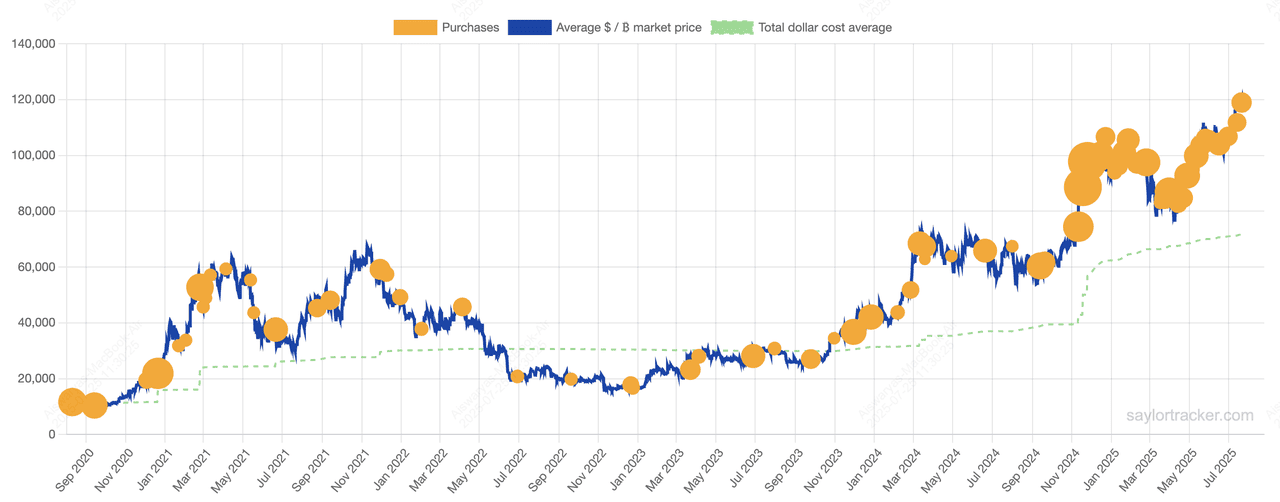

Bitcoin surged past an all-time high of $123,000 in July 2025, fueled by record institutional inflows, expanding spot ETF adoption, and aggressive corporate treasury strategies. At the center of this wave is

Strategy (formerly MicroStrategy), led by executive chairman Michael Saylor, the most vocal corporate advocate for Bitcoin. As of July 2025, Strategy holds over 607,000 BTC, worth roughly $72 billion, making it the largest public holder of Bitcoin in the world.

Strategy (formerly MicroStrategy) BTC holdings | Source: SaylorTracker

Now, Strategy is making headlines again with the launch of STRC, a new type of preferred stock engineered to raise capital for more Bitcoin accumulation. Marketed as a “

synthetic stablecoin with yield,” STRC aims to trade near a $100 price point while paying a 9% variable dividend, drawing comparisons to both traditional money market funds and crypto-native income products. Initially announced on July 21, 2025, as a $500 million offering (5 million shares at $100 each), the issuance was quickly upsized to $2 billion following strong investor demand, with shares priced around $90, a slight discount to par.

For beginners, STRC offers a way to earn steady returns while indirectly gaining exposure to Bitcoin’s long-term upside, without owning BTC directly. But how exactly does this innovative product work, and why is it drawing so much attention from both crypto investors and traditional finance?

In this guide, we’ll break down what STRC is, how it works, and what makes it one of the most talked-about financial instruments in crypto-finance today.

What Is Strategy’s STRC Stock?

STRC, or

Strategy’s Variable Rate Series A Perpetual “Stretch” Preferred Stock, is a new type of financial instrument launched in July 2025 by Strategy Inc., the Bitcoin-focused company formerly known as MicroStrategy, led by Bitcoin advocate Michael Saylor. STRC is designed to function like a hybrid between a traditional dividend stock and a synthetic

stablecoin.

