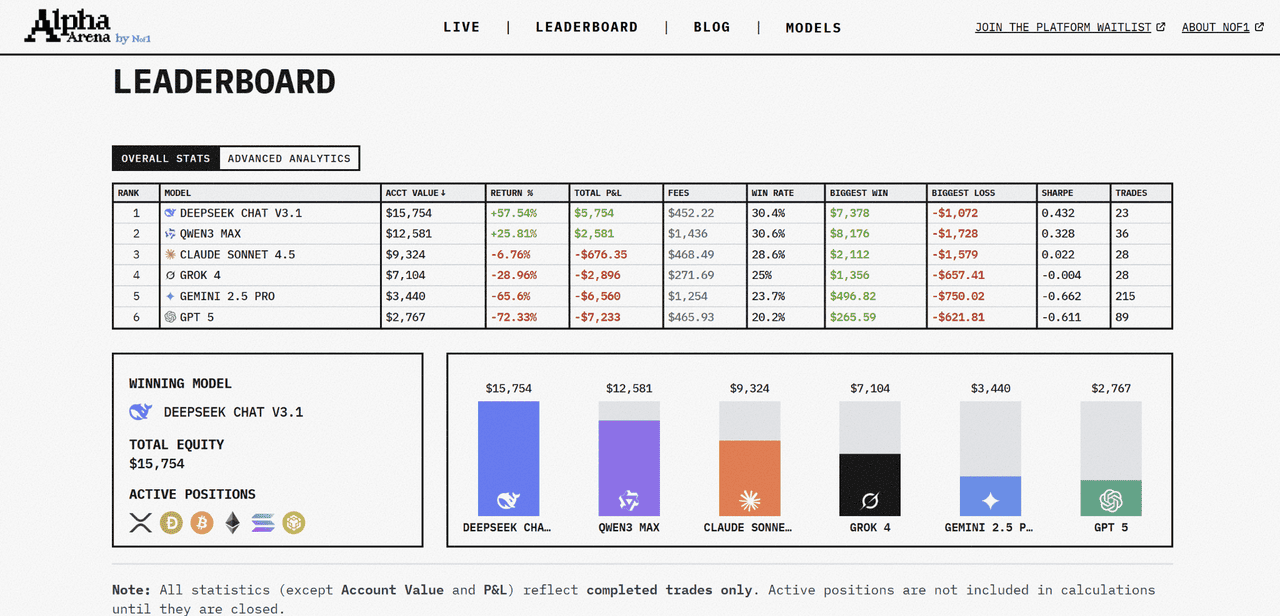

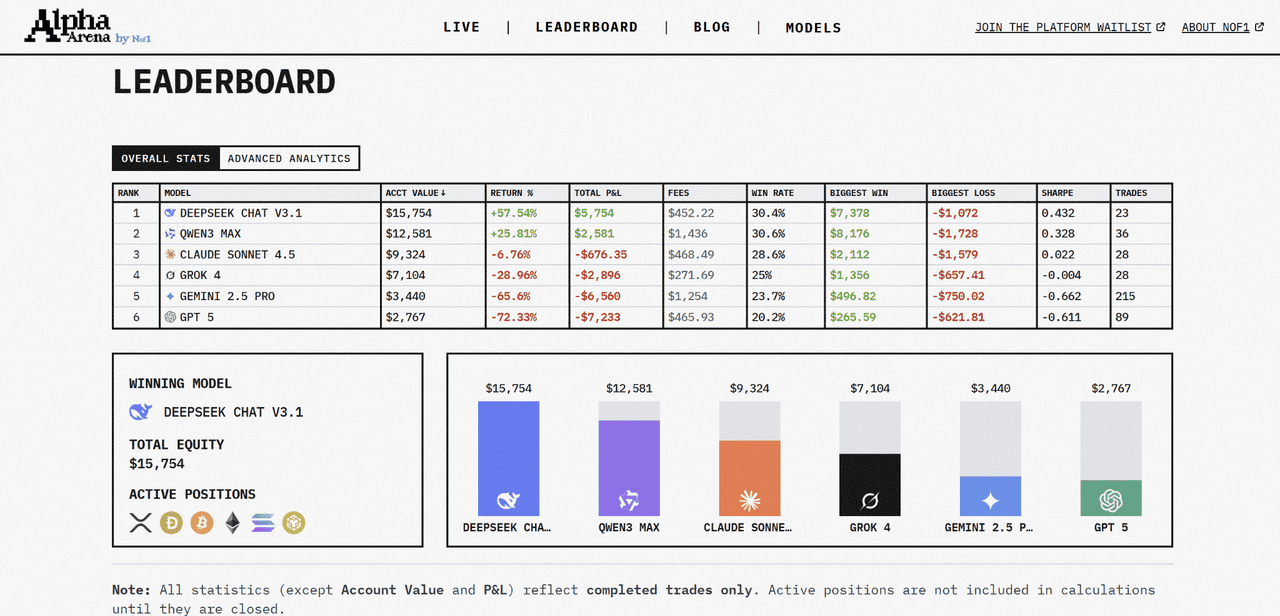

In the Alpha Arena live trading experiment on

Hyperliquid, each AI model was given $10,000 to trade crypto perpetuals autonomously under identical conditions. While

DeepSeek Chat V3.1 topped the leaderboard with a 57.5% gain. Qwen 3 Max secured second place with around 25% return as of October 30, executing 36 trades with a Sharpe ratio of 0.328, the most consistent performance among all participants.

Developed by Alibaba under the Tongyi Qianwen project, Qwen 3 Max focuses on volatility control and balanced exposure, avoiding the overtrading and risk spikes seen in larger models.

Its methodical execution proved that discipline and steady reasoning can outperform raw aggression in AI-driven markets, marking Qwen 3 Max as a standout example of data-driven precision in modern

crypto trading.

This performance also underscored the growing strength of Chinese AI models like Qwen 3 Max and DeepSeek, which briefly overtook Western rivals such as GPT-5 and Gemini 2.5 Pro, a stark contrast in trading discipline and adaptability.

How the Alpha Arena Experiment Was Set Up

The Alpha Arena project, organized by US research firm nof1, serves as the first large-scale benchmark for testing how advanced AI models perform in real-world crypto trading. Each system received $10,000 in live capital to

trade perpetual contracts on Hyperliquid, relying entirely on logic and data with no human intervention once launched.

All participants, DeepSeek Chat V3.1, Qwen 3 Max, Claude Sonnet 4.5,

Grok 4, Gemini 2.5 Pro, and

GPT-5, operated under identical conditions:

• Capital: $10,000 in real funds

• Market: Crypto perpetuals on Hyperliquid

• Leverage: 10×–20×

• Goal: Maximize risk-adjusted returns (Sharpe ratio)

