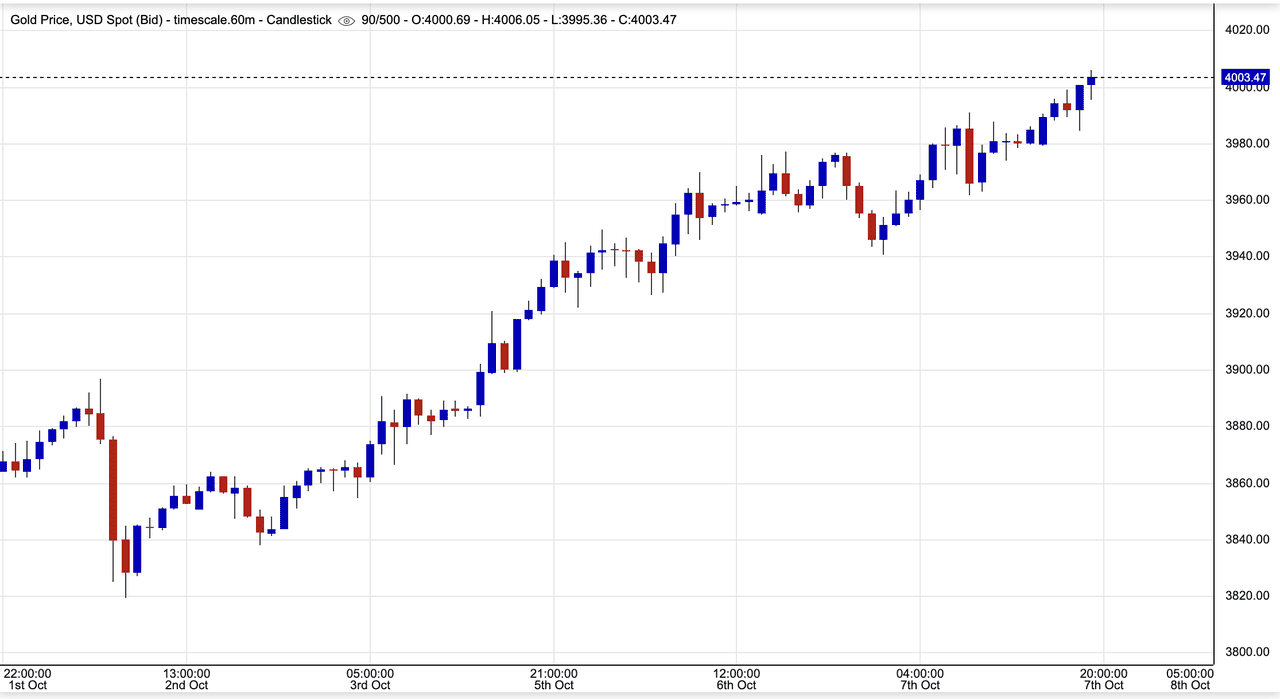

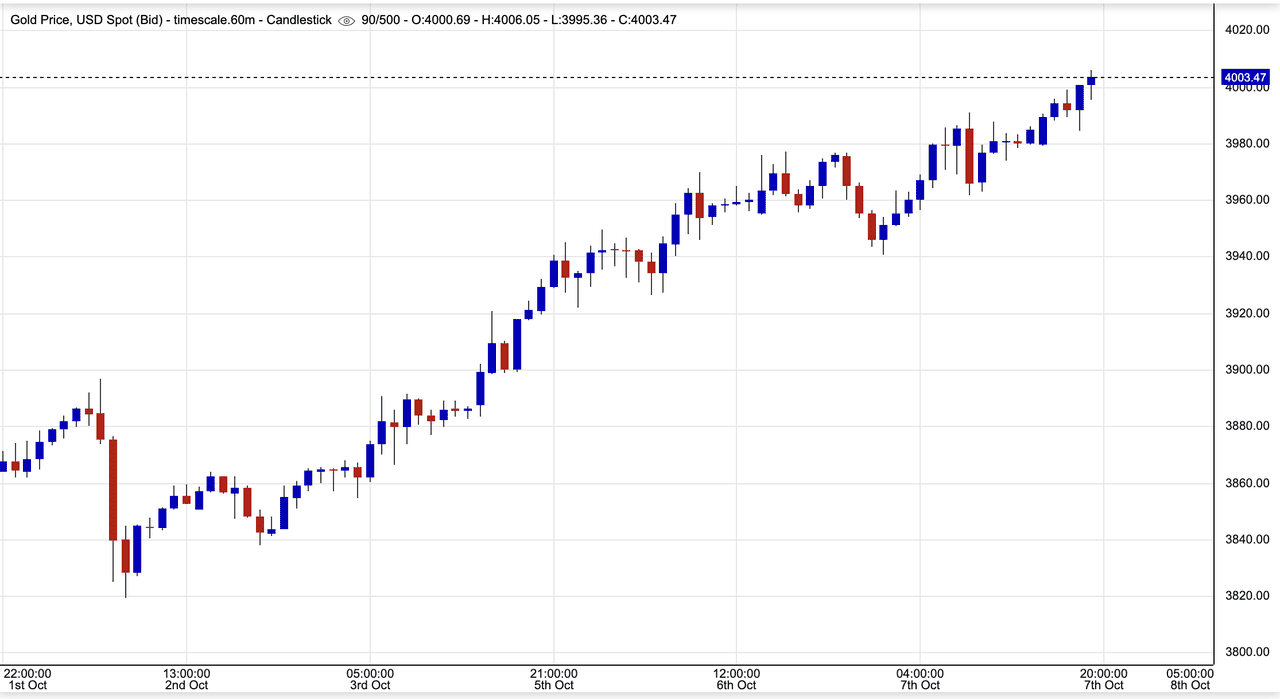

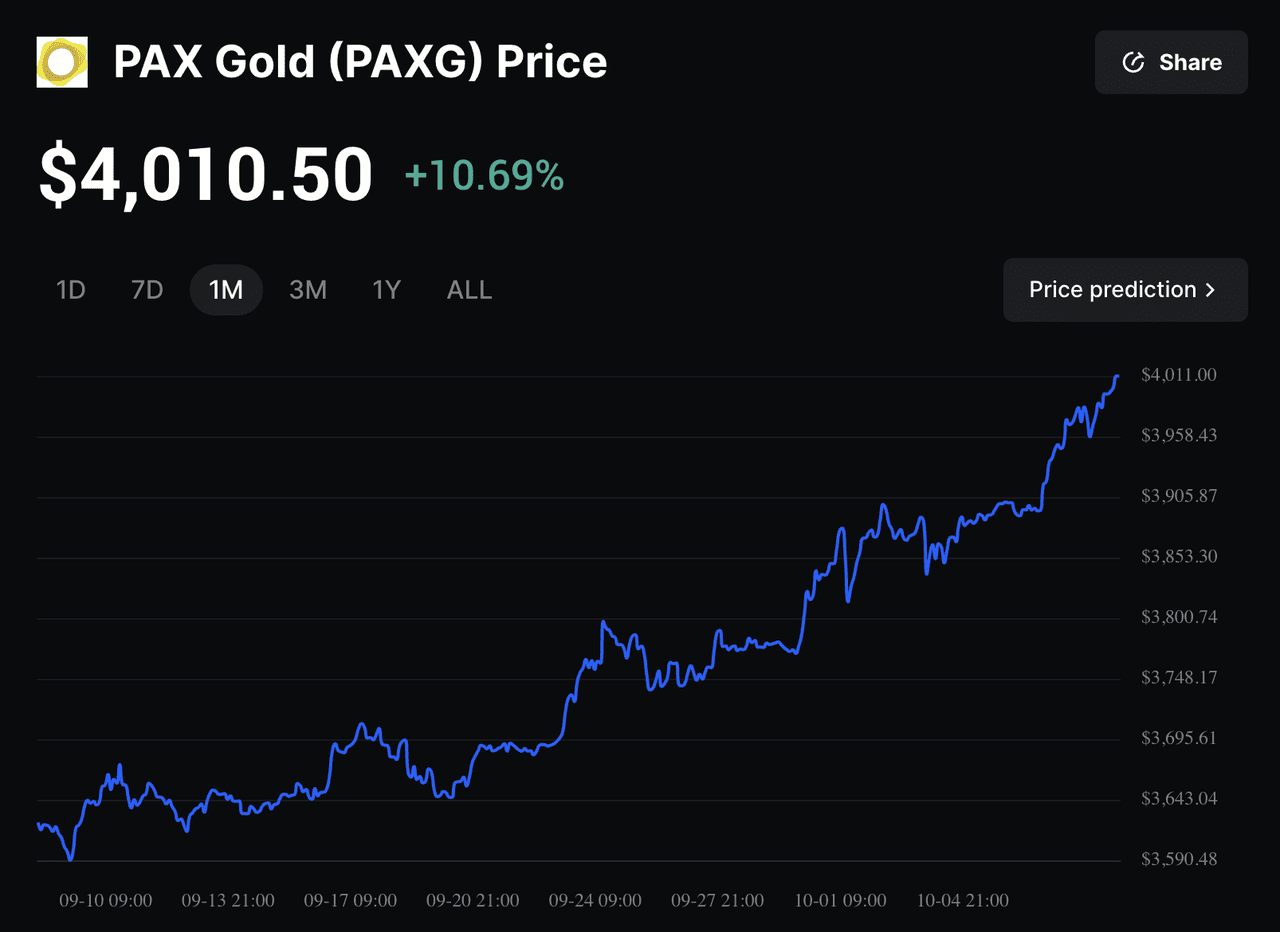

As of October 7, 2025, the market capitalization of gold-backed cryptocurrency tokens has exceeded $3 billion for the first time, coinciding with physical gold prices surpassing $4,000 per ounce. According to The Block on October 7, 2025, this milestone reflects growing investor interest in

tokenized real-world assets (RWAs) amid heightened economic uncertainty, including the ongoing U.S. The federal government shutdown, which began on October 1, 2025, and entered its seventh day today. Trading volumes for these tokens reached approximately $640 million in the 24 hours ending October 7, 2025, driven primarily by leading issuers such as

