Ethena’s USDe is a new kind of

stablecoin that doesn’t just hold its value, it also earns yield. Backed by crypto assets and delta-neutral hedging strategies,

USDe gives you a way to access a dollar-like asset with passive income baked in. And when you stake USDe to mint sUSDe, you unlock even more rewards.

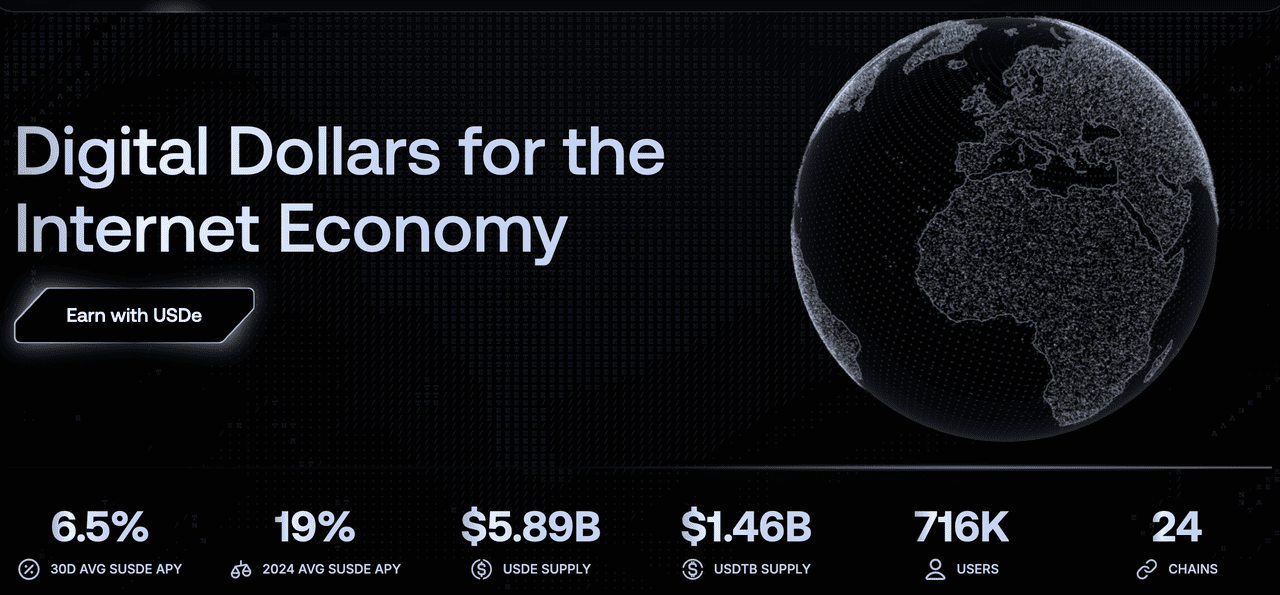

In 2025,

yield-bearing stablecoins are taking over the

DeFi space. From

Solana’s sUSD to

LayerZero-powered vaults, users are moving from passive dollar tokens like

USDC to smart dollars that work for you. With over $5.8 billion in supply and 700K+ users, Ethena’s USDe is leading this shift, and it’s built to scale.

What Is Ethena?

Ethena is a synthetic dollar protocol built on

Ethereum. It lets you mint and use USDe, a fully backed stablecoin that uses crypto-native tools instead of traditional banks. That means no fiat, no banks, just Ethereum, futures markets, and a stable dollar-like token you can earn with.

The idea behind Ethena comes from Arthur Hayes’ 2023 essay “Dust on Crust.” He imagined a stablecoin backed by crypto and derivatives that could pay real yield. Ethena’s founder, Guy Young, turned that vision into reality. His goal? Build a

censorship-resistant, scalable dollar for the internet economy, and make it profitable to hold.

