In 2026, the “rotation” isn’t just

Bitcoin to

Ethereum to high-beta altcoins anymore. It’s increasingly alts to macro hedges, because liquidity has become more selective and narratives fade faster. Wintermute’s 2025 OTC reporting notes that liquidity concentrated at the top of the market and the median altcoin narrative rally shortened meaningfully versus the prior year.

At the same time, TradFi access is getting frictionless on crypto rails.

Tokenized real-world assets (RWAs) have grown into a meaningful

on-chain category, with leading assets including private credit and tokenized Treasuries, and institutional infrastructure is now explicitly targeting public blockchains as settlement layers.

In this article, you will learn why capital is rotating from altcoins into TradFi-linked assets in 2026, what the data says about this shift, and how you can

trade USDT-settled TradFi perpetuals and tokenized RWAs on BingX to diversify your portfolio from altcoins to TradFi instruments.

Key Takeaways

1. Altcoin rallies are less durable. Liquidity is clustering in

BTC,

ETH, and a narrow set of majors, while narrative bursts fade faster.

2. Risk-off phases punish correlated beta. In stress regimes, most altcoins trade as one bucket, so diversification within crypto stops working.

3. Macro drivers dominate. Rates, USD liquidity, real yields, and geopolitics increasingly set the tone, making gold/indices/stocks/forex cleaner expressions than high-beta tokens.

4. TradFi is now crypto-native. Tokenized RWAs and USDT-settled TradFi perps make rotating into macro exposure fast and capital-efficient.

5. The new edge is execution along with risk control. As institutions use ETFs, OTC, options, CFDs more actively, “clean” retail-style cycles become harder to trade.

What Is Altcoin Rotation?

Altcoins are crypto assets beyond

Bitcoin, from major platforms like

Ethereum and

Solana to smaller tokens tied to DeFi,

AI,

gaming. Their value comes from growth and speculation; when markets are risk-on, altcoins can rise fast as capital chases innovation. But they also carry high volatility and high correlation, meaning they tend to fall together when sentiment turns.

Altcoin rotation is the flow of capital from Bitcoin into alternative cryptocurrencies when risk appetite improves and liquidity expands. In classic cycles, it often progresses: BTC strength leading to ETH outperformance and then moving on to large-cap alts and mid/small-cap “mania.”

What’s different in 2026: rotation is increasingly two-dimensional. Capital can rotate out of altcoin beta and into macro assets like gold, equities, stock indices, commodities, and forex (FX) using the same crypto collateral and venues.

Altcoins vs. TradFi Instruments: Two Very Different Ways to Take Risk in 2026

Gold gained over 60% in 2025 | Source: TradingView

TradFi assets like

gold, stock indices, FX, energy, and bonds offer a different kind of exposure for crypto investors. In 2026, these markets are increasingly traded through tokenized assets and USDT-settled futures on crypto exchanges. Their importance lies in liquidity and macro relevance. In 2025 alone,

gold gained over 60% and silver nearly 150%, showing how hard assets attracted capital while crypto went through repeated leverage-driven selloffs.

Today, capital no longer moves only between Bitcoin and altcoins. It rotates between high-beta crypto trades and macro assets, often on the same crypto platforms. Thin altcoin breadth, rising institutional ownership of Bitcoin, and the growth of tokenized real-world assets mean 2026 is about crypto vs. macro assets, not just BTC vs. alts. The difference in risk profile explains the rotation.

Top 5 Reasons Why Investors are Rotating From Altcoins to TradFi in 2026

In 2026, the altcoin rotation into TradFi assets is not driven by sentiment or narratives, but by structural shifts in liquidity, market plumbing, and macro risk that are reshaping how institutional and retail investor capital moves through crypto in 2026.

1. Crypto Liquidity Focused on Crypto Majors Instead of Being Recycled Into Altcoins

When volatility rises, capital moves toward markets that can handle size without blowing out spreads. In 2025–2026, Wintermute and other major OTC desks reported that crypto liquidity has become far more concentrated in BTC, ETH, and a small handful of liquid perps, while most altcoins now trade on much thinner order books. That shift matters because when leverage unwinds, 10–30% gaps in mid-cap and small-cap alts are common, while BTC, ETH, and macro-linked contracts still offer continuous price discovery and tighter spreads.

