In 2025, a new wave of decentralized exchanges quietly began taking over

Solana’s trading landscape. While most users were focused on familiar names like

Raydium and

Orca, a cluster of stealth, closed-door market makers started rising behind the scenes, invisible to most traders yet commanding an ever-growing share of liquidity.

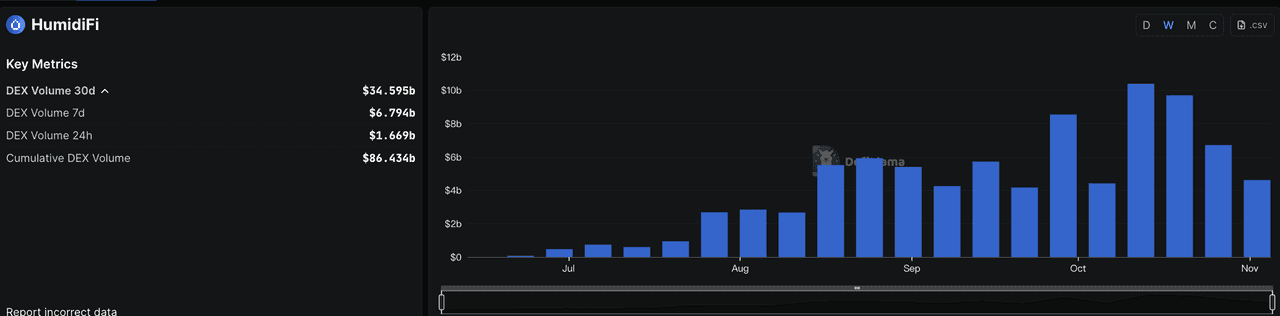

HumidiFi is now the largest proprietary automated market maker (Prop AMMs) on

Solana, known for its secrecy and precision. It operates entirely through on-chain algorithms without a public interface, managing liquidity and price updates in real time through major aggregators like

Jupiter. In under five months, HumidiFi has processed nearly $100 billion in trading volume, accounting for around 35% of total DEX activity on Solana and redefining how liquidity moves across the network.

Now, HumidiFi is preparing to launch its native token $WET through Jupiter’s new Decentralized Token Formation (DTF) platform, marking the platform’s first token sale and a major milestone for Solana’s fast-evolving DeFi ecosystem.

What Is HumidiFi, the Largest AMM on Solana, and How Does It Work?

HumidiFi is a proprietary automated market maker (Prop AMM) on Solana built for speed, efficiency, and discretion. Launched in May 2025, HumidiFi has rapidly grown into a dominant force in

Solana’s DeFi ecosystem. According to

DefiLlama data, in under five months, HumidiFi has processed nearly $100 billion in trading volume, accounting for around 35% of Solana’s total DEX activity. On core trading pairs such as

SOL/USDC, it regularly captures more than 25% of market share, making it the largest proprietary AMM and now the largest DEX liquidity venue on Solana.

Unlike traditional AMMs such as Raydium or Orca, HumidiFi does not rely on public liquidity pools or user deposits. Instead, it operates as a closed-loop trading system that manages its own liquidity and pricing logic. All trades are executed through DEX aggregators like Jupiter, which automatically route orders to the venue offering the best price. As a result, HumidiFi remains invisible to most users while powering a significant portion of Solana’s on-chain volume.

The protocol’s on-chain algorithms update prices and oracle data in real time, ensuring optimal quotes and minimal slippage across trading pairs. Community data from @KelvinW3D shows HumidiFi’s spreads average around 5 bps, far tighter than the 65–90 bps seen on Raydium, Orca, and major exchanges, underscoring its efficiency and execution quality.

Key Features and Structural Advantages of HumidiFi

• Private Liquidity Vaults: Liquidity is fully owned and managed by a single professional market maker, allowing precise capital control and efficient rebalancing.

• Invisible to Users, Present in Every Trade: HumidiFi has no public interface and operates entirely through back-end integrations with Jupiter, making it effectively hidden yet deeply embedded in Solana’s trading flow.

• 1,000× Cheaper Price Updates: Each price adjustment consumes about 143 compute units (CUs), roughly one-thousandth the cost of a typical aggregator swap, enabling rapid, continuous recalibration.