Today, Ethena powers billions in value across 24 chains, with USDe and its staked version, sUSDe, used for savings, trading, and DeFi integration. It's not just a protocol, it’s building what many call crypto’s first “Internet Bond.”The protocol is governed by the Ethena (ENA) token, which plays a key role in governance, staking rewards, and ecosystem incentives.

What Is Ethena USDe (USDE) Stablecoin?

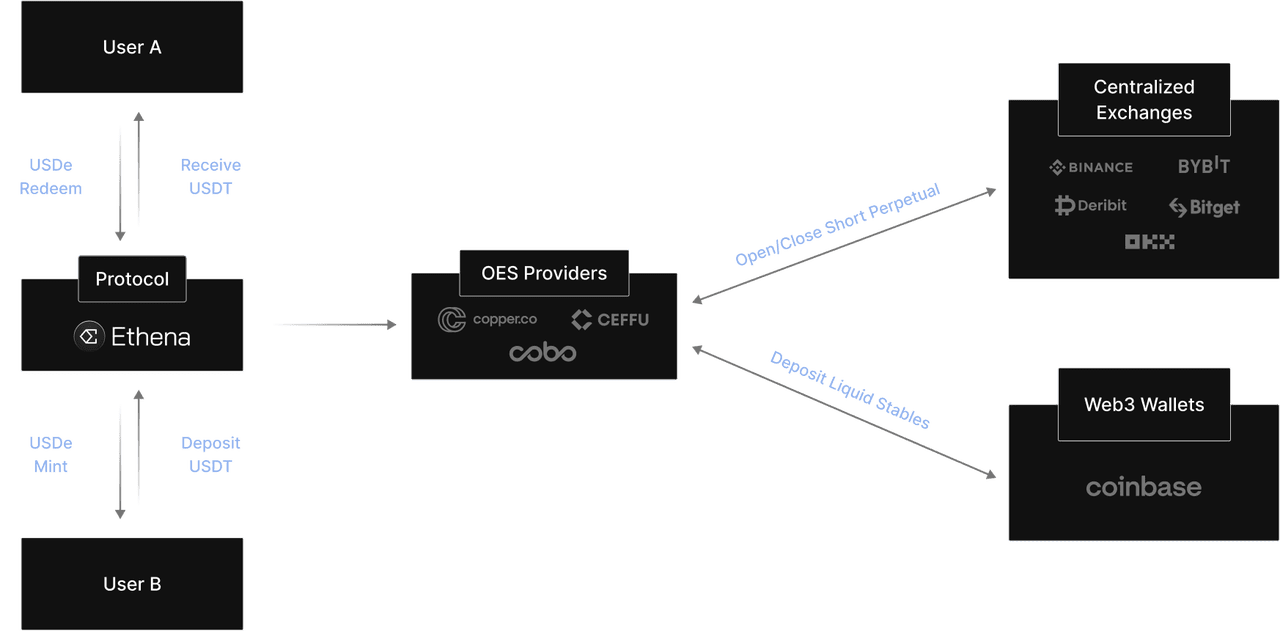

USDe is Ethena’s flagship stablecoin, but it works very differently from traditional dollar-pegged tokens like USDT or USDC. Instead of using fiat or real-world assets as collateral, USDe is a synthetic dollar backed by crypto assets and delta-neutral hedging strategies.

This means the protocol pairs long crypto positions, like

ETH or stETH, with short futures contracts of equal value. When the price of the crypto goes up or down, the short futures position offsets that change. The result? A stable value close to $1, no matter what the market does.

USDe is backed by:

• Ethereum (ETH) and staked ETH (stETH)

• Short perpetual futures (perps) on centralized exchanges

• Liquid stablecoins like USDC,

USDT, and USDtb held in reserve

This mix creates a stable and scalable dollar alternative that doesn’t rely on banks or centralized custodians. You can hold it, use it, or stake it to earn passive rewards, right from your

crypto wallet.

How Does USDe Maintain Its $1 Peg?