At the same time, Bitcoin liquidity is being absorbed by institutions, not recycled into altcoins. CryptoQuant data shows long-term holders selling into dips while ETFs, funds, and corporate treasuries accumulate, turning BTC into a balance-sheet asset rather than a speculative liquidity pool. That capital stays in BTC and does not flow downstream into high-beta tokens the way it did in prior cycles.

In practice, liquidity in 2026 is concentrated where leverage and institutions operate: BTC, ETH, and USDT-settled macro perpetuals.

Perpetual futures now account for roughly three-quarters of total crypto trading volume, with BTC and ETH alone holding more than half of all open interest, which keeps their markets deep and tradable even during sell-offs. By contrast, most altcoins have 10–40× thinner order books, so

liquidation waves create sharp gaps and heavy slippage, making them poor vehicles for hedging. That is why capital increasingly rotates into gold, index, FX, and energy exposure - markets that offer massive, stable liquidity and cleaner macro signals when crypto risk spikes.

2. Altcoins' Correlation Spikes in Stress, Diversification in Crypto Becomes Less Appealing

During sell-offs, altcoins stop behaving like independent assets and start trading as a single risk bucket. In late-2025’s leverage unwind, rolling 30-day correlations between major alts such as

SOL,

AVAX,

SUI, and

LINK rose into the 0.75–0.90 range, meaning nearly all price movement was driven by the same forced-liquidation flows rather than token-specific fundamentals.

When correlations approach one, diversification inside crypto disappears, owning five alts becomes the same as holding one highly leveraged position. That is why, as funding turns negative and liquidations accelerate, capital rotates into assets with different drivers, gold for inflation and crisis hedging, USD and FX for liquidity stress, and equity indices for growth risk, rather than staying trapped in correlated altcoin beta.

3. Macro Signals Now Drive Crypto More Than Token Fundamentals

By early-2026, Bitcoin and the broader crypto market trade far more like a macro asset class than a collection of isolated tech tokens. BTC’s rolling 90-day correlation with US real yields and the US Dollar Index has climbed into the 0.50–0.65 range, meaning price moves increasingly reflect rate expectations, dollar liquidity, and global risk sentiment rather than protocol-level news.

At the same time, BTC’s monthly

RSI (relative strength index) sitting in the mid-50s, a zone that historically aligns with institutional de-risking phases, signals that traders are prioritizing capital preservation over growth narratives. In these environments, flows concentrate in BTC and traditional safe havens like gold, which gained over 60% in 2025, while high-beta altcoins underperform. When CPI prints, Fed decisions, or geopolitical shocks hit, it is often more efficient to express those macro views directly through gold, equity indices, or FX exposure than through speculative altcoin positions that are increasingly detached from their own fundamentals.

