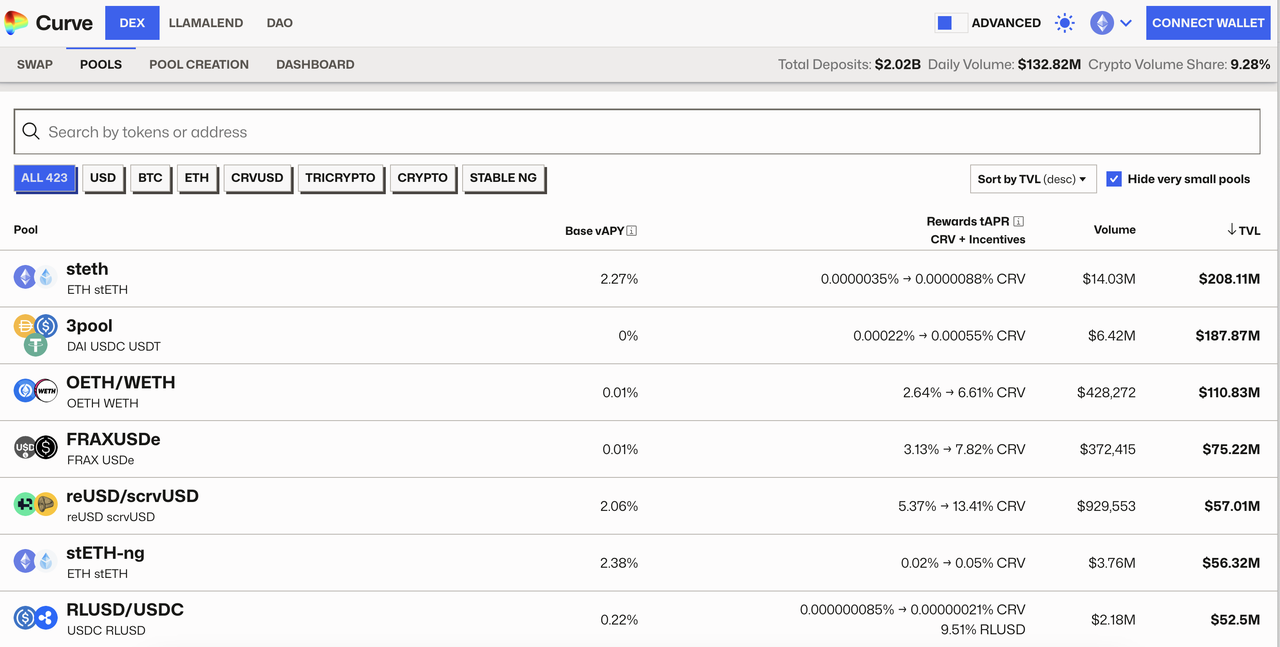

2. Curve Finance (CRV) - Stablecoin Pools on Multichain

Typical APY Range: 3-25% (stablecoin pools typically 3-8%, crypto pools up to 25%)

Key Metrics: ~$1.5-3B TVL | 200+ Active Pools | Strong Security Record | $100M-$500M Daily Volume

Curve Finance specializes in efficient stablecoin trading with minimal slippage, making it ideal for conservative liquidity providers seeking stable returns with reduced impermanent loss risk. The platform's unique algorithm optimizes trades between similarly-priced assets, while its vote-escrowed CRV (veCRV) system rewards long-term participants with boosted yields and governance influence over protocol decisions and reward distribution.

Since launching in January 2020, Curve became the first platform to successfully solve the stablecoin liquidity problem and has maintained its position as the leading stablecoin DEX. The protocol's introduction of vote-escrowed tokenomics in August 2020 created a new standard for sustainable DeFi governance that influenced countless projects, with its expansion across multiple Layer-2 networks cementing its role as critical infrastructure for stable asset trading throughout DeFi.