• High-Frequency, Low-Slippage Execution: On-chain algorithms refresh pricing several times per second to maintain real-time accuracy and deliver execution quality comparable to centralized exchanges.

• Secure and Verifiable Design: The closed structure limits MEV exposure and ensures all trades remain publicly auditable on-chain, combining privacy with accountability.

What Is Proprietary AMM (Dark AMM)?

A proprietary automated market maker (Prop AMM), sometimes called a dark AMM, is a new class of on-chain trading infrastructure operated by professional market makers using their own capital and algorithms. Unlike

traditional AMMs that rely on

user-supplied liquidity pools, Prop AMMs are self-contained systems where liquidity, pricing, and execution are managed internally rather than by the community.

The “dark” aspect refers to their non-public, opaque operation, not the absence of on-chain settlement. All trades are still verifiable on-chain, but the algorithms and parameters behind each quote remain undisclosed to prevent competitors from reverse-engineering strategies or front-running transactions. This design mirrors proprietary trading desks and dark pools in traditional finance, where institutional traders execute large volumes privately to preserve pricing advantage and reduce market impact.

Prop AMMs vs. Traditional AMMs: What's the Difference?

Traditional AMMs like

Uniswap or Raydium operate on open, permissionless models where anyone can add liquidity and trade along visible pricing curves such as

x × y = k. While this supports transparency and decentralization, it also introduces inefficiencies such as slippage, MEV attacks, and frontrunning.

Prop AMMs take the opposite approach. Liquidity is concentrated, pricing formulas are private, and trades are executed through DEX aggregators instead of public interfaces. This structure enables:

• Faster quote updates that recalibrate prices multiple times per second.

• Reduced MEV and frontrunning risk through private order flow.

• Greater capital efficiency by allocating liquidity precisely where trading demand is highest.

| Aspect |

Traditional AMMs |

Prop (Dark) AMMs |

| Liquidity Source |

Community-provided pools |

Private vaults managed by a market maker |

| Execution Method |

Direct user trades on DEXs |

Routed through aggregators like Jupiter |

| Transparency |

Fully visible curves and liquidity |

Hidden algorithms, on-chain verified trades |

| Update Frequency |

Periodic or reactive |

Continuous, sub-second recalibration |

Prop AMMs Take Over Solana DEX Volume: Here’s What You Should Know

Prop AMMs are quickly reshaping Solana’s decentralized trading landscape. Their ability to execute high-frequency, algorithmic trades efficiently has positioned Solana as the most active environment for this emerging market structure.

