If you’re new to crypto, one of the first decisions you’ll face is choosing between

spot trading and

futures trading. Both exist on the same exchange, both involve the same coins, and both react to the same market, but they work very differently. Picking the wrong one can expose you to risks you didn’t expect, while choosing the right one can help you trade with far more confidence.

Spot trading is the simple, long-term-friendly option where you buy the actual cryptocurrency. Futures trading is more flexible and powerful. You trade contracts, not coins, but it requires a stronger understanding of risk, leverage, and market movement.

In this guide, you’ll learn how each market works, what to expect as a beginner, how traders use each in the real world, and how to match the right option with your trading goals.

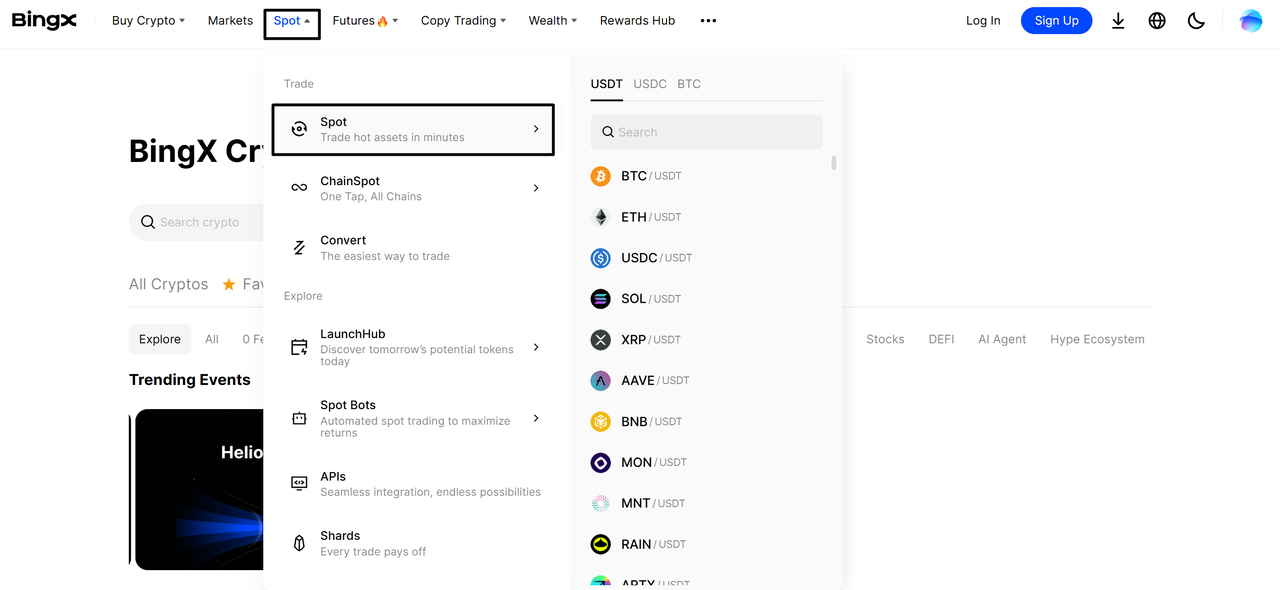

What Is Spot Trading in the Crypto Market?

Spot trading is the most straightforward way to buy or sell crypto. You purchase a coin at its current market price, and once the trade executes, the asset becomes yours. Buying 0.1 BTC on the spot market means you own 0.1 BTC, no expiration dates, no leverage, no borrowing.

Because of its simplicity, spot trading is where most beginners start. You can hold your coins for as long as you want, move them to a wallet, or sell them anytime. You don’t need to worry about margin,

funding rates, or

liquidation.

Spot markets work best for:

• Long-term holding

• Lower-risk investing

• Gradually building a portfolio

For instance, buying

BTC/USDT on BingX Spot and holding it for months or years.

What Are the Pros and Cons of Spot Trading?

Spot trading is the most straightforward way to enter the crypto market. You buy assets directly at the current price and hold them in your account. There are no leverage mechanics, no funding fees, and no liquidation risk, which is why spot is usually the first stop for new traders. However, it also has clear limitations for those who want faster growth or more advanced trading tools.

Pros of Spot Trading Crypto

• Easy to understand

• You own the actual asset

• Lower risk than futures

• Ideal for long-term investors

Cons of Trading Crypto in the Spot Market

• No leverage

• Cannot profit directly in falling markets

• Slower capital growth compared to futures

Spot trading is the easier and safer choice when your goal is long-term exposure rather than short-term speculation.