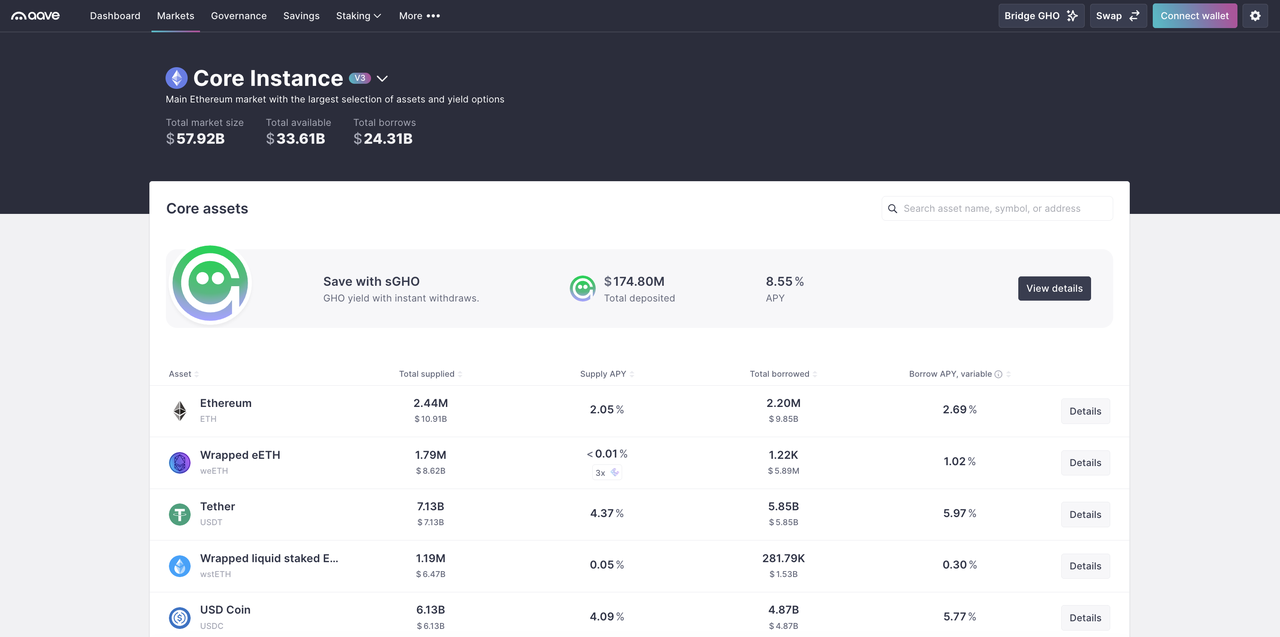

3. Aave (AAVE) - Lending Pools on Multichain

Typical APY Range: 2-15% (varies by asset utilization rates and safety incentives)

Key Metrics: ~$4-8B TVL | 30+ Active Pools | Strong Security Record | $50M-$200M Daily Volume

Aave provides liquidity providers with multiple earning opportunities through traditional lending markets, flash loan fees, and Safety Module staking, offering more diversified income streams compared to traditional AMMs. Users can benefit from variable or stable interest rates while maintaining the flexibility to use their deposits as collateral for borrowing, plus earn additional AAVE token rewards through the protocol's incentive programs.

Originally ETHLend in 2017 before rebranding and launching as Aave in January 2020, the platform pioneered flash loans and became one of the first protocols to offer sophisticated DeFi lending mechanisms. Aave's multi-chain deployment across Ethereum, Polygon, and

Avalanche has established it as a cornerstone of institutional DeFi adoption, with its innovative Safety Module creating an insurance mechanism that has helped build institutional confidence in decentralized lending protocols.