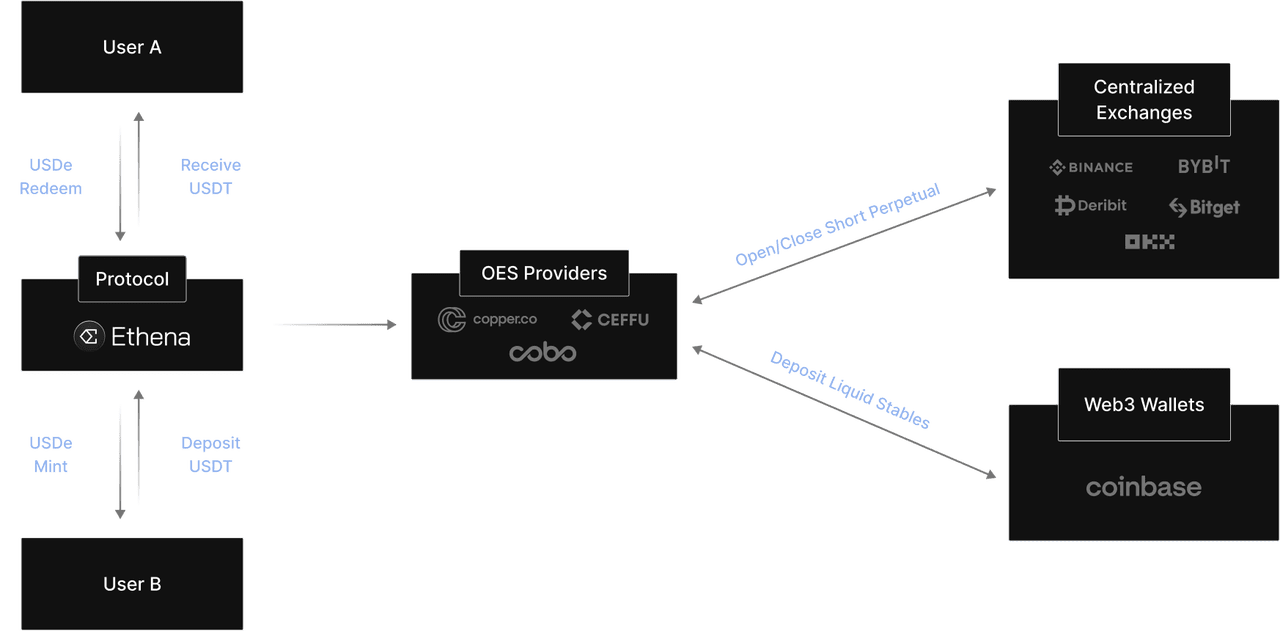

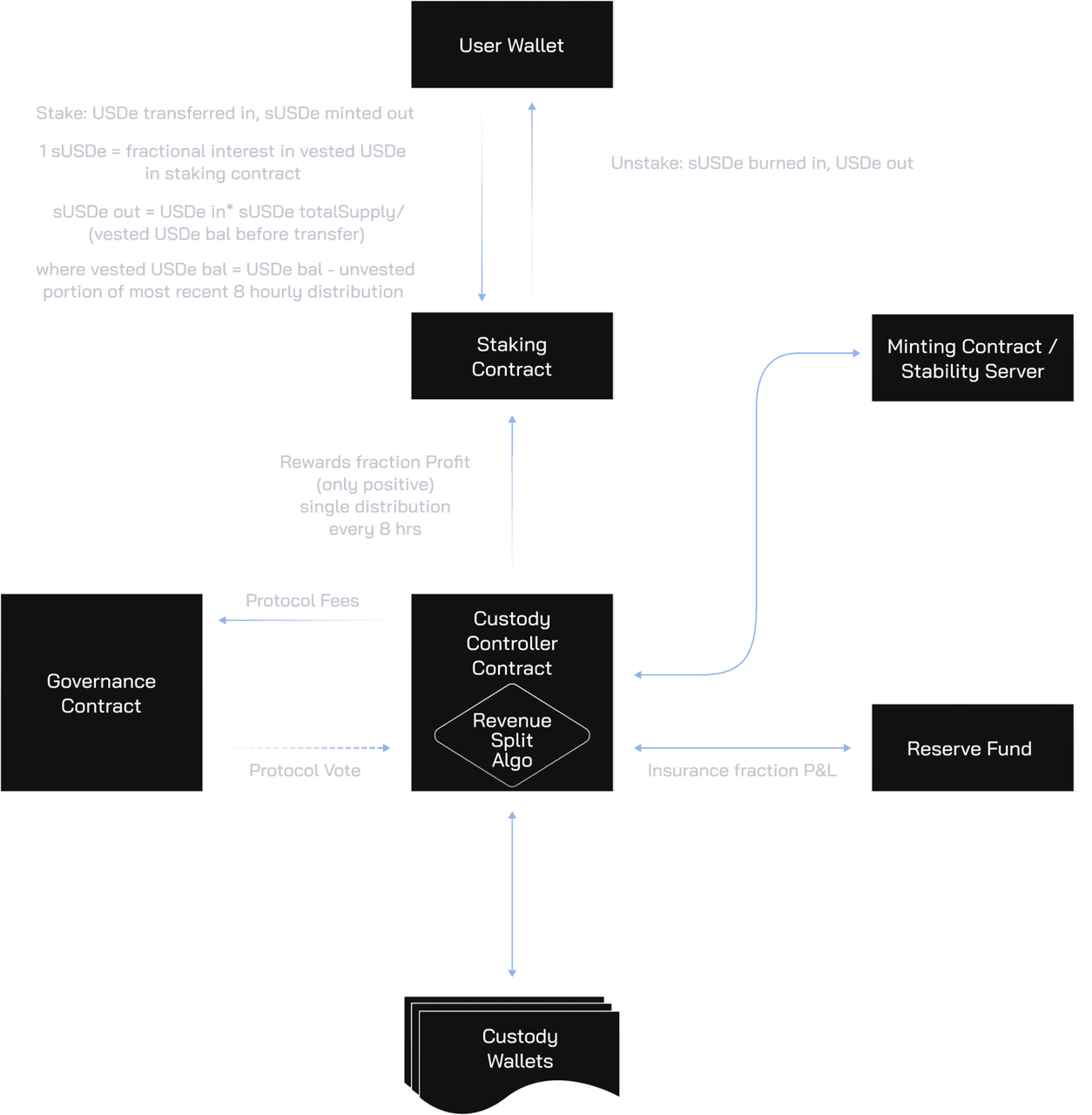

How Ethena's USDe stablecoin works | Source: Ethena docs

USDe stays pegged to the U.S. dollar through automated delta-neutral hedging. This technique balances risk by opening equal and opposite positions in spot and futures markets.

Here’s how it works:

When you mint USDe, Ethena takes your collateral (like ETH or

BTC), buys the spot asset, and then opens a short perpetual futures position of the same size. This offsets price swings. If ETH rises, the short position loses value, but the ETH gains. If ETH falls, the ETH loses value, but the short gains. The result is stability.

This model doesn’t just keep USDe pegged to $1, it also generates yield. Ethena earns funding fees from those short futures positions. When you stake USDe into sUSDe, you get a share of those rewards.

Unlike overcollateralized stablecoins that require more value than you mint, USDe is capital-efficient and fully backed at a 1:1 ratio. The peg stays steady thanks to continuous rebalancing and off-exchange settlement with trusted custodians.

What Is sUSDe, USDe's Yield‑Bearing Version?