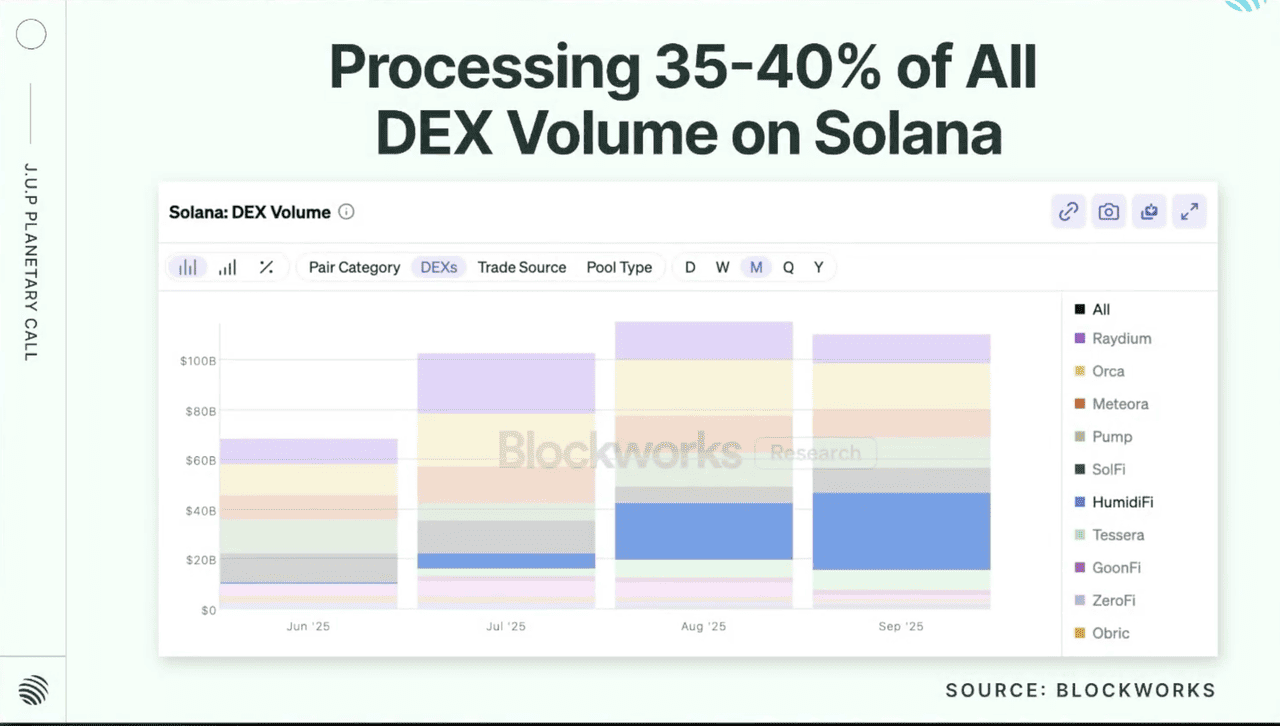

1. Prop AMMs Now Account for 30–40% of Total DEX Volume on Solana

Source: Jupiter Announcement - Blockworks Research

According to

Blockworks Research, Prop AMMs currently handle between 30% and 40% of all decentralized trading volume on Solana. The largest among them, HumidiFi, contributes about 35% alone, processing nearly 100 billion USD in cumulative trades within five months. This scale of activity rivals or surpasses traditional AMMs like Raydium and Orca, marking a structural shift in how liquidity is managed and priced on-chain.

2. Jupiter’s Dominance Expands Prop AMM Reach

Jupiter, Solana’s leading DEX aggregator, processes more than 80% of all swap volume on the network and surpassed 100 billion USD in total routed volume in early Q4 2025. Because Prop AMMs such as HumidiFi, SolFi, and ZeroFi are directly integrated into Jupiter’s routing system, they automatically receive the majority of transaction flow without requiring user-facing interfaces. This network effect has made Jupiter the key infrastructure layer connecting users to Prop AMM liquidity.