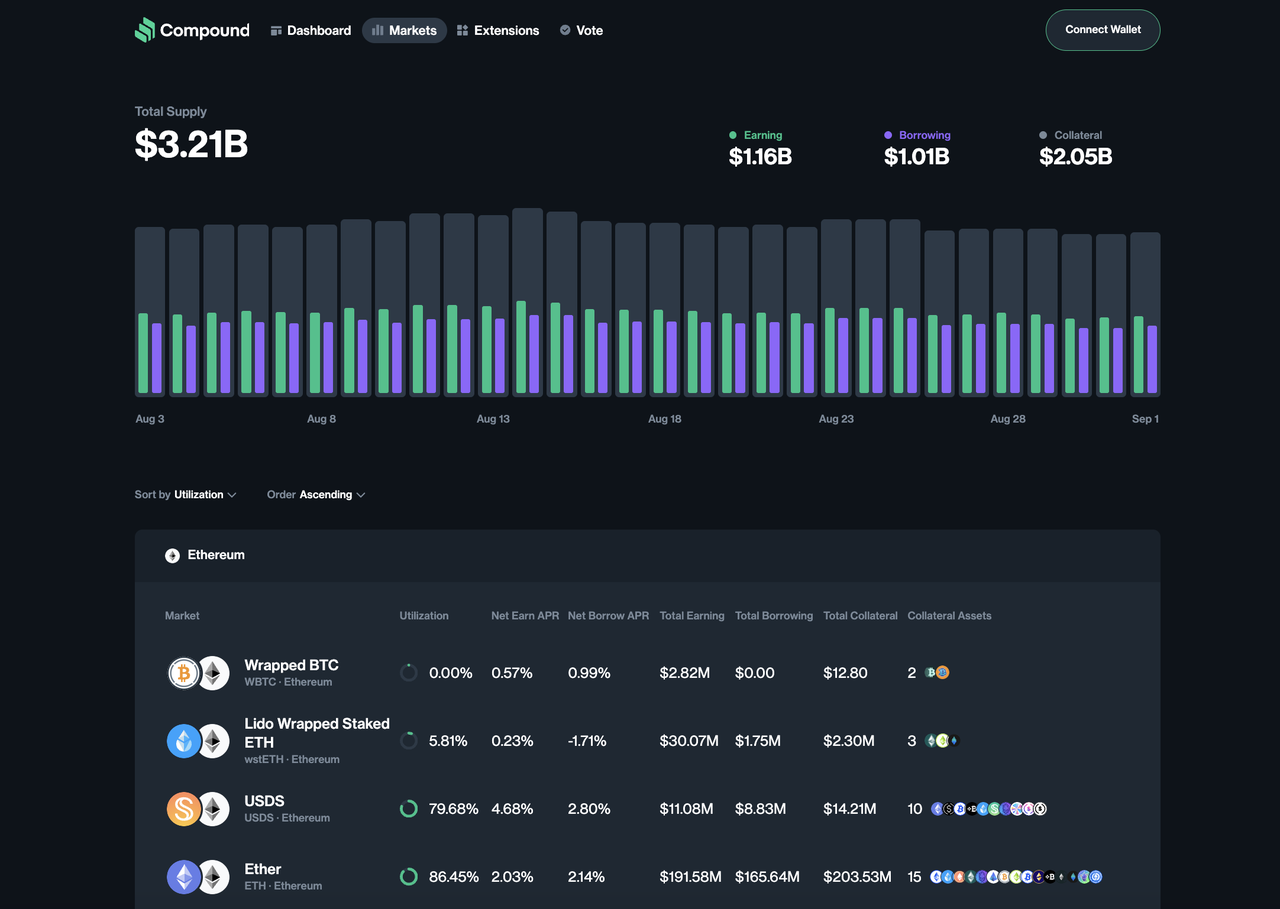

4. Compound (COMP) - Lending Pools on Ethereum

Typical APY Range: 1-12% (algorithmically determined by supply/demand dynamics)

Key Metrics: ~$1-3B TVL | 15+ Active Pools | Strong Security Record | $20M-$100M Daily Volume

Compound offers straightforward lending pool participation where users earn interest automatically distributed in real-time, plus COMP governance tokens that provide voting rights on protocol upgrades and parameter changes. The platform's algorithmic interest rate model ensures fair market-driven returns without human intervention, while the transparency of on-chain operations appeals to institutional users requiring auditable lending processes.

Launched in September 2018, Compound pioneered algorithmic interest rate determination and established the foundation for autonomous money markets in DeFi. The protocol's COMP token distribution in June 2020 sparked the "DeFi Summer" phenomenon and created the blueprint for liquidity mining incentives across the entire ecosystem, with its governance model becoming the template for decentralized protocol management that has influenced hundreds of subsequent projects.