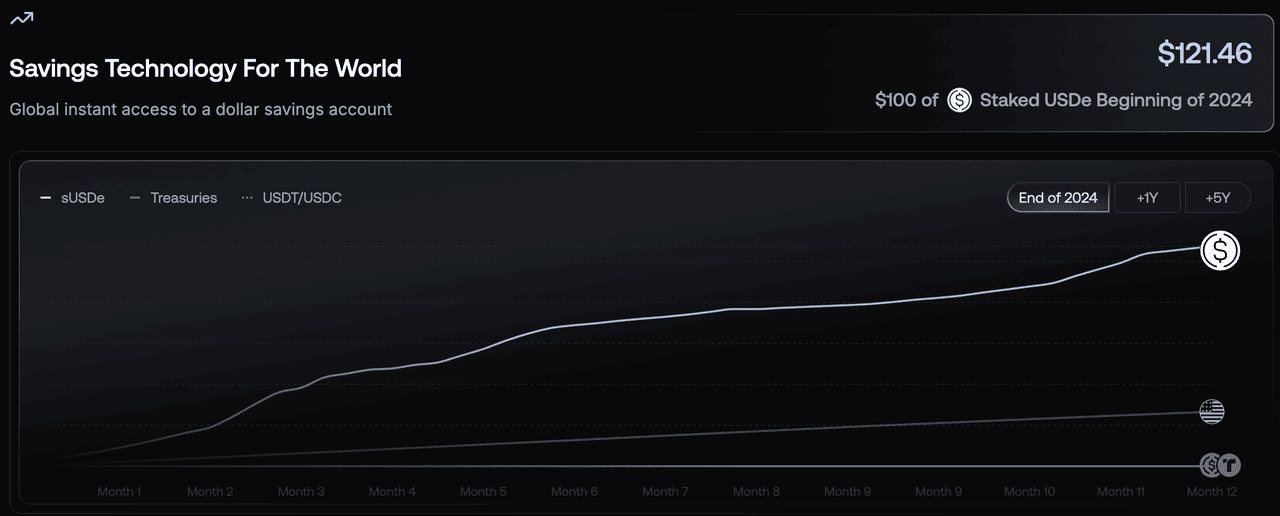

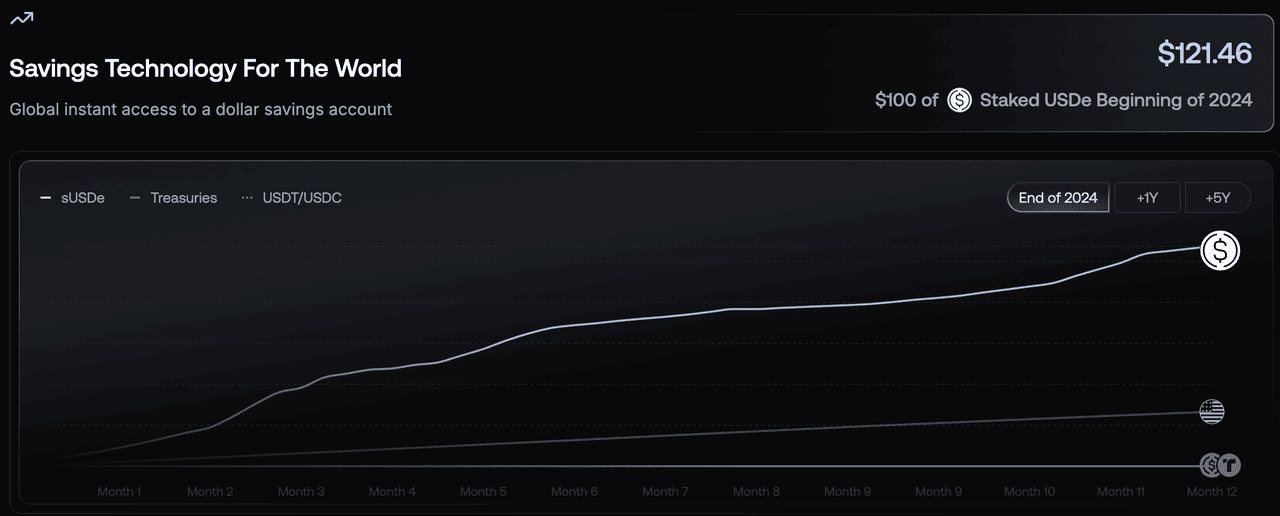

sUSDe returns over 2024 | Source: Ethena

sUSDe is the staked version of USDe. When you stake USDe, the protocol gives you sUSDe in return, a token that earns yield automatically. You send 1 USDe, you receive 1 sUSDe. Over time, that 1 sUSDe becomes worth more USDe. This is a non-rebasing model, your balance stays the same, but its value grows. If the yield is 20%, your sUSDe/USDe exchange rate goes from 1.0 to 1.20 after a year.

