In August 2025, Bitcoin surged to an all-time high above $124,000, setting a fresh benchmark in the crypto universe. As analysts project its long-term potential even higher, with some like PlanB, creator of the Bitcoin stock-to-flow (S2F) model, forecasting up to

$1 million per BTC, knowing how to effectively go long on Bitcoin can be a powerful strategy for beginners and seasoned traders alike to maximize returns in the bullish market.

This guide will show you how to go long on Bitcoin, when the timing makes sense, and how to control your risks with a clear step-by-step roadmap on BingX.

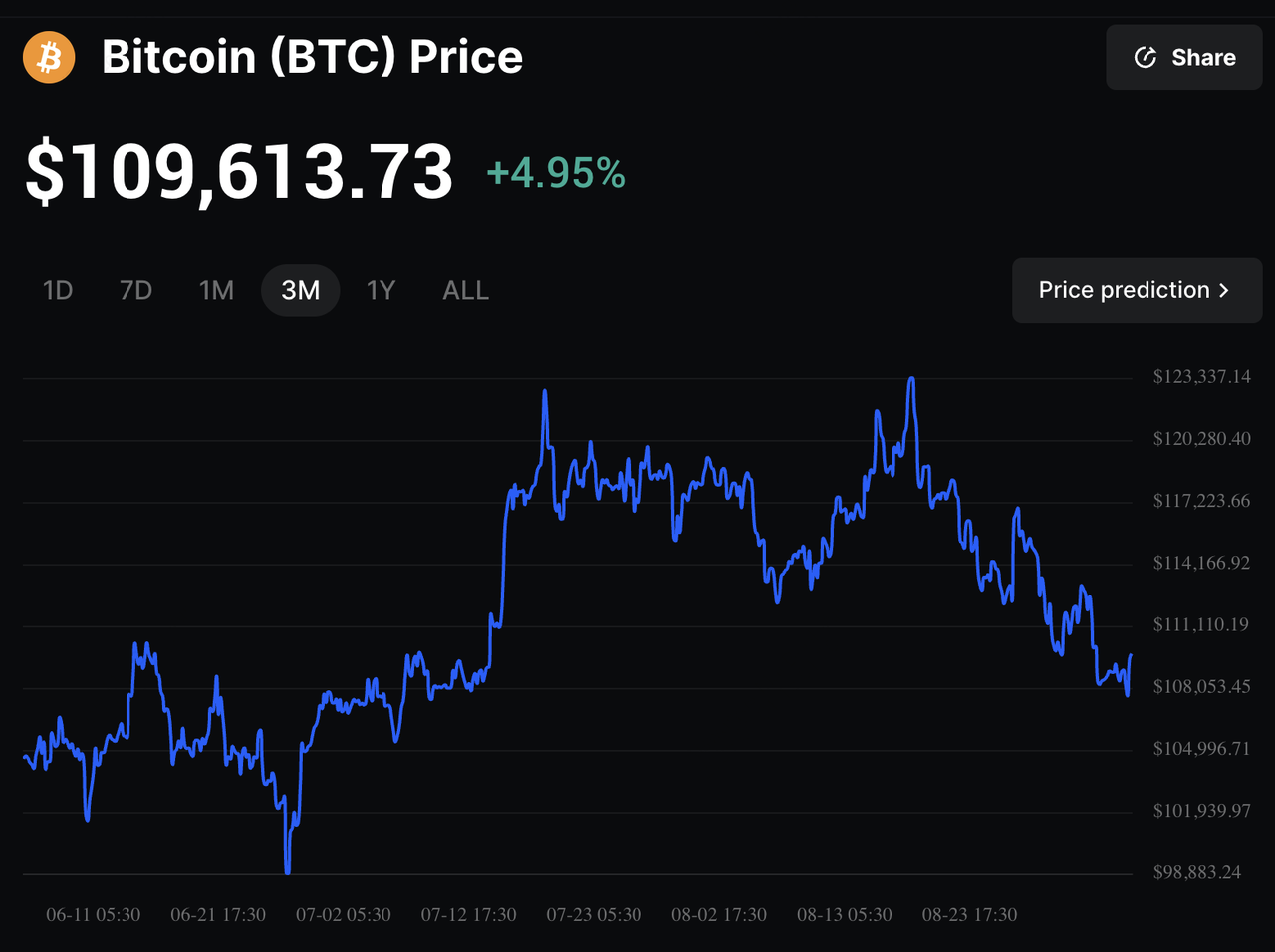

Bitcoin Hit New ATH in August 2025: What's Driving the Bullish Sentiment?

Bitcoin price on BingX

In August 2025, Bitcoin broke through $124,000 to set a new all-time high, marking a milestone moment for the crypto market. The rally was fueled by a confluence of strong institutional flows, with U.S.-listed

spot Bitcoin ETFs drawing in over $55 billion in net inflows, as well as

BTC corporate treasuries like

MicroStrategy and Metaplanet continuing to accumulate BTC as a reserve asset. Retail participation also surged, encouraged by bullish momentum and liquidity triggers such as clusters of short liquidations that amplified upward moves. Together, these factors reinforced Bitcoin’s reputation as a scarce digital asset with growing mainstream acceptance.