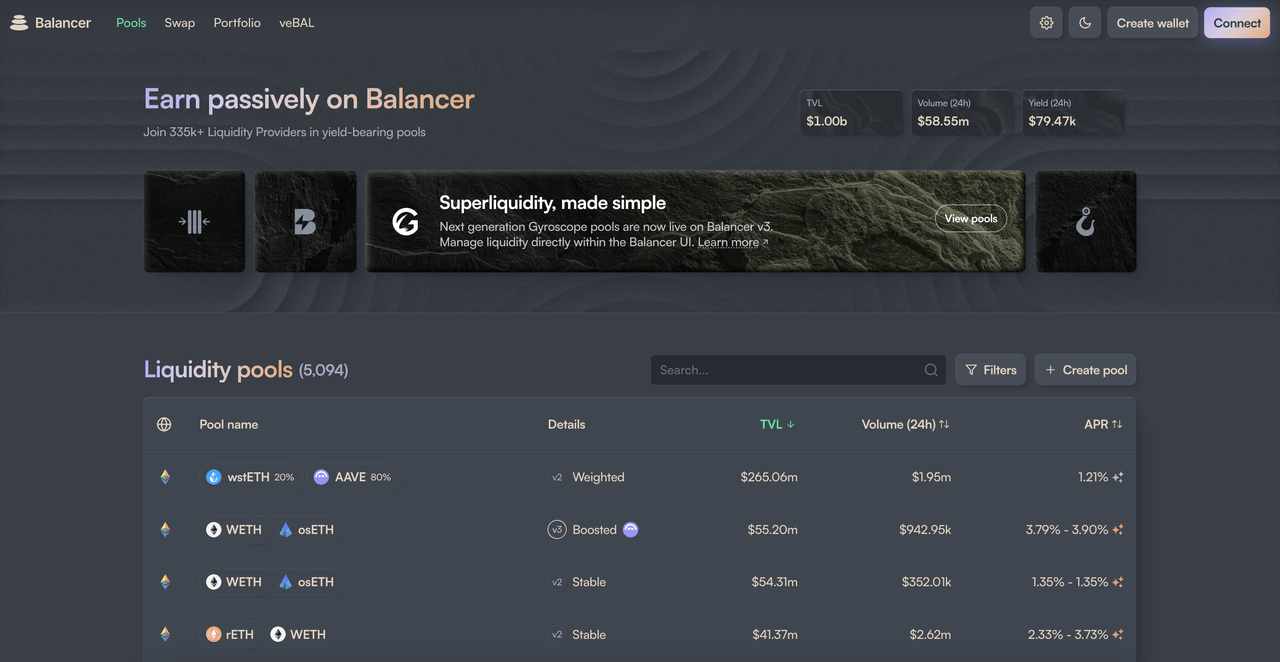

5. Balancer (BAL) - AMM Pools on Multichain

Typical APY Range: 8-30% (higher for boosted pools and multi-asset strategies)

Key Metrics: ~$800M-1.5B TVL | 300+ Active Pools | Strong Security Record | $30M-$150M Daily Volume

Balancer enables liquidity providers to create custom pools with up to 8 tokens in any weight ratio, allowing for portfolio-like exposure while earning trading fees from rebalancing activities. The platform's boosted pools integrate with external protocols to provide additional yield layers, while the veBAL tokenomics system offers long-term participants enhanced rewards and governance influence over pool incentives and protocol direction.

Launching in March 2020, Balancer introduced the revolutionary concept of weighted pools that transformed traditional 50/50 AMM limitations into flexible portfolio management tools. The platform's evolution through boosted pools in 2021 and veBAL tokenomics in 2022 has established it as the premier solution for sophisticated institutional strategies, with its modular architecture supporting everything from simple weighted pools to complex multi-asset rebalancing strategies used by professional fund managers.