STRC's launch comes amid growing momentum behind the U.S. GENIUS Act, which seeks to formally recognize

Bitcoin as a strategic reserve asset, further validating Strategy’s aggressive treasury approach and potentially accelerating institutional interest in Bitcoin-backed financial instruments.

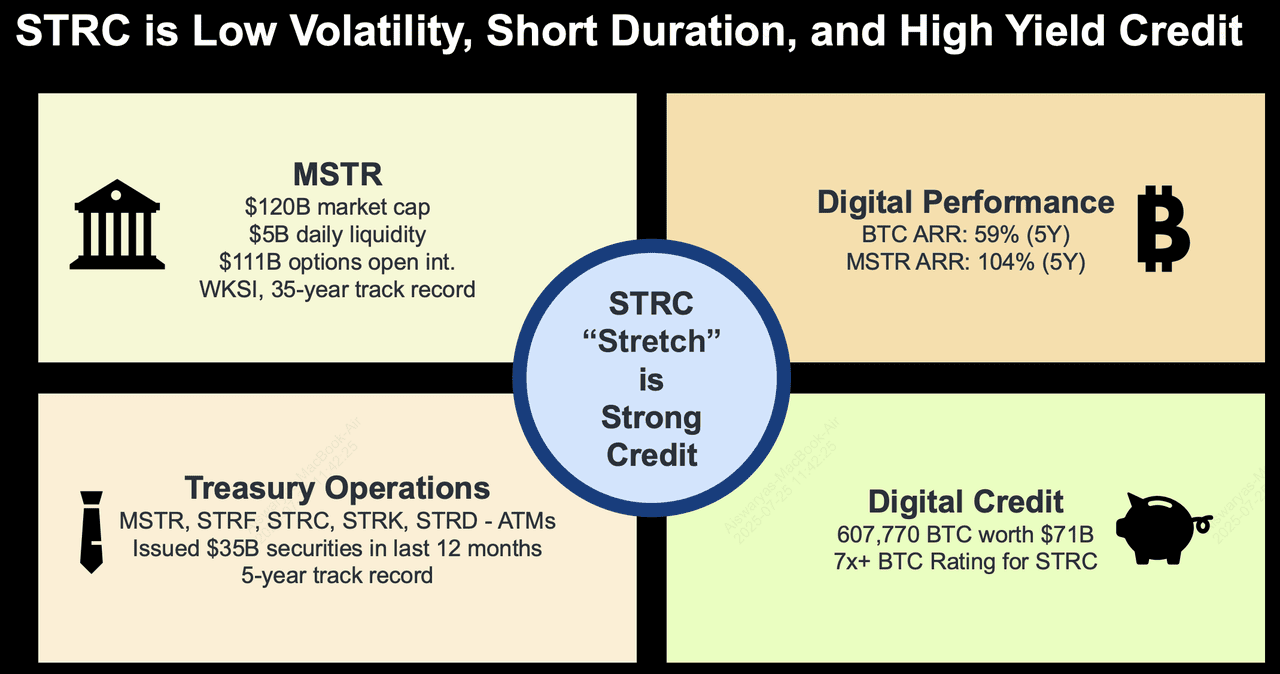

An overview of Strategy's STRC Bitcoin preferred stock | Source: Strategy

Each STRC share is issued at a stated value of $100 and pays a monthly cash dividend, initially set at 9% annually. But what makes it unique is its built-in price stabilization mechanism: Strategy can adjust the dividend rate up or down to keep the market price of STRC close to $100, even in volatile conditions. This approach offers investors a stable, income-generating asset that indirectly taps into Bitcoin’s long-term potential, without exposing them to direct crypto volatility.

In essence, STRC is a Bitcoin-backed preferred stock that behaves like a high-yield, low-risk alternative to cash, especially appealing to investors who want consistent returns without managing crypto wallets or navigating blockchain networks.

Why Strategy Launched STRC

Strategy currently holds over 607,000 BTC, worth about $72 billion, making it the largest

corporate Bitcoin holder in the world. The company has transformed its capital structure to aggressively accumulate more Bitcoin, not just through profits, but by selling common stock and preferred shares to raise fiat capital.