Macroeconomic conditions added further fuel. The U.S. dollar index (DXY) weakened by double digits year-to-date, pressured by tariff-driven inflation and expectations of rate cuts. Investors increasingly turned to Bitcoin as a hedge against inflation, policy uncertainty, and global economic instability. With the April 2024

Bitcoin halving reducing block rewards to 3.125 BTC, the shrinking supply collided with rising demand, intensifying bullish sentiment. Bold price targets from analysts and high-profile investors projecting $1 million or more per coin only added to the momentum, creating an environment where traders sought long exposure to ride the wave.

What Does It Mean to "Go Long" on Bitcoin?

Going long means opening a buy position expecting BTC’s price to appreciate. In spot trading, you simply purchase BTC and wait for it to climb. In leveraged trades, margin or futures amplify both gains and losses. For example, a 5× long with $10,000 gives $50,000 exposure, turning a 5% price move into a 25% return, but also risking liquidation if the market turns against you.

Success requires risk controls like stop-loss orders, monitoring liquidation heatmaps, and aligning entries with broader market structure and technical signals. In 2025’s volatile market, precise execution and disciplined exits matter more than ever.

When and Where to Use a Long Position

You go long on Bitcoin when you believe the price will rise, usually during bullish trends, breakouts above key resistance levels, or after major catalysts like ETF inflows or halving events. Longs can be taken in spot markets (buy and hold) for safer exposure, or with margin and futures (using leverage) for higher but riskier returns.

1. Go Long on Bitcoin with Margin Trading

Margin trading allows you to borrow funds from the exchange to increase your buying power and open a larger position than your account balance alone would allow. When you go long on Bitcoin with margin, you’re betting that BTC’s price will rise, using leverage to magnify your potential gains.

Suppose you have $5,000 in your BingX margin account. With 3× leverage, you can control $15,000 worth of BTC. If Bitcoin rises 10%, your position grows by $1,500 instead of just $500. Margin lets traders maximize profits on smaller price moves, which is useful in Bitcoin’s volatile market.

However, losses are amplified in the same way as gains. If BTC drops 10% in the above example, you’d lose $1,500, potentially triggering liquidation if you don’t maintain margin requirements.

Margin trading is best for traders who want short-term exposure with controlled leverage, but it requires discipline and strong risk management (e.g., stop-losses and conservative position sizing).

Futures contracts let you speculate on Bitcoin’s future price without owning the asset directly. Going long on BTC futures means agreeing to buy BTC at today’s price, expecting to sell at a higher price later. On BingX, this is done via perpetual contracts (no expiration date), settled in

USDT.

Opening a long on

BTC/USDT perpetual futures means you’re betting on price gains with leverage. For example, at $120,000 with 5× leverage, a 5% rise to $126,000 delivers a 25% return on margin. The appeal is clear, BingX offers leverage up to 150× for aggressive strategies; but the risks are just as sharp. A 5% drop at 5× leverage can wipe out your position, and factors like funding rates and liquidation levels often decide whether you stay profitable.

Futures are better suited for traders seeking more aggressive exposure, but they require careful monitoring of funding rates, market sentiment, and strict risk controls.