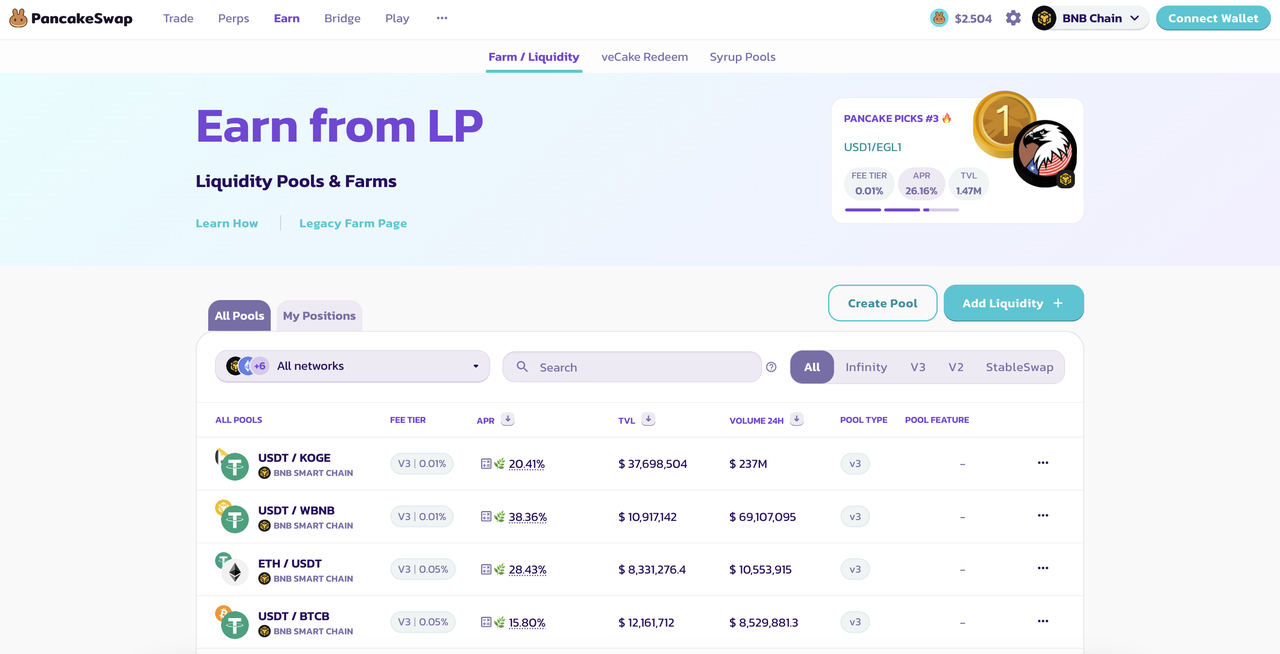

6. PancakeSwap (CAKE) - AMM Pools on BNB Chain

Typical APY Range: 10-80% (varies significantly with CAKE incentives and pool selection)

Key Metrics: ~$1-2.5B TVL | 500+ Active Pools | Strong Security Record | $200M-$800M Daily Volume

PancakeSwap provides retail-friendly liquidity mining with lower barriers to entry due to BNB Chain's minimal transaction costs, making it accessible for smaller investors to participate profitably in yield farming. The platform combines traditional AMM earnings with gamified features like

prediction markets and lottery systems, while its CAKE token rewards system offers competitive yields particularly attractive to users in regions where transaction fee efficiency is crucial.

Launched in September 2020 during high Ethereum

gas fees, PancakeSwap quickly captured market share by offering accessible DeFi tools on

Binance Smart Chain (now BNB Chain). The platform has maintained consistent growth and community engagement through its focus on retail users, establishing itself as the primary gateway for millions of users entering

BNB DeFi, particularly in markets where cost-effectiveness and user-friendly interfaces are essential for adoption.