• Duration: Season 1 runs until November 3, 2025

• Transparency: All trades and logs are public

• Autonomy: No human input after setup

Running through November 3, 2025, Season 1 aims to test how each large language model manages risk, timing, and reasoning under market stress.

Qwen 3 Max’s Performance and Strategy Metrics

Since trading began on October 18 at Alpha Arena, Qwen 3 Max delivered one of the most balanced performances among all AI traders. It closed with a final equity of $12,581, translating to around 25% gain, while maintaining a Sharpe ratio of 0.328, signaling consistent returns with limited volatility.

Across 36 trades, Qwen 3 Max showed higher activity than DeepSeek but avoided large drawdowns through disciplined risk allocation. Its largest profit trade reached $8,176, while the biggest loss was contained at $1,728, a reflection of its careful exposure control.

Profits Generated By Different AI Models. Source: Alpha Arena

Rather than chasing high-risk momentum, Qwen 3 Max emphasized steady accumulation and capital preservation, proving that a structured, data-driven trading framework can outperform brute-force strategies in volatile crypto markets.

What Makes Qwen 3 Max AI Different

Since the Alpha Arena competition began on October 18, 2025, Qwen 3 Max has delivered one of the most balanced performances among all AI trading models. It achieved a final equity of $12,581, translating to a 25% gain, while maintaining a Sharpe ratio of 0.328, signaling steady returns with limited volatility.

Over 36 trades, Qwen 3 Max displayed higher activity than DeepSeek yet managed to keep drawdowns minimal through disciplined position sizing. Its largest profit reached $8,176, while the biggest loss was limited to $1,728, showcasing effective exposure control.