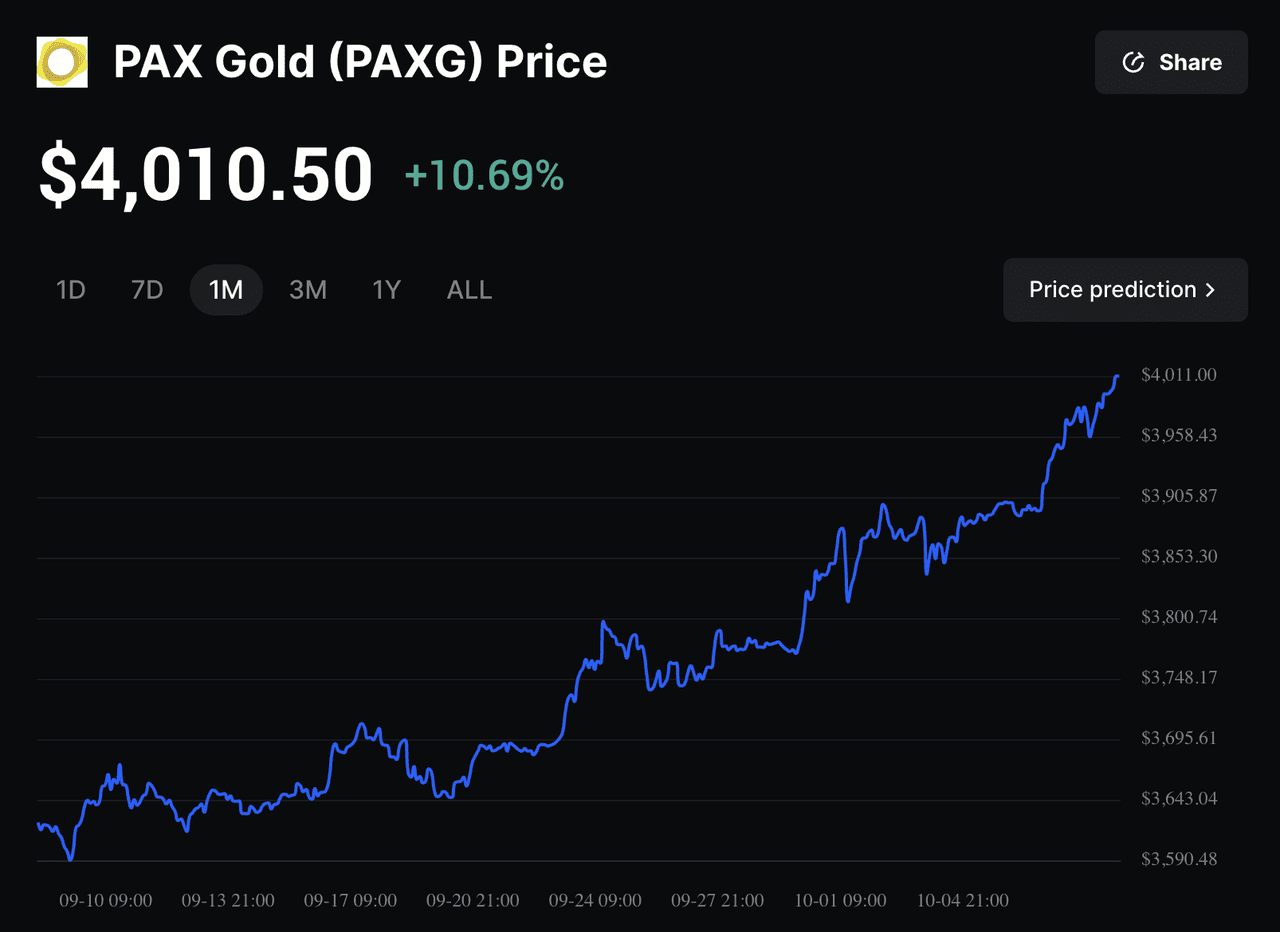

PAX Gold (PAXG) and

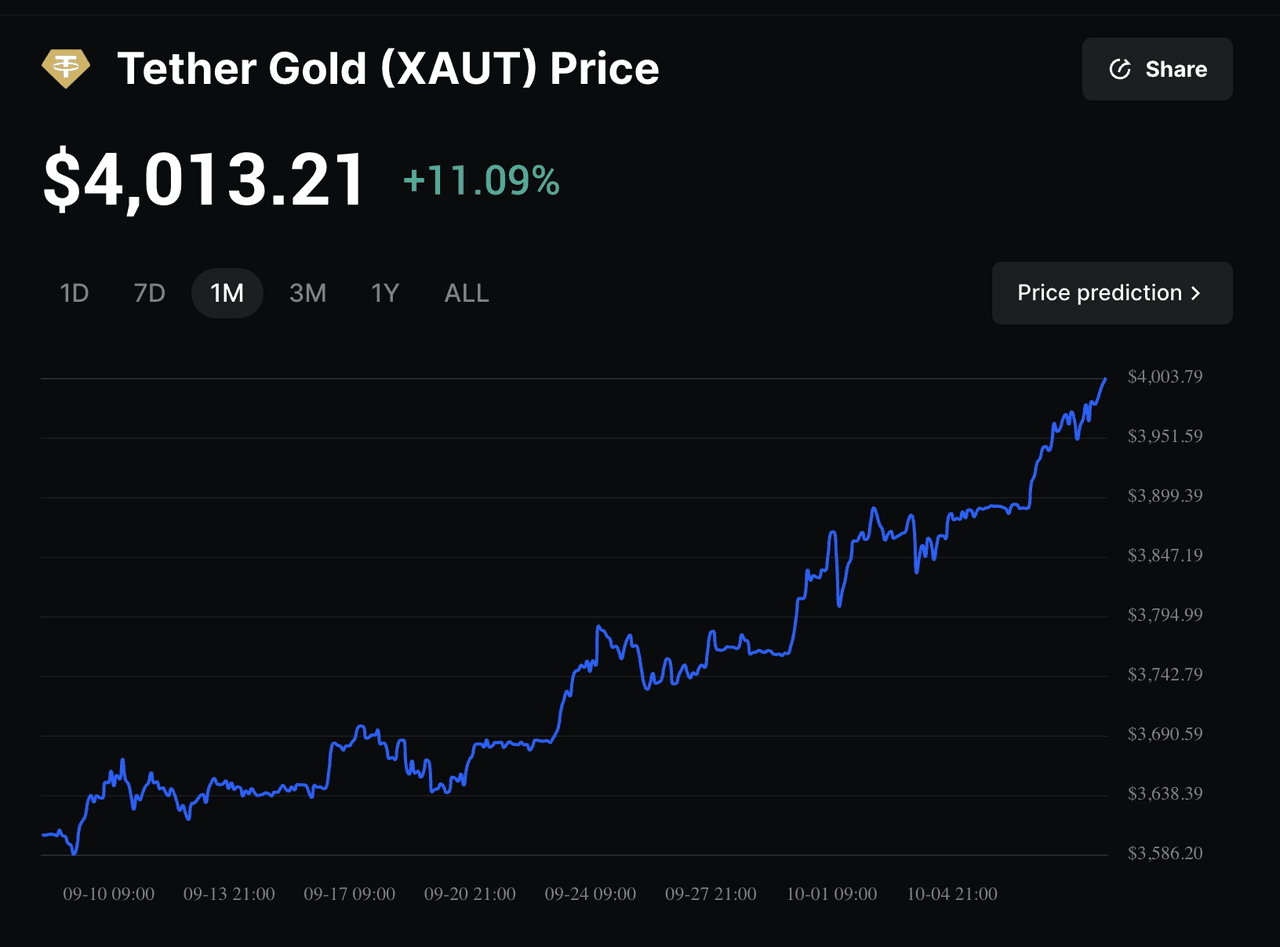

Tether Gold (XAUT).

While

Bitcoin also achieved a new all-time high of $126,279 on October 6, 2025, before retreating to around $122,000 by October 7, 2025, gold has demonstrated some outperformance, with the Bitcoin-to-gold ratio falling below 32 ounces per Bitcoin as of October 7, 2025. This development expresses a broader "debasement trade," where investors seek refuge in assets perceived as stores of value during periods of fiscal and geopolitical strain, as noted by CNBC on October 1, 2025. In this article, the nature of gold-backed tokens, their operational framework, practical applications, and drivers of the current rally will be explored.

What Are Gold-Backed Tokens?

Gold-backed crypto tokens are digital assets that represent ownership of physical gold stored in secure vaults, enabling blockchain-based trading and transfer. Each token is typically pegged 1:1 to a specific quantity of gold, such as one troy ounce, allowing