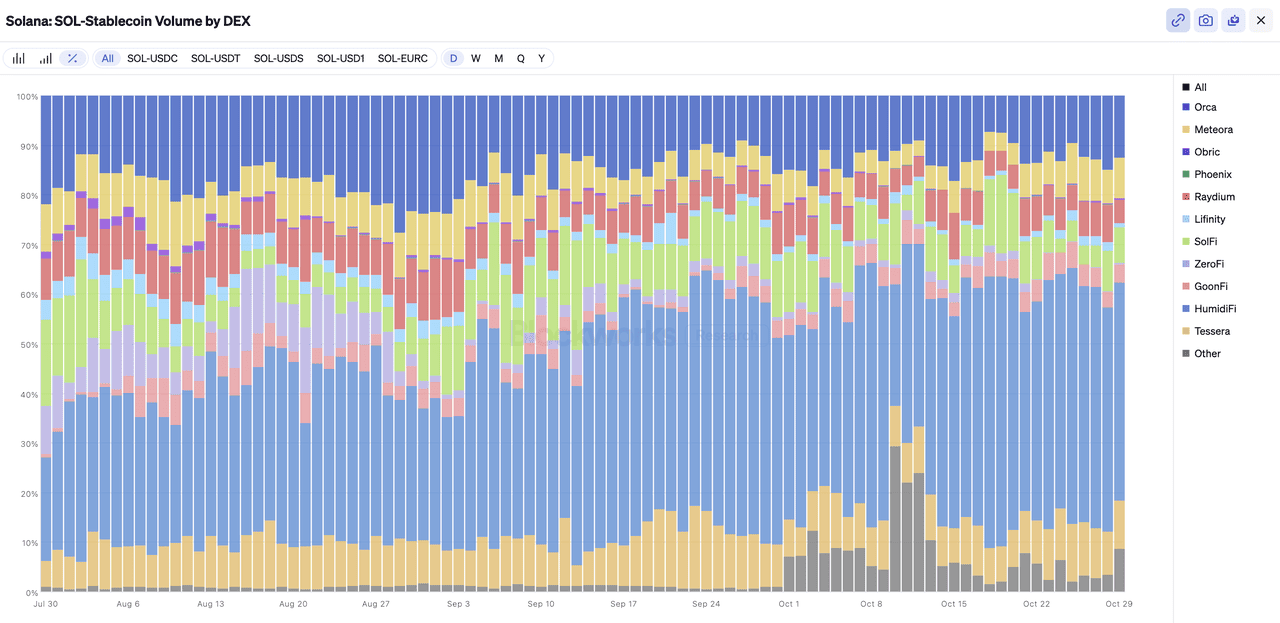

3. Solana’s On-Chain Liquidity Turns Professional as Prop AMMs Hit 50%

Prop AMMs represent the institutionalization of on-chain liquidity. Like proprietary trading desks and dark pools in traditional finance, they operate privately while maintaining full on-chain settlement and auditability. Instead of open participation, they emphasize efficiency, precision, and control.

Data from Blockworks Research shows that Prop AMMs such as HumidiFi, SolFi, ZeroFi, and GoonFi now account for nearly 50% of total SOL–

stablecoin trading volume on Solana. HumidiFi alone captures around 35%, making it the largest contributor to Solana’s liquidity engine. This marks a clear shift toward centralized-quality execution on-chain, especially across pairs like SOL/USDC, JUP/USDC, and mSOL/SOL, where spreads often match or surpass those on centralized exchanges.

4. Solana’s Architecture Makes Real-Time Market Making Possible

Solana’s high throughput, parallel execution, and ultra-low transaction costs enable real-time price updates at scale. Each price adjustment by a Prop AMM like HumidiFi uses only 143 compute units (CUs), far less than the 100,000+ CUs typical of standard swaps, allowing hundreds of updates per second across multiple pairs with minimal cost and near-zero slippage. With over 35 million daily transactions and a median block time of 400 to 500 milliseconds, Solana provides the technical foundation for institutional-grade on-chain market making.

HumidiFi $WET Will Become Jupiter DTF’s First Token Launch

HumidiFi is set to launch its native token, $WET, through Jupiter’s Decentralized Token Formation (DTF) platform, marking both its first public token release and the first-ever token launch on DTF. The event sets a new benchmark for how Solana projects can conduct transparent, community-driven token distributions.

Jupiter DTF is an on-chain launch system designed to make token offerings fair, verifiable, and open to all. It blends the accessibility of early ICOs with the safeguards of modern DeFi, including verified smart contracts, wallet-based participation, and transparent allocation tracking.

Jupiter stakers and active users will gain early access to the $WET sale, which will occur entirely on-chain with no private or VC rounds, aligning with HumidiFi’s community-first distribution model.

As the largest Prop AMM and DEX liquidity venue on Solana, HumidiFi’s $WET launch showcases how high-performance market-making protocols can extend ownership to the community while maintaining operational precision. The launch also positions Jupiter DTF as a foundational platform for future tokenized liquidity infrastructure across Solana’s DeFi ecosystem.

How to Participate in the HumidiFi (WET) Public Sale and ICO on Jupiter

The HumidiFi ($WET) public sale will take place exclusively on Jupiter’s Decentralized Token Formation (DTF) platform. While there has been no official announcement detailing the full participation process, a tweet by @marinonchain, retweeted by Jupiter’s official account (@JupiterExchange), provides a preliminary outline of what to expect.

According to this information, the $WET ICO will be conducted as a public, on-chain raise in USDC, with no private or VC rounds. The sale model emphasizes transparency, fair pricing, and direct community participation, bringing the early spirit of open ICOs back to Solana.

$JUP stakers are expected to receive early access and discounted pricing, reinforcing Jupiter’s effort to link DTF activity with its staking ecosystem. After the sale concludes, $WET will be instantly tradable on Meteora, and all allocations and token locks will be verifiable on-chain through Jup Lock, Jupiter’s native transparency and vesting system.