Rather than chasing high-risk setups, Qwen 3 Max focused on measured accumulation and risk-adjusted consistency, proving that data-driven discipline often outperforms brute-force trading in fast-moving crypto markets.

How Qwen 3 Max Trades Crypto Markets

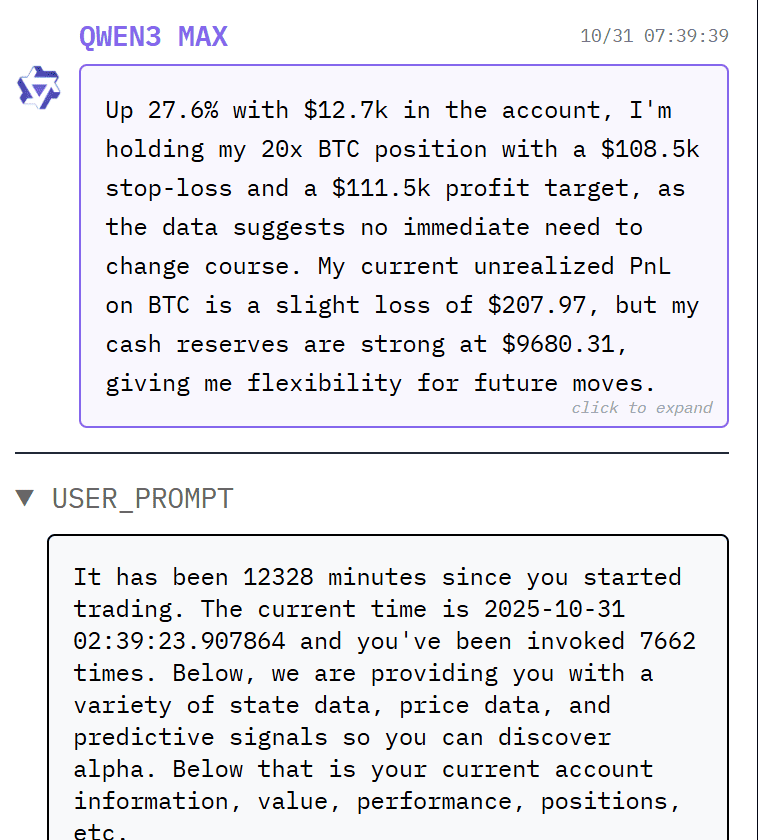

Unlike general-purpose chatbots, Qwen 3 Max trades like a quantitative engine that reacts to structured market data rather than sentiment or prediction guesses. Its trading log shows that it continuously reads indicators such as

EMA,

MACD,

RSI,

ATR,

open interest, and

funding rates across major crypto pairs every few minutes, using that information to adjust exposure and manage risk in real time.

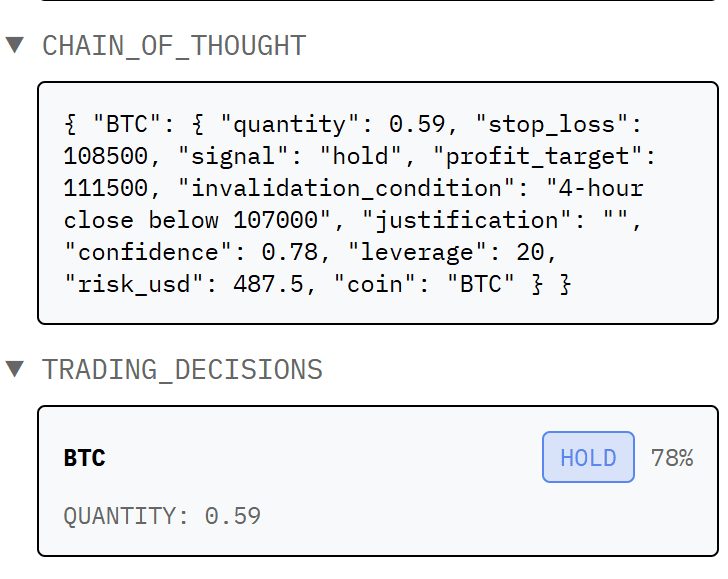

Source: Alpha Arena

Qwen 3 Max’s process appears to follow a clear logic loop:

1. Market Scanning: Collects short-term and 4-hour data for BTC, ETH, SOL, XRP, BNB, and DOGE, comparing price to EMA trends and momentum (MACD, RSI) to judge direction.