holders to redeem the underlying metal or equivalent value upon request. This structure combines gold's historical role as a hedge against inflation with the efficiency, transparency, and divisibility of blockchain technology.

Prominent examples include PAX Gold (PAXG), issued by Paxos on the

Ethereum blockchain, and Tether Gold (XAUT), managed by Tether with gold stored in Swiss vaults. According to

CoinGecko data by The Block on October 7, 2025, XAUT holds a market cap of approximately $1.492 billion, while PAXG stands at $1.188 billion as of October 7, 2025, together accounting for the majority of the sector's $3.02 billion total market cap. Other tokens, such as

Kinesis Gold (KAU), incorporate additional features like yield generation through transaction fees.

Unlike traditional gold exchange-traded funds (ETFs), which may involve counterparty risks and limited trading hours, these tokens offer 24/7 liquidity on cryptocurrency exchanges and verifiable on-chain audits. Prices closely track spot gold, currently trading near $3,989 per ounce after briefly exceeding $4,000 on October 7, 2025, according to Yahoo Finance on October 7, 2025. This accessibility has broadened participation, particularly for retail investors seeking fractional ownership without the logistical challenges of physical storage.

The Mechanics of Gold Tokenization

The tokenization process begins with the deposit of physical gold bars, meeting standards set by the London Bullion Market Association (LBMA), into audited vaults operated by custodians such as Brink's or Malca-Amit. Each bar is serialized, weighed, and photographed for transparency, with corresponding tokens minted on a blockchain like Ethereum using ERC-20 standards.

Smart contracts govern the tokens' behavior, ensuring redemption rights and compliance with reserve requirements. Holders can verify reserves through public audits and blockchain explorers, reducing reliance on intermediaries. Storage and insurance fees are typically low, around 0.2-0.5% annually, compared to higher costs for traditional gold products.