4. TradFi Is Moving On-Chain, Changing How Traders Hedge

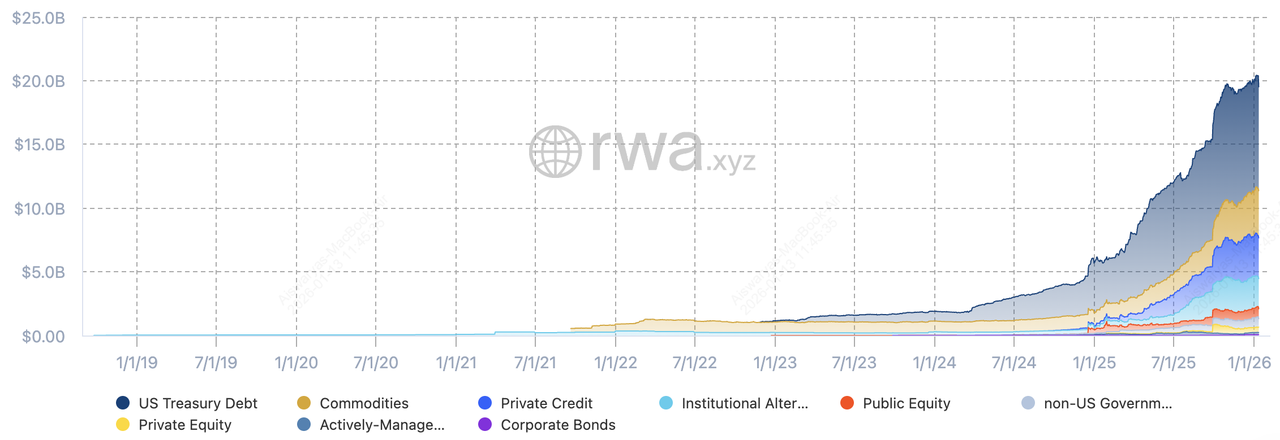

The growth of tokenized RWAs on-chain | Source: RWA.xyz

One of the biggest reasons this rotation from altcoins into TradFi exposure is accelerating in 2026 is that TradFi no longer lives off-chain. Large banks and asset managers are now actively using blockchains for tokenized deposits, settlement, and collateral movement, turning crypto networks into financial market plumbing rather than just speculative rails. The a16z crypto playbook describes blockchains as a new settlement and ownership layer, highlighting live use cases such as tokenized bank deposits, near-real-time securities settlement, and on-chain collateral mobility, all of which allow traditional assets to function like programmable crypto assets.

At the same time,

stablecoins have become the dominant liquidity rail for global trading. Institutional market commentary going into 2026 increasingly frames stablecoins as “core financial infrastructure” because they enable 24/7 settlement, instant cross-border transfers, and on-chain margining. This is what makes USDT-settled perpetual futures on commodities, stocks, indices, and FX viable at scale. Traders can now long or short gold, oil, stock indices, or USD exposure using the same margin wallet they use for crypto, without touching banks or brokers.

This is what makes the rotation powerful. With

tokenized real-world assets (RWAs) and

USDT-margined TradFi perpetuals, you can hold crypto, manage leverage, and still express macro trades tied to inflation, rates, USD strength, or geopolitical risk. Instead of choosing between altcoins and TradFi, traders can now move between narratives and assets on the same crypto rails, which is why capital increasingly flows out of fragile altcoin beta and into hard-asset, index, and FX exposure when volatility rises.

5. Shorter Crypto Cycles + Institutional Trade Structures Favor TradFi Liquidity

Market structure in 2026 no longer resembles the long, reflexive altcoin super-cycles of 2017 or 2021. According to Wintermute’s 2025 OTC and derivatives flow data, a growing share of crypto volume now runs through OTC desks, CFDs, options, and basis trades rather than spot-driven retail speculation. This signals a shift toward tactical, balance-sheet-managed trading, where capital rotates faster and positions are actively hedged rather than held through long narrative runs.

In this environment, liquidity quality matters more than upside potential. Assets that can absorb large orders, respond cleanly to macro catalysts, and support structured hedging, such as gold, commodities, stocks, equity indices, and FX, become more attractive than thin, story-driven altcoins. When rallies are shorter and capital is professionally managed, investors gravitate toward markets where they can scale in and out, hedge risk, and preserve capital, not just chase beta.

How to Get TradFi Exposure on BingX with Crypto

BingX allows you to access traditional financial assets using crypto-native tools, letting you move between altcoins and macro assets without touching banks, brokers, or fiat rails. You can do this in two primary ways: tokenized RWAs on the spot market and USDT-margined TradFi perpetuals on the futures market.