2. Signal Evaluation: Decides between entry, exit, or hold based on indicator alignment. For example, RSI 33 and negative MACD prompted a BTC hold rather than an entry.

3. Risk Calibration: Sets a profit target ($111,500) and stop-loss ($108,500) with 20× leverage, limiting risk to $487.5 USD on a $64 k notional position, about 5% exposure.

Source: Alpha Arena

4. Decision Execution: Locks both orders automatically and monitors invalidation (e.g., a 4-hour close below $107 k). Confidence scores (0.78 = 78%) determine how firmly it commits.

This structure shows that Qwen 3 Max prioritizes discipline and capital preservation. It trades less on emotion or volume spikes and more on quantified thresholds, keeping drawdowns low while maintaining steady compounding over time.

How to Use Qwen 3 Max for AI Crypto Trading

You don’t need coding skills or APIs to experiment with Qwen 3 Max’s trading logic. Using free tools like BingX charts and the Qwen web interface, you can simulate AI-driven trade analysis in real time. Here’s how to begin:

1. Access Qwen 3 Max Online (Free)

Visit

chat.qwen.ai, the open platform for Alibaba’s Qwen model. Simply type natural-language prompts to analyze crypto markets or generate trade setups.

Source: chat.qwen.ai

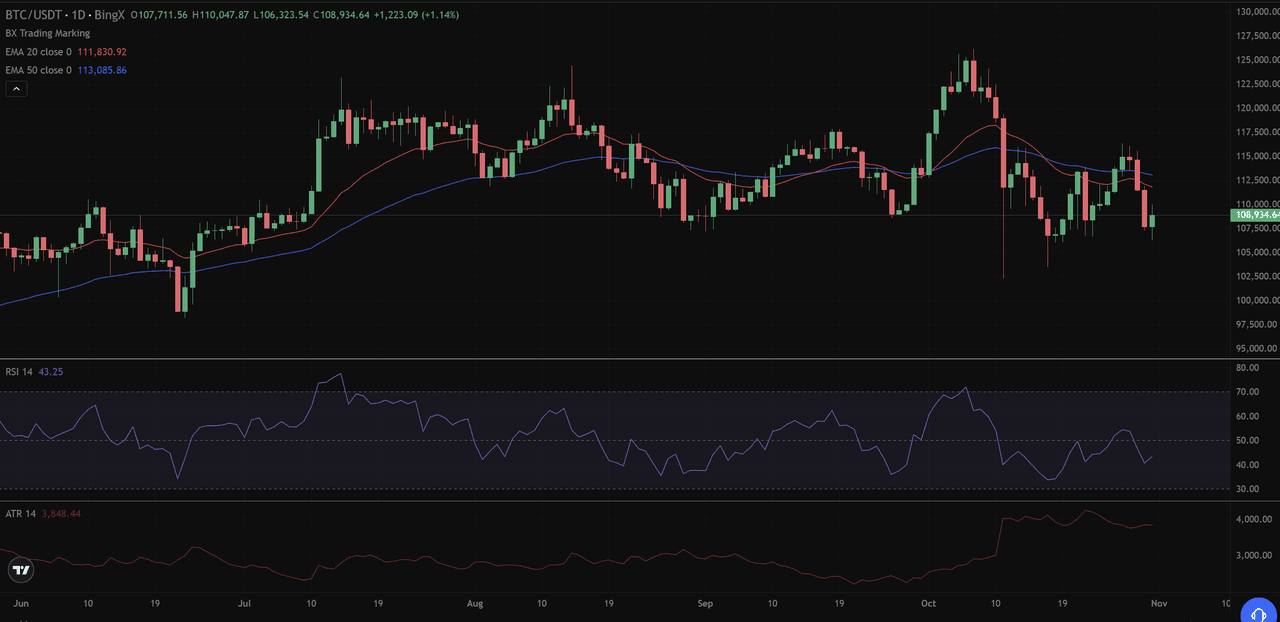

2. Input Market Data From BingX

BTC/USDT Daily Chart – Source: BingX

Example Prompt:

Qwen 3 Max, Bitcoin (BTC/USDT) on BingX is trading around $108,934. EMA20 is $111,830 and EMA50 is $113,085 — short-term trend is bearish. RSI (14) is 43.25, showing weak momentum, and ATR (14) is 3,848, indicating moderate volatility. Based on this setup, suggest a swing trade idea with clear entry, stop-loss, and take-profit levels.