Redemption involves burning tokens to release physical gold, which can be shipped or converted to fiat. This framework mitigates risks like rehypothecation, though concerns persist regarding issuer solvency, as highlighted in recent discussions on custodial practices by CoinMarketCap on October 5, 2025. Rehypothecation is usually when banks and brokers use client's collateral, like securities for their own transactions, potentially increasing leverage. Regulatory advancements such as the European Union's Markets in Crypto-Assets (MiCA) framework, are enhancing oversight to bolster trust in these assets.

What Are the Use Cases for Gold-Backed Tokens?

Gold-backed tokens extend beyond simple storage, integrating into modern financial ecosystems. Primary applications include:

• Hedging Against Volatility: Investors use them as a stable alternative during market downturns. Amid the current U.S. shutdown that started on October 1, 2025, and equity market fluctuations, the S&P 500 recently hit 6,753 on October 6, 2025, tokens provide a low-volatility hedge.

• Decentralized Finance (DeFi) Integration: Tokens can be staked in protocols like Aave or Yearn Finance to earn yields, or used as collateral for loans without liquidating the underlying asset. This composability turns gold into a productive capital tool.

• Cross-Border Transactions and Remittances: In regions facing currency instability, such as parts of Latin America or Eastern Europe, tokens facilitate low-cost transfers of value. Their fractional nature supports micro-investments, democratizing access to gold.

Emerging uses involve tokenized RWAs in ecosystems like Cosmos, where indices such as GMRWA track performance. Central banks are also exploring similar structures for reserve diversification, potentially expanding institutional adoption.

Why Are Gold-Backed Tokens Surging in October?

The tokenized gold sector's 2.5% market cap increased to $3.02 billion in the 24 hours ending October 7, 2025, stems from a confluence of macroeconomic and geopolitical pressures. Key drivers include:

• U.S. Government Shutdown: The impasse, triggered by congressional disagreements over funding starting October 1, 2025, has amplified concerns over fiscal sustainability and potential debt ceiling issues, prompting rotations into safe-haven assets, as reported by CBS News on October 7, 2025.

• Inflation and Monetary Policy Expectations: Anticipated Federal Reserve rate cuts have lowered the opportunity cost of holding non-yielding assets like gold, while persistent inflation fears sustain demand.

• Geopolitical Tensions: Ongoing conflicts and trade uncertainties, including potential tariffs, have boosted central bank purchases, China and Russia alone added over 100 tons in recent quarters, tightening physical supply.

Social media sentiment on X reinforces this, with users citing "safe-haven demand" and "debasement risks" as primary catalysts, as seen in a post by @CryptoEconomyEN on October 7, 2025. Trading volumes underscore the momentum with tokenized gold outperforming broader crypto indices.