Option 1: Trade Tokenized RWAs on the Spot Market

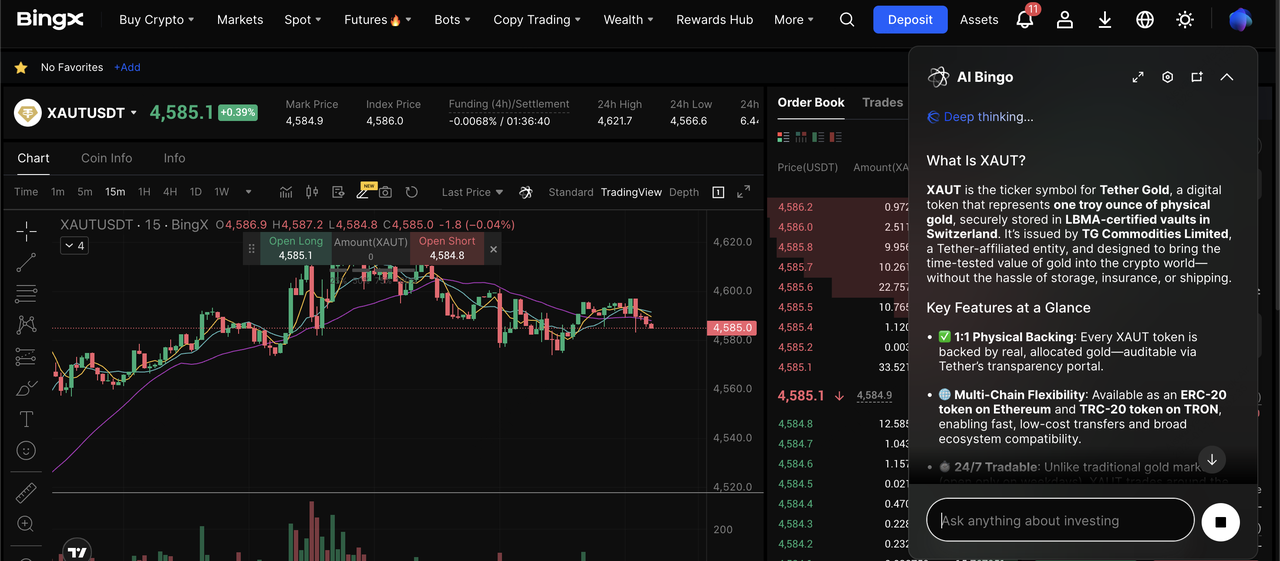

XAUT/USDT trading pair on the spot market powered by BingX AI

Tokenized RWAs are blockchain-based tokens that track the value of traditional assets like gold, silver, or other commodities, giving you unleveraged, long-only exposure similar to holding the asset itself. On BingX spot market, you can trade

popular tokenized stocks and tokenized gold cryptos.

3. Use

Limit Orders to enter at a specific price instead of chasing volatility during macro news or market spikes.

4. Treat the position as a portfolio hedge, not a speculation. Size it as protection against crypto drawdowns or inflation risk.

Spot RWAs behave more like digital versions of traditional assets. There is no funding, no liquidation risk, and no forced exits, making them ideal for holding gold or other hard assets alongside crypto in a single account.