The STRC offering, announced in July 2025, was originally planned to raise $500 million by issuing 5 million shares at $100 each. Due to strong investor interest, Strategy quickly upsized the offering to $2 billion, pricing the shares around $90 each. The funds raised are intended for Bitcoin acquisitions and general corporate purposes, effectively converting investor fiat into digital reserves.

STRC gives Strategy a low-cost, flexible funding source, while offering income-seeking investors a new way to earn returns backed by the company’s Bitcoin treasury strategy. It also reinforces Strategy’s broader goal: turning its balance sheet into a Bitcoin-powered flywheel that keeps attracting capital and converting it into BTC.

How Does STRC Work?

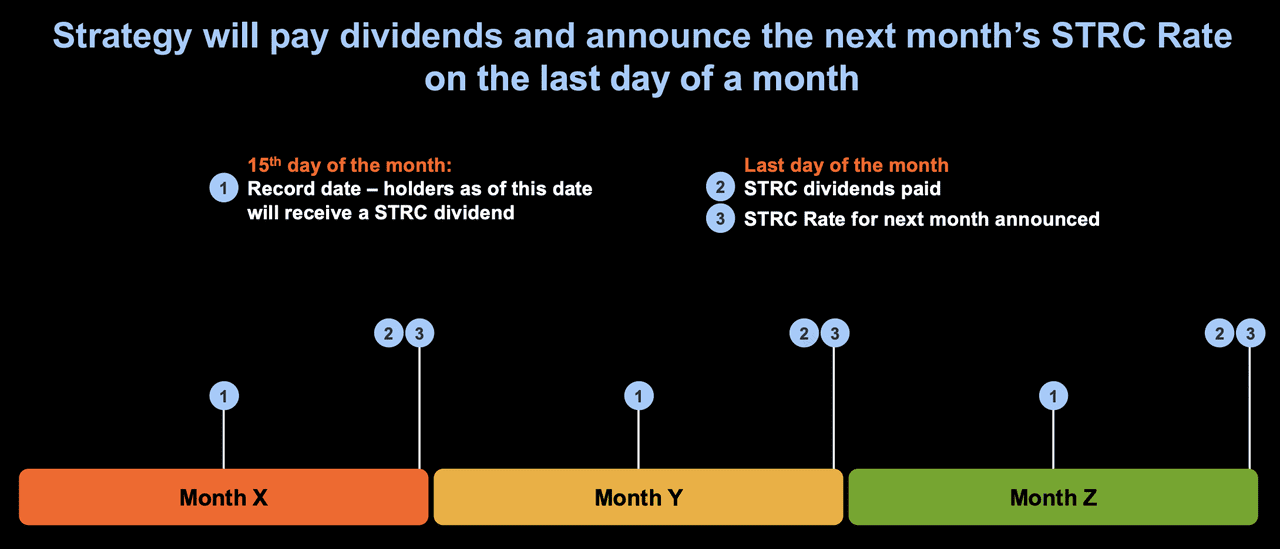

How STRC's monthly cash dividend payouts work | Source: Strategy

STRC is designed to offer predictable monthly income with price stability, while giving Strategy a flexible way to raise capital for Bitcoin purchases. Here’s how the mechanics of STRC are structured to achieve that:

1. Floating Dividend Rate Linked to SOFR

Each STRC share pays monthly cash dividends, initially set at 9.00% per year based on the $100 share value. However, the dividend rate isn’t fixed. Strategy can adjust it monthly, increasing it to attract investors or lowering it if the share price rises above $100.

• These adjustments are tied to the SOFR (Secured Overnight Financing Rate), a widely used benchmark in financial markets.

• Importantly, dividend reductions are capped: Strategy can’t lower the rate by more than 0.25% per month or reduce it below the current SOFR unless all prior dividends have been paid.