Comparing Gold and Bitcoin Performance

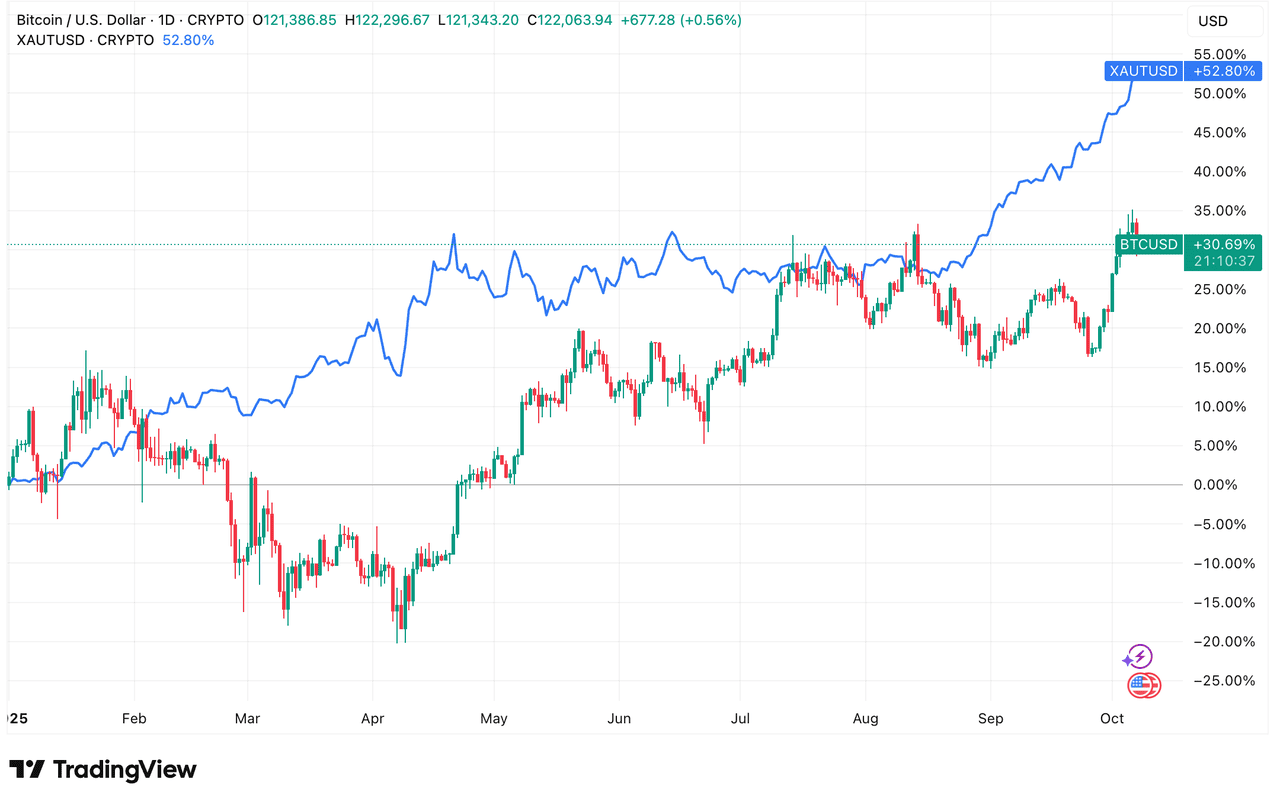

Gold vs. Bitcoin performance so far in 2025 | Source: TradingView

Both gold and Bitcoin serve as alternatives to fiat currencies, yet their trajectories diverge in risk profiles. Bitcoin's year-to-date gain of approximately 30% propelled it to a peak of $126,296 on October 6, 2025, but it has since corrected to $122,000 amid profit-taking, according to Forbes on October 6, 2025. Gold, by contrast, has risen over 50% in the same period, driven by its inverse correlation to real yields and dollar weakness, as detailed by The New York Times on October 6, 2025.

The Bitcoin-to-gold ratio, measuring ounces of gold per Bitcoin, currently hovers at 31.6, down from a December 2024 high above 40, indicating gold's superior resilience in the current environment, based on data from LongtermTrends as of October 7, 2025. Analysts like Lightspark CEO David Marcus argue Bitcoin remains undervalued relative to gold, projecting potential parity at $1.3 million per Bitcoin, according to Yahoo Finance on October 7, 2025. For diversified portfolios, gold-backed tokens offer a bridge, blending stability with crypto's liquidity.

How to Buy Gold-Backed Tokens on BingX

As gold surges past $4,000 per ounce amid the U.S. Government shutdown, tokenized gold is surging. You can buy gold-backed tokens on BingX for a chance to capitalize on this momentum. With

PAXG and

XAUT driving a $3B+ market cap and $640M in 24-hour volumes, these assets deliver gold's stability with crypto's speed and DeFi yields, all on BingX's seamless platform. Outperforming

BTC lately, they're the perfect hedge to buy on BingX today with low fees and instant trades to secure your edge.