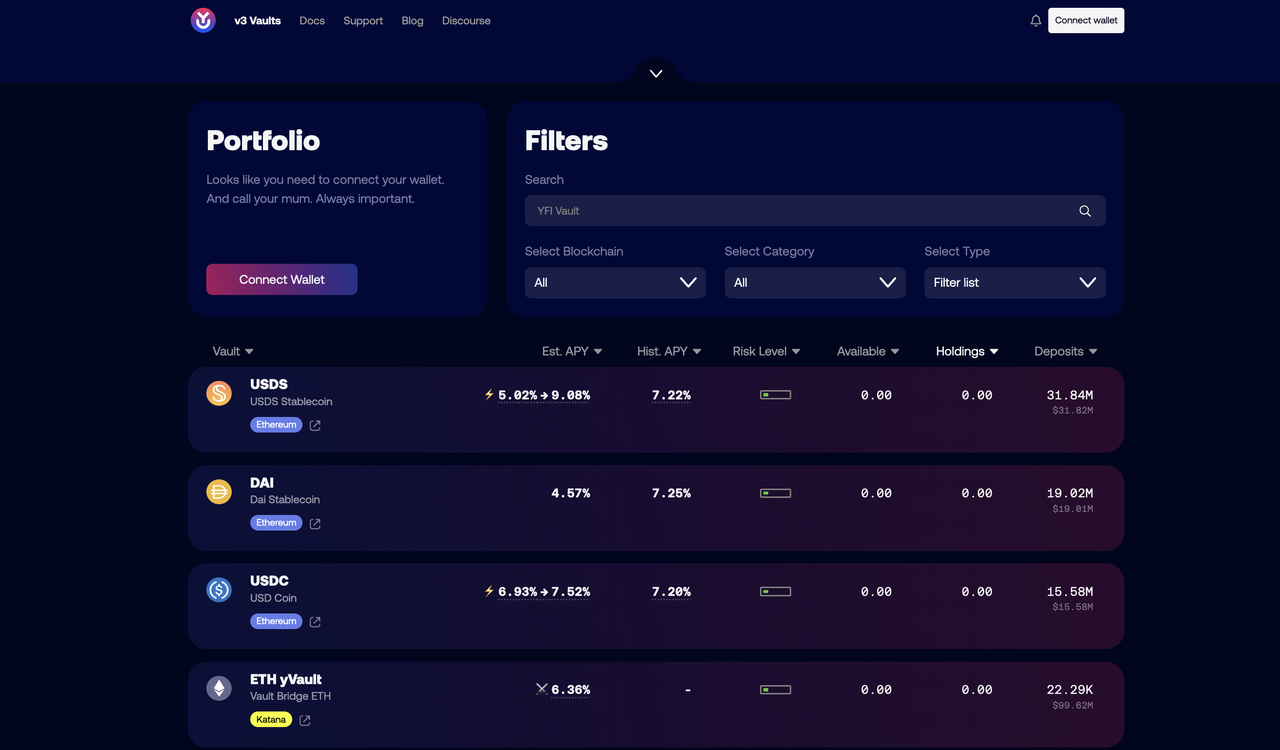

7. Yearn Finance (YFI) - Yield Aggregator Pools on Multichain

Typical APY Range: 5-25% (automatically optimized across multiple strategies)

Key Metrics: ~$300M-1B TVL | 50+ Active Pools | Strong Security Record | $10M-$50M Daily Volume

Yearn Finance automates complex yield farming strategies, allowing users to deposit assets and let the platform's algorithms continuously optimize for the highest available returns across DeFi. The protocol abstracts away the complexity of managing multiple positions, gas optimization, and strategy monitoring, making institutional-grade yield farming accessible to everyday users while providing automated compounding and rebalancing services.

Launched in July 2020 by Andre Cronje with a legendary fair launch distributing YFI tokens entirely through farming with no founder allocation, Yearn became the gold standard for equitable DeFi tokenomics. The platform pioneered automated yield optimization during DeFi Summer 2020 and has maintained its position as the premier yield aggregator through continuous innovation in strategy development, with its decentralized approach to strategy creation allowing the community to propose and implement new yield generation methods across multiple blockchain networks.

What Is Impermanent Loss: The Primary Risk of Liquidity Mining

Impermanent loss happens because of how

automated market maker (AMM) pools work. An AMM is a type of decentralized exchange that uses liquidity pools instead of order books, relying on a simple formula:

x × y = k

• x = amount of Token A

• y = amount of Token B

• k = constant that must stay the same

When token prices move, the pool automatically adjusts the ratio of tokens to keep the equation balanced.

Example: Suppose you deposit 1 ETH + 2,000 USDC when ETH is $2,000, for a total value of $4,000. If ETH’s price rises to $3,000, the pool rebalances your share to about 0.816 ETH + 2,449 USDC. At the new price, this position is worth around $4,897. If you had simply held 1 ETH + 2,000 USDC, the value would be $5,000. The $103 difference is called "impermanent loss".

Impermanent loss is more significant in volatile token pairs and less noticeable in stablecoin pools, where prices stay close. Liquidity providers often manage this risk by using stablecoin pools, concentrating liquidity ranges on platforms like Uniswap V3, or diversifying across several pools.

Other Major Risks to Consider When Becoming a Liquidity Provider

Beyond impermanent loss, liquidity providers face several other risks that can impact returns and capital safety:

1. Smart Contract Risk: Liquidity mining platforms run on code. Even with audits, bugs or vulnerabilities can be exploited, leading to permanent loss of funds.

2. Market Volatility: Sudden price swings can quickly change the value of assets in a pool, reduce APYs, or affect collateral safety in lending pools.

3. Reward Dilution: Token rewards are often highest at launch. As more users join a pool or as emissions taper, yields decline, leaving early providers better positioned than latecomers.

4. Liquidity Withdrawal Risk: In thinly traded pools, removing large amounts of liquidity can cause high slippage or delays in withdrawal, especially during market stress.

5. Regulatory Uncertainty: DeFi remains under evolving legal scrutiny. Depending on jurisdiction, access to certain pools or reward tokens could change unexpectedly.

Careful pool selection, diversification, and ongoing risk management are key to protecting capital while still benefiting from liquidity mining opportunities.