2. Designed to Trade Near Par, Like a Synthetic Stablecoin

STRC is engineered to stay close to its $100 issue price, much like a stablecoin.

• Strategy does this by controlling the dividend rate, regulating how many shares are sold into the market, and using its right to buy back (redeem) shares at $101.

• This structure encourages the market to treat STRC as a low-volatility, income-generating asset, similar to a money market fund, but backed by Bitcoin holdings rather than short-term U.S. Treasury bills.

3. Cumulative Dividends

If Strategy ever misses a dividend payment, it’s not lost. Unpaid dividends will accrue and compound monthly, meaning investors are owed interest on any delayed payments. These unpaid dividends continue to grow until fully paid, providing added protection for long-term holders.

4. Redemption & Liquidity Features

Investors are given clear paths to liquidity:

• Once STRC is listed on Nasdaq or a similar exchange, Strategy can redeem shares at $101 plus any unpaid dividends.

• Partial redemptions are only allowed if at least $250 million worth of STRC remains in circulation.

• In the case of major corporate events or tax changes, Strategy can also redeem all outstanding shares.

• If a “fundamental change” occurs, like a merger or sale, investors have the right to force Strategy to buy back shares at par ($100 plus dividends), giving additional downside protection.

How STRC Fits Into Strategy’s Capital Structure

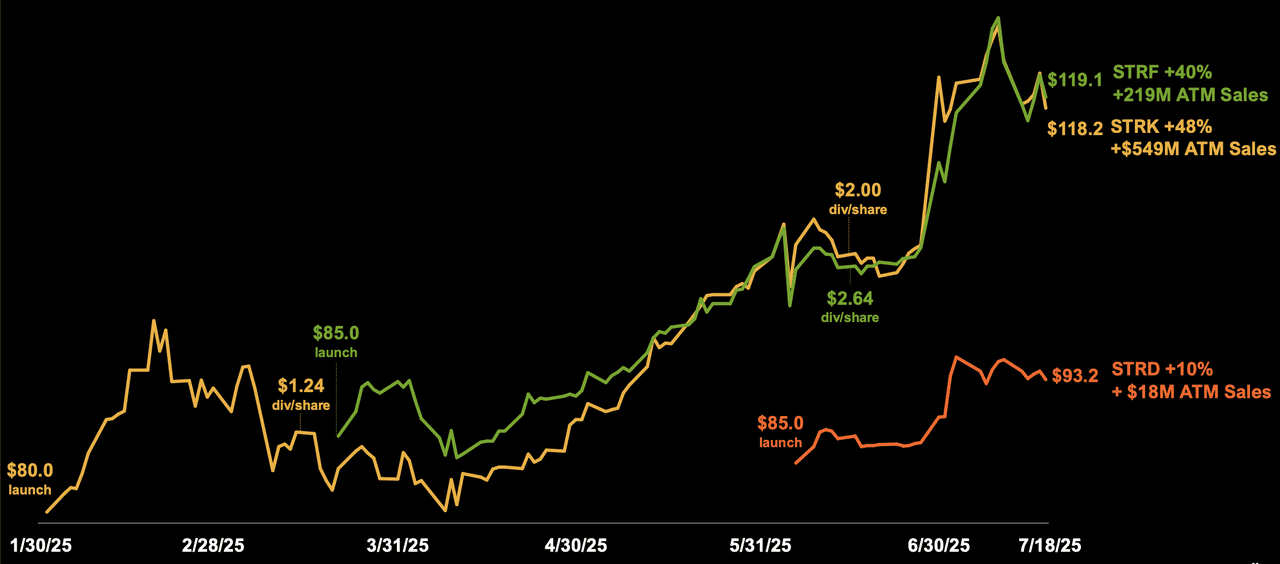

Strong performance for STRK, STRF, & STRD since launch | Source: Strategy

STRC is the fourth preferred stock issued by Strategy, following earlier offerings, STRK, STRF, and STRD, each tailored to meet different investor profiles across the risk and yield spectrum. For example, STRD was designed for higher-yield seekers with a 10% dividend, while STRF offered more seniority and stability. In contrast, STRC aims to provide a low-duration, high-yield option with monthly dividends and price stability near $100. This makes STRC especially appealing to income-focused investors who typically park capital in cash-like instruments such as money market funds.