In 2024, sUSDe delivered a strong average

APY of ~18%, making it one of the top performers in the yield-bearing stablecoin space. Compared to traditional stablecoins like USDC, this was a game-changer for yield-seeking users.

Before that, the rate fluctuated widely, from a peak of 55.9% in March 2024 to a low of about 4.3% in August 2024. This volatility reflects the nature of crypto funding rates and staking returns. More recently, yields have ranged between 7% and 30% APY, depending on market conditions. If funding rates are high, your rewards go up. If they dip, expect lower, but still competitive, returns.

This model makes it simple. Just hold sUSDe, and your dollar value increases without manual compounding. You don’t need to reinvest rewards, it happens behind the scenes.

Where Does the Yield Come From?

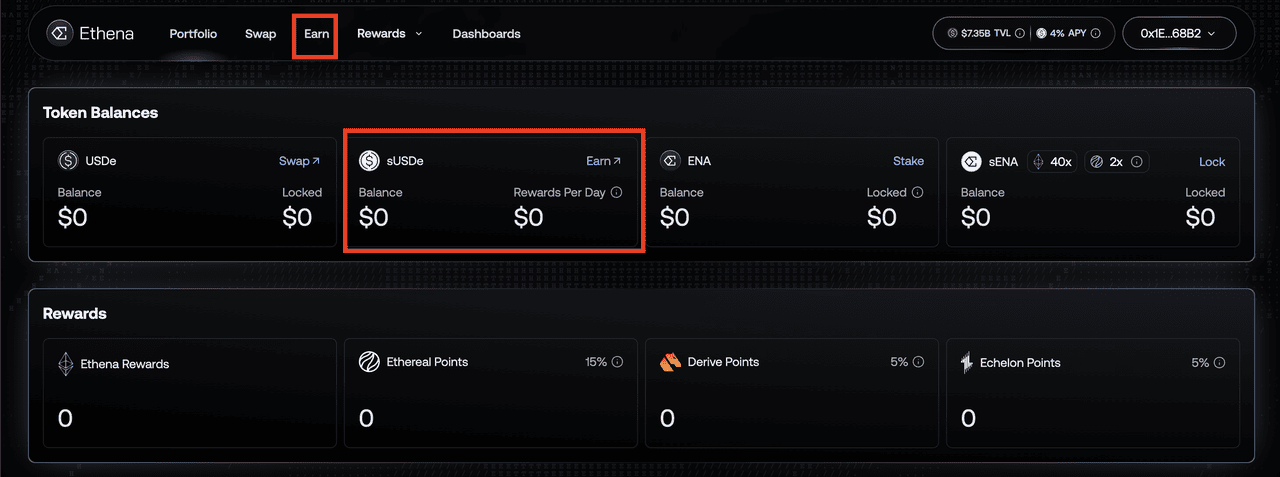

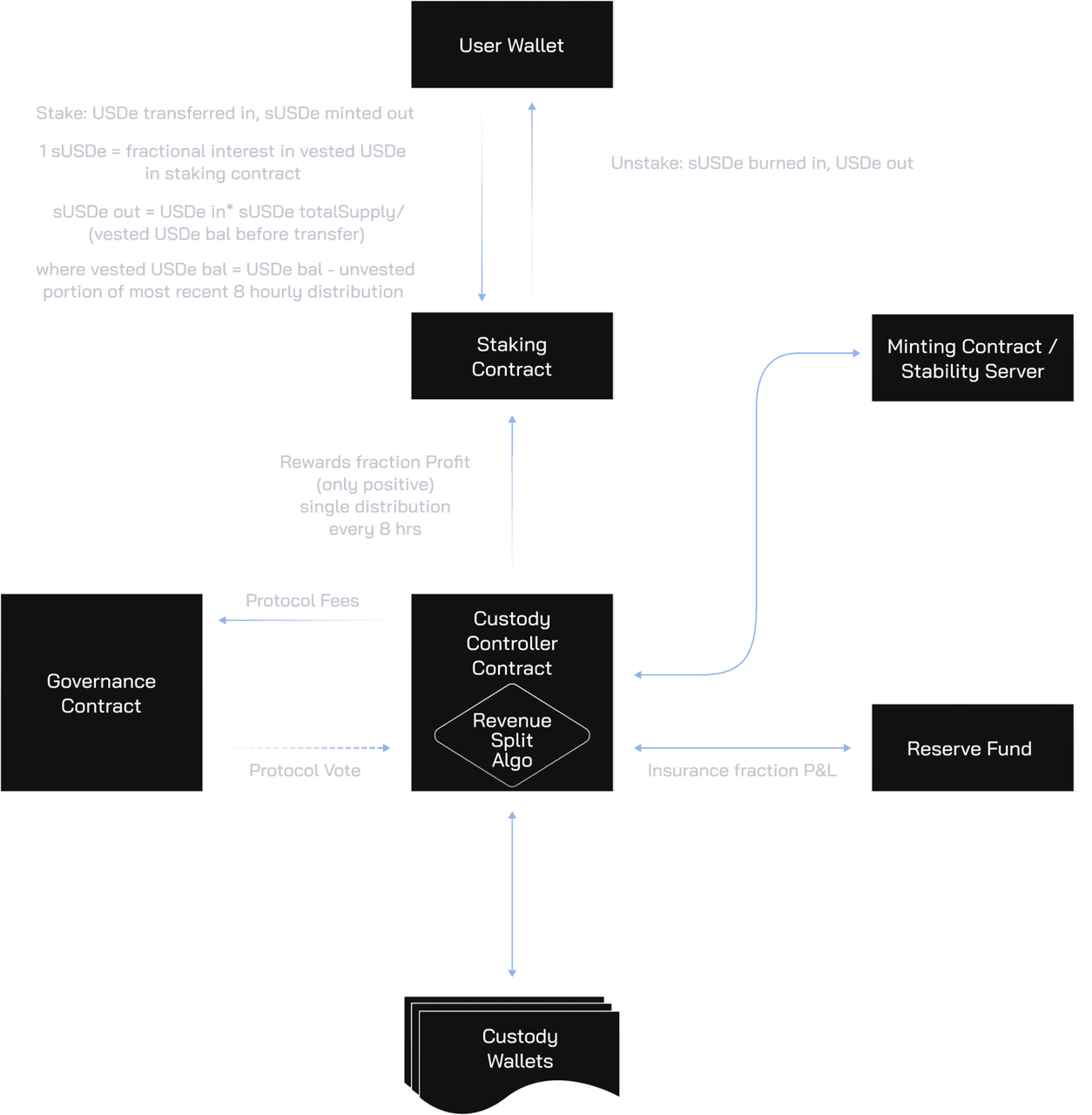

How staking USDe for sUSDe works | Source: Ethena docs

1. Funding Rates from Perp Markets: Perpetual futures markets charge periodic funding fees between long and short positions. Ethena’s strategy earns when short futures positions pay funding fees to long positions. This fee revenue is routed to sUSDe holders.

2. Rewards from Liquid Staked ETH and Stablecoins: Ethena backs USDe partly with assets like stETH, which earn Ethereum staking rewards (~3–7%). It also holds stablecoins such as USDC and USDtb that earn interest elsewhere. These ancillary yields boost the protocol’s total returns.

3. Auto‑Compounding into sUSDe: Every time Ethena earns from funding rates or staking rewards, that revenue is added to the sUSDe pool. You don’t need to claim or manual reinvest. Your sUSDe balance stays constant, but the exchange value increases, auto-compounding in action.