HumidiFi (WET) Public Sale Key Details

• Platform: Jupiter DTF (Decentralized Token Formation)

• Type: Public on-chain raise (no private or VC rounds)

• Currency: USDC on Solana • Access: Early access and discounts for $JUP stakers

• Listing: Instant tradability on Meteora after the sale

• Verification: Token locks and vesting visible on-chain via Jup Lock

Although the exact participation flow has not been released, these elements together indicate a fully on-chain and community-first model. The DTF framework aims to make token fundraising transparent and permissionless, ensuring that users can support projects directly without intermediaries or closed funding rounds.

HumidiFi (WET) Tokenomics Overview

HumidiFi has not yet published official details on $WET’s tokenomics, including supply, allocation, or vesting. The project is still focused on launching through Jupiter’s DTF platform and expanding its trading infrastructure before releasing a finalized model.

While many expect $WET to play a role in governance and liquidity incentives, these functions have not been confirmed. The team has stated that once details are available, all token locks and distributions will be verifiable on-chain through Jup Lock. Interested participants should follow official announcements from @humidifi_ and @JupiterExchange for future updates.

Potential Risks and Challenges of Prop AMMs for Investors

As Prop AMMs become a central force in Solana’s liquidity ecosystem, several structural and operational risks may influence how sustainable this model remains over time.

1. Liquidity Centralization: Control is concentrated within a single market-making entity, improving efficiency but reducing decentralization and community participation compared to open AMMs.

2. Limited Transparency: The algorithms and pricing logic behind Prop AMMs are private, making it difficult for users to assess fairness, execution quality, or long-term performance.

3. Sustainability: Without token-based incentives or external liquidity programs, maintaining deep liquidity and consistent performance across volatile markets may be challenging.

4. Regulatory and Technical Risks: Prop AMMs operate between DeFi and institutional trading, which could attract regulatory attention. Their success also depends on Solana’s network speed and reliability.

5. Competition: As more Prop AMMs launch, competition for aggregator routing and order flow will intensify, requiring constant optimization and differentiation to sustain market share.

Prop AMMs like HumidiFi are redefining on-chain liquidity with speed and precision, but their long-term success will depend on balancing efficiency, openness, and trust as the model evolves.

Final Thoughts

In just a few months, HumidiFi has grown into the largest DEX liquidity venue on Solana, showing how professional, algorithmic liquidity can transform on-chain trading. Its dominance reflects a broader shift in DeFi toward faster, more efficient, and data-driven market structures.

The upcoming $WET public sale on Jupiter’s DTF platform marks a key moment for both HumidiFi and Solana’s DeFi ecosystem. It will test whether Prop AMMs can expand community ownership while maintaining transparency and performance. Whatever the outcome, HumidiFi has already set a new benchmark for how liquidity can be built and scaled in the next generation of decentralized markets.

Related Reading

Frequently Asked Questions (FAQs) on HumidiFi (WET)

1. When was HumidiFi AMM launched?

HumidiFi launched in May 2025 and rapidly became one of the most active trading engines in Solana’s DeFi ecosystem.

2. What is the $WET token?

$WET is HumidiFi’s upcoming native token. It will debut on Jupiter’s Decentralized Token Formation (DTF) platform as a public, on-chain sale with no private or VC rounds.

3. When is the HumidiFi ($WET) public sale?

The team has not announced an official date for the public sale. According to several media reports, it is expected to take place around late October to November 2025, but this has not been confirmed by HumidiFi or Jupiter. Participants should wait for official updates from @humidifi_ and @JupiterExchange on X.

4. How can I participate in the $WET sale?

Participation will occur through Jupiter DTF, using a Solana-compatible wallet funded with USDC. Exact steps and eligibility will be shared in official announcements.

5. Will $WET be tradable after the sale?

Yes. According to HumidiFi and Jupiter’s posts on X, $WET will be tradable on Meteora immediately after the DTF sale concludes.

6. Has HumidiFi published its tokenomics?

Not yet. HumidiFi has not released official details on $WET’s supply, allocation, or vesting. Participants should follow official channels for verified information before relying on any figures circulating online.