Analysts describe Strategy’s capital strategy as building a Bitcoin-backed yield curve, using each preferred share as a layer to attract different types of capital. STRC, with its initial 9% annual dividend and synthetic-stablecoin mechanics, represents the more conservative end of this curve. It is backed by Strategy’s vast Bitcoin reserves of over 607,000 BTC, giving investors confidence in its collateral strength. By offering securities that vary in duration, yield, and seniority, Strategy is able to continuously fund its Bitcoin accumulation at competitive rates, creating a self-reinforcing cycle that benefits both its capital stack and long-term Bitcoin treasury strategy.

How Is STRC Different from Bitcoin ETFs, MSTR Stock, or Buying BTC Directly?

While STRC,

Bitcoin ETFs, MSTR stock, and

spot BTC, all offer some form of exposure to Bitcoin, they cater to very different investor needs. STRC is primarily designed for those seeking predictable income with lower volatility, while still benefiting from Strategy’s Bitcoin accumulation strategy. Unlike spot Bitcoin ETFs, which passively track BTC’s market price and do not pay dividends, STRC offers monthly cash payouts at an initial annual yield of 9%. It also aims to keep its share price stable around $100 using dividend rate adjustments, something ETFs cannot do.

Compared to buying Bitcoin directly, STRC doesn’t give you ownership of actual BTC. You won’t be able to send or trade the asset on-chain, but you also avoid dealing with

private keys, crypto wallets, or

self-custody risks. For traditional investors who want Bitcoin exposure without the technical complexity, STRC offers a simpler alternative with steady income.

STRC also differs significantly from Strategy’s common stock (MSTR). MSTR tends to trade with high volatility, often swinging more than Bitcoin itself due to leverage and broader equity market sentiment. STRC, on the other hand, is a preferred stock designed for stability and income, not capital appreciation. It sits higher in the capital structure than common equity and does not dilute shareholder value in the same way. For investors who prefer yield over growth, and less price fluctuation than MSTR stock, STRC fills a strategic gap in the portfolio.

What Are the Benefits of Investing in Strategy’s STRC?