Source: chat.qwen.ai

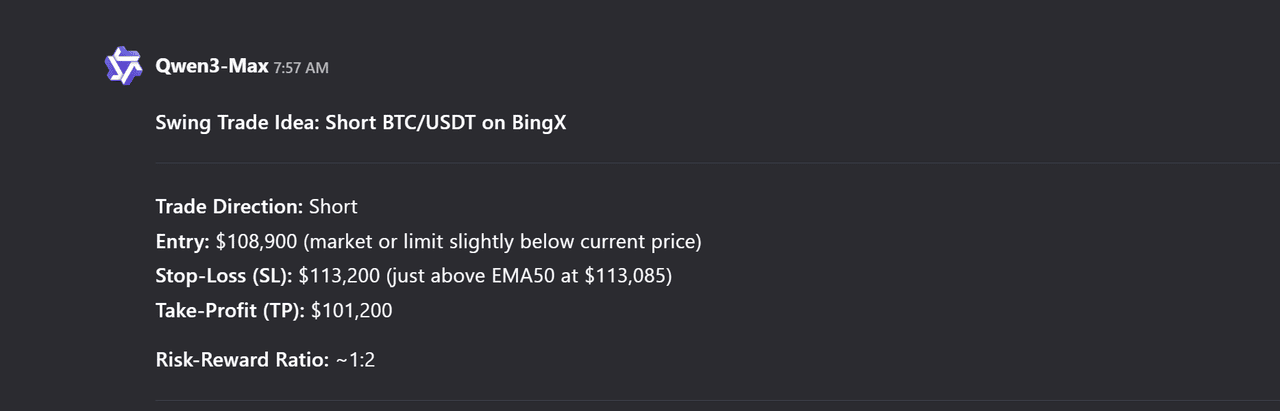

3. Review the AI-Generated Setup

Qwen 3 Max responded with a structured short trade plan:

- Direction: Short

- Entry: $108,900 (market or slightly below current price)

- Stop-Loss: $113,200 (just above EMA50 at $113,085)