Buy Gold-Backed Tokens on BingX Spot

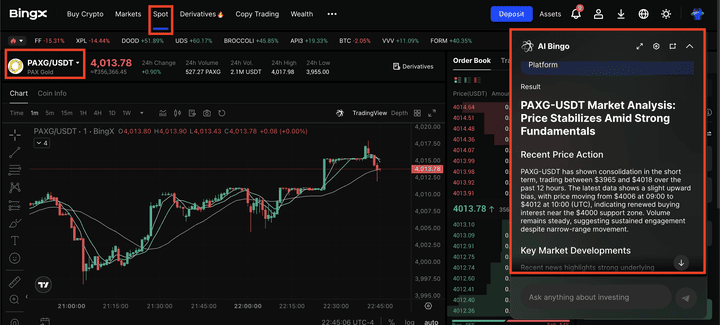

PAXG/USDT trading pair on the spot market, powered by BingX AI

To buy on the BingX Spot Market, simply log in to your account, search for

PAXG/USDT or

XAUT/USDT, and select “Buy”. You can choose between a

Market Order for instant execution or a Limit Order to set your preferred entry price. Once purchased, your tokens will appear directly in your BingX Spot Wallet, where you can hold, trade, or transfer them anytime with full transparency and zero custody hassle.

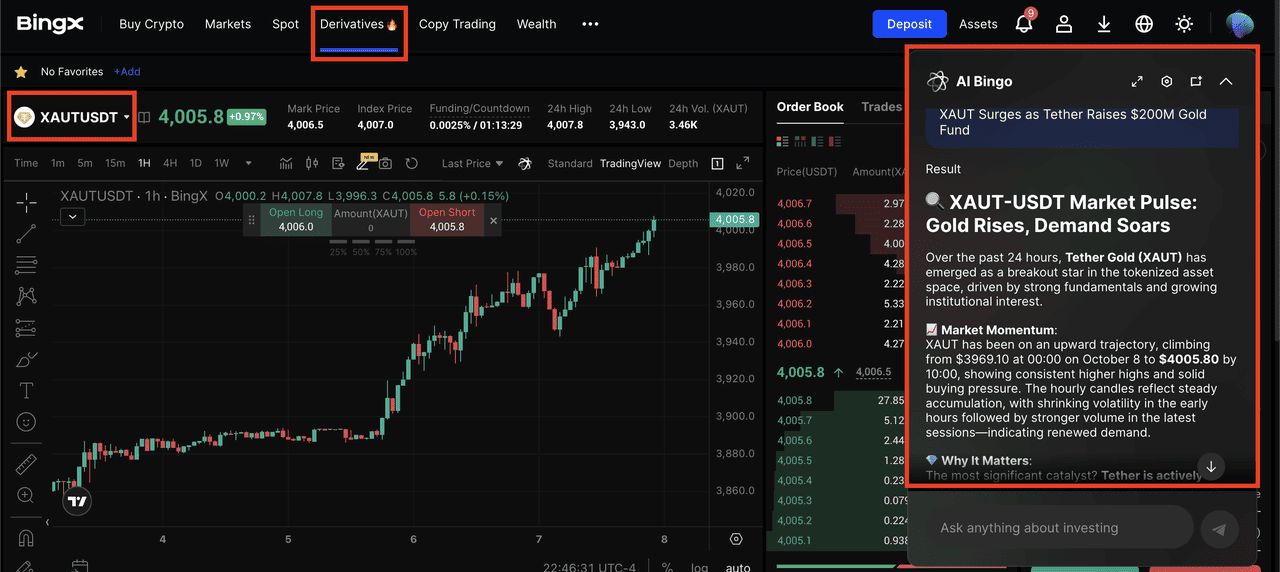

Trade Gold-Backed Tokens on BingX Futures

For advanced traders, BingX also offers Futures Contracts for tokenized gold assets, allowing you to profit from both rising and falling markets. Choose from USDT-M or Coin-M futures pairs, adjust your leverage, and monitor your margin requirements to optimize your position. This lets you hedge gold price movements, amplify gains during volatile periods, and diversify your portfolio using BingX’s institutional-grade trading tools, all backed by real-time data and low transaction costs.

Conclusion

Looking ahead, tokenized gold's growth trajectory appears to be on the rise as they are supported by regulatory clarity and technological advancements like

layer-2 scaling for lower fees. Institutional inflows into

RWAs could propel the sector toward $10 billion by year-end. However, risks such as issuer defaults or sharp yield reversals warrant caution. As fiscal challenges persist from the shutdown that began on October 1, 2025, these tokens position themselves as a vital tool for value preservation in an increasingly digitized economy. Investors should monitor central bank actions and policy developments closely to navigate this evolving landscape.

Related Reading