Cryptocurrency trading has advanced far beyond simple spot market transactions. Today, derivatives such as perpetual futures dominate trading volumes, allowing traders to speculate on price movements without expiry dates. These contracts rely on the funding rate to keep futures prices aligned with the spot market.

For most traders, funding fees are simply a cost of holding positions. For arbitrage traders, however, they create opportunities. By combining spot and futures positions in a structured way, traders can earn from funding rate arbitrage while keeping their exposure market-neutral. This strategy focuses on capturing predictable funding payments rather than betting on price direction.

This guide explains how funding rates work, why they differ across exchanges, the most common arbitrage strategies, and the tools and risks involved, helping traders decide whether this method fits their trading approach.

What Is Funding Rate Arbitrage?

Funding rate arbitrage is a market-neutral trading strategy that earns from funding payments in perpetual futures contracts. Unlike traditional futures,

perpetual contracts have no expiry date. To keep their prices close to the spot price of the underlying asset, exchanges apply a funding rate, a periodic payment exchanged between traders holding long and short positions.

Arbitrage traders take advantage of this by holding offsetting positions: for example, buying the asset in the spot market while shorting the same asset in perpetual futures. The spot position protects against price changes, while the futures position earns the funding payments. In this way, profits come from collecting fees rather than predicting price directions.

For example, if Bitcoin trades at $100,000 and the funding rate is +0.03%, going long on the spot market and shorting

Bitcoin futures of equal size with minimal leverage could earn around $30 every 8 hours on a $100,000 position. While small, these payments can compound into meaningful returns over time, especially with larger capital or automation.