How to Long Bitcoin on BingX Futures: Step-by-Step

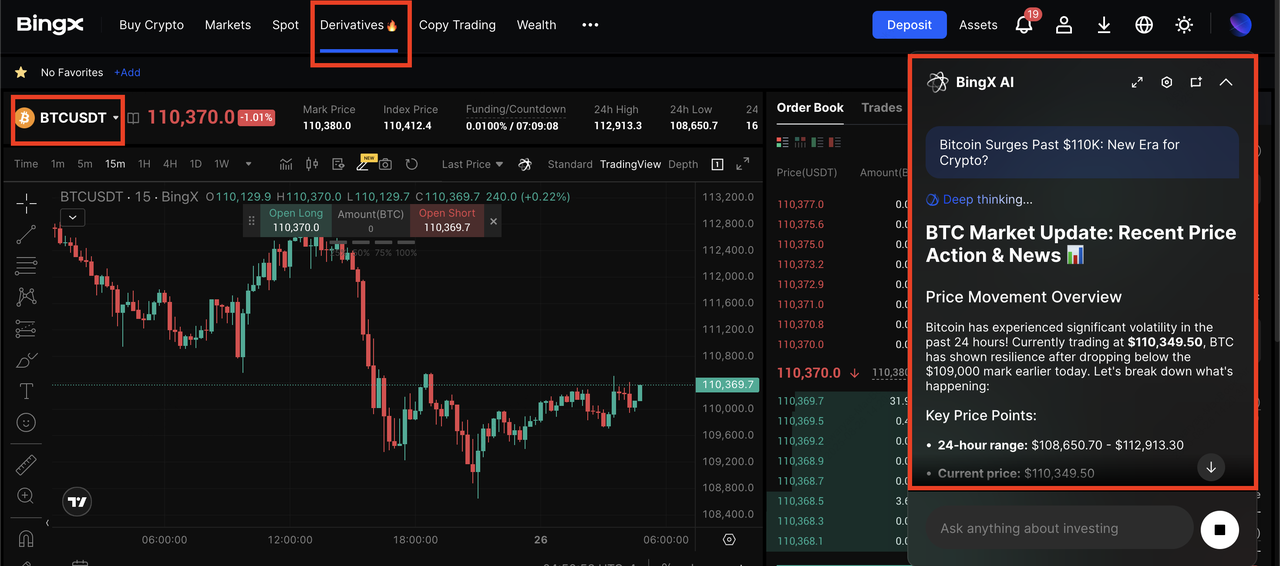

Perpetuals is the main way to long or short Bitcoin on BingX, making it easy to open and manage long positions on BTC. Here’s how you can do it step by step:

BTC/USDT perpetual contract on futures market powered by BingX AI

Futures let you amplify gains by using leverage, but this also increases risk. Here’s how to do it on BingX:

1. Create & Fund Your BingX Account: Register, complete

KYC verification, and deposit USDT into your Futures account.

2. Go to the Futures Market: From your dashboard, select Derivatives > USD-M Perp Futures > BTC/USDT Perpetual Contract.

3. Choose Leverage Wisely: Set your leverage level. Beginners should stick to 2×–3× to limit risk.

4. Place a Long Order

• Limit Order: Set a preferred entry price.

Enter how much you want to long, then confirm.

5. Set Stop-Loss & Take-Profit: Protect yourself with a stop-loss (e.g., 5–10% below entry) and lock in gains with a take-profit order.

7. Close Your Position: Exit manually once your price target is met, or let your stop-loss/take-profit orders trigger automatically. Profits (or losses) are reflected in USDT.

Pro Tip: Start small and scale as you gain confidence. Futures trading is high risk, so never invest more than you can afford to lose.

Practical Example: Longing BTC on BingX Futures

Suppose Bitcoin is consolidating around $120,000 and you expect a short-term breakout. Here’s how you could structure your trade on BTC/USDT perpetual futures:

1. Entry Point: You go long at $120,000 with a BTC/USDT perpetual contract.

2. Leverage: You select 2× leverage, keeping it conservative to reduce liquidation risk.

3. Stop-Loss: You place a stop-loss at $114,000 (5% below entry). With 2× leverage, this caps your loss at roughly 10% of margin used.

4. Take-Profit: You set a take-profit at $130,000 (about 8% above entry). If BTC reaches this level, your position automatically closes with a 16% gain on margin.

5. Position Sizing: You allocate just 10% of your portfolio to this trade, so even in a worst-case scenario, the rest of your capital remains safe.

6. Risk-to-Reward Ratio: You’re risking ~10% to potentially earn ~16%, giving you a favorable 1:1.6 ratio.

7. Monitoring Tools: While your position is open, you track BingX AI alerts, the Fear & Greed Index, and ETF inflows to confirm bullish momentum and adjust risk if conditions change.

This structured setup ensures you have a clear plan for entry, exit, and risk management — turning your futures long into a disciplined short-term strategy rather than an emotional bet.

How to Control Your Risks When Going Long on Bitcoin

Managing risk is the most important part of going long on Bitcoin. Without a clear plan, even the strongest bullish setup can turn into heavy losses. Here’s a checklist to help you trade more safely and effectively:

1. Check Market Sentiment – Use tools like the Fear & Greed Index or BingX AI. Extreme greed often signals overheated conditions, while fear can provide better entries.

2. Track Key Drivers – Watch ETF inflows, treasury buys, and regulatory news. These events often fuel sharp moves.

3. Set Clear Limits – Define your loss tolerance. Place stop-loss orders 5–10% below entry and keep risk per trade at 1–2% of your portfolio.

4. Mind Liquidity – Even in Bitcoin’s deep market, futures can wick violently. Use limit orders to avoid poor fills.

5. Use Safe Platforms – Trade only on trusted platforms like BingX with tools such as AI alerts and guaranteed stop-loss.

6. Avoid High Leverage – Stick to 2×–3× leverage as a beginner. Even small dips can wipe out over-leveraged positions.

7. Stay Disciplined – Don’t let FOMO or panic selling dictate your trades. Plan entries and exits in advance.

8. Do Your Research (DYOR) – Check on-chain data, market structure, and sentiment before entering.

9. Always Place a Stop-Loss – Protect your margin from liquidation the moment you open a position.

10. Don’t Chase Hype – Parabolic moves often reverse quickly. Focus on fundamentals and risk-to-reward, not social media noise.

Final Thoughts

Longing Bitcoin in 2025 via margin trading or on the futures market is a powerful short-term strategy, but it’s not without risk. With BingX, you can open futures positions easily, supported by advanced tools like AI-powered alerts, customizable stop-loss/take-profit orders, and flexible leverage settings.

Risk Reminder: Bitcoin is highly volatile. While leverage can amplify gains, it can also magnify losses and trigger liquidation. Only trade with capital you can afford to lose, and always prioritize risk control over chasing profits.

Related Reading