Option 2: Trade TradFi Perpetual Futures With USDT

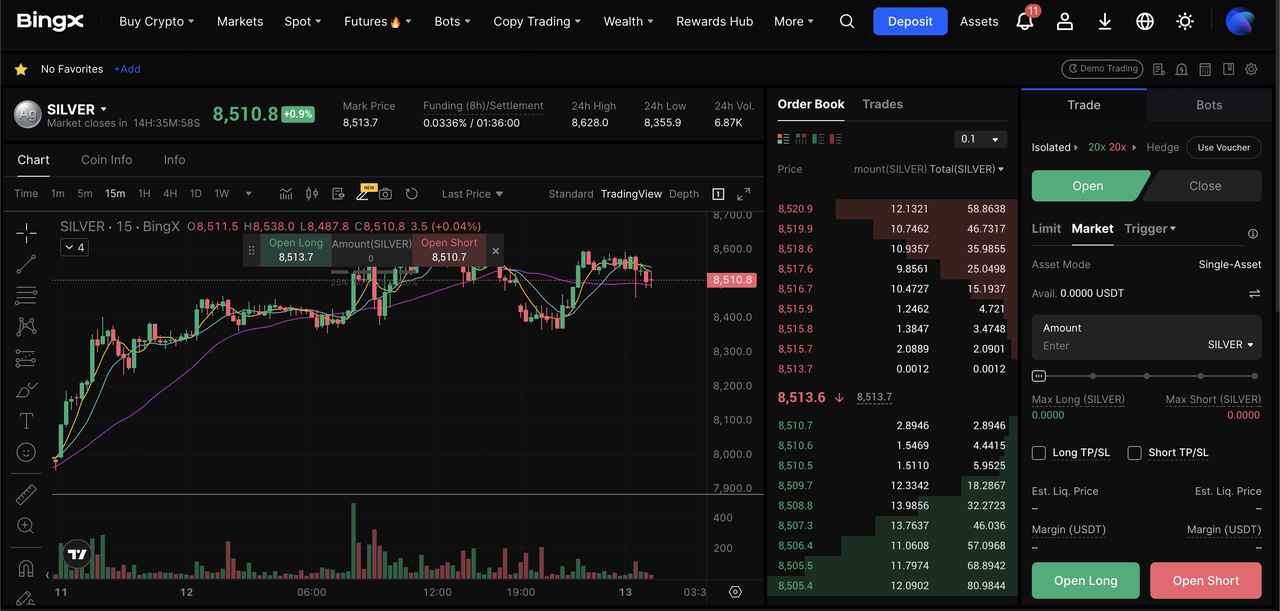

SILVER perpetual contract on the futures market

For active traders and hedgers,

BingX TradFi offers USDT-settled perpetual futures on commodities, indices, and FX proxies, allowing you to long or short TradFi markets using your crypto margin wallet.

1. Open the Futures trading section and choose a TradFi-linked perpetual contract, such as

gold,

silver,

WTI oil, or an index like

S&P 500.

2. Select Isolated Margin and keep leverage conservative, typically 2x to 5x, to reduce liquidation risk.

3. Set your

stop-loss before entering the trade, then place a Limit or Market order.

4. Monitor

funding rates and liquidation levels, especially during Fed decisions, CPI releases, or geopolitical events.

TradFi perps let you hedge crypto risk or express macro views, like gold for rising inflation, stock indices for slowing growth, or forex pairs for USD strength, without selling your crypto holdings or moving funds off exchange.

Key Considerations When Trading TradFi Exposure on Crypto Venues

Trading TradFi-linked assets on crypto platforms brings powerful flexibility, but it also introduces unique risk layers. Leverage amplifies volatility, especially in USDT-margined perpetuals tied to gold, indices, oil, or FX, where sudden macro headlines like Fed decisions, inflation data, and geopolitical events can trigger fast, multi-percent moves in minutes. Because these contracts have no expiry, adverse funding rates can also quietly erode P&L (profit and loss) if you hold positions through crowded, one-sided markets.

Liquidation risk is the second major factor. When markets gap, prices can move through stop levels, and over-leveraged positions may be closed automatically at unfavorable prices. That’s why TradFi perps should be treated as hedging and macro-trading tools, not high-leverage bets. Keep position sizes modest, use Isolated Margin, place stop-losses before entering trades, and avoid holding large leveraged exposure through high-impact macro events.

Conclusion

The shift from altcoins to TradFi-linked assets in 2026 is not a rejection of crypto; instead, it reflects how the market has matured. With institutional ownership rising, leverage concentrated in perpetual futures, and macro forces like rates, inflation, and USD liquidity increasingly driving price action, traders are choosing exposures that offer deeper liquidity, clearer catalysts, and better hedging. Tokenized real-world assets and USDT-settled TradFi perpetuals make it possible to express those views without leaving crypto rails, blurring the old line between “crypto trades” and “macro trades.”

That said, no asset class is risk-free. TradFi instruments can be volatile during macro shocks, and leveraged futures carry liquidation and funding risks just like crypto derivatives. Whether you are trading altcoins, tokenized assets, or TradFi perpetuals on BingX, disciplined position sizing, stop-losses, and an awareness of broader market conditions remain essential to managing risk in a market that is now driven as much by global finance as by blockchain innovation.

Related Reading