How Funding Rates Work in Perpetual Futures

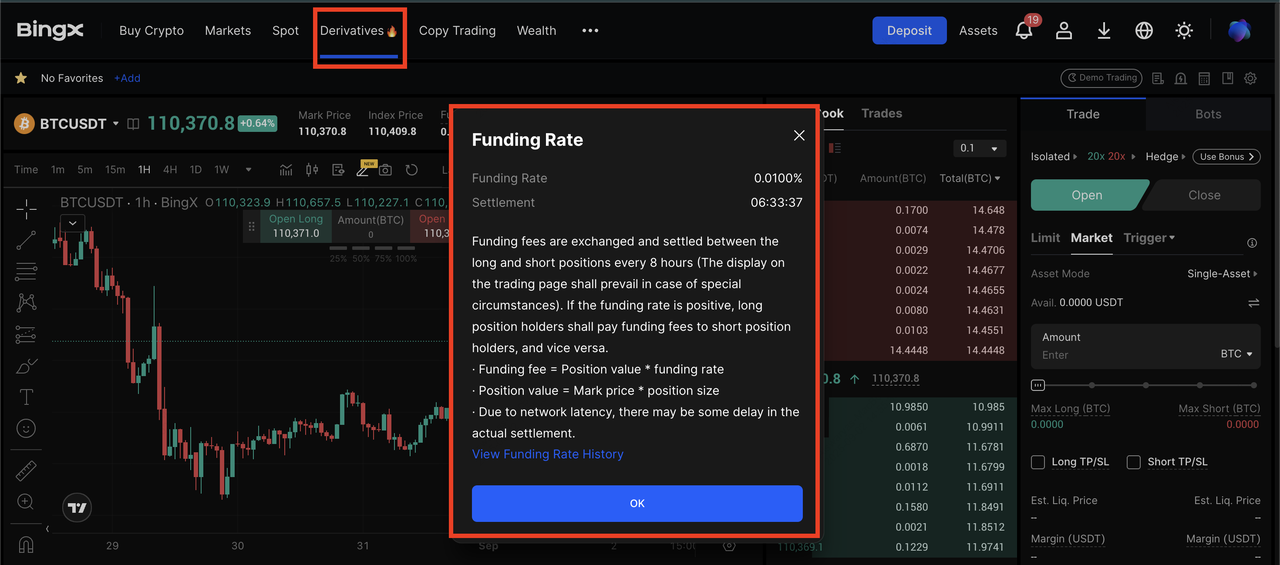

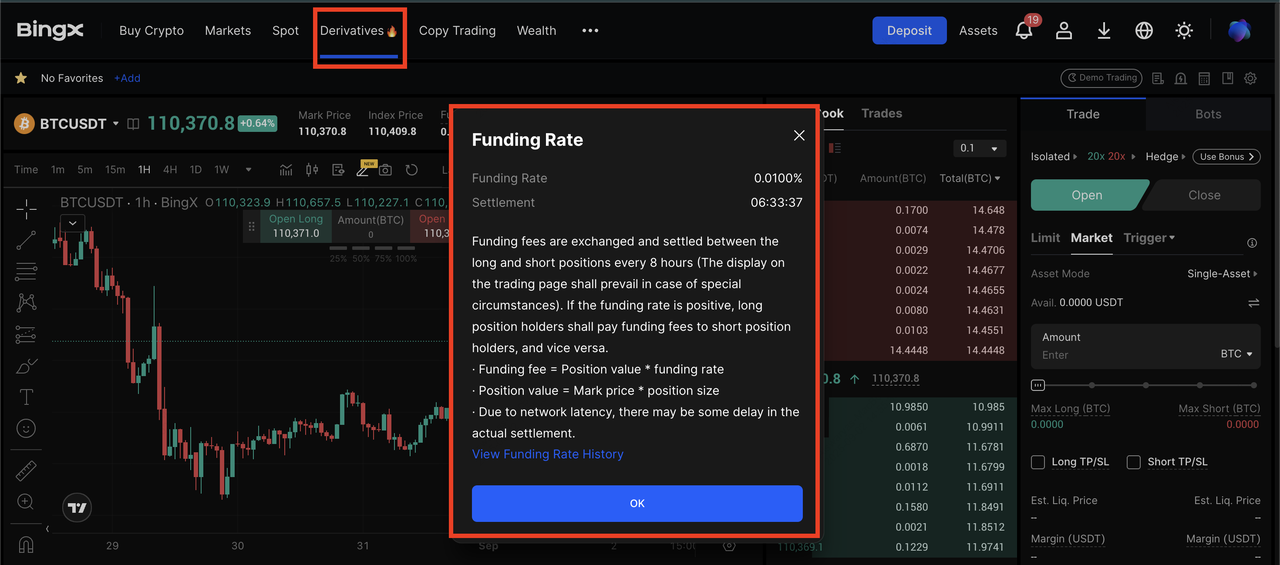

Funding rate in BingX perpetual futures market

Perpetual futures differ from traditional contracts because they have no expiry date. To keep their prices close to the spot market, exchanges use a funding rate, a small fee exchanged directly between traders every few hours.

• Positive funding rate: When perpetual futures trade above the spot price, longs pay shorts. An arbitrageur can go long in the spot market and short perpetual futures. The spot position balances price risk, while the short earns the funding payments.

• Negative funding rate: When futures trade below spot, shorts pay longs. In this case, the arbitrageur sells the asset in spot and goes long in perpetual futures to collect funding fees.

For arbitrage traders, these regular funding payments create predictable cash flows that can be harvested systematically.

Why Do Funding Rates Differ Across Exchanges?

Funding rates vary across exchanges. On BingX, funding rates may differ from those on small and mid-sized exchanges worldwide, creating potential arbitrage opportunities. Several factors drive the variation:

• Liquidity: Platforms with fewer active traders may exhibit larger gaps between spot and futures prices, resulting in extreme funding rates.

• Trader Behavior: On retail-heavy platforms, over-leveraged longs or shorts can push rates in one direction.

• Volatility: During sharp market moves, funding swings quickly as traders rush into one side of the market.

• Exchange Rules: Each platform may use different formulas, intervals, or caps to calculate funding.

Example: Imagine Bitcoin perpetuals trade at a funding rate of 0.04% on Exchange A but only 0.01% on Exchange B. A trader could short futures on A while going long on B, pocketing the 0.03% rate difference every cycle. Of course, in practice, trading fees, execution speed, and liquidity must be factored in, as these can reduce or even cancel out the profit.

Core Funding Rate Arbitrage Strategies

Funding rate arbitrage can be applied in different ways depending on whether rates are positive, negative, or vary across exchanges. Below are the three most common approaches traders use:

a) Positive Funding Rates: Long Spot, Short Futures

When funding rates are positive, longs pay shorts. Traders buy the asset in spot and short it in perpetual futures.