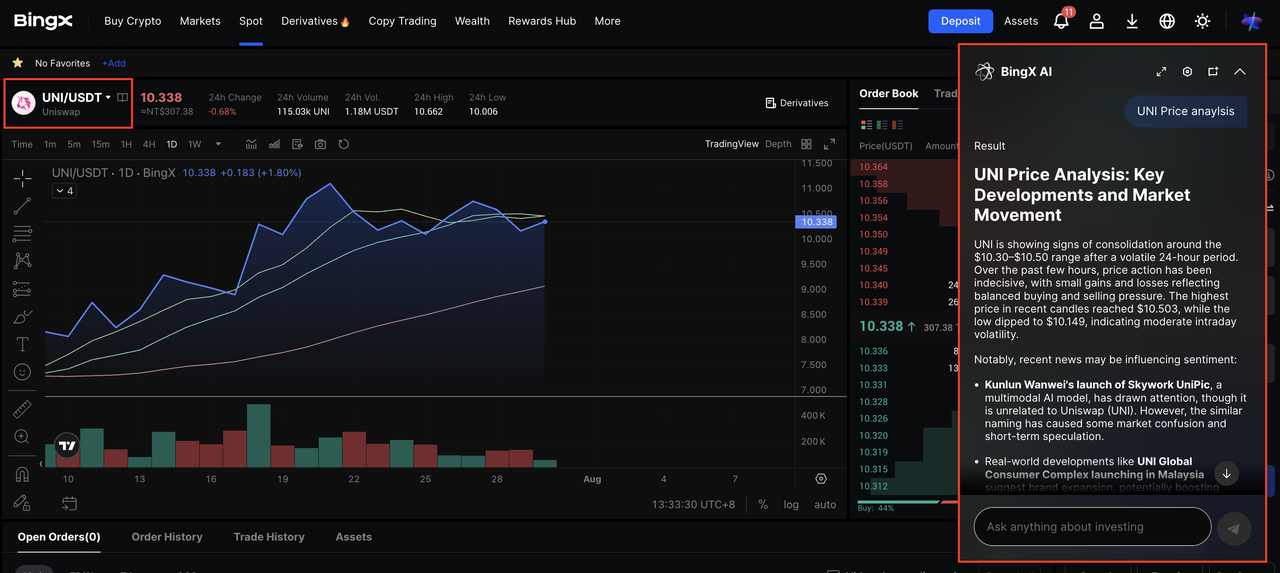

How to Trade Liquidity Mining Tokens on BingX

Once you’ve earned tokens from liquidity mining, the next step is deciding how to trade or manage them. BingX makes this process straightforward by offering both spot and futures markets, along with AI-powered trading insights.

Step 1: Find Your Trading Pair Search for the liquidity mining token you want to trade, for example,

UNI/USDT,

CRV/USDT, or

AAVE/USDT, on BingX. Use the

Spot Market if you want direct ownership of the token, or choose the

Futures Market to trade with leverage and capture short-term price moves.

Step 2: Analyze with BingX AI Click the AI icon on the trading page to access

BingX AI, which highlights price trends, support and resistance levels, and key signals to guide your strategy.

Step 3: Execute and Monitor Your Trade Use a market order for instant execution or a limit order to enter at your preferred price. Continue monitoring BingX AI to adjust your position as market conditions change.

With BingX and BingX AI, trading tokens earned from liquidity mining becomes more accessible, data-driven, and flexible, whether you’re building a long-term position or taking advantage of short-term opportunities.

Final Thoughts

Liquidity mining has grown from a short-term experiment into one of the most important building blocks of decentralized finance. In 2025, platforms like Uniswap, Curve, Aave, Compound, Balancer, PancakeSwap, and Yearn Finance offer a wide variety of pools that suit different strategies, from low-risk stablecoin positions to higher-yield but more volatile pairs.

For liquidity providers, the opportunity is two-fold: earning trading fees and rewards while also supporting the smooth functioning of DeFi markets. At the same time, risks such as impermanent loss, smart contract vulnerabilities, and market volatility mean that success depends on careful pool selection, diversification, and realistic expectations.

Liquidity mining will remain a cornerstone of DeFi’s growth. For investors willing to learn the mechanics, manage risks, and think long term, it provides one of the most direct ways to participate in and benefit from the expansion of decentralized markets

Related Reading