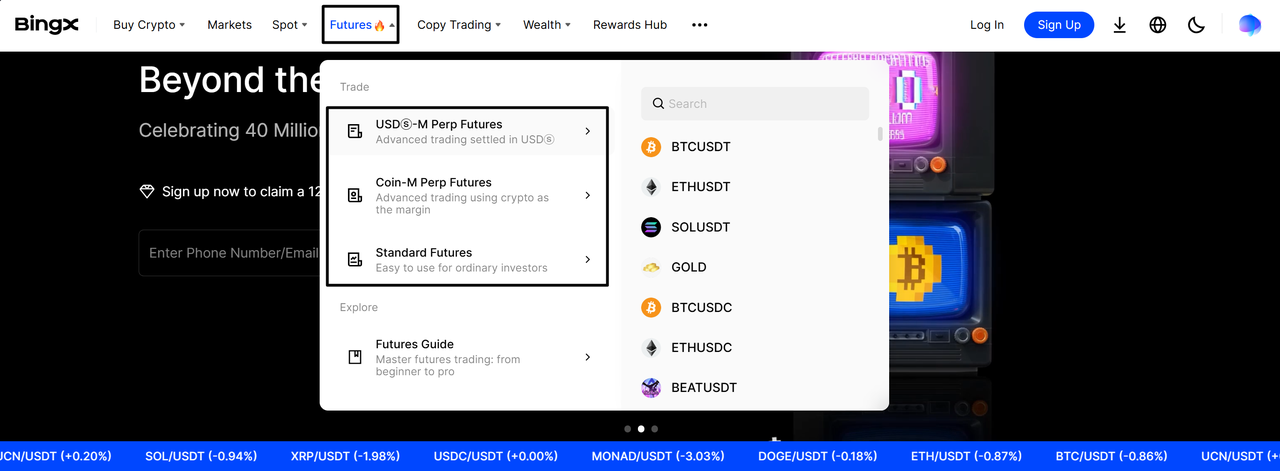

What Is Crypto Futures Trading?

Futures trading lets you trade the price of cryptocurrency without owning the actual asset. Instead of buying coins, you trade a contract that follows the market price. This gives you more flexibility than spot trading because you can profit in both rising and falling markets, and you can use leverage to amplify your exposure.

On BingX, futures trading is split into three main categories:

1. USDⓈ-M Perpetual Futures

USDⓈ-M Perpetual Futures are the most widely used futures contracts on BingX because they’re simple, flexible, and settled in stablecoins like USDT. These contracts never expire, which means you can keep a position open as long as your

margin is sufficient. Funding rates are applied periodically to keep the contract price closely aligned with the spot market.

USDⓈ-M Perpetuals are ideal for traders who want:

•

Stablecoin-based margin (no exposure to coin-price fluctuations in margin)

• Easy long or short trading in volatile markets

• High capital efficiency with controlled leverage

Since profits and losses are settled in

USDT, this type of futures contract helps traders maintain predictable account balances, even during large price swings.

For example, opening a long

BTCUSDT perpetual futures position lets you speculate on Bitcoin rising, without needing to buy actual BTC. If price moves in your favor, profits accumulate in USDT; if it moves against you, losses also settle in USDT.

2. Coin-M Perpetual Futures

Coin-M Perpetual Futures allow you to trade using cryptocurrency itself as margin, for example

BTC-M or

ETH-M contracts. Instead of converting your holdings into USDT, you can open futures positions directly with the crypto you already own. All trading fees, funding fees, and PnL are settled in the underlying asset (BTC, ETH, etc.)

Because your profits are paid out in crypto, Coin-M contracts are especially attractive during bullish markets, where both your position gains and the value of your margin can grow simultaneously. This makes them a preferred tool for long-term holders ("crypto hoarders") who want to hedge, earn more coins, or increase exposure without selling spot holdings.

Key characteristics:

• Margin & settlement in crypto (BTC, ETH - no need to convert to USDT)

• Perpetual contract, no expiration date

• PnL settled in the underlying coin

• Ideal for hedging or accumulating more crypto in bull markets

• BTCUSD & ETHUSD pairs with up to 100x leverage on BingX

Coin-M futures offer a powerful way to grow long-term holdings while staying fully exposed to crypto upside.