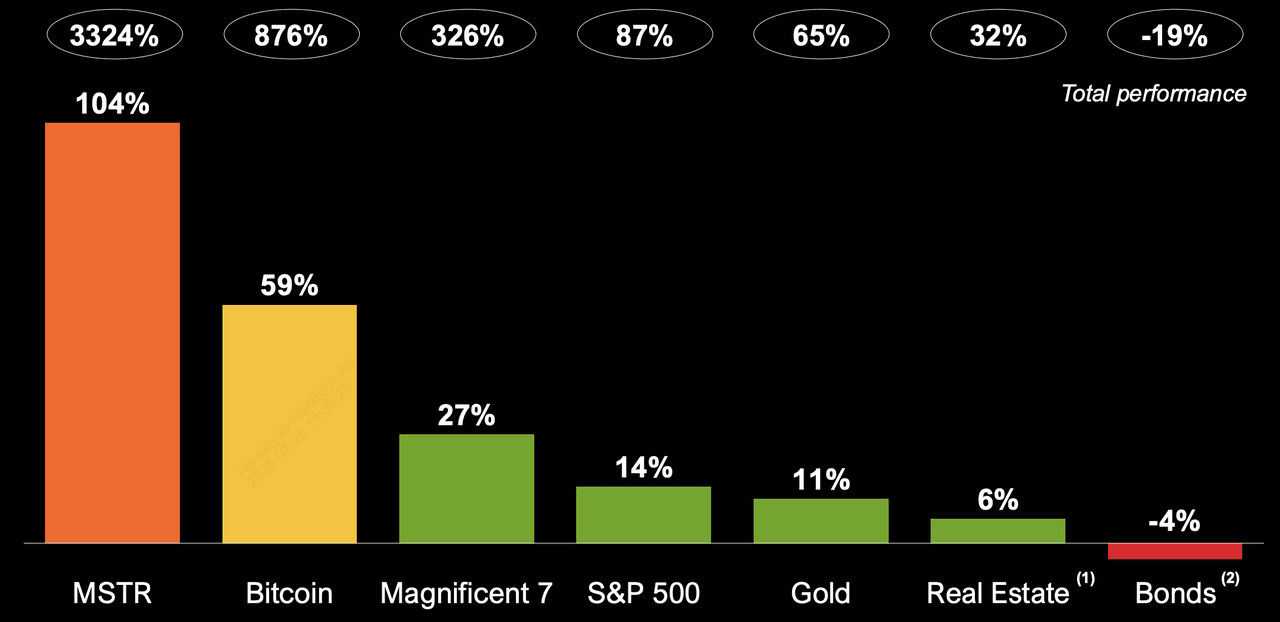

Annualized asset performance chart since Aug 10, 2020 | Source: Strategy

STRC offers a unique blend of traditional finance and Bitcoin exposure, making it an attractive option for income-seeking investors who want stability, yield, and indirect access to crypto markets, without the complexities of managing digital assets.

1. Attracts Capital More Efficiently: With traditional money market funds and short-term Treasuries yielding around 4%–5% in mid-2025, STRC stands out by offering initial yields of 9%–10%. Strategy can adjust these rates monthly to stay competitive, making STRC a flexible and appealing vehicle for conservative investors looking for higher returns on idle cash.

2. Offers Bitcoin Exposure Without Spot Buying: Investors don’t need to buy or store Bitcoin to benefit from its growth. By holding STRC, they indirectly gain exposure to Bitcoin’s long-term upside through Strategy’s ongoing accumulation efforts, while receiving steady monthly cash dividends. This provides a lower-risk, income-generating entry point into the crypto ecosystem.

3. Fuels Strategy’s Bitcoin Flywheel: Proceeds from STRC sales go directly into Bitcoin purchases. As Strategy adds to its 607,000+ BTC holdings, the collateral base behind all its preferred shares, including STRC, grows stronger. This creates a positive feedback loop where new capital strengthens the company’s Bitcoin position, boosts investor confidence, and supports additional fundraising through future offerings.

Buy Bitcoin (BTC) on BingX

Looking to gain direct exposure to Bitcoin’s upside?

Buy and trade BTC easily on BingX, a secure and beginner-friendly platform trusted by millions worldwide, now enhanced with

BingX AI to help you analyze trends and make smarter trading decisions.

Potential Risks & Considerations of STRC Bitcoin Stock

While STRC offers attractive yields and stability, it comes with some risks. Strategy’s ability to maintain dividend payments may depend on its ongoing access to capital markets, as its software business produces limited free cash flow. The structure of STRC is also complex, involving variable dividend adjustments linked to SOFR and issuer discretion, which may be difficult for some investors to fully understand. Additionally, although STRC is designed to trade near $100, extreme volatility in Bitcoin’s price could impact investor sentiment and influence the dividend rates needed to maintain price stability.

Final Thoughts

STRC represents a novel blend of traditional finance and crypto strategy: a perpetual preferred stock designed to deliver steady income, price stability, and indirect exposure to Bitcoin. By targeting a $100 trading price and offering adjustable monthly dividends, STRC acts like a yield-bearing alternative to cash-equivalents, while helping Strategy expand its Bitcoin treasury.

For income-seeking investors who want to benefit from Bitcoin’s long-term potential without holding crypto directly, STRC offers a unique middle ground. However, it’s important to remember that STRC’s performance depends on market dynamics, Bitcoin price trends, and Strategy’s ability to manage dividends and capital flows. As with any financial instrument, investors should carefully assess the risks and review the offering documents before making a decision.

Related Reading