Ethena’s USDe is designed to be decentralized and composable, with broad integration across major DeFi platforms.

Aave supports sUSDe, allowing you to lend, borrow, or earn yield in decentralized money markets. You can also leverage sUSDe through integrations with protocols like

Morpho and

Pendle. Institutional platforms such as Converge and Securitize have opened the door for USDe to be used in tokenized TradFi products. Whether you’re using sUSDe as a savings tool to passively earn yield or as collateral in DeFi strategies, Ethena’s stablecoin ecosystem offers flexibility, capital efficiency, and access to both retail and institutional crypto users.

How to Stake USDe and Earn Yield with sUSDe

Getting started with USDe and sUSDe is simple. Here’s how you can do it:

Step 1: Acquire USDe

You can buy USDe on decentralized exchanges like

Curve or

Uniswap by swapping assets such as USDT or USDC. If you’re a whitelisted institution, you can also mint USDe directly by depositing collateral like ETH or stETH.

Step 2: Stake USDe for sUSDe

Once you have USDe, go to the Ethena app and stake it to receive sUSDe. This token earns rewards over time and grows in value automatically. No manual claiming needed.

Step 3: Unstake When Ready

To redeem your yield, you can unstake sUSDe. This starts a 7-day cooldown period, after which you’ll receive your original USDe plus accrued rewards. You can hold, restake, or use it across DeFi platforms.

Final Thoughts: Is USDe Right for You?

USDe offers a smarter way to hold dollars in crypto. By combining delta-neutral hedging with crypto-backed collateral, Ethena delivers a stable, yield-generating stablecoin that works across DeFi and CeFi. When you stake USDe to mint sUSDe, you passively earn from funding rates and staking rewards, no active management required.

But like all DeFi protocols, Ethena carries risks.

Smart contracts can have bugs. Funding rates can turn negative. Off-exchange custodians or derivatives platforms may face issues. While Ethena’s reserve fund helps absorb volatility and protect users, it’s not foolproof. Always do your own research and understand how the system works before you commit capital. If you’re looking for a capital-efficient way to earn yield on dollars, USDe is a potentially promising option, but one that deserves careful consideration.

Related Reading

FAQs on Ethena USDe (USDE)

1. What’s the difference between USDe and sUSDe?

USDe is Ethena’s synthetic stablecoin, pegged to the U.S. dollar. It stays close to $1 through delta-neutral hedging. sUSDe is the staked version of USDe. When you stake USDe, you get sUSDe, which earns passive yield over time. Your token amount stays the same, but its value grows.

2. How does delta‑neutral hedging work?

Delta-neutral hedging balances risk by pairing long and short positions. Ethena holds crypto like ETH or BTC (long) and opens short positions in futures markets. If prices go up or down, the gains and losses offset each other. This helps keep USDe stable around $1, even when markets are volatile.

3. What APY can I expect by staking USDe?

In 2024, sUSDe earned an average APY of ~18%. Yields have ranged from 4% to over 50%, depending on market conditions. Most recently, rates hover between 7% and 30%. Rewards come from funding fees, staking rewards, and interest on stablecoin reserves. Yield can go up or down, there’s no fixed rate.

4. What are the risks of using Ethena USDe?

Like all DeFi protocols, USDe carries risks such as smart contract bugs, funding rate volatility, custody issues, and exchange counterparty exposure. Ethena’s reserve fund helps mitigate these risks, but it can’t fully eliminate them. Make sure to do your own research and assess whether the protocol aligns with your risk tolerance.

How Ethena's USDe stablecoin works | Source: Ethena docs

How Ethena's USDe stablecoin works | Source: Ethena docs sUSDe returns over 2024 | Source: Ethena

sUSDe returns over 2024 | Source: Ethena How staking USDe for sUSDe works | Source: Ethena docs

How staking USDe for sUSDe works | Source: Ethena docs