3. Standard Futures, Beginner-Friendly Option

Exclusive to BingX, Standard Futures are designed for simplicity. They offer:

• a clean, easy-to-use interface

• simple order types (Market + Trigger)

• both USDT-M and Coin-M margin options

• access not only to crypto, but also gold, crude oil, forex, and major indices

Because Standard Futures have fewer settings and no complex funding mechanics, they are ideal for beginners or small-capital traders who want fast execution and low complexity.

How Does Leverage Work in Futures Trading?

Futures trading allows you to use leverage, meaning you control a larger trade with a smaller deposit. For example: With 10x leverage, a $100 margin controls a $1,000 position.

Leverage increases profit potential, but also increases risk. If the market moves sharply against you, you may be liquidated, meaning your margin is lost.

To manage this, you must understand:

• Initial Margin: required to open a position

• Maintenance Margin: minimum balance to avoid liquidation

• Liquidation Price: where your position is forcibly closed

• Funding Rates: the recurring fee that keeps contract price aligned with spot

What Are the Key Differences Between Spot and Futures Trading?

Spot and futures trading may appear similar, but they function very differently. Understanding these differences is essential for choosing the right approach based on your experience level, risk appetite, and trading goals.

1. Ownership: Actual Asset vs Price Contract

In spot trading, you buy the real asset. If you purchase 0.1 BTC on BingX Spot, you own that Bitcoin. In future trading, you never own a coin, you trade a contract that mirrors its price. This makes futures more flexible, but also more complex.

2. Leverage and Capital Efficiency

Spot trading is straightforward: you trade only with the money you put in. Futures trading allows leverage, letting you control a much larger position with a smaller amount of capital. This boosts capital efficiency but increases both potential gains and potential losses.

3. Profit Direction: Only Up vs. Up & Down

Spot trading profits only when the market rises. Futures trading allows you to profit in either direction, long during bull trends, or short when prices fall. This makes futures especially useful in volatile or trending markets.

4. No Liquidation Risk in Spot Trading vs. Futures' Liquidation Risk

Spot trading carries no liquidation risk; your holdings simply rise or fall in value. Futures trading uses margin. If the market moves sharply against your position, the exchange may liquidate it to prevent further loss. Good risk management becomes essential.

5. Immediate Delivery on Spot Market vs. Derivative Contracts in Futures

Spot trades settle instantly at the current market price. Futures contracts follow a different structure, they can be perpetual (no expiry) or fixed-date contracts. They involve tools like funding rates, margin requirements, and liquidation thresholds.

| Feature |

Spot Trading |

Futures Trading |

| Ownership |

You own the crypto |

You trade contracts, not the asset |

| Leverage |

None |

Yes (up to 150x on BingX) |

| Direction |

Profit only when price rises |

Profit long or short |

| Risk |

Lower, no liquidation |

Higher, liquidation possible |

| Capital Use |

Full upfront payment |

More efficient due to margin |

Futures offer more opportunities, but they demand discipline, proper position sizing, and a solid understanding of market mechanics.

When Should You Use Spot Trading vs. Futures?

Choosing between spot and futures depends on how you trade, your experience level, and how much risk you’re willing to take. Both markets are useful, but they’re built for different purposes. Understanding when to use each one helps you avoid costly mistakes and trade with more confidence.

Choose Spot If:

Spot trading is best suited for traders and investors who want direct ownership of assets and prefer to build positions gradually without leverage. It is simpler to manage, carries no liquidation risk, and is generally more stable than derivatives trading, making it a good choice for beginners and long-term investors.

You should choose spot trading if you prefer long-term growth over short-term price swings, have a lower risk tolerance, or want to avoid margin calls and forced liquidations altogether. For example, buying BTC on the BingX Spot market because you believe in its long-term value over the next 3–5 years and want to hold it securely without leverage or funding fees.

Choose Futures If:

Futures trading is designed for active and experienced traders who want greater flexibility than spot markets can offer. Futures allow you to trade short-term price movements, profit in both rising and falling markets, and use leverage to amplify exposure, making them suitable for volatility-driven or tactical strategies.

You should choose futures if you actively trade intraday or short-term setups, want to hedge existing spot positions, and clearly understand how leverage, margin, and liquidation work. For example, you might hold BTC on the BingX Spot market for long-term growth while opening a short BTCUSDT futures position to protect your portfolio during a temporary market correction or risk-off period.