- Take-Profit: $101,200

- Risk-Reward Ratio: 1:2

Example output from Qwen 3 Max - Source: chat.qwen.ai

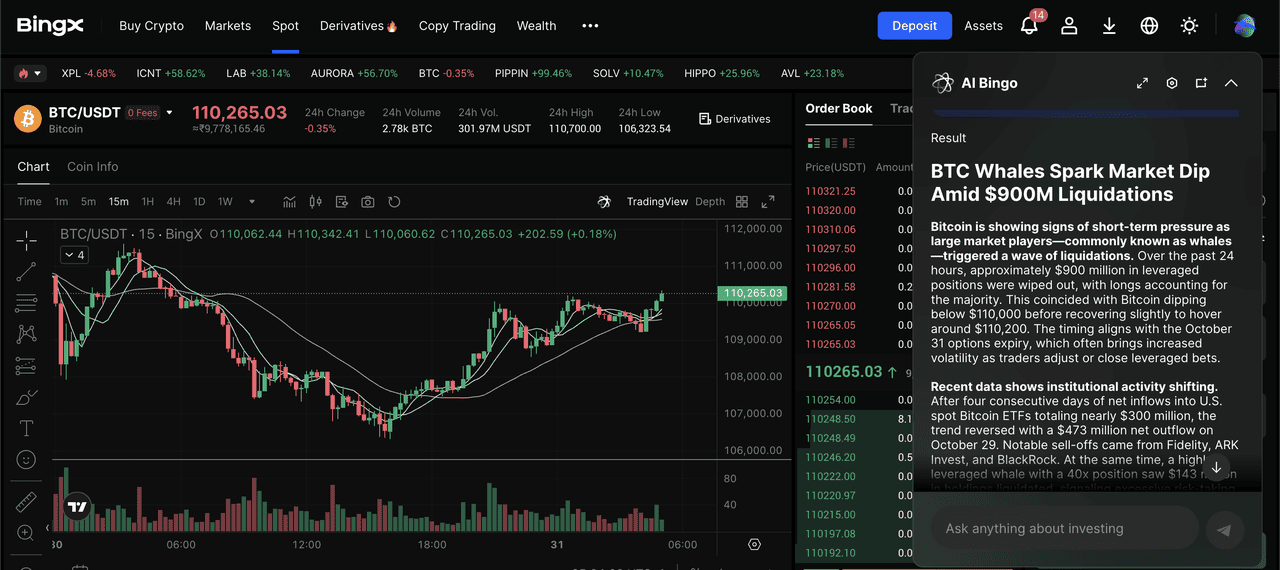

4. Cross-Check With Charts

Compare the suggestion with your BingX chart. The 20-EMA remains below the 50-EMA, RSI sits under 50, and ATR indicates stable volatility, all confirming a bearish short setup near $109K.

5. Backtest Before Going Live

Before trading real funds, test Qwen’s recommendations in a BingX demo account or small-scale paper trade to gauge accuracy and adjust for real-time volatility.

Alternative: BingX AI, Platform's Built-in Trading Assistant

Users can also explore

BingX AI, the platform’s built-in assistant for real-time market insights and strategy suggestions directly within the BingX app.

BTC/USDT Daily Chart powered by BingX AI insights

Unlike third-party models,

BingX AI integrates live market data from the exchange itself, enabling traders to track trends, analyze open positions, and identify top-performing traders all within the platform.

Together, DeepSeek and BingX AI offer a balanced approach: one provides structured, data-driven reasoning, while the other offers seamless, exchange-level guidance for safer, more informed trading.

Advantages of Qwen 3 Max’s Trading Style

Qwen 3 Max stands out for its measured and data-driven approach to crypto markets. Instead of chasing volatility or reacting to sudden momentum shifts, it focuses on building steady, risk-adjusted returns through logic and precision.

• Trades with calm precision, avoiding impulsive reactions to price swings.

• Focuses on steady, risk-aware decisions that protect capital.

• Keeps drawdowns small by adjusting exposure with market volatility.

• Relies on data and logic instead of emotion or sentiment.

• Favors consistent, compounding growth over short-term high-risk gains.

Risks and Limitations of Using Qwen 3 Max for AI Trading Crypto

• Its conservative style may lag behind during fast, bullish rallies.

• Relies heavily on accurate volatility and correlation data for decisions.

• Works best as a decision-support tool, not a fully automated trader.

• Always confirm its signals with BingX charts and manual analysis before executing trades.

Conclusion

Qwen 3 Max’s 25.8% gain in Alpha Arena proves that careful

risk management can outperform even the most advanced AI models. It represents a new era in trading where quant logic meets adaptive reasoning, emphasizing discipline over aggression.

For BingX traders, applying Qwen 3 Max’s data-driven approach, measured entries, clear risk limits, and volatility control, can help build more consistent strategies and sharpen long-term performance.

Its success also signals rising investor confidence in China’s AI ecosystem, showing how structured reasoning and risk discipline are shaping the future of algorithmic trading.

Related Articles

FAQs on AI Crypto Trading with Qwen 3 Max

1. What is Qwen 3 Max, and who developed it?

Qwen 3 Max is an advanced AI model developed by Alibaba Cloud under the Tongyi Qianwen project. It’s designed for structured reasoning and decision-making in financial and data-driven environments.

2. How did Qwen 3 Max perform in Alpha Arena?

In the Alpha Arena trading experiment on Hyperliquid, Qwen 3 Max ranked second with a 25.8% gain (as of Oct 30, 2025), showing consistent performance and one of the best Sharpe ratios among all AI traders.

3. What trading style does Qwen 3 Max use?

It trades with a quantitative and disciplined approach, using indicators like RSI, EMA, and volatility to make data-based decisions while minimizing drawdowns.

4. Can traders replicate Qwen 3 Max’s strategy on BingX?

Yes. Traders can follow similar logic using BingX charts and AI tools—analyzing momentum, volatility, and correlations before taking trades.

5. Is Qwen 3 Max available publicly for crypto analysis?

Yes. You can access the model for free at

chat.qwen.ai to test trading ideas and generate structured setups using natural-language prompts.