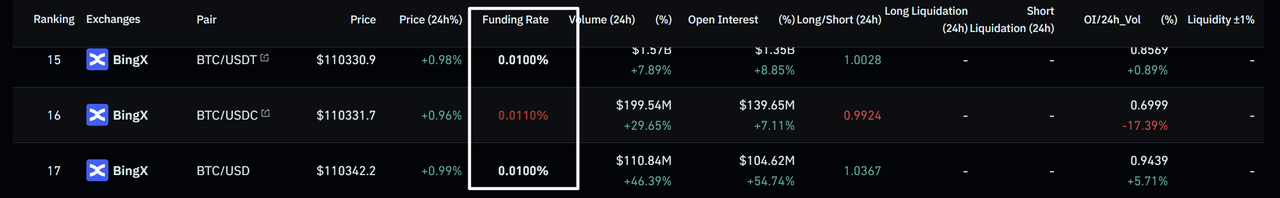

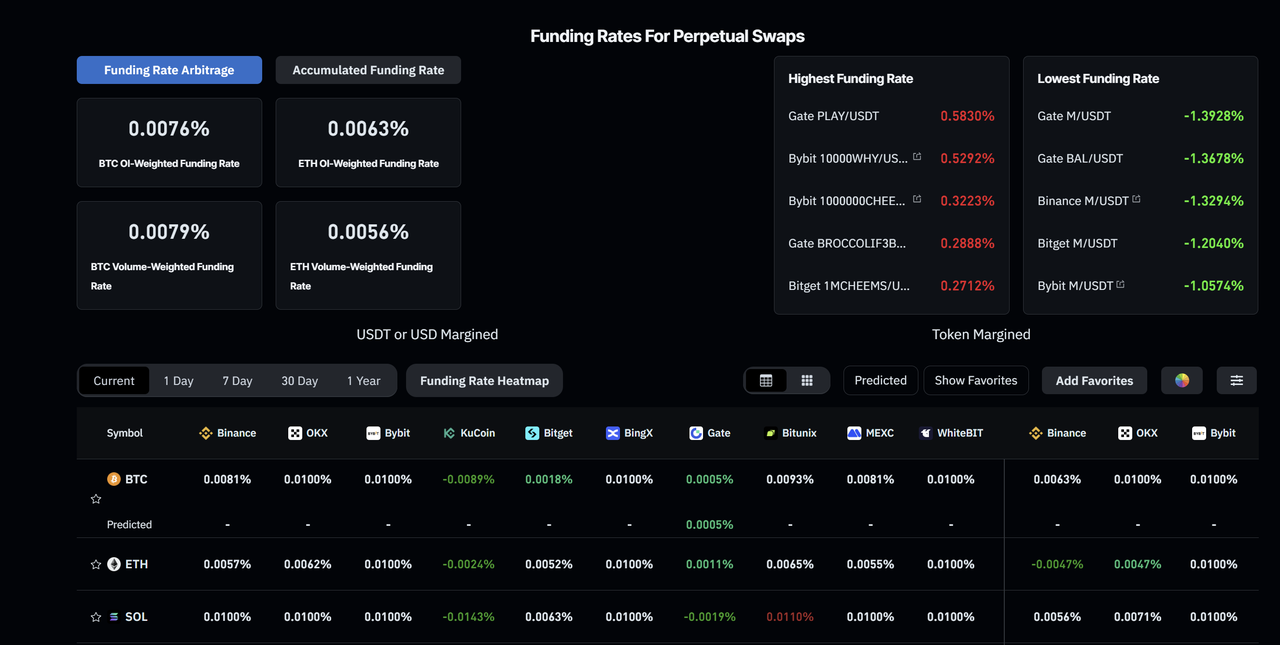

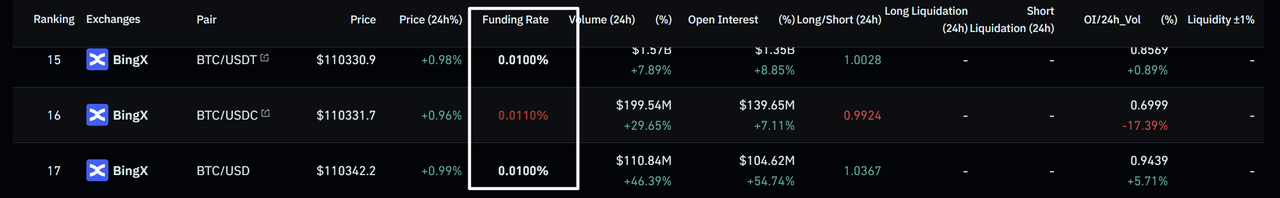

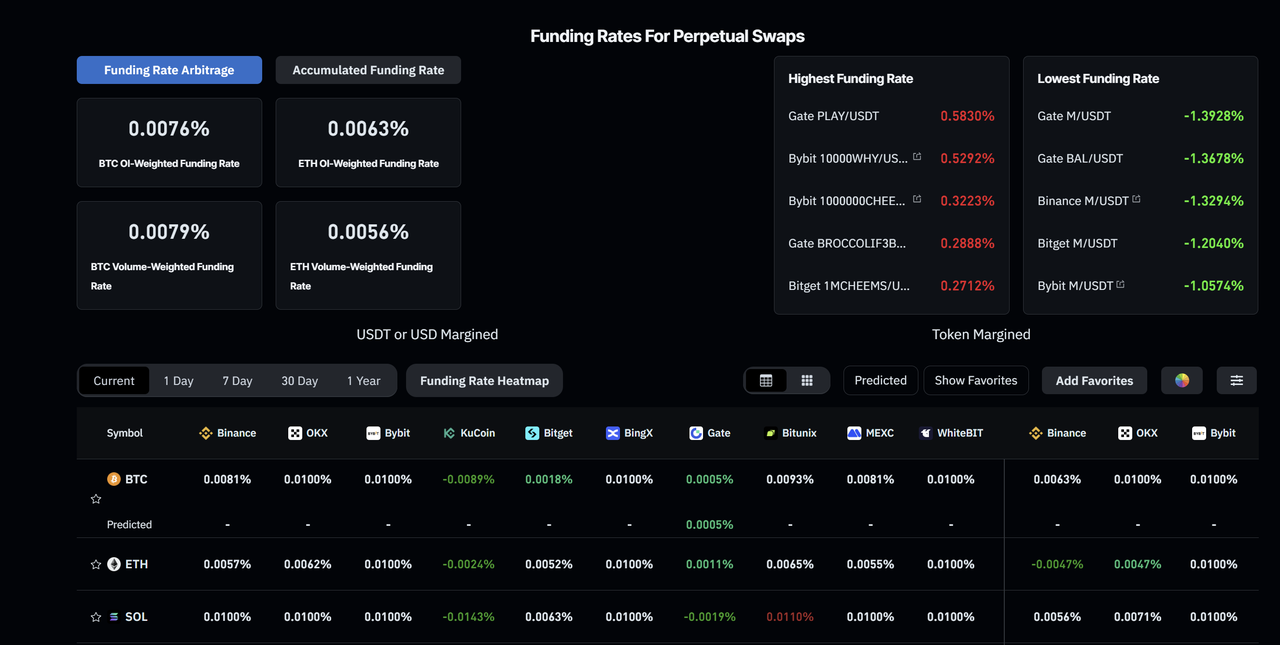

Bitcoin Funding Rate - Source: coinglass

For instance, if Bitcoin’s funding rate is +0.01% every 8 hours, a trader holding BTC in spot while shorting futures of equal size earns the funding payment without price risk.

To make these opportunities easier to spot, traders can monitor real-time funding rates across exchanges using dashboards like the one shown above.

Bitcoin Funding Rate - Source: coinglass

For instance, the chart highlights that BTC funding rates recently varied from 0.0081% on Binance to 0.0100% on Bybit. By tracking these differences, traders can quickly identify spreads worth arbitraging and decide where to open opposite positions.

b) Negative Funding Rates: Short Spot, Long Futures

When rates are negative, shorts pay longs. Traders sell the asset on spot and go long in perpetual futures. Such as, if Ethereum perpetuals trade below spot, shorting ETH spot and going long in the future collects funding fees while staying market-neutral.

c) Cross-Exchange Funding Rate Arbitrage

Funding rates differ across platforms. Traders can hold opposite futures positions on two exchanges to capture the gap.

For example, if Bitcoin perpetual futures on Upbit show a high funding rate of +0.05%, while BingX lists the same contract at just +0.01%, a trader can short BTC futures on Upbit and go long on BingX. This setup allows the trader to capture the 0.04% difference, regardless of whether BTC’s price rises or falls.

These strategies are most effective when combined with sufficient capital, reliable execution, and ongoing monitoring of fees and market conditions.

Top Platforms and Tools for Funding Rate Arbitrage

Executing funding rate arbitrage successfully requires both access to liquid markets and the right set of tools. Since profits often come from small differences, speed and reliability are essential.

• Exchanges: Large, liquid exchanges with active perpetual futures markets are the best places to run this strategy. Traders typically choose platforms that offer transparent funding structures and strong risk controls.

• Data Tools: Aggregators such as Coinglass or similar dashboards provide real-time funding rate data, helping traders spot differences across multiple markets quickly.

• Automation Software: Portfolio managers and trading bots allow users to execute hedged positions instantly, reducing the risk of slippage or missed opportunities.

• Analytics Platforms: Tools like TradingView or blockchain analytics services help monitor volatility, open interest, and broader market sentiment, which all affect funding rates.

In practice, most traders combine at least one reliable exchange with automated tools and live data feeds. This mix allows them to identify profitable setups faster and act before conditions change.

How to Get Started as a Trader

Funding rate arbitrage may sound advanced, but beginners can approach it step by step. Preparation, small test trades, and gradual scaling are key to success.

Choose Exchanges: Open accounts on both a spot and derivatives exchange. Platforms like BingX, which provide access to liquid spot and perpetual futures markets, make it easier to manage hedged positions in one place.

Fund Accounts: Deposit stablecoins such as USDT or USDC. On BingX, margin accounts allow flexible collateral management to reduce liquidation risk.

Track Funding Rates: Use dashboards or BingX’s in-platform data to monitor real-time funding rates and identify assets offering the best opportunities.

Open Hedged Positions: Enter equal and opposite positions—long spot and short futures when funding is positive, or the reverse when it’s negative.

Manage Collateral: Check margin balances regularly, especially during volatile swings, to ensure positions remain safe.

Automate When Possible: For greater efficiency,

connect APIs or

trading bots to execute hedged positions automatically. This minimizes human error and captures opportunities faster. BingX supports API connectivity, allowing traders to deploy bots that execute arbitrage instantly while reducing slippage.

Starting small and scaling slowly enables traders to build confidence before committing larger amounts of capital.

Is Funding Rate Arbitrage Profitable as a Trading Strategy?

Funding rate arbitrage can be profitable, but returns vary widely depending on market conditions. During bullish phases, when perpetual futures often trade at a premium, positive funding rates can climb to 0.05–0.2% every 8 hours.

This can translate into double-digit annualized yields if managed well. In bearish phases, negative funding rates may offer similar opportunities on the opposite side.

In calmer markets, returns may shrink to near zero as funding stabilizes and competition increases. This is why most successful arbitrageurs monitor multiple assets and exchanges, scaling their capital when opportunities are strong and reducing exposure when conditions quiet down.

What Are the Costs, Risks, and Challenges in Rate Arbitrage?

Funding rate arbitrage helps reduce exposure to market direction, but it is not risk-free. Traders must account for costs and operational challenges that can significantly affect returns:

• Trading and Transfer Costs: Trading and transfer fees can quickly eat into profits, especially as spreads tighten with more participants.

• Liquidity and Execution Risk: Slippage, thin order books, and delays in placing both legs of a trade may turn a hedge unprofitable.

• Margin and Liquidation Pressure: Even hedged positions can be liquidated if margin requirements aren’t maintained during sharp swings.

• Exchange Relibility Risks: Outages, freezes, or insolvency at centralized platforms can leave funds trapped.

• Regulatory and Compliance Barriers: Strict KYC/AML rules apply. Without verified accounts, executing cross-exchange arbitrage is nearly impossible.

Arbitrage remains a strategy of precision; successful traders manage these risks carefully instead of assuming funding income is free money.

Conclusion

Funding rate arbitrage gives traders a way to earn from perpetual futures without taking big directional bets. By combining spot and futures positions, the strategy focuses on predictable funding payments rather than price speculation. It can deliver steady returns during volatile markets, especially when funding rates are extreme.

However, it is not without challenges, fees, execution delays, liquidity issues, and shrinking spreads must all be managed carefully. Success comes down to discipline, reliable platforms, and strong risk controls. For traders who prepare well and act efficiently, funding rate arbitrage can be a valuable addition to a diversified trading approach.

Related Articles

FAQs on Funding Rate Arbitrage

1. Is funding rate arbitrage risk-free?

No. While it reduces exposure to price direction, risks such as exchange outages, liquidation, and slippage still exist. Proper risk management is essential.

2. How much can I earn from funding rate arbitrage?

Returns depend on market conditions. In volatile periods, annualized yields can reach double digits, while in calmer markets, profits may shrink close to zero.

3. Do I need large capital to start?

Not necessarily. Some traders begin with a few hundred dollars, but larger balances usually make small funding spreads more worthwhile after fees.

4. Can funding rate arbitrage be automated?

Yes. Many traders use bots or APIs to monitor rates and open hedged positions instantly. Automation reduces delays and helps capture fleeting opportunities.

5. Which assets offer the best arbitrage opportunities?

Highly liquid coins like Bitcoin and Ethereum often provide the most stable setups. However, altcoins with extreme funding swings can sometimes deliver higher spreads.