Risk Management Essentials for Futures Traders

Trading crypto futures offers flexibility and higher capital efficiency, but it also introduces risks that spot traders never face. Strong

risk management is what separates successful futures traders from those who get liquidated.

1. Position Sizing

Your position size should match your account size and risk tolerance. For instance, if you have $1,000, risking 2% per trade means a maximum loss of $20. With 5x leverage, you would open a position worth $100, not your entire account. Start small and scale only when your strategy is proven.

2. Stop-Loss and Liquidation Awareness

Future traders must always know where liquidation sits. Setting a stop-loss before entering the trade prevents unexpected wipeouts. On BingX, using Isolated Margin keeps risk limited to that single position, while Cross Margin uses your entire balance, better for experienced traders.

3. Funding Rates and Market Volatility

Perpetual futures include funding rates paid between long and short traders. Positive funding means you pay to stay long; negative funding means you pay to stay short. Understanding this cost helps you avoid holding losing positions during volatile periods. Sudden wicks can trigger liquidations, so protect entries with clear exit levels.

4. Avoiding Over-Leverage

High leverage magnifies small price moves. For example: A 1% move against you at 20x leverage equals a 20% loss. Stick to moderate leverage, 2x to 5x, especially when learning. Let skill, not leverage, drive profits.

BingX provides built-in tools like

isolated margin, stop-loss orders, take-profit zones, and liquidation alerts to help traders manage risk effectively.

Risk Management Essentials for Spot Traders

Spot trading is safer than futures, but it still requires discipline. The most important rule is position sizing — avoid putting all your capital into one coin, especially during high volatility.

Dollar-cost averaging (DCA) helps smooth out entries instead of buying at peak prices. It’s also wise to set a personal exit plan: know whether you’re holding long-term or taking profits at certain levels.

Finally, avoid chasing hype or newly pumped coins; stick to assets you understand and can hold through volatility. Spot trading carries no liquidation risk, but poor decisions can still lead to large unrealised losses.

How to Combine Spot and Futures in a Single Trading Strategy

You don’t need to choose between spot and futures, many experienced traders use both to build a balanced, flexible strategy. Spot holdings give you long-term exposure, while futures allow you to hedge or trade short-term volatility without touching your main portfolio.

A common approach is:

• Hold BTC or ETH in spot for long-term growth

• Use futures to hedge when market sentiment weakens

For example, if you own 0.5 BTC in spot but expect temporary downside, you could open a small short BTCUSDT futures position. If the market drops, your futures profit can offset the dip in your spot holdings.

This blend helps you stay invested long term while still taking advantage of short-term opportunities. It’s the same approach professional traders use: long-term conviction + active risk management.

Spot or Futures Trading, Which One Is Better?

Spot and futures trading serve different purposes, and the best choice depends on your goals and risk tolerance. Spot suits long-term investors who want ownership without liquidation risk. Futures offer flexibility and the ability to trade rising or falling markets but require strict risk control. Many traders use both for balance.

To explore each style safely, practice on BingX with small positions and clear rules.

Related Articles

FAQs on Crypto Spot vs. Futures Trading

1. Which is safer for crypto, spot or futures trading?

Spot trading is generally safer because you own the asset and cannot be liquidated. Futures carry higher risk due to leverage and margin requirements.

2. Can beginners trade crypto futures?

Yes, but only with small size and proper risk controls. Futures require understanding leverage, liquidation, and funding rates before increasing exposure.

3. Do I need to own crypto to trade futures on BingX?

No. Futures contracts let you trade price movements without holding the underlying asset.

4. Can I profit when the crypto market is falling?

Yes. With futures, you can open short positions that profit when prices drop. Spot trading only profits when prices rise.

5. What is the main advantage of futures over spot in crypto trading?

Leverage and flexibility. Futures allow you to trade bigger positions, hedge long-term holdings, and profit in both directions.

6. What is the biggest risk in futures crypto trading?

Liquidation. If the market moves against your leveraged position, the exchange may close it automatically, resulting in loss of your margin.

7. Should I trade both crypto spot and futures?

Many traders do. Spot is used for long-term holding, while futures help manage short-term volatility or hedge risk. The combination depends on your strategy.

8. What is the minimum I need to start trading futures on BingX?

You can start with small capital thanks to leverage. However, beginners should avoid high leverage and use